BOSTON - June 15, 2018 - (Newswire.com)

Technology improvement with electrified road vehicles has been slow. The primary reason why trucks are now a major focus for electrification is local and national government and other regulations and incentives in the face of increasing public concern about road vehicle emissions and global warming. The brand new IDTechEx Research report Electric Trucks and Delivery Vans 2018-2028 finds the market for electric trucks and vans will reach $480bn by 2028.

Most trucks run on diesel and the ongoing announcements by certain countries and cities that they will ban diesel from a certain date in the future causes increasing uncertainty and risk for those making and using conventional trucks, including possible collapse in resale values.

The trucking industry runs on tight margins and total cost of ownership is key, so fleet management companies delay purchases so they comply with new toughening carbon dioxide emissions laws — but the days of reckoning are now approaching. In 2018, the German government announced it will drop the tolls for electric semi trucks as of Jan. 1, 2019. The move by transport minister Andreas Scheuer is designed to motivate the slow electrification of truck transport as it promises savings for haulage firms.

Larger and larger vehicles will become affordable in pure electric form due to battery and other costs reducing and ICE costs increasing due to extra emission control devices being fitted to meet more onerous emissions laws. However, some EVs are bought as pure electric earlier for other reasons such as indoor working, the wish to take a lead in tackling urban pollution, tightening emissions laws or having the fast, accurate response needed for various degrees of autonomy up to driverless operation.

IDTechEx has prepared this report because ever larger vehicles become viable in pure electric form, and now it is the turn of on-road trucks. Primarily this is due to the all-important cost of ownership being lower a few years from now. Also included are small vans that have been used in pure electric form for 130 years because they are of interest to the same logistics, retailing and industrial companies.

Electric Trucks and Delivery Vans 2018-2028 covers technical and marketing aspects, by segmenting the market into light-duty electric vehicles (LDV), medium-duty electric vehicles (MDV), and heavy-duty electric vehicles (HDV). The main models across these categories under development are presented, together with innovations in enabling technologies like powertrains, axles, and battery packs. With a global coverage, this report aims at informing users about the size of the market and the underlying opportunities, also in terms of energy storage sources: will Li-ion batteries or fuel cells capture most of the market for long-haul transport applications? A detailed split over battery chemistry is also provided, detailing how NMC, LFP, and other cathode materials will capture the total addressable market.

This technical document is complemented with information on autonomous driving for the trucking industry, as well as enabling technologies like smart roads and charging infrastructure. This report is intended to be useful to all in the value chain from materials and research organisations to parts and systems suppliers, operators, legislators and others. It is the only up to date comprehensive coverage of the subject based on thorough research worldwide. See www.IDTechEx.com/etruck.

Analyst access from IDTechEx

All report purchases include up to 30 minutes telephone time with an expert analyst who will help to link key findings in the report to the business issues you are addressing. This needs to be used within three months of purchasing the report.

Report Table of Contents

1. EXECUTIVE SUMMARY

1.1. Purpose and scope of this report

1.2. Megatrends affected by and affecting EV markets

1.3. Social megatrends red. Technological megatrends blue

1.4. The end game is not as popularly portrayed

1.5. Electrification roadmap

1.6. Who is being disrupted?

1.7. Upcoming restrictions for commercial vehicles

1.8. Specialty vehicles

1.9. More carrot, more stick

1.10. Pure electric vehicle adoption dynamics

1.11. Benefits from truck and van electrification

1.12. Pure electric vehicle adoption dynamics

1.13. Nikola fuel cell hybrid or Tesla battery truck?

1.14. Need for a systems approach

1.15. Limited 48V opportunity with delivery trucks/ vans

2. INTRODUCTION

2.1. Urban pollution

2.2. Emissions cause much more injury than previously realised

2.3. CO2 emission limits enacted worldwide to 2025

2.4. Why go electric? Drivers of truck electrification

2.5. GHG emissions from transport, EU-28, 2015

2.6. Final energy consumption in the EU-28 (mtoe), 2015

2.7. CO2 emission from road transport, EU-28, 2015

2.8. CO2 emission from road transport

2.9. Projected global freight activity and GHG emissions from 2015 to 2050

2.10. The state of the art in alternative drivetrains

2.11. Market for urban goods transport grows rapidly

2.12. Market for e-commercially transported goods

2.13. Share of US grocery market

2.14. The worldwide freight transport industry

2.15. Euro 6 emissions standard adoption around the world

2.16. Fuel emissions policies around the world

2.17. Electric trucks and vans cut pollution faster than cars

2.18. EU initiatives to offset additional powertrain weight

2.19. Fuel saving technology areas

2.20. The easy way out of emissions control: aerodynamics

2.21. Aerodynamics: Shell Airflow Starship

2.22. Other avenues for fuel efficiency: lightweighting

2.23. Is retrofitting an economically viable option?

2.24. Electric powertrain options for trucks

2.25. Start-stop electrification and other fuel efficiency measures

2.26. Maxwell's Ultracapacitor-Based Engine Start Module

3. CLASSIFICATIONS OF TRUCKS AND VANS

3.1. The worldwide freight transport industry

3.2. Value chain rewritten

3.3. Different segments of goods transportation by land

3.4. Types of popular on-road truck

3.5. Existing truck classifications

4. TRUCKS AND VANS IN THE EU

4.1. The worldwide freight transport industry - EU

4.2. Pollutant emissions have been slashed to near-zero levels

4.3. Main truck brands in Europe

4.4. Truck sales in EU-28 by size and brand, 2016

4.5. Vans in Europe

4.6. Vans in EU-28 - market share by brand, fuel and sales, 2016

4.7. Best-selling vans in EU-28, 2016

4.8. CO2 emissions for vans in Europe by brand, 2009-2016

4.9. CO2 emissions for vans in Europe by country, 2016

5. TRUCKS AND VANS IN THE US

5.1. The worldwide freight transport industry - USA

5.2. US truck population by vehicle type

5.3. HDV market share in the US

5.4. Average Daily Truck Traffic on the National Highway System, 2012

5.5. Industry issues according to US truckers

5.6. Average truck age in the US

5.7. Alternative fuel choices for trucks in the US

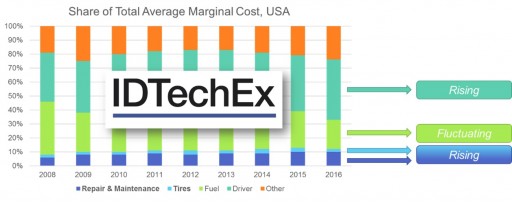

5.8. The cost of trucking in the United States

5.9. Average U.S. On-Highway Diesel Prices, 2008 - 2016

5.10. Repair & maintenance, another running cost for US truckers

5.11. Nobody wants to be a truck driver in the US

5.12. The solution: electric, autonomous trucks?

6. TRUCKS AND VANS IN JAPAN

6.1. Truck transport business in Japan

6.2. The number of truck carriers has plateaued

6.3. CO2 emissions from trucks

6.4. Main truck brands in Japan

6.5. Historic truck sales in Japan

6.6. Medium and heavy duty truck sales in Japan

6.7. Large and medium-sized trucks market share

7. TRUCKS AND VANS IN CHINA

7.1. The worldwide freight transport industry - China

7.2. HDV registrations in China by province, by type, and brand

7.3. Truck engine supplier relationships in China

7.4. Chinese truck joint ventures

7.5. China's truck market segments

7.6. China exports its trucks too

7.7. Buses down in China, trucks up

7.8. China's first emissions testing standard for heavy-duty vehicles

7.9. Argonne National Labs

8. TRUCKS AND VANS IN THE ROW

8.1. The worldwide freight transport industry - Russia

8.2. Other markets - Mexico

8.3. A visual history of commercial hybrid trucks

9. LIGHT DUTY ELECTRIC VEHICLES

9.1. An industry changing from the ground up

9.2. Last Mile vehicle needs and challenges

9.3. Small vehicles that move the local economy

9.4. Retrofitting of old delivery vans

9.5. Harrod's electric van

9.6. Functions required

9.7. UPS to transform diesel trucks into electric vehicles

9.8. Deutsche Post DHL runs 5000 StreetScooters

9.9. Nissan e-NV200

9.10. StreetScooter

9.11. Renault Kangoo Z.E.

9.12. Renault Master Z.E.

9.13. Citröen Berlingo Electric / Peugeot Partner Electric

9.14. LDV/Saic Maxus EV80

9.15. Iveco Daily Electric

9.16. Mercedes Benz eVito

9.17. Mercedes Benz eSprinter

9.18. Daimler Vision Van

9.19. Volkswagen e-Crafter

9.20. Ford Transit Custom PHEV

9.21. LEVC taxi-based PHEV van

9.22. Dongfeng Motor Corporation

9.23. Mitsubishi Minicab MiEV

9.24. Bakery Vehicle 1

9.25. Bucher

9.26. TU Munich aCar

9.27. Tropos Motors ABLE

9.28. Polaris GEM eL XD

9.29. IFEVS

10. MEDIUM DUTY ELECTRIC VEHICLES

10.1. A category that is difficult to define

10.2. Fuso eCanter

10.3. Wrightspeed

10.4. Orange EV

10.5. Iveco

10.6. Dual Energy

10.7. Iveco Dual Energy

10.8. Alkane and evLaboratory MoU

10.9. Geely and Via Motors to make electric truck

10.10. Royal Mail with all-electric vans

10.11. Zero Truck

10.12. Chanje vans

10.13. Efficient Drivetrains Inc

10.14. Dongfeng Motor Corporation

10.15. List of Commercial Medium Duty Vehicles

10.16. Medium Duty Electric Vehicle demonstration projects

11. HEAVY DUTY ELECTRIC VEHICLES

11.1. Trucks

11.2. EDF: electric trucks to disrupt highway transport

11.3. MAN e-mobility roadmap

11.4. Why Daimler is pushing for electric trucks

11.5. VW and Navistar to use joint e-drivetrain for trucks

11.6. Cummins announces acquisition of Brammo

11.7. Cummins Acquires Johnson Matthey's Automotive Battery Systems Business

11.8. Scania and Northvolt partnership

11.9. Hino Motors

11.10. BMW and SCHERM

11.11. Tesla Semi

11.12. Tesla's New Semi Already Has Some Rivals

11.13. Daimler eActros

11.14. Daimler

11.15. Timeline of Daimler's electric truck models

11.16. Hyundai rushes to electrify commercial vehicles

11.17. Mack Trucks

11.18. BYD electric truck assembly plant in Ontario, Canada

11.19. Motiv Power Systems

11.20. Efficient Drivetrains Inc

11.21. Atlas Copco adds to haulage truck range

11.22. VDL will present its Electric Truck early in 2019

11.23. E-Force One

11.24. Renault and Groupe Delanchy

11.25. eMoss

11.26. eMoss - pure EV trucks

11.27. eMoss - electric trucks with range extender

11.28. eTruck from eMoss and Tampere University

11.29. Shannxi Automotive PHEV Class 8 cement mixer truck

11.30. Hybrid upfit system for trucks

11.31. BYD Delivers First All-Electric Garbage Truck To Palo Alto

11.32. First electric truck by VDL

11.33. Magna

11.34. Thor Trucks

11.35. Renault to sell electric trucks in 2019

11.36. Volvo to reveal electric semi truck for 2019

11.37. Volvo with Samsung for full-electric trucks

11.38. List of commercial Heavy Duty Vehicles

11.39. Heavy Duty Electric Vehicle demonstration projects

11.40. Some electric trucks compared

12. HYBRID VS. PURE ELECTRIC TRUCKS AND VANS

12.1. Powertrain focus

12.2. Motor-generator REM duty cycle, type, function

12.3. A matter of use cases

12.4. Heavy duty powertrains by application

12.5. ICE vs. parallel hybrid drivetrain

12.6. Eaton Hybrid Electric System Layout

12.7. Anatomy of a hybrid electric van

12.8. Waste heat recovery (WHR) in a hybrid powertrain

12.9. CO2eq emissions in different heavy duty vehicles

12.10. Hybrid upfit system for trucks

12.11. TEVA / JAC

12.12. Mahle Range Extender

12.13. The more battery capacity the better, right?

12.14. Ricardo's view of long haul options

13. FUEL CELLS FOR TRUCKS AND VANS

13.1. Fuel cell vehicles will never be mainstream

13.2. Fuel cells are dead. Long live fuel cells!

13.3. The need for long range beyond range extenders

13.4. What fuel cell vans used to look like

13.5. What fuel cell vans look like today

13.6. Fuel cell trucks in China

13.7. Fuel cells and trucks today

13.8. Primary problems between battery and fuel cell on-road vehicles

13.9. Batteries vs. Fuel Cells - driving range

13.10. Are batteries viable for long-haul?

13.11. Batteries vs. Fuel Cells - cost

13.12. Batteries vs. Fuel Cells - efficiency

13.13. Guide to Hydrogen Truck Refuelling

13.14. Hydrogen refuelling station

13.15. Developing Hydrogen Refuelling Infrastructure

13.16. Alternative fuels generation - 2030 vs. 2050

13.17. Fuel cell-battery hybrid systems

13.18. Anheuser-Busch Makes Record Order of 800 Nikola Trucks

13.19. Ballard and Kenworth

13.20. Ballard Fuel Cell Module to Power Hybrid UPS Delivery Van Trial Program in California

13.21. Ballard and Hyster-Yale

13.22. ULEM Co

13.23. How bio-waste generates hydrogen

13.24. Nikola and Bosch partnership - hydrogen fuel cell

13.25. DHL/Streetscooter also trials fuel cell delivery vans

13.26. Keyou

13.27. Fuel Cell vehicle demonstration projects

14. THE ECONOMICS OF GOODS DELIVERY

14.1. Top challenges for commercial vehicles

14.2. Differences between e-car and e-truck

14.3. How many km do trucks travel in a year and in a day

14.4. Testing and Demonstration of PHEV Parcel Delivery Vehicles

14.5. TCO of a diesel truck vs. an all-electric truck

14.6. Financial benefits for the freight industry

14.7. Potential CO2eq reduction potential of HEV trucks

14.8. Battery makers in China see tough times

14.9. What does this imply for niche EV markets?

14.10. Commercial EVs help the others cross the Devil's Bridge

14.11. When will cost parity be reached?

14.12. Tesla sued for $2B by Nikola over alleged patent infringement

14.13. Last Mile Delivery - DHL

14.14. Last Mile Delivery - Amazon

14.15. The Tesla Semi Will Eclipse Diesel

14.16. Making Sense Out of Tesla's Semi Truck Economics

14.17. U.K. Truckers: Tesla Semi Performance not Important

14.18. Tesla Truck gets DHL order as shippers test Semi

14.19. Ryder To Order Tesla's Semi

14.20. Barriers to fuel-saving technologies

14.21. Trucks are only convenient below 400 km range

14.22. Cost of electricity in California by time of day ($/kWh)

14.23. Strategies for reducing the cost of electricity for xEVs

14.24. The total cost of ownership of electric trucks

14.25. The economics of battery swapping for electric trucks

14.26. The economics of fuel cells in trucks

14.27. The economics of e-roads and catenaries

14.28. Cost projections in selected countries for various powertrains

14.29. Economic viability of several zero-emission technologies

14.30. E-truck adoption rate forecasts in California

14.31. Powertrain cost comparison - China

14.32. Powertrain cost comparison - Europe

14.33. Powertrain cost comparison - United States

14.34. Advantages and disadvantages of electric vs. fuel cell trucks

15. SOME OF THE KEY ENABLING TECHNOLOGIES

15.1. The key enabling technologies are changing15.2. Energy storage

15.3. Forecasts of energy density by type 2018-2028

15.4. Rapid scale-up with rapid change of product spells trouble

15.5. Safety

15.6. EVs catching fire get media attention, but ICEs are not immune to that either

15.7. Battery choices at MAN Truck & Bus

15.8. Bosch and batteries for trucks

15.9. GVI - battery packs for delivery vans

15.10. EnerDel - battery packs for trucks

15.11. Supercapacitors in heavy trucks

15.12. Skeleton Tech: supercap opportunity

15.13. Iveco and Supercaps - a cost perspective

15.14. Iveco and Supercaps - a history of tests

15.15. Iveco and high power- LTO, NCM, or Supercaps?

15.16. Motor technology choices

15.17. Technology preference by type of vehicle

15.18. REM technologies performance in powertrains: the show so far

15.19. Trend to high voltage, high speed motors

15.20. Oerlikon SR motor in large hybrids

15.21. Planned PM synchronous heavy duty drive UQM, Eaton,Pi Innovo15.22. Electric Wheel Hub Drives

15.23. Dana in-axle motor

15.24. Move to integration - Volkswagen's approach

15.25. Examples of trend to product integration

15.26. Example of multiple REM per vehicle

15.27. Flybrid KERS used by Wrightbus UK on hybrid buses

15.28. LeTourneau switched reluctance

15.29. Continental

15.30. BPW axles

15.31. TM4

15.32. Cool Tech (formerly HPEV Inc.)

15.33. Reinventing wind turbines for use on boats, ships, aircraft, land vehicles

15.34. Charging needs for LCV and MCV/HCV

15.35. Opportunity charging makes batteries for trucks smaller

16. SMART ROADS FOR ELECTRIC TRUCKS

16.1. There's Now An Electric Highway In California

16.2. Mack demonstrates catenary-powered PHEV

16.3. Volvo's electric roads point to battery-free EV future

16.4. Dynamic EV charging

16.5. Qualcomm

16.6. ElectRoad

16.7. University of Washington

16.8. Auckland University

17. AUTONOMOUS TRUCKING

17.1. Joint venture for autonomous electric trucks

17.2. Joint venture: CEO statements

17.3. What Does Tesla's Automated Truck Mean for Truckers?

17.4. Automation levels in trucking explained

17.5. Uber acquiring Otto sets the scene on fire?

17.6. Embark: Hybrid approach for autonomous truck driving on highways

17.7. Starsky Robotics: retrofitting existing trucks and making them remote-controlled

17.8. Baidu: becoming the Android of autonomous vehicles

17.9. TuSimple: Chinese Al provider for level-4 autonomous trucks

17.10. Market forecasts for autonomous trucking: a 20-year view for level-4 and level-5 automation (market share as % total truck unit sales)

17.11. Historical price evolution for cameras, primary/secondary memory, computing and photovoltaics

17.12. Ten-year and twenty-year component-segmented price projections for hardware for autonomous mobility

17.13. Market forecasts for autonomous trucking: a 20-year view for level-4 and level-5 automation (in unit numbers and dollars)

17.14. Market forecasts for autonomous trucking: a 20-year view for the value of automation hardware/components

17.15. The economic case for autonomous trucks

17.16. Pelton: V2V links to enable closer platooning

18. MARKET FORECASTS 2018-2028

18.1. Assumptions behind the forecasts - light-duty vehicles (LDV)

18.2. Assumptions behind the forecasts - medium- and heavy-duty vehicles (MDV/HDV)

18.3. Average battery size for vans and trucks (kWh) 2018-2028

18.4. LDV - Market forecasts (000's units) 2018-2028

18.5. LDV - Market forecasts (GWh) 2018-2028

18.6. LDV - Market forecasts (GWh) by battery chemistry 2018-2028

18.7. LDV - Market forecasts ($B) 2018-2028

18.8. MDV/HDV - Market forecasts (000's units) 2018-2028

18.9. MDV/HDV - Market forecasts (000's units) - battery-powered and fuel cells 2018-2028

18.10. MDV/HDV - Market forecasts (GWh) 2018-2028

18.11. MDV/HDV - Market forecasts (GWh) by battery chemistry 2018-2028

18.12. MDV/HDV - Market forecasts ($B) 2018-2028

Media Contact

Charlotte Martin

Marketing & Research Co-ordinator

c.martin@IDTechEx.com

+44(0)1223 810286

Related Links

Further IDTechEx Research on Electric Vehicles and Energy

Electric Vehicles: Everything is Changing USA 2018

Related Files

Electric Trucks 2018 Table of Contents.doc.pdf

Press Release Service by Newswire.com

Original Source: IDTechEx Research Releases Global Electric Trucks and Delivery Vans Markets Report for 2018-2028