Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Leggett & Platt (NYSE: LEG) and the best and worst performers in the home furnishings industry.

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

The 6 home furnishings stocks we track reported a satisfactory Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.8% above.

In light of this news, share prices of the companies have held steady as they are up 4.2% on average since the latest earnings results.

Leggett & Platt (NYSE: LEG)

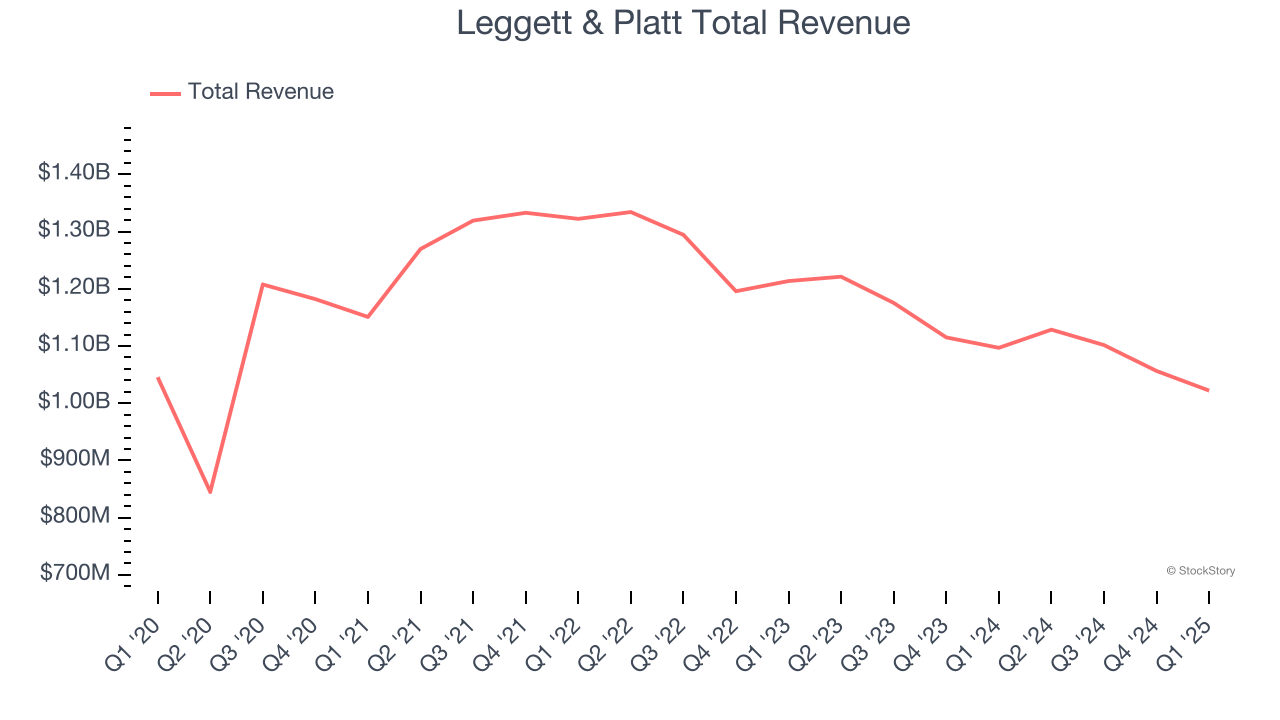

Founded in 1883, Leggett & Platt (NYSE: LEG) is a diversified manufacturer of products and components for various industries.

Leggett & Platt reported revenues of $1.02 billion, down 6.8% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

President and CEO Karl Glassman commented, "We are pleased to report better than anticipated first quarter earnings. Our earnings improvement is a testament to the excellent execution of our restructuring plan and operational efficiency improvement initiatives, as well as disciplined cost management. As we navigate the complex and fluid tariff environment, we are mitigating impacts while pursuing any opportunities to capture increased demand for domestically produced products. While we expect that tariffs overall may be a net positive for our business, we are concerned about potential negative effects on inflation, consumer confidence, and discretionary demand.

Leggett & Platt delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 34.7% since reporting and currently trades at $9.78.

Is now the time to buy Leggett & Platt? Access our full analysis of the earnings results here, it’s free.

Best Q1: Purple (NASDAQ: PRPL)

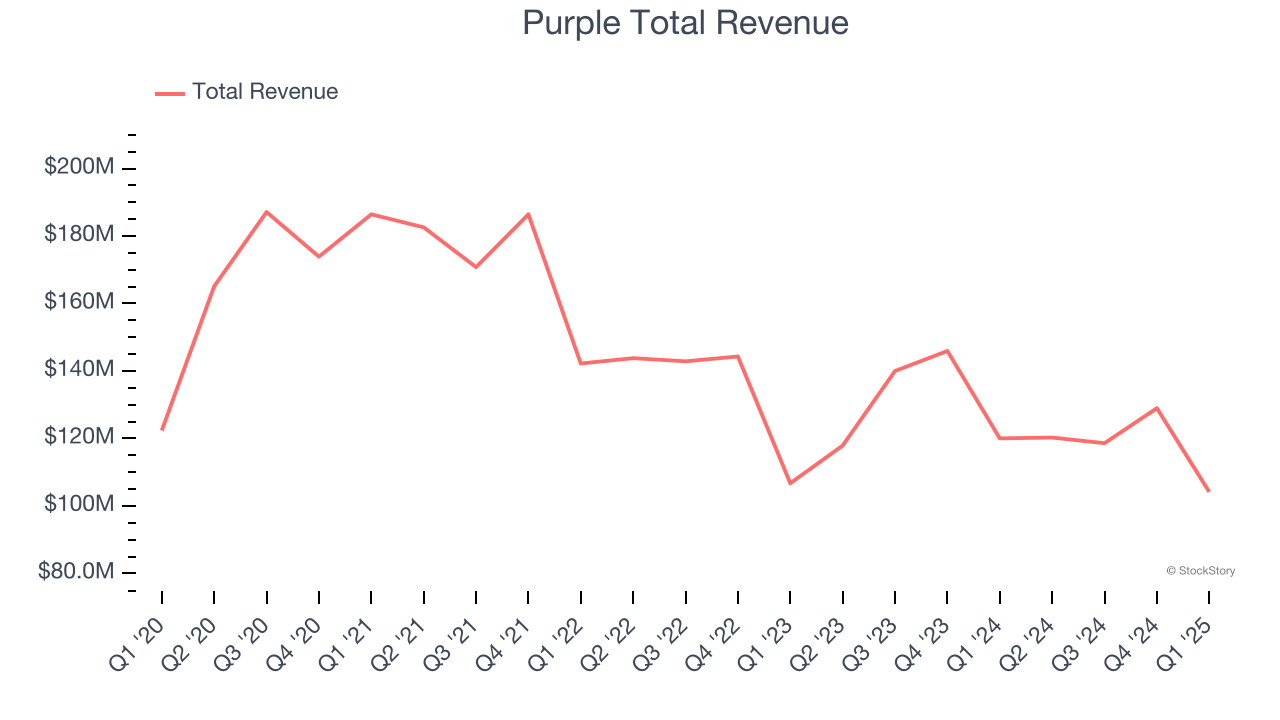

Founded by two brothers, Purple (NASDAQ: PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

Purple reported revenues of $104.2 million, down 13.2% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Purple pulled off the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 8.5% since reporting. It currently trades at $0.69.

Is now the time to buy Purple? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Somnigroup (NYSE: SGI)

Established through the merger of Tempur-Pedic and Sealy in 2012, Somnigroup (NYSE: SGI) is a bedding manufacturer known for its innovative memory foam mattresses and sleep products

Somnigroup reported revenues of $1.60 billion, up 34.9% year on year, falling short of analysts’ expectations by 1.8%. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a miss of analysts’ Direct revenue estimates.

Somnigroup delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 15.9% since the results and currently trades at $70.26.

Read our full analysis of Somnigroup’s results here.

Lovesac (NASDAQ: LOVE)

Known for its oversized, premium beanbags, Lovesac (NASDAQ: LOVE) is a specialty furniture brand selling modular furniture.

Lovesac reported revenues of $138.4 million, up 4.3% year on year. This number topped analysts’ expectations by 0.7%. It was a very strong quarter as it also put up EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 14.5% since reporting and currently trades at $17.58.

Read our full, actionable report on Lovesac here, it’s free.

La-Z-Boy (NYSE: LZB)

The prized possession of every mancave, La-Z-Boy (NYSE: LZB) is a furniture company specializing in recliners, sofas, and seats.

La-Z-Boy reported revenues of $570.9 million, up 3.1% year on year. This result beat analysts’ expectations by 2.2%. More broadly, it was a satisfactory quarter as it also produced a decent beat of analysts’ adjusted operating income estimates but a slight miss of analysts’ EPS estimates.

La-Z-Boy pulled off the biggest analyst estimates beat among its peers. The stock is down 4.2% since reporting and currently trades at $37.16.

Read our full, actionable report on La-Z-Boy here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.