Clothing company Kontoor Brands (NYSE: KTB) announced better-than-expected revenue in Q2 CY2025, with sales up 8.5% year on year to $658.3 million. The company’s full-year revenue guidance of $3.11 billion at the midpoint came in 1.6% above analysts’ estimates. Its non-GAAP profit of $1.21 per share was 46.1% above analysts’ consensus estimates.

Is now the time to buy Kontoor Brands? Find out by accessing our full research report, it’s free.

Kontoor Brands (KTB) Q2 CY2025 Highlights:

- Revenue: $658.3 million vs analyst estimates of $634.9 million (8.5% year-on-year growth, 3.7% beat)

- Adjusted EPS: $1.21 vs analyst estimates of $0.83 (46.1% beat)

- Adjusted EBITDA: $107.2 million vs analyst estimates of $83.7 million (16.3% margin, 28.1% beat)

- The company slightly lifted its revenue guidance for the full year to $3.11 billion at the midpoint from $3.08 billion

- Management reiterated its full-year Adjusted EPS guidance of $5.45 at the midpoint

- Operating Margin: 11.9%, in line with the same quarter last year

- Free Cash Flow Margin: 3.4%, down from 15.3% in the same quarter last year

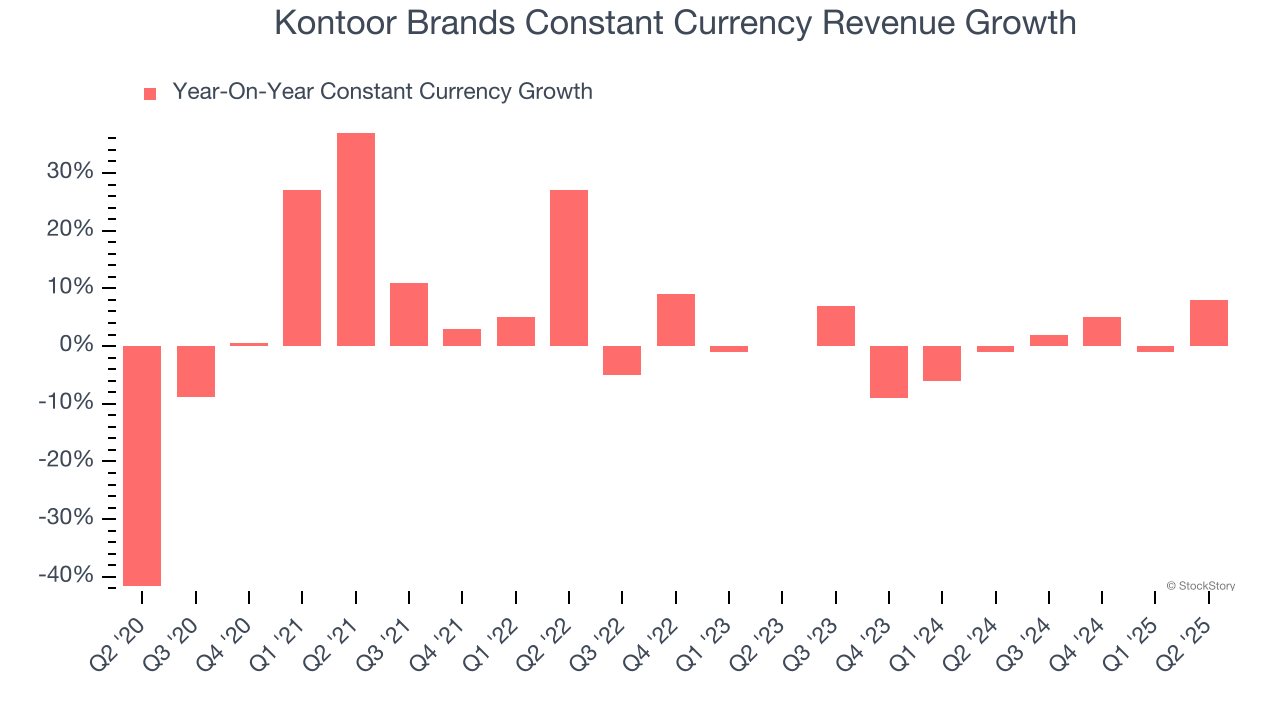

- Constant Currency Revenue rose 8% year on year (-1% in the same quarter last year)

- Market Capitalization: $3.15 billion

“Our strong second quarter results were driven by better-than-expected organic revenue growth, gross margin expansion, operating efficiency and cash generation, as well as a stronger-than-expected contribution from Helly Hansen,” said Scott Baxter, President, Chief Executive Officer and Chairman of the Board of Directors.

Company Overview

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE: KTB) is a clothing company known for its high-quality denim products.

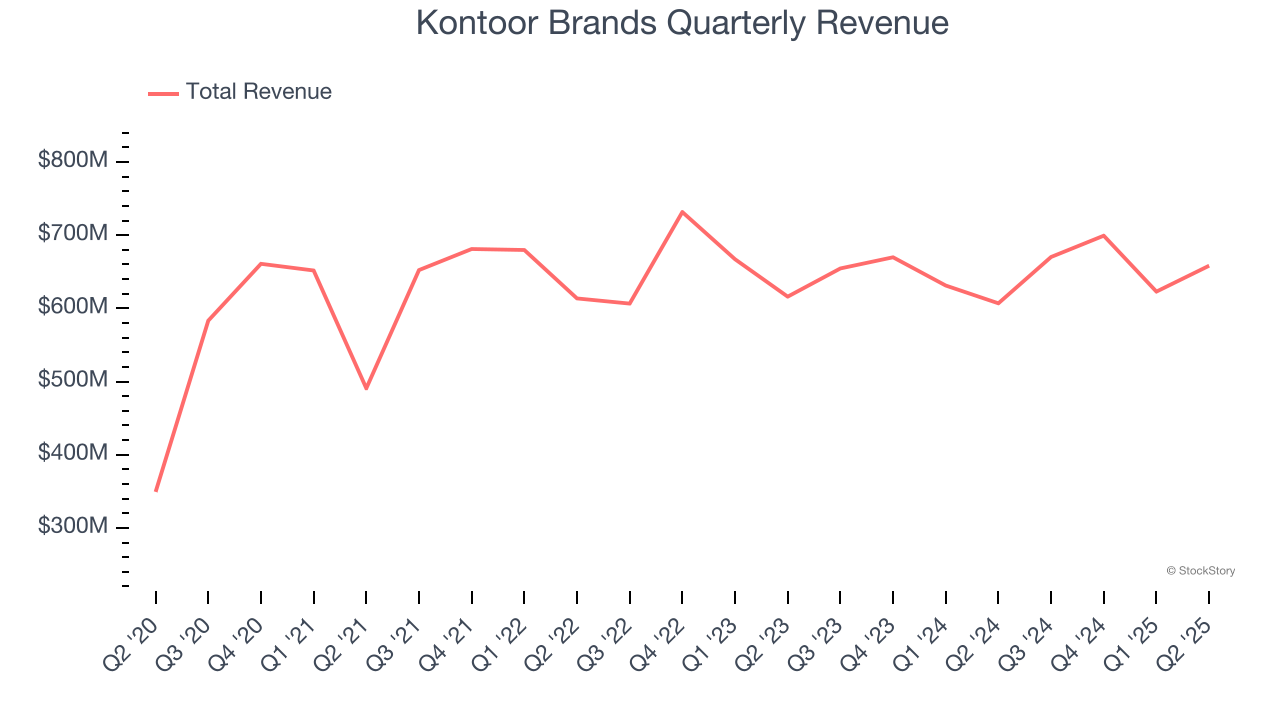

Revenue Growth

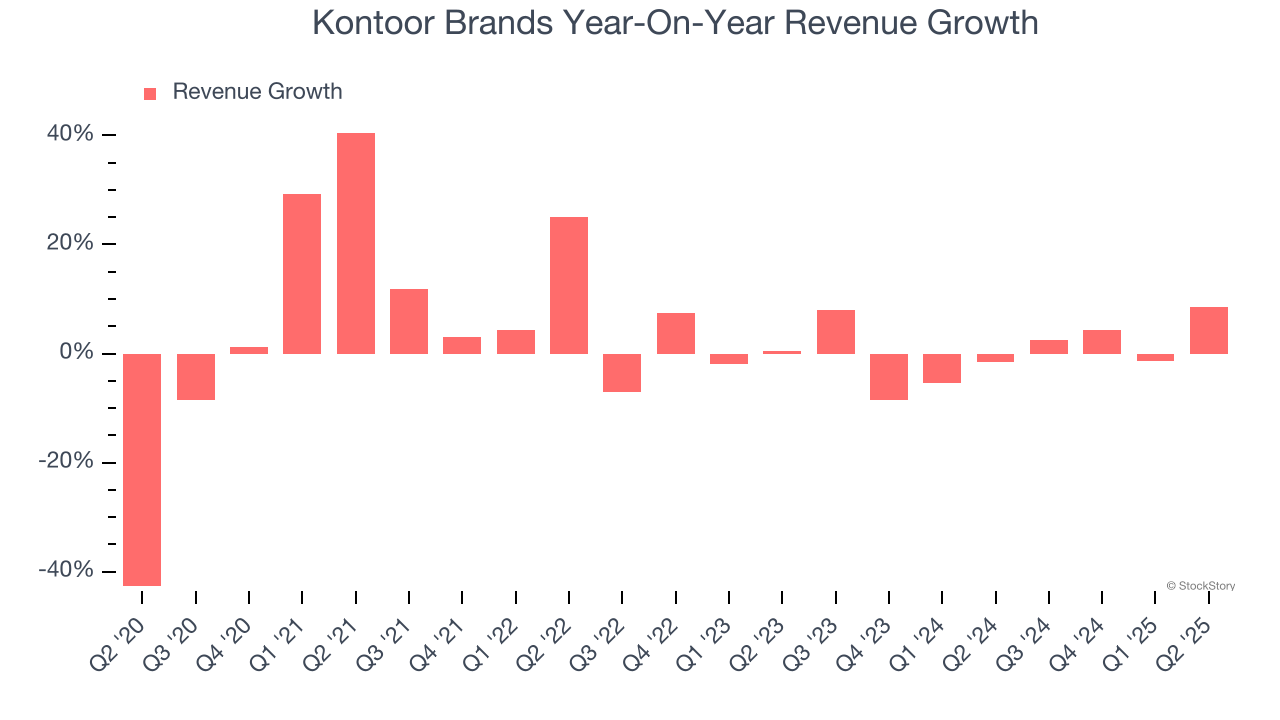

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Kontoor Brands’s 4.3% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Kontoor Brands’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

Kontoor Brands also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales were flat. Because this number aligns with its normal revenue growth, we can see that Kontoor Brands has properly hedged its foreign currency exposure.

This quarter, Kontoor Brands reported year-on-year revenue growth of 8.5%, and its $658.3 million of revenue exceeded Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to grow 26.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

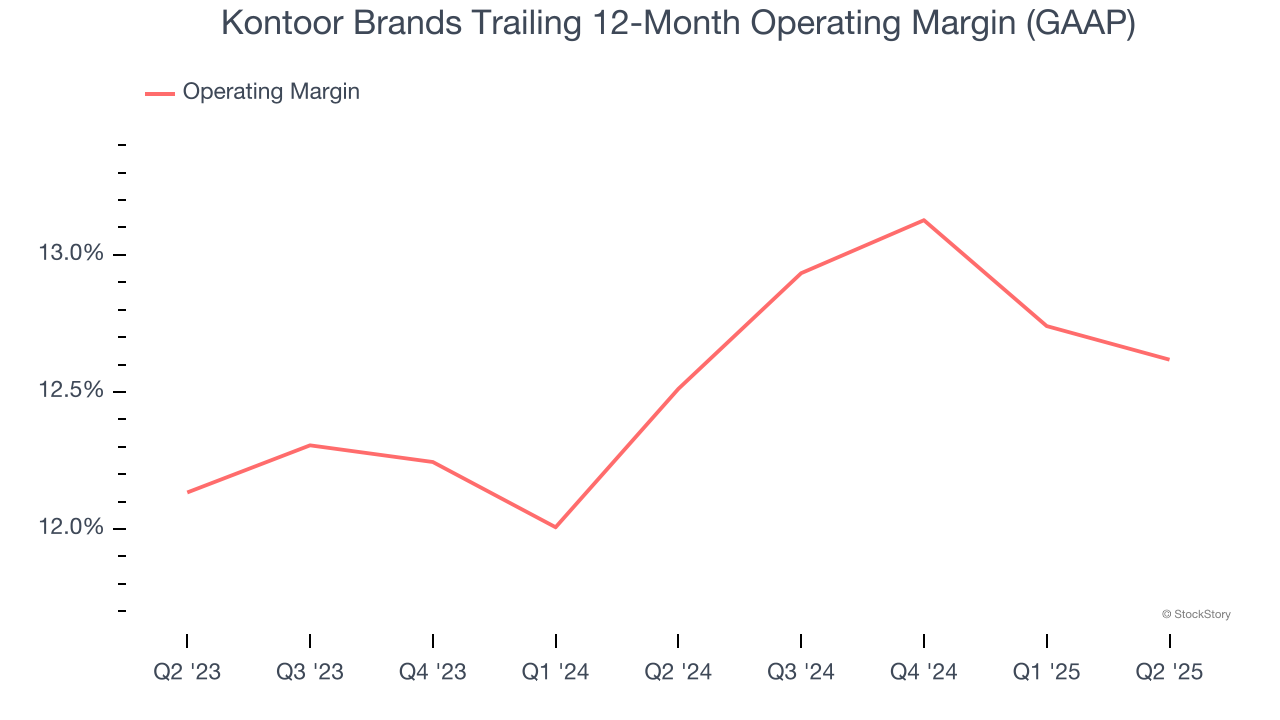

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Kontoor Brands’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 12.6% over the last two years. This profitability was higher than the broader consumer discretionary sector, showing it did a decent job managing its expenses.

In Q2, Kontoor Brands generated an operating margin profit margin of 11.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

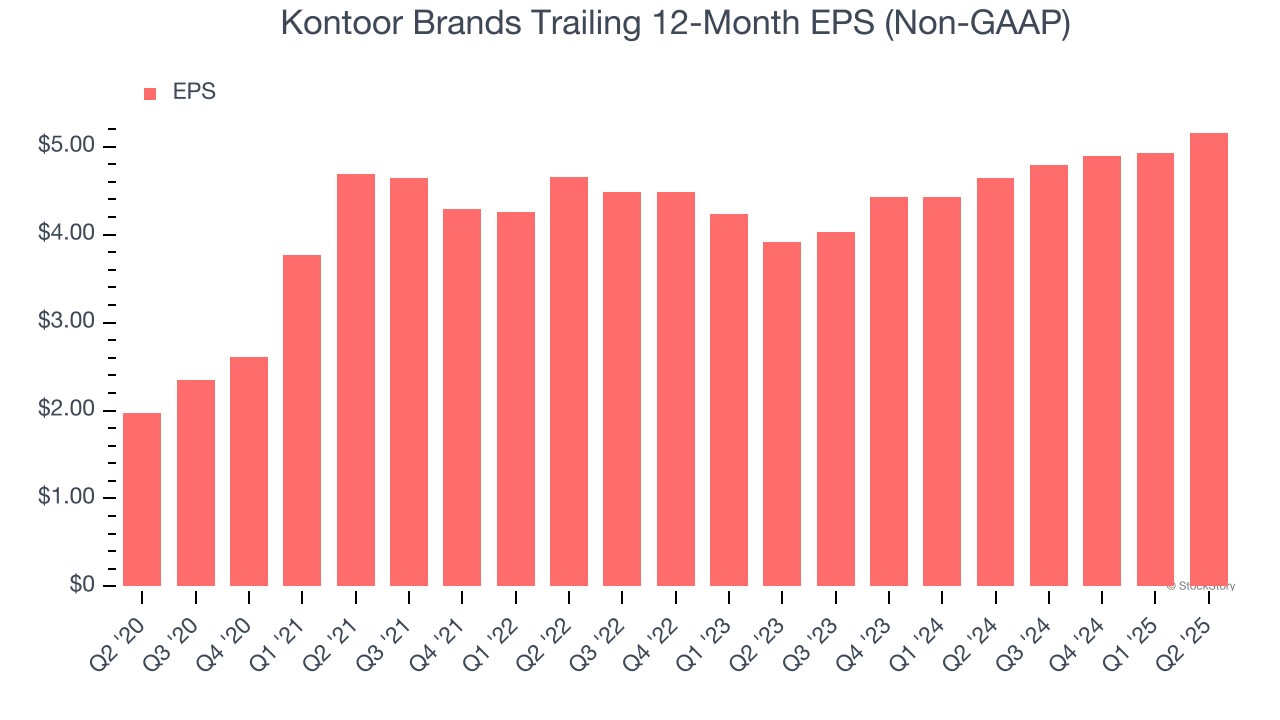

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Kontoor Brands’s EPS grew at a spectacular 21.2% compounded annual growth rate over the last five years, higher than its 4.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Kontoor Brands reported adjusted EPS at $1.21, up from $0.98 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Kontoor Brands’s full-year EPS of $5.16 to grow 5.8%.

Key Takeaways from Kontoor Brands’s Q2 Results

We were impressed by how significantly Kontoor Brands blew past analysts’ constant currency revenue expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 15.4% to $65.44 immediately following the results.

Kontoor Brands had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.