Spencer Platt/Getty Images

Spencer Platt/Getty Images

Growth stocks are back in fashion after lagging their value counterparts to start the year.

In early 2021 investors took profits in the growth names that had dominated the market during 2020 and rotated into value stocks, anticipating a robust economic recovery. That trade has unwound in recent weeks as skepticism regarding the strength of the recovery grows while COVID-19 cases tick up.

Markets have seesawed in recent sessions between selloffs driven by virus fears and strong gains dismissing those fears. Timing the shifts between growth and value stocks can be exhausting.

Secular growth stocks, or those that can enjoy gains regardless of the economic backdrop, are one way for stock-pickers to approach an uncertain market.

In a July 23 note a team of Morgan Stanley strategists led by Adam Virgadamo compiled a semiannually updated list of such stocks and split it into two groups: those in the technology, media, and telecommunication (TMT) industries, and those that aren't.

According to the strategists the non-TMT growth stocks have increased revenue in the past 12 quarters through the end of 2019, will achieve strong sale growth in 2022 and 2023, and can "deliver strong fundamental growth, driven by forces such as sustainable competitive advantages, product cycles, market share gains, or pricing power."

The pandemic accelerated growth for many of these non-TMT names, though Virgadamo's team warned that some of these stocks face difficult year-over-year earnings comparisons that they said could "be a risk to our near term growth views."

Stock valuations are vital to consider given macroeconomic environment headwinds, and investors should remain choosy in case of a correction, according to the strategists.

"We believe the transition to a mid-cycle environment will lower equity market multiples and the premium paid for structural growth — a process that is underway — while a multi-year upward trend for rates may challenge valuations in long-duration equities," the note read.

Below is Morgan Stanley's list of the 26 stocks rated overweight (buy) or equal-weight (hold) for growth outside of the technology, media, and telecommunication industries, along with ticker, market capitalization, price-to-earnings ratios, and analysis.

1. Alnylam PharmaceuticalsMarkets InsiderTicker: ALNY

Market capitalization: $21.3B

P/E ratio: N/A

Analysis: "The company has received three FDA approvals in the last two years, including Onpattro for hATTR with polyneuropathy, Givlaari for acute hepatic porphyria, and Oxlumo (lumasiran) for the treatment of PH1. Despite the pandemic, the launches have experienced solid trajectories and are poised to benefit from a post-pandemic environment." - David Lebowitz, analyst

2. Ball CorporationMarkets Insider

Ticker: BLL

Market capitalization: $26B

P/E ratio: 34.6

Analysis: "North America beverage can demand meaningfully accelerated from ~0.2% in 2018 to ~3.5% in 2019 and ~12% in 2020. As a result, there is a significant can shortage that we think could persist over the next 2-3years. ... Ball has among the most attractive growth algorithms in our coverage. From 2020 through 2025, we expect CAGRs of ~8% for revenue, ~13% for operating earnings, and ~15% for EPS." -Neel Kumar, analyst

3. BeiGeneMarkets Insider

Ticker: BGNE

Market capitalization: $28B

P/E ratio: N/A

Analysis: "BeiGene is commercializing three internally developed drugs, including PD-1 antibody Tislelizumab and BTK inhibitor Brukinsa, both of which have opportunity to be expanded to numerous indications and used as backbone drugs in the development of combination therapies. ... In addition, BeiGene is quickly expanding business by collaboration with leading biotech/pharma companies, including Amgen, to develop and commercialize licensed-in products in China. The company is expecting to have a total of 12 commercial products by the end of 2021." -Matthew Harrison, analyst

4. The Blackstone GroupMarkets Insider

Ticker: BX

Market capitalization: $135.1B

P/E ratio: 17.5

Analysis: "We view BX as a compelling secular grower and an attractive play on the structural growth in private markets. We believe that aging populations, thirst for income/yield in a low-rate environment, expectations for lower public-market returns, and demand for higher returns with a smoother ride are powerful secular tailwinds driving investors to allocate more money to alternative investments." -Michael Cyprys, analyst

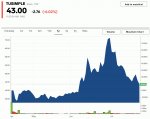

5. CarvanaMarkets Insider

Ticker: CVNA

Market capitalization: $57.2B

P/E ratio: N/A

Analysis: "Carvana's fully digital experience with full vertical integration — both software and physical inspection recondition centers (IRCs)/logistics — offers a superior consumer experience that can scale profitably. We see Carvana as becoming the largest used car dealer in the US, growing at an over-30% 10-year revenue CAGR and growing market share from under 1% today to over 10% by 2030." -Adam Jonas, analyst

See the rest of the story at Business Insider

See Also:

- CREDIT SUISSE: Buy these 19 high-conviction stock picks that Wall Street is completely overlooking — including 3 set to surge 40% or more

- BANK OF AMERICA: Buy these 26 small and mid-size stocks now to take advantage when they beat Wall Street's expectations for the second quarter

- Bank of America names 18 semiconductor stocks to buy as cloud spending accelerates and firms focus on 5G, artificial intelligence, and machine learning