Since December 2020, the S&P 500 has delivered a total return of 82.9%. But one standout stock has more than doubled the market - over the past five years, American Express has surged 218% to $377.95 per share. Its momentum hasn’t stopped as it’s also gained 29.1% in the last six months thanks to its solid quarterly results, beating the S&P by 15.2%.

Is it too late to buy AXP? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On American Express?

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE: AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

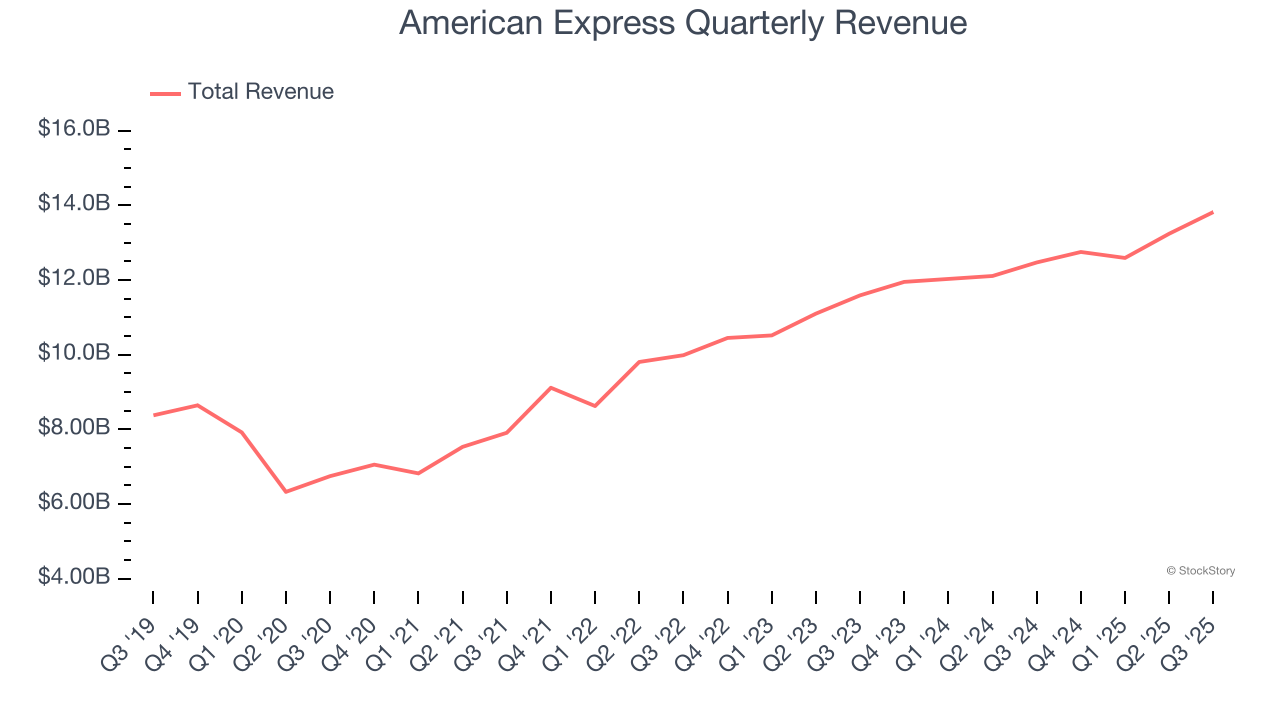

1. Long-Term Revenue Growth Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

Luckily, American Express’s revenue grew at a solid 12.1% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

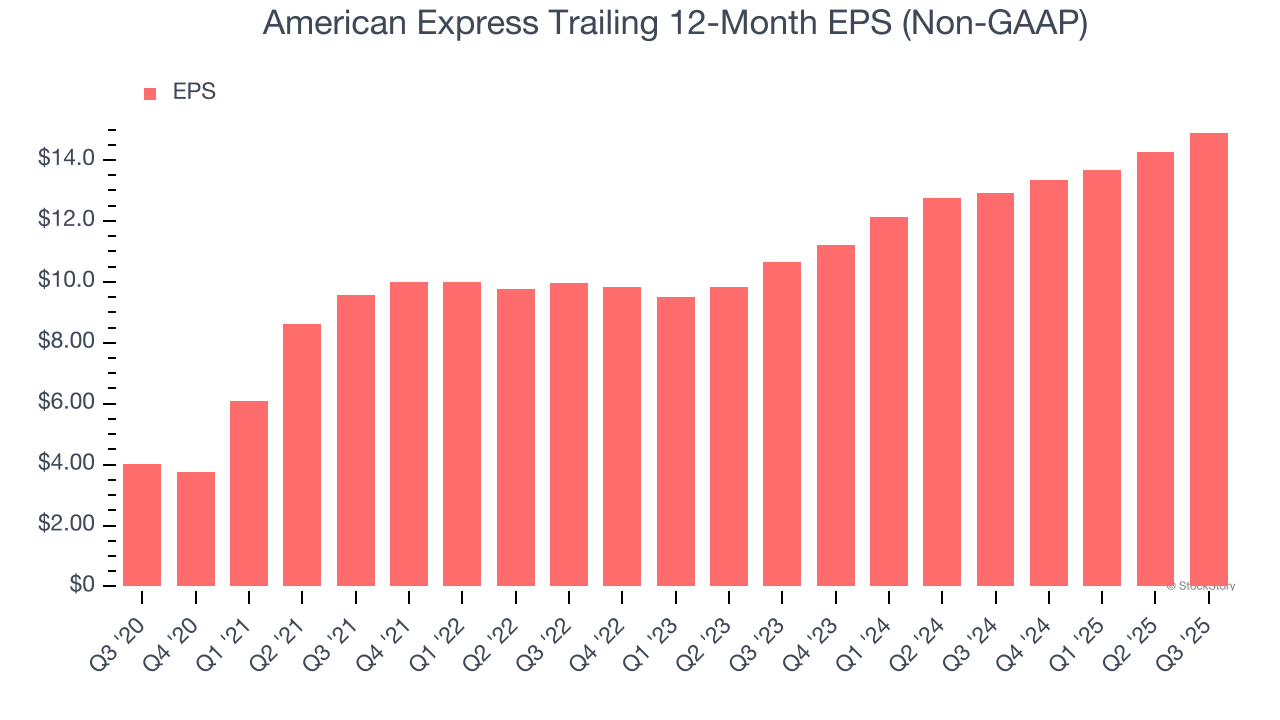

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

American Express’s EPS grew at an astounding 29.9% compounded annual growth rate over the last five years, higher than its 12.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

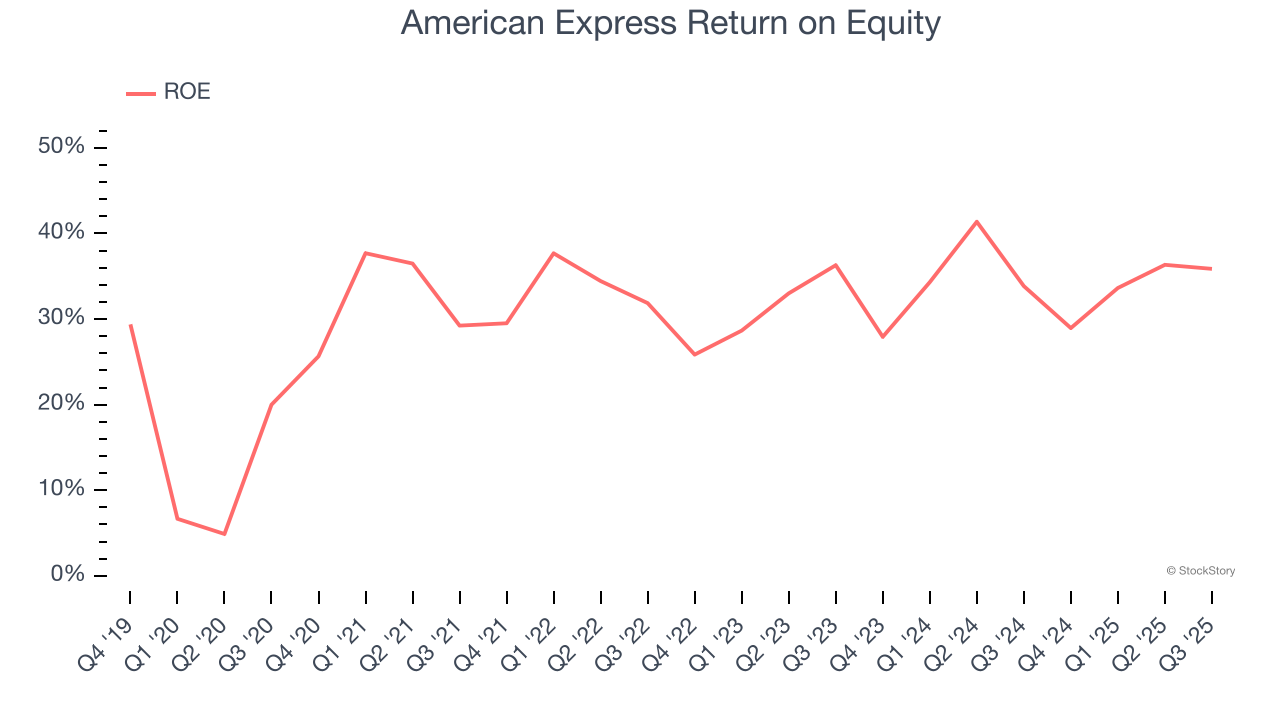

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, American Express has averaged an ROE of 32.9%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows American Express has a strong competitive moat.

Final Judgment

These are just a few reasons why we think American Express is an elite financials company, and with its shares topping the market in recent months, the stock trades at 23× forward P/E (or $377.95 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.