Simmons First National trades at $21.30 and has moved in lockstep with the market. Its shares have returned 11.8% over the last six months while the S&P 500 has gained 9.8%.

Is there a buying opportunity in Simmons First National, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Simmons First National Will Underperform?

We're sitting this one out for now. Here are three reasons there are better opportunities than SFNC and a stock we'd rather own.

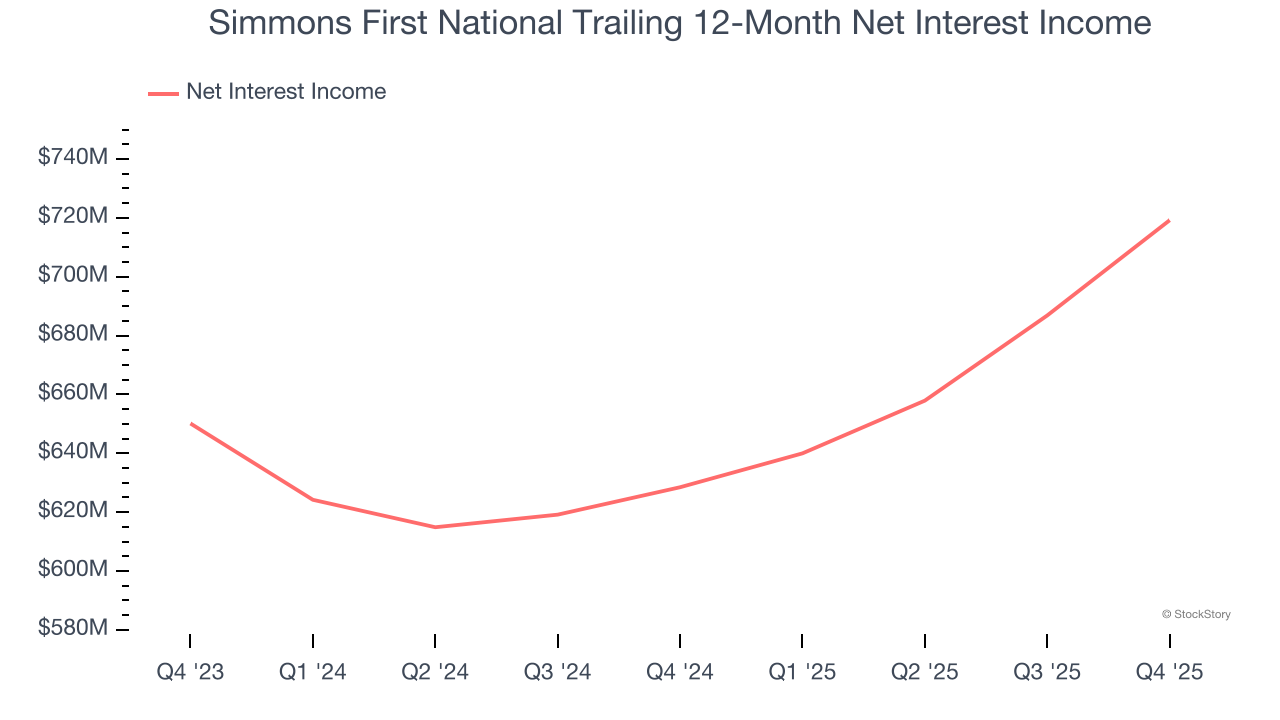

1. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Simmons First National’s net interest income has grown at a 2.4% annualized rate over the last five years, much worse than the broader banking industry and in line with its total revenue.

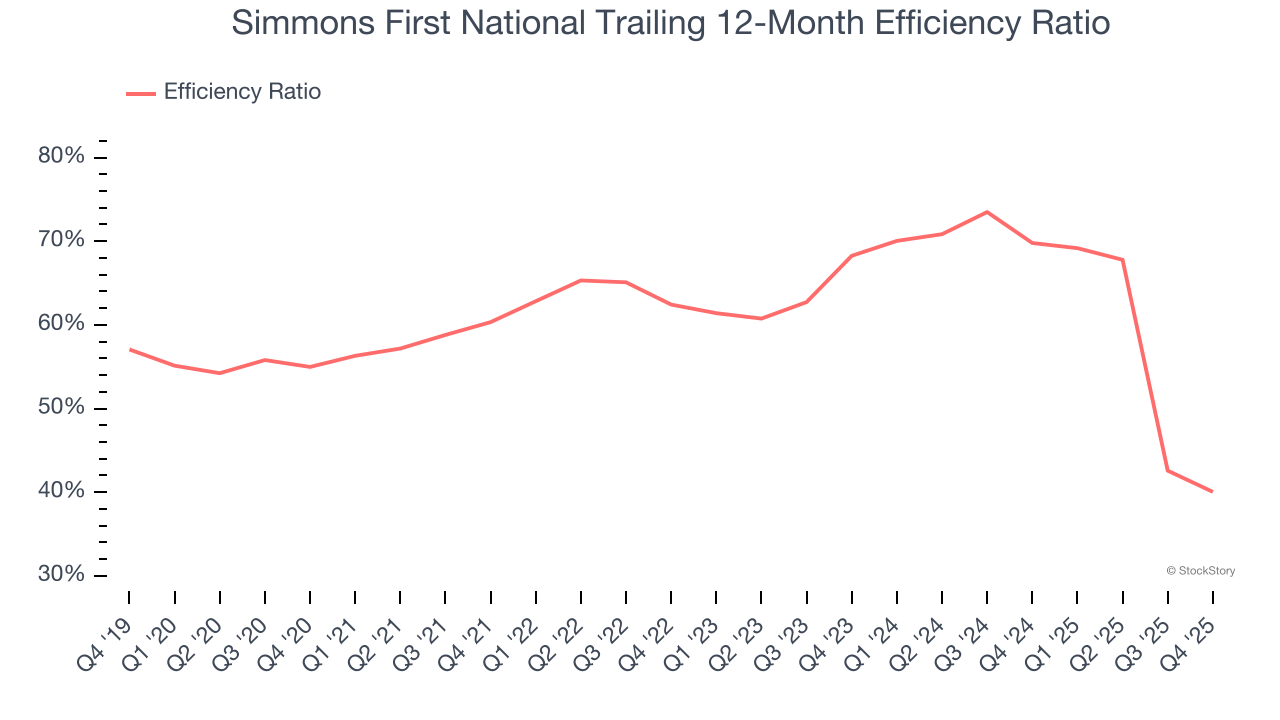

2. Efficiency Ratio Expected to Falter

Topline growth carries importance, but the overall profitability behind this expansion determines true value creation. For banks, the efficiency ratio captures this relationship by measuring non-interest expenses, including salaries, facilities, technology, and marketing, against total revenue.

Markets emphasize efficiency ratio trends over static measurements, recognizing that revenue compositions drive different expense bases. Lower efficiency ratios signal superior performance by indicating that banks are controlling costs effectively relative to their income.

For the next 12 months, Wall Street expects Simmons First National to become less profitable as it anticipates an efficiency ratio of 57.1% compared to 40% over the past year.

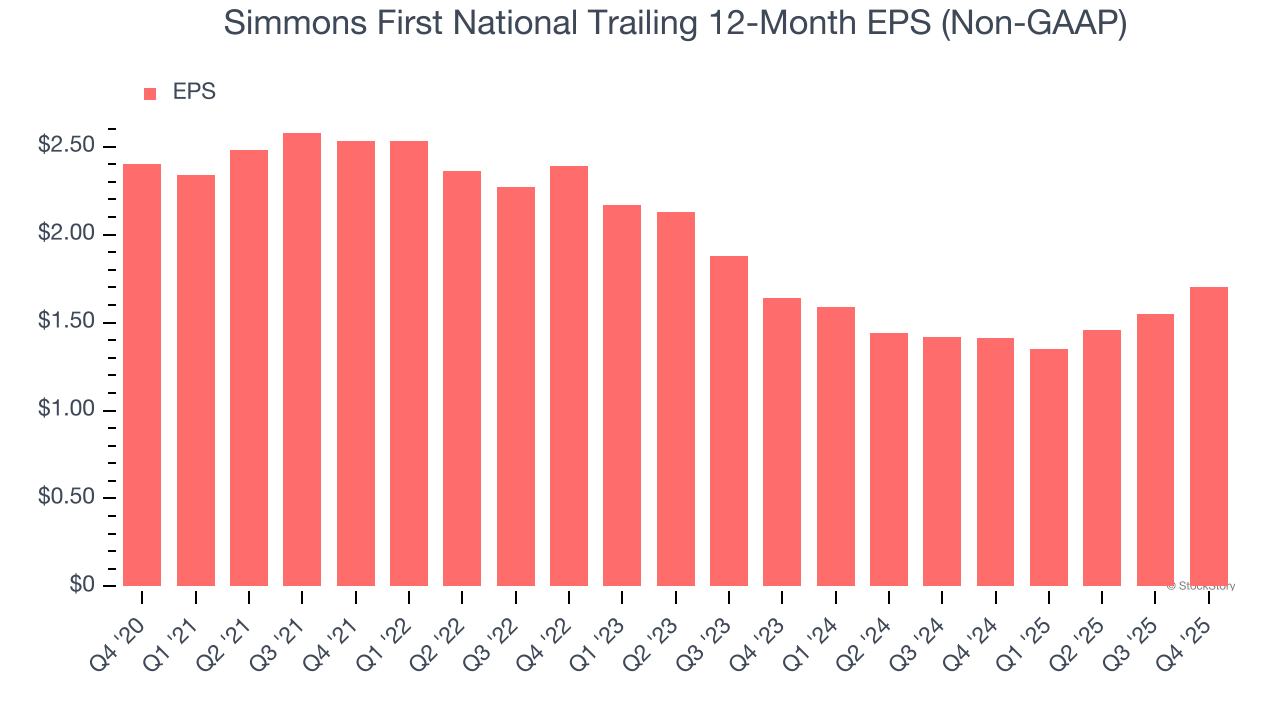

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Simmons First National, its EPS declined by 6.7% annually over the last five years while its revenue grew by 1.9%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Simmons First National falls short of our quality standards. That said, the stock currently trades at 0.8× forward P/B (or $21.30 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.