Electricity storage and software provider Fluence (NASDAQ: FLNC) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales fell by 30.7% year on year to $431.6 million. On the other hand, the company’s full-year revenue guidance of $2.7 billion at the midpoint came in 15.3% below analysts’ estimates. Its GAAP loss of $0.24 per share was 10.3% below analysts’ consensus estimates.

Is now the time to buy Fluence Energy? Find out by accessing our full research report, it’s free.

Fluence Energy (FLNC) Q1 CY2025 Highlights:

- Revenue: $431.6 million vs analyst estimates of $343.5 million (30.7% year-on-year decline, 25.7% beat)

- EPS (GAAP): -$0.24 vs analyst expectations of -$0.22 (10.3% miss)

- Adjusted EBITDA: -$30.41 million vs analyst estimates of -$31.74 million (-7% margin, 4.2% beat)

- The company dropped its revenue guidance for the full year to $2.7 billion at the midpoint from $3.4 billion, a 20.6% decrease

- EBITDA guidance for the full year is $10 million at the midpoint, below analyst estimates of $49.82 million

- Operating Margin: -10.2%, down from -2.5% in the same quarter last year

- Free Cash Flow was -$53.76 million, down from $65.99 million in the same quarter last year

- Backlog: $4.9 billion at quarter end

- Market Capitalization: $544.9 million

"The evolving trade and tariff landscape has created significant uncertainty in the U.S. market, which has led us to agree with our customers during the second quarter to pause certain contracts both under execution and those we expected to sign until we have better visibility. As a result, our order intake for the quarter was below initial expectations, reflecting this dynamic. Over time, we expect our domestically sourced solutions to benefit from higher tariff levels," said Julian Nebreda, Fluence's Chief Executive Officer.

Company Overview

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ: FLNC) helps store renewable energy sources with battery systems.

Sales Growth

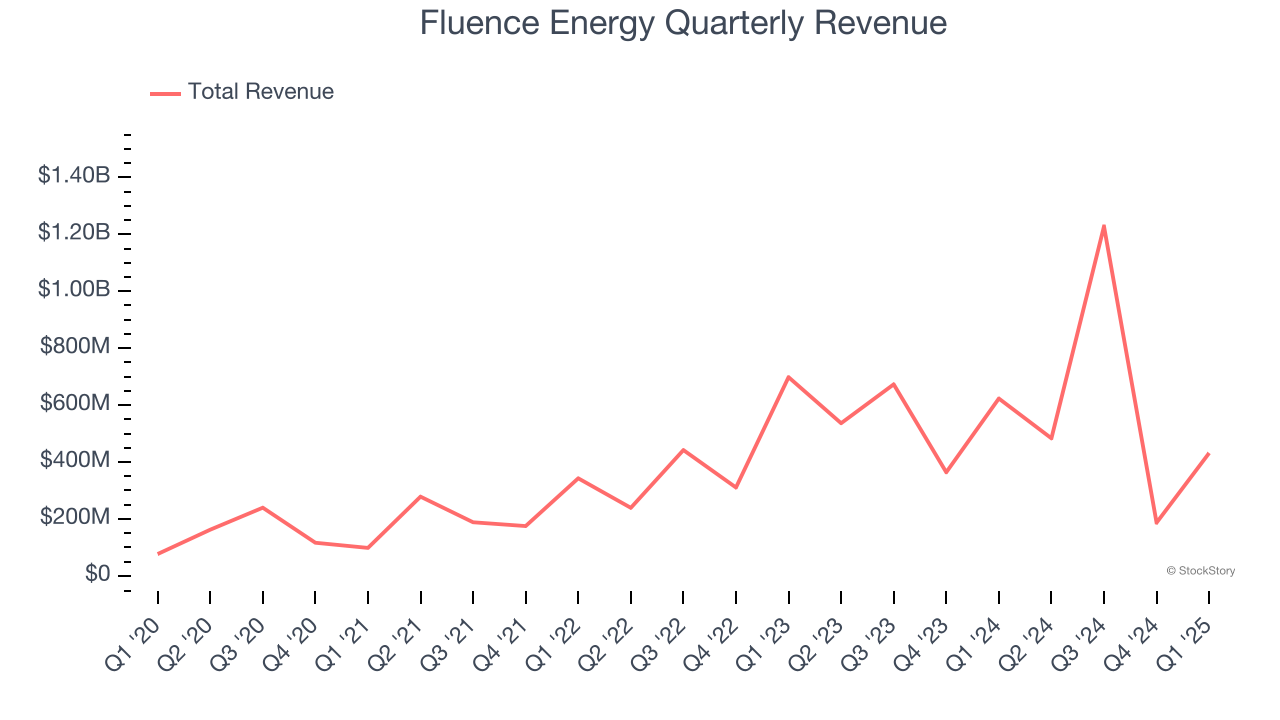

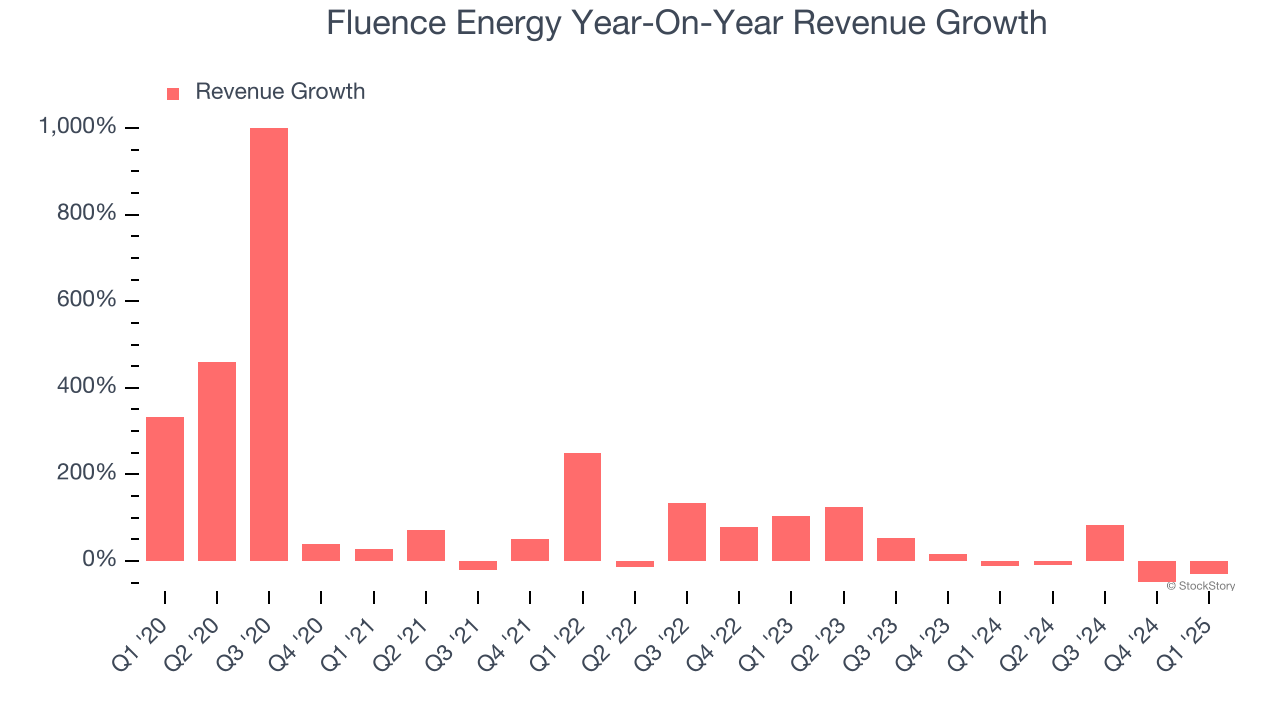

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Fluence Energy’s 63.4% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Fluence Energy’s annualized revenue growth of 17.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand. Fluence Energy recent performance stands out, especially when considering many similar Renewable Energy businesses faced declining sales because of cyclical headwinds.

This quarter, Fluence Energy’s revenue fell by 30.7% year on year to $431.6 million but beat Wall Street’s estimates by 25.7%.

Looking ahead, sell-side analysts expect revenue to grow 62.5% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

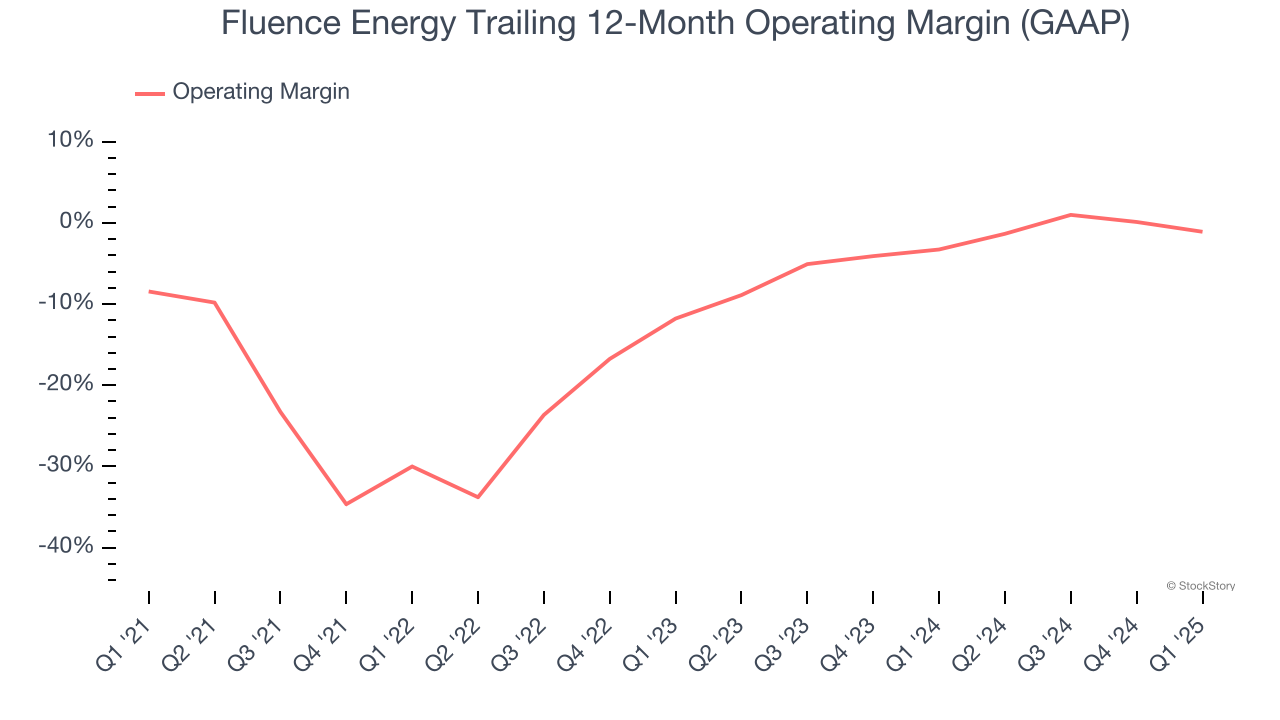

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Fluence Energy’s high expenses have contributed to an average operating margin of negative 8.2% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Fluence Energy’s operating margin rose by 7.4 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Fluence Energy generated a negative 10.2% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

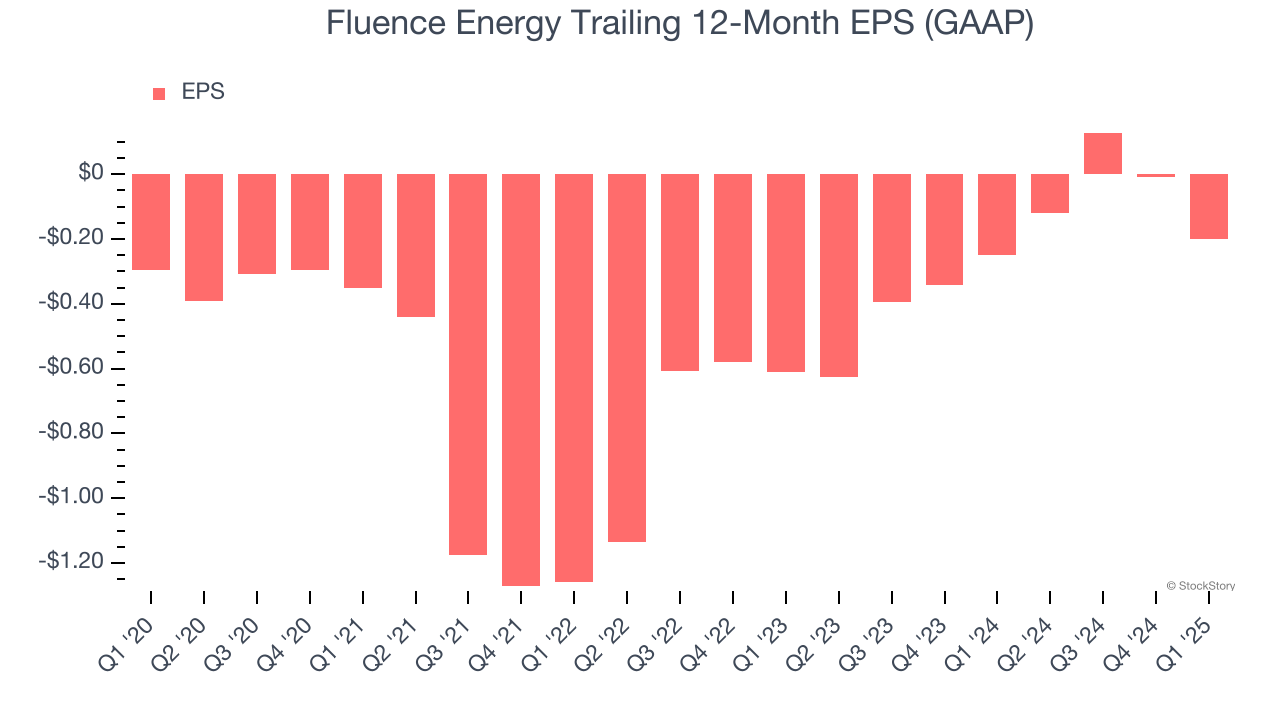

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Fluence Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 7.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Fluence Energy, its two-year annual EPS growth of 42.8% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q1, Fluence Energy reported EPS at negative $0.24, down from negative $0.05 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Fluence Energy’s full-year EPS of negative $0.20 will reach break even.

Key Takeaways from Fluence Energy’s Q1 Results

We liked that Fluence Energy beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its full-year revenue guidance missed significantly and its full-year EBITDA guidance fell short of Wall Street’s estimates. The company said it "is revising its fiscal year 2025 guidance to reflect the currently-anticipated impact of ongoing economic uncertainty in the U.S. market, caused particularly by tariff policy that led to what the Company expects is a temporary deceleration in its U.S. customer contracting activity." Overall, this was a worrisome quarter. The stock traded down 21.9% to $3.51 immediately after reporting.

Fluence Energy didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.