Telecommunications and cable services provider Altice USA (NYSE: ATUS) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 4.2% year on year to $2.15 billion. Its GAAP loss of $0.21 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Altice? Find out by accessing our full research report, it’s free.

Altice (ATUS) Q2 CY2025 Highlights:

- Revenue: $2.15 billion vs analyst estimates of $2.15 billion (4.2% year-on-year decline, in line)

- EPS (GAAP): -$0.21 vs analyst estimates of -$0.01 (significant miss)

- Adjusted EBITDA: $803.8 million vs analyst estimates of $848.9 million (37.4% margin, 5.3% miss)

- Operating Margin: 14.5%, down from 22.4% in the same quarter last year

- Free Cash Flow was $28.45 million, up from -$40.93 million in the same quarter last year

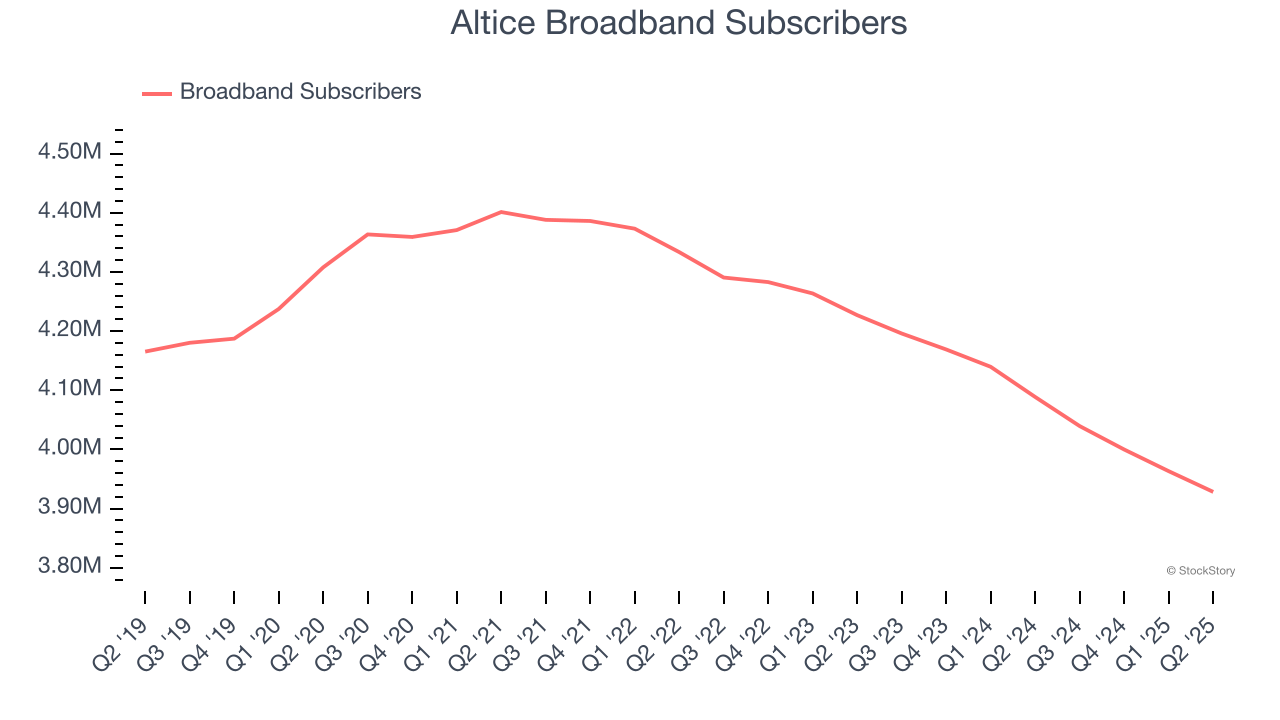

- Broadband Subscribers: 3.93 million, down 160,400 year on year

- Market Capitalization: $1.12 billion

Dennis Mathew, Altice USA Chairman and Chief Executive Officer, said: "Our second quarter results reflect continued momentum across our operational and financial priorities. We delivered sequential and year over year improvement in broadband subscriber trends and grew broadband ARPU year over year, reinforcing the strength of our core offering. We saw progress across our footprint, driven by targeted localized offers, improved sales channel performance, and stronger go-to-market execution, while churn reached its lowest second-quarter level in three years. We continued to scale our award-winning network, drove penetration of fiber, mobile, and our value-added services categories, executed efficiencies across workforce, programming, and network operations, and took important steps to enhance our capital structure. With these improvements in place, we remain focused on long-term growth, disciplined execution, and delivering value to our customers, communities, and shareholders. "

Company Overview

Based in Long Island City, Altice USA (NYSE: ATUS) is a telecommunications company offering cable, internet, telephone, and television services across the United States.

Revenue Growth

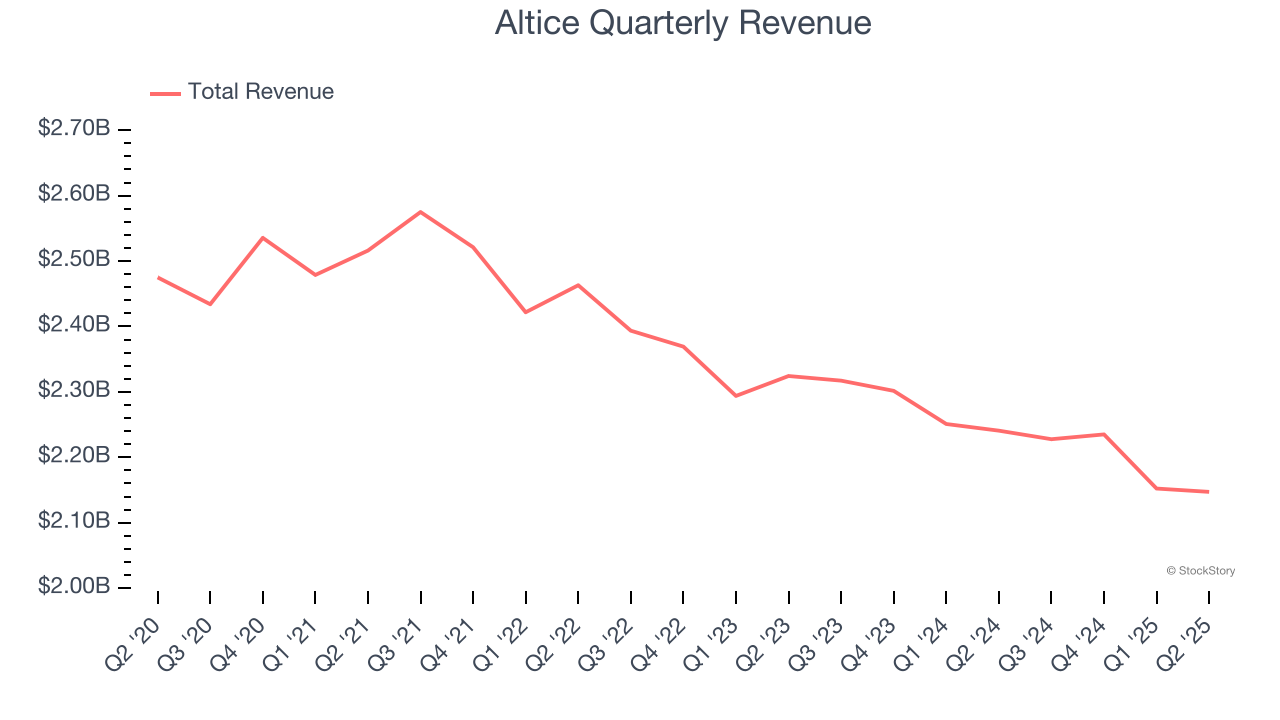

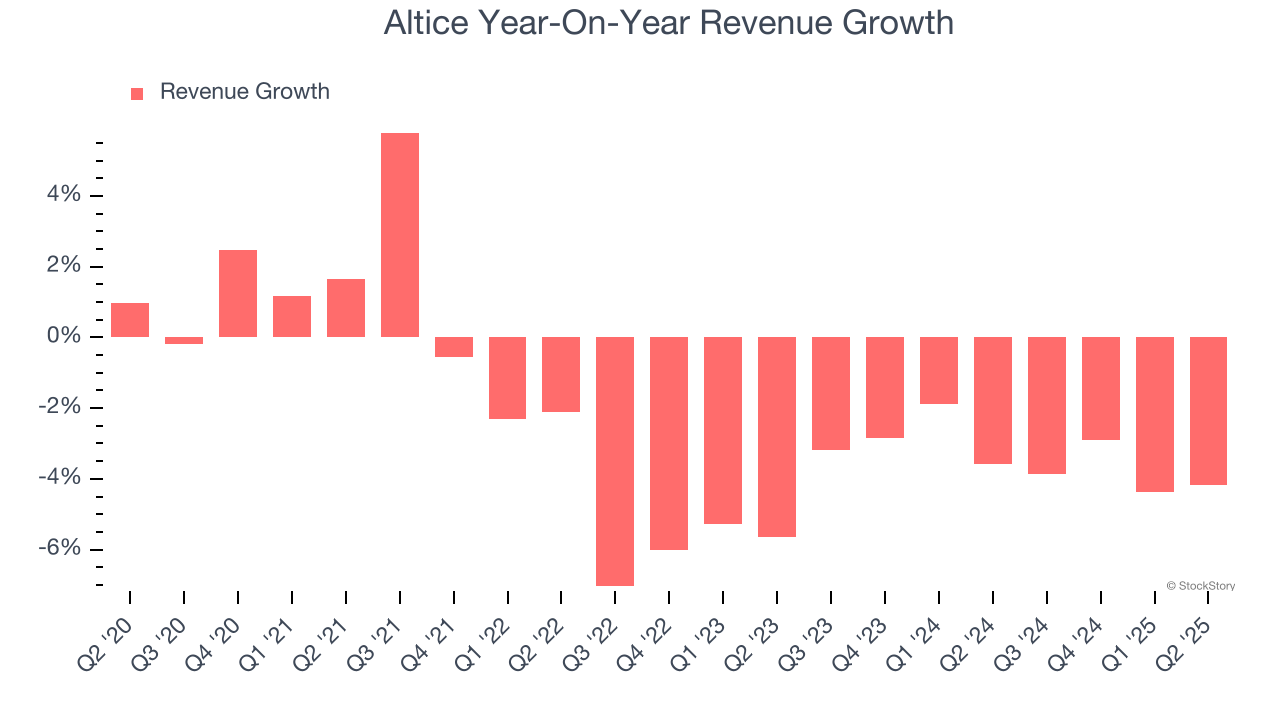

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Altice’s demand was weak and its revenue declined by 2.3% per year. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Altice’s recent performance shows its demand remained suppressed as its revenue has declined by 3.4% annually over the last two years.

Altice also discloses its number of broadband subscribers and pay tv subscribers, which clocked in at 3.93 million and 1.74 million in the latest quarter. Over the last two years, Altice’s broadband subscribers averaged 3.4% year-on-year declines while its pay tv subscribers averaged 12.6% year-on-year declines.

This quarter, Altice reported a rather uninspiring 4.2% year-on-year revenue decline to $2.15 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 3.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

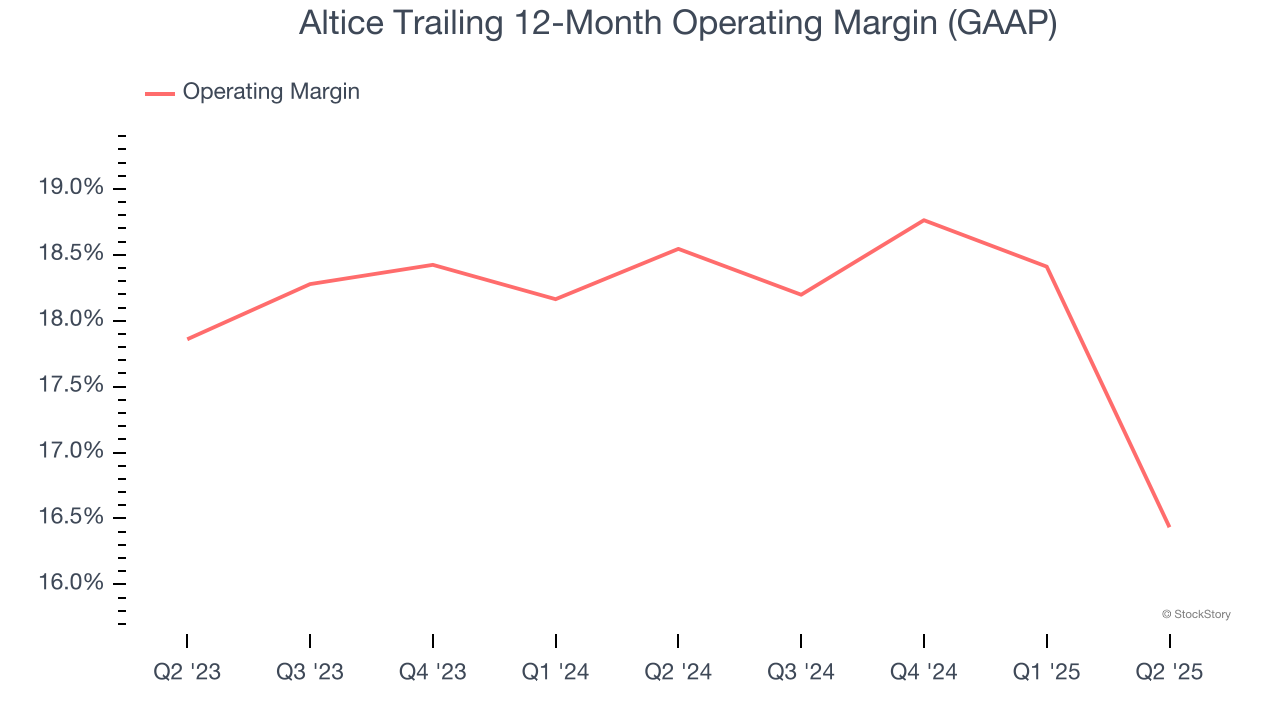

Operating Margin

Altice’s operating margin has been trending down over the last 12 months, but it still averaged 17.5% over the last two years, top-notch for a consumer discretionary business. This shows it’s an efficient company that manages its expenses effectively.

This quarter, Altice generated an operating margin profit margin of 14.5%, down 7.9 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

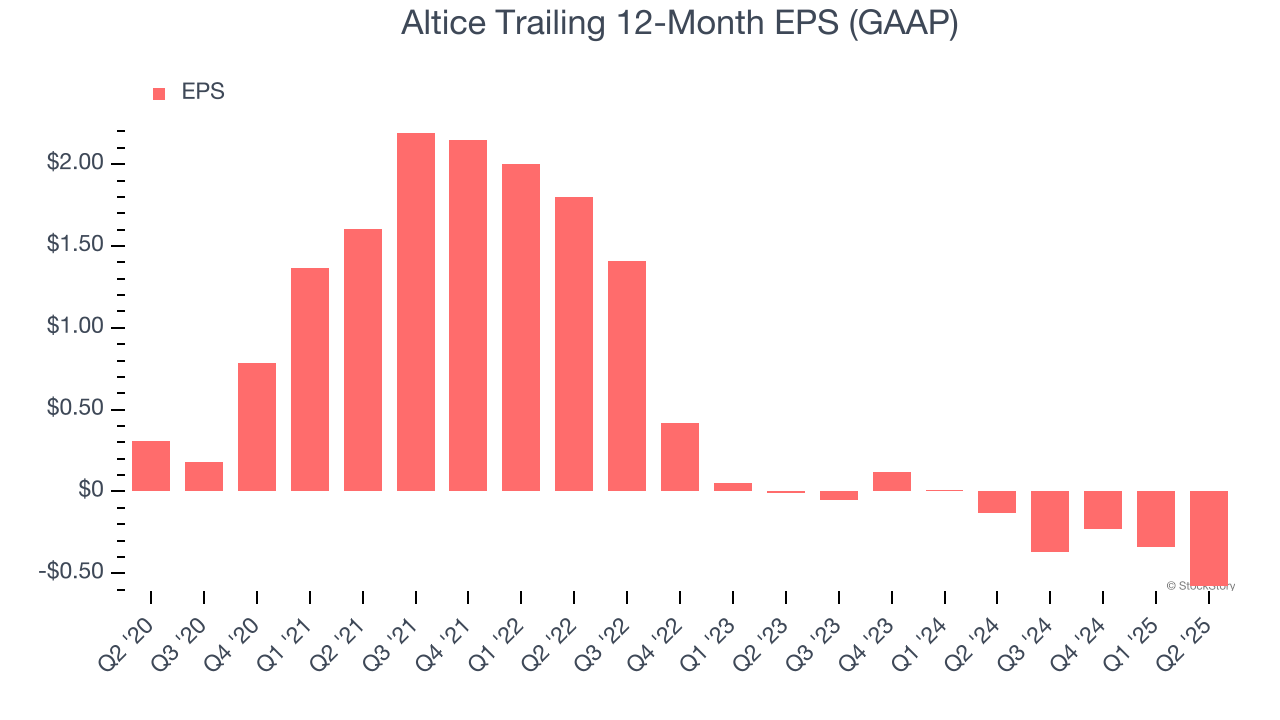

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Altice, its EPS declined by 31.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q2, Altice reported EPS at negative $0.21, down from $0.03 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Altice’s full-year EPS of negative $0.58 will reach break even.

Key Takeaways from Altice’s Q2 Results

We struggled to find many positives in these results. Its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 10.5% to $2.13 immediately following the results.

Altice didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.