Since June 2024, Douglas Dynamics has been in a holding pattern, posting a small loss of 1% while floating around $25.32. The stock also fell short of the S&P 500’s 13.5% gain during that period.

Is there a buying opportunity in Douglas Dynamics, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We don't have much confidence in Douglas Dynamics. Here are three reasons why you should be careful with PLOW and a stock we'd rather own.

Why Do We Think Douglas Dynamics Will Underperform?

Once manufacturing snowplows designed for the iconic jeep vehicle precursor, Douglas Dynamics (NYSE: PLOW) offers snow and ice equipment for the roads and sidewalks.

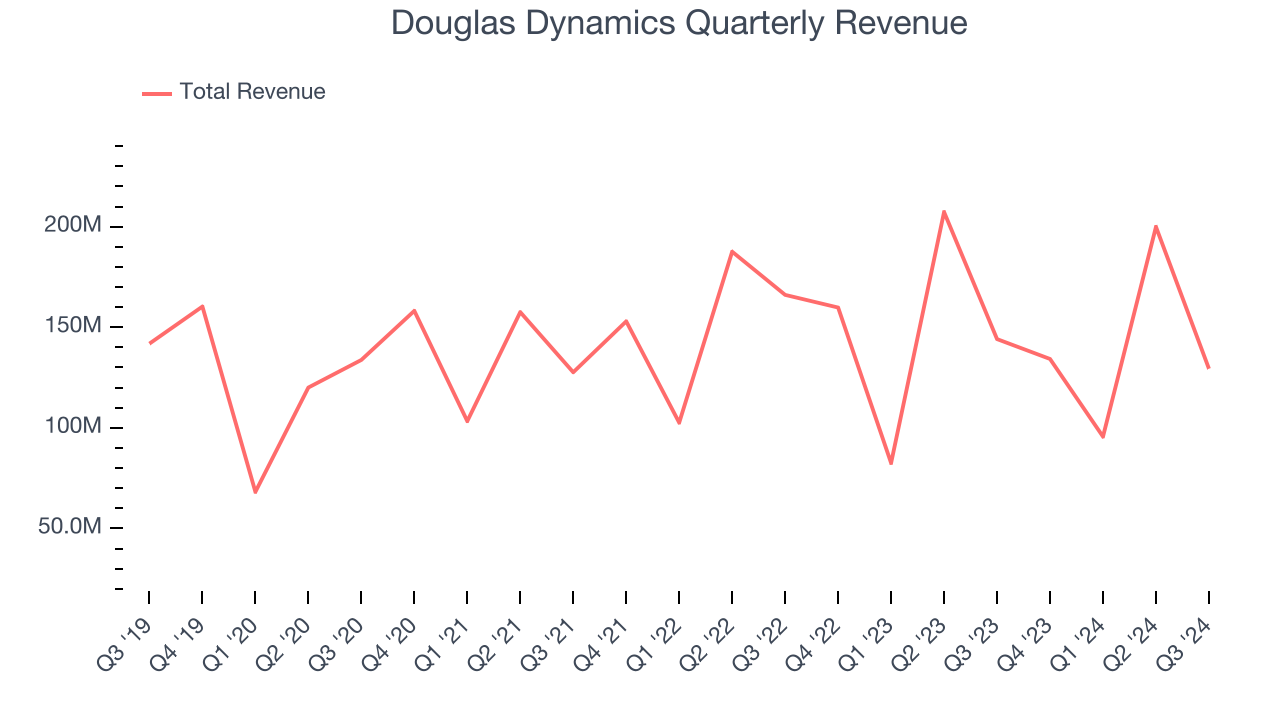

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Douglas Dynamics struggled to consistently increase demand as its $559.2 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

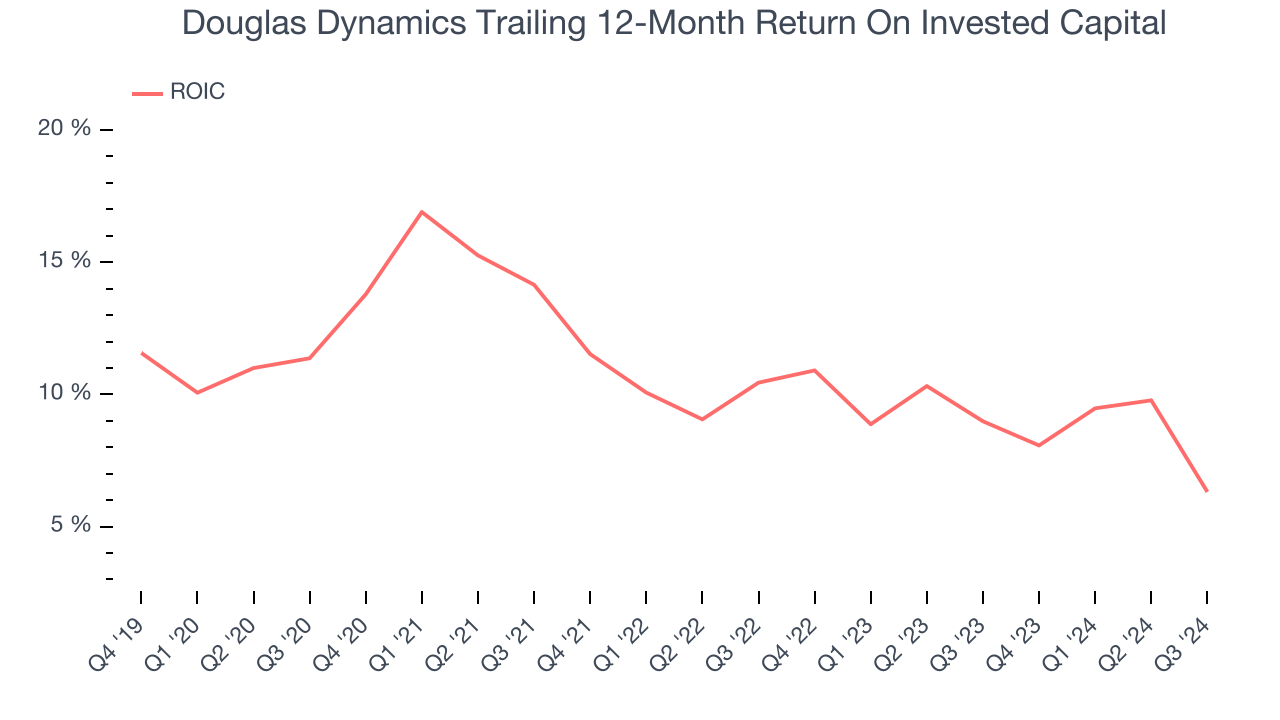

2. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Douglas Dynamics’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

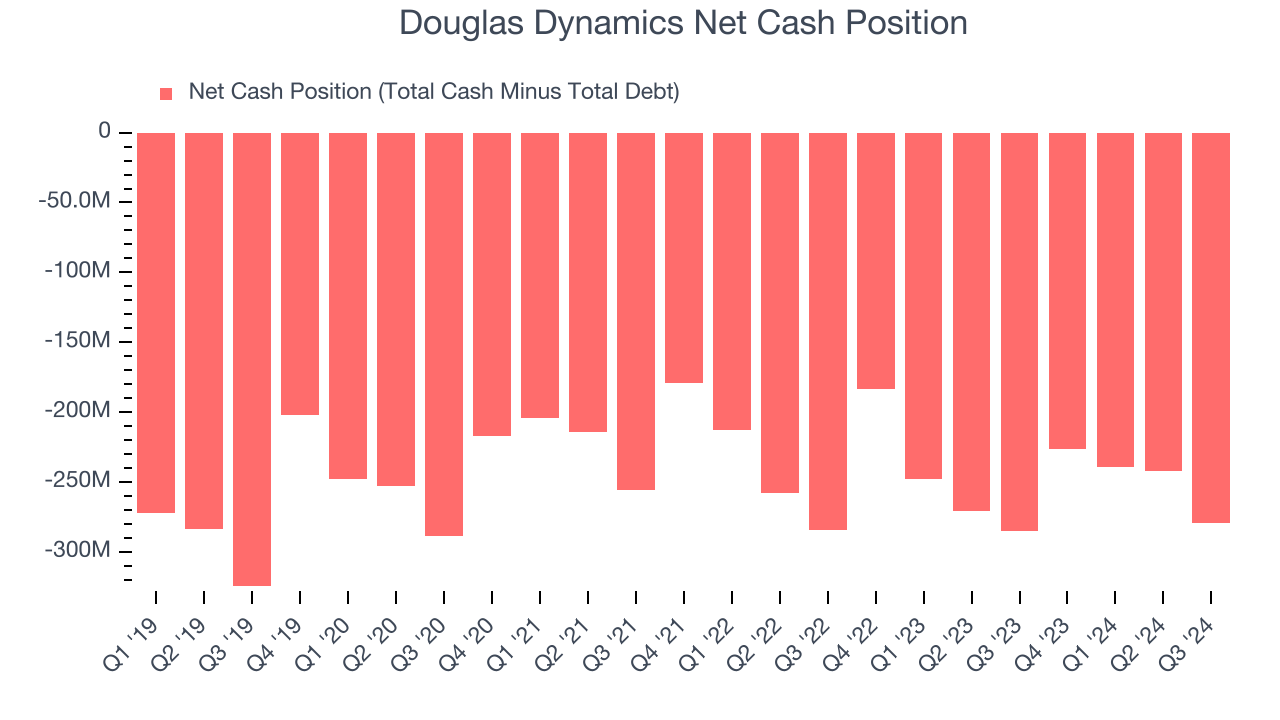

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Douglas Dynamics’s $287.6 million of debt exceeds the $8.41 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $52.35 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Douglas Dynamics could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Douglas Dynamics can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

Douglas Dynamics doesn’t pass our quality test. With its shares underperforming the market lately, the stock trades at 13× forward price-to-earnings (or $25.32 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now. We’d suggest looking at Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Douglas Dynamics

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.