AAR has been treading water for the past six months, recording a small return of 1.3% while holding steady at $68.45. The stock also fell short of the S&P 500’s 13.5% gain during that period.

Does this present a buying opportunity for AIR? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does AIR Stock Spark Debate?

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE: AIR) is a provider of aircraft maintenance services

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

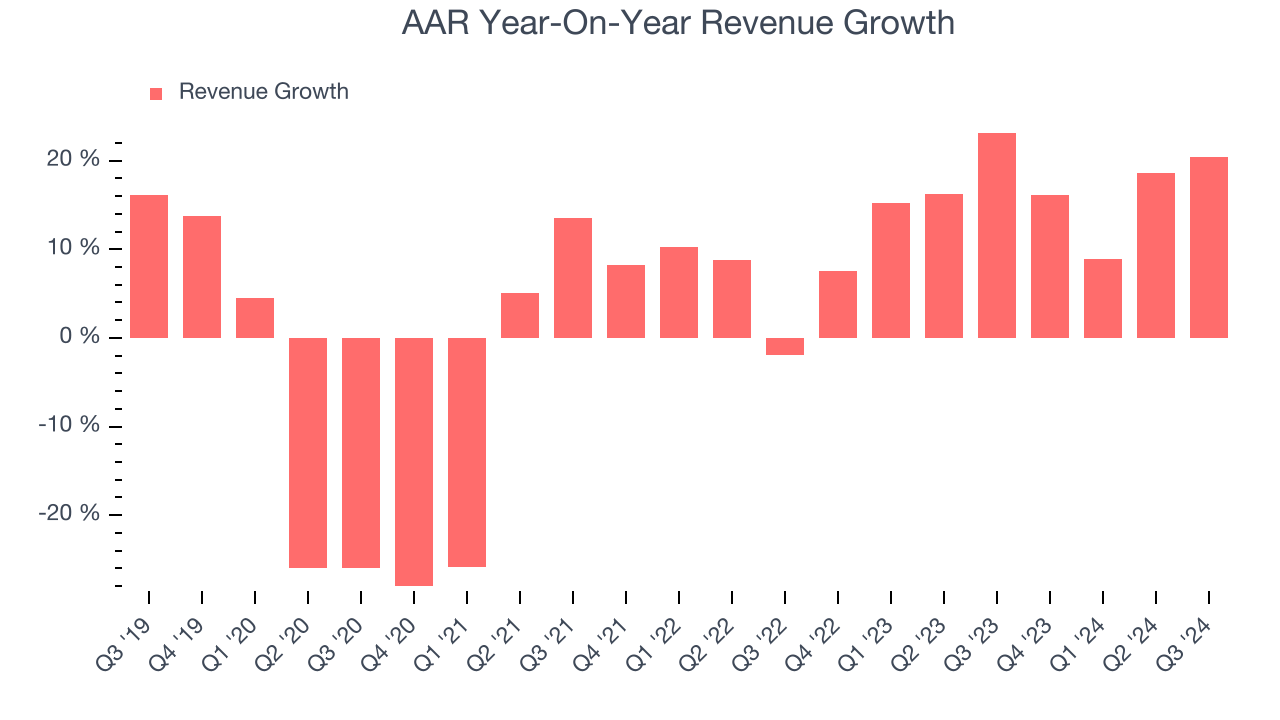

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. AAR’s annualized revenue growth of 15.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

2. Operating Margin Rising, Profits Up

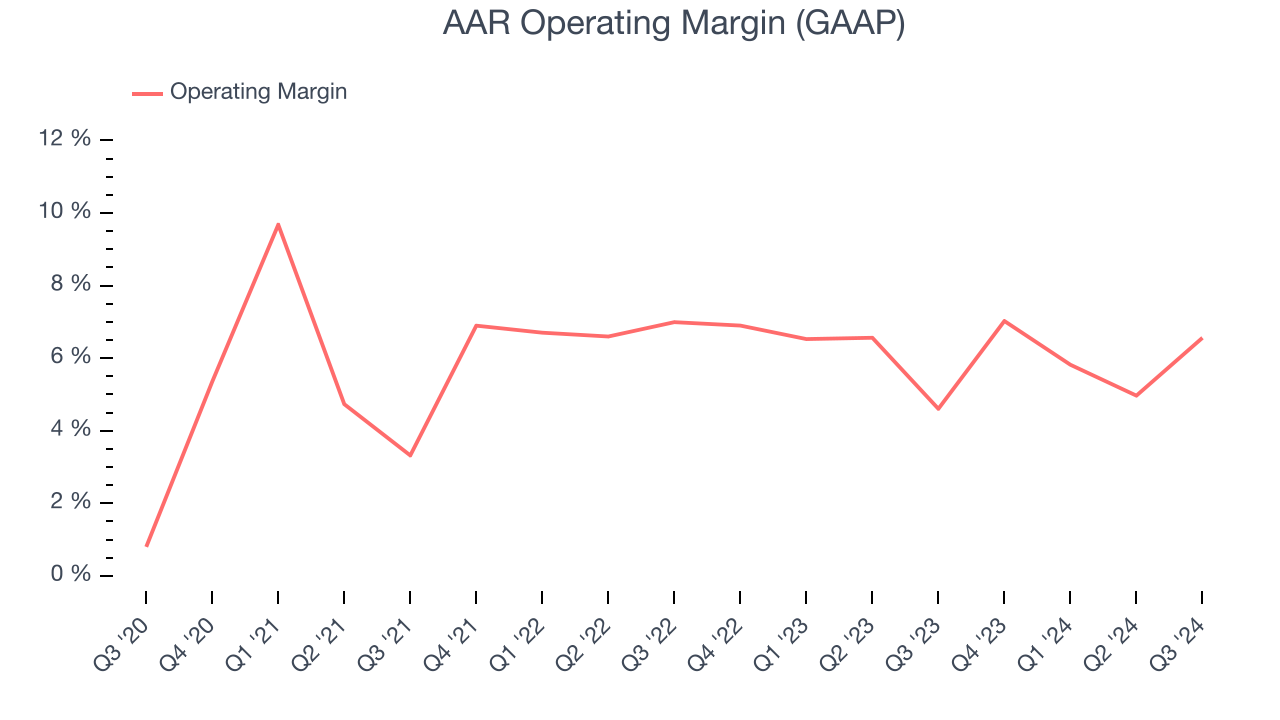

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

AAR’s operating margin rose by 4.9 percentage points over the last five years. Its operating margin for the trailing 12 months was 6.1%.

One Reason to be Careful:

Mediocre Free Cash Flow Margin Limits Reinvestment Potential

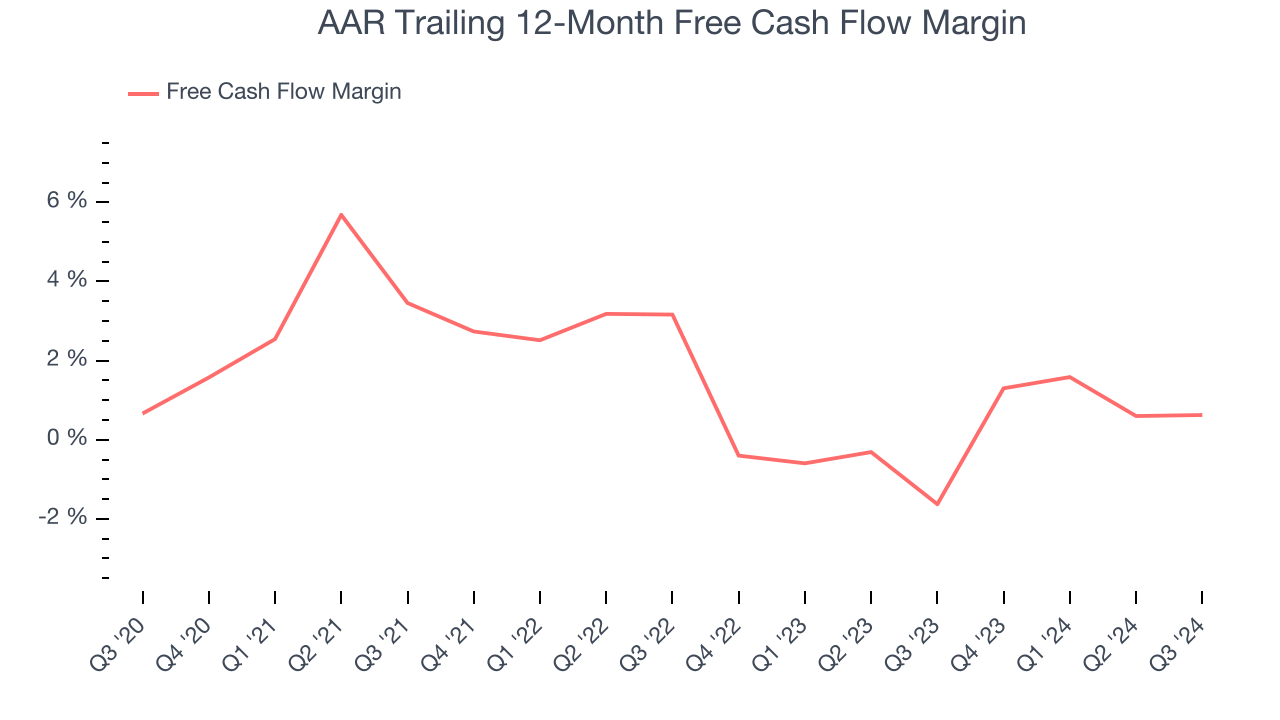

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AAR has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.1%, lousy for an industrials business.

Final Judgment

AAR has huge potential even though it has some open questions. With its shares lagging the market recently, the stock trades at 17× forward price-to-earnings (or $68.45 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than AAR

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.