As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at data infrastructure stocks, starting with Teradata (NYSE: TDC).

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

The 5 data infrastructure stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was 1.2% below.

Thankfully, share prices of the companies have been resilient as they are up 6% on average since the latest earnings results.

Best Q3: Teradata (NYSE: TDC)

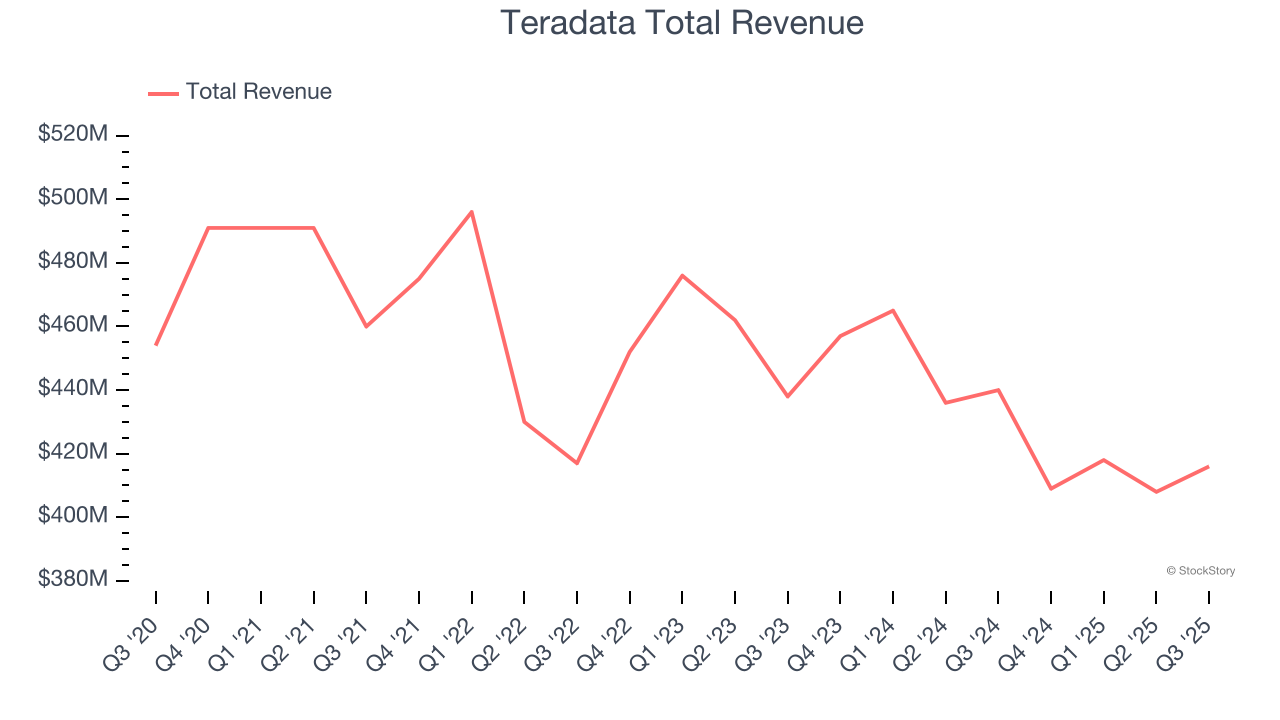

Pioneering data warehousing technology in the 1980s before "big data" was a common term, Teradata (NYSE: TDC) provides cloud-based data analytics and AI platforms that help large enterprises integrate, analyze, and leverage their data across multiple environments.

Teradata reported revenues of $416 million, down 5.5% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

“Q3 marked another quarter of solid execution as we beat our revenue and recurring revenue guidance ranges, as well as delivered non-GAAP earnings per share and free cash flow ahead of expectations. We are affirming our outlook for 2025,” said Steve McMillan, president and CEO, Teradata.

Teradata achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 43.7% since reporting and currently trades at $29.75.

Is now the time to buy Teradata? Access our full analysis of the earnings results here, it’s free for active Edge members.

Elastic (NYSE: ESTC)

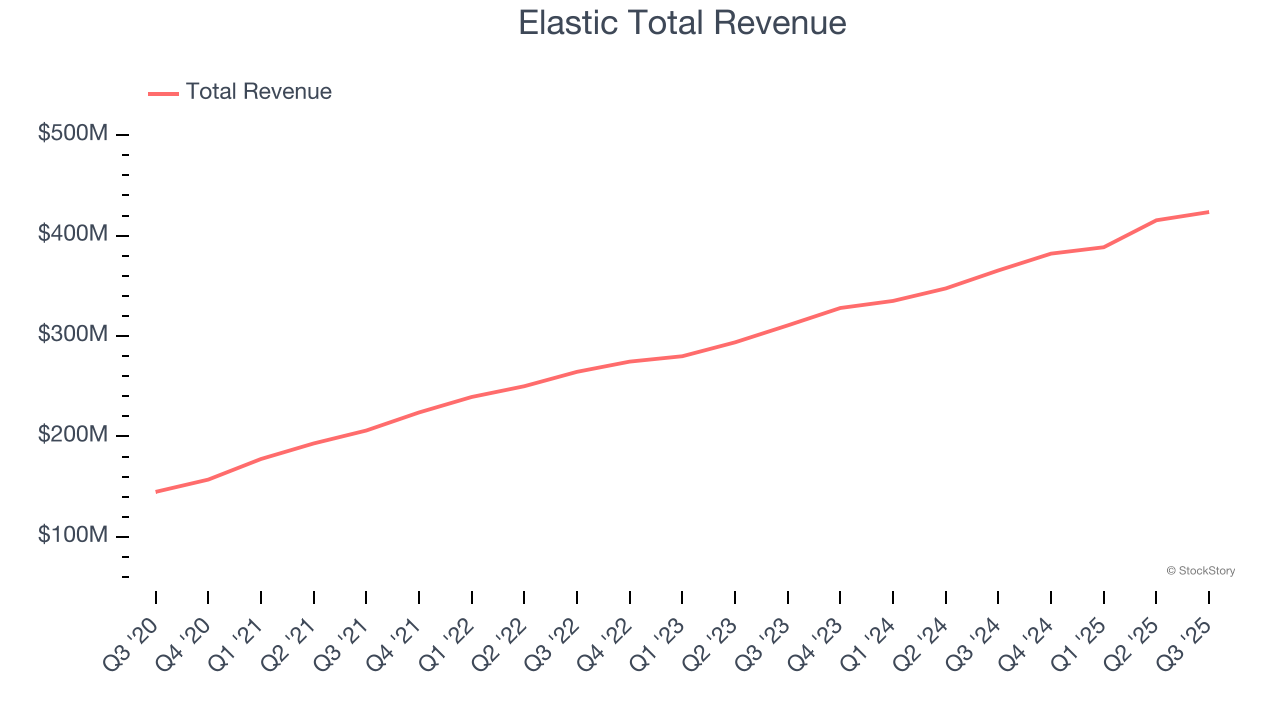

Built on the powerful open-source Elasticsearch technology that powers search functionality for thousands of websites worldwide, Elastic (NYSE: ESTC) provides a search and AI platform that helps organizations find insights from their data, monitor applications, and protect against security threats.

Elastic reported revenues of $423.5 million, up 15.9% year on year, outperforming analysts’ expectations by 1.3%. The business had a satisfactory quarter with EPS guidance for next quarter exceeding analysts’ expectations but a significant miss of analysts’ billings estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 10.2% since reporting. It currently trades at $73.74.

Is now the time to buy Elastic? Access our full analysis of the earnings results here, it’s free for active Edge members.

Oracle (NYSE: ORCL)

Starting as a database company in 1977 and now powering mission-critical systems across the globe, Oracle (NYSE: ORCL) provides enterprise software and hardware products and services that help businesses manage their information technology needs.

Oracle reported revenues of $14.93 billion, up 12.2% year on year, falling short of analysts’ expectations by 0.7%. It was a mixed quarter as it posted a solid beat of analysts’ remaining performance obligation estimates but a slight miss of analysts’ revenue estimates.

Oracle delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 10.2% since the results and currently trades at $217.15.

Read our full analysis of Oracle’s results here.

C3.ai (NYSE: AI)

Named after the three Cs of its original focus—carbon, cloud computing, and customer relationship management—C3.ai (NYSE: AI) provides enterprise AI software that helps organizations develop, deploy, and operate large-scale artificial intelligence applications across various industries.

C3.ai reported revenues of $75.15 million, down 20.3% year on year. This result met analysts’ expectations. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

C3.ai scored the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is up 1.3% since reporting and currently trades at $15.37.

Read our full, actionable report on C3.ai here, it’s free for active Edge members.

Confluent (NASDAQ: CFLT)

Built by the original creators of Apache Kafka, the popular open-source messaging system, Confluent (NASDAQ: CFLT) provides a data infrastructure platform that enables organizations to connect their applications, systems, and data layers around real-time data streams.

Confluent reported revenues of $298.5 million, up 19.3% year on year. This number beat analysts’ expectations by 2.1%. More broadly, it was a mixed quarter as it also logged an impressive beat of analysts’ billings estimates but full-year revenue guidance missing analysts’ expectations significantly.

Confluent delivered the fastest revenue growth but had the weakest full-year guidance update among its peers. The company added 48 enterprise customers paying more than $100,000 annually to reach a total of 1,487. The stock is up 5.5% since reporting and currently trades at $23.40.

Read our full, actionable report on Confluent here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.