Gibraltar currently trades at $70.66 per share and has shown little upside over the past six months, posting a small loss of 0.9%. The stock also fell short of the S&P 500’s 13.5% gain during that period.

Is there a buying opportunity in Gibraltar, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're swiping left on Gibraltar for now. Here are three reasons why there are better opportunities than ROCK and a stock we'd rather own.

Why Is Gibraltar Not Exciting?

Gibraltar (NASDAQ: ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

1. Long-Term Revenue Growth Disappoints

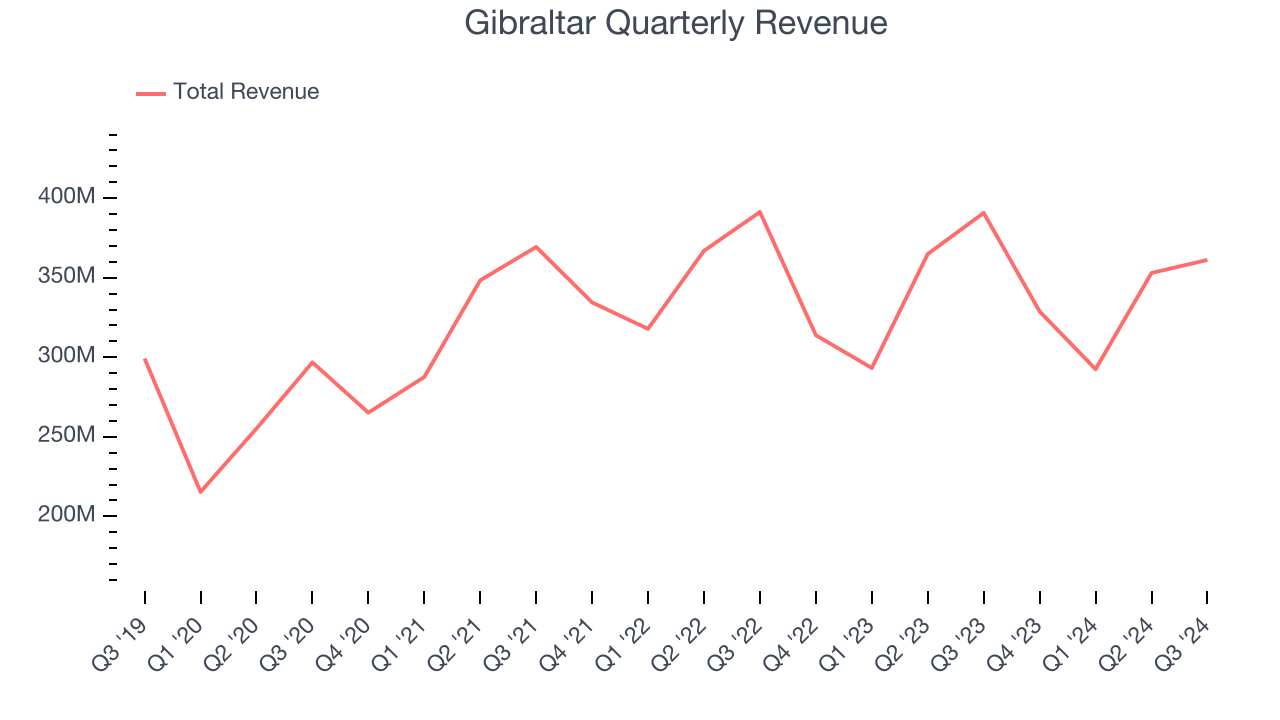

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Gibraltar’s 5.3% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector.

2. Low Gross Margin Reveals Weak Structural Profitability

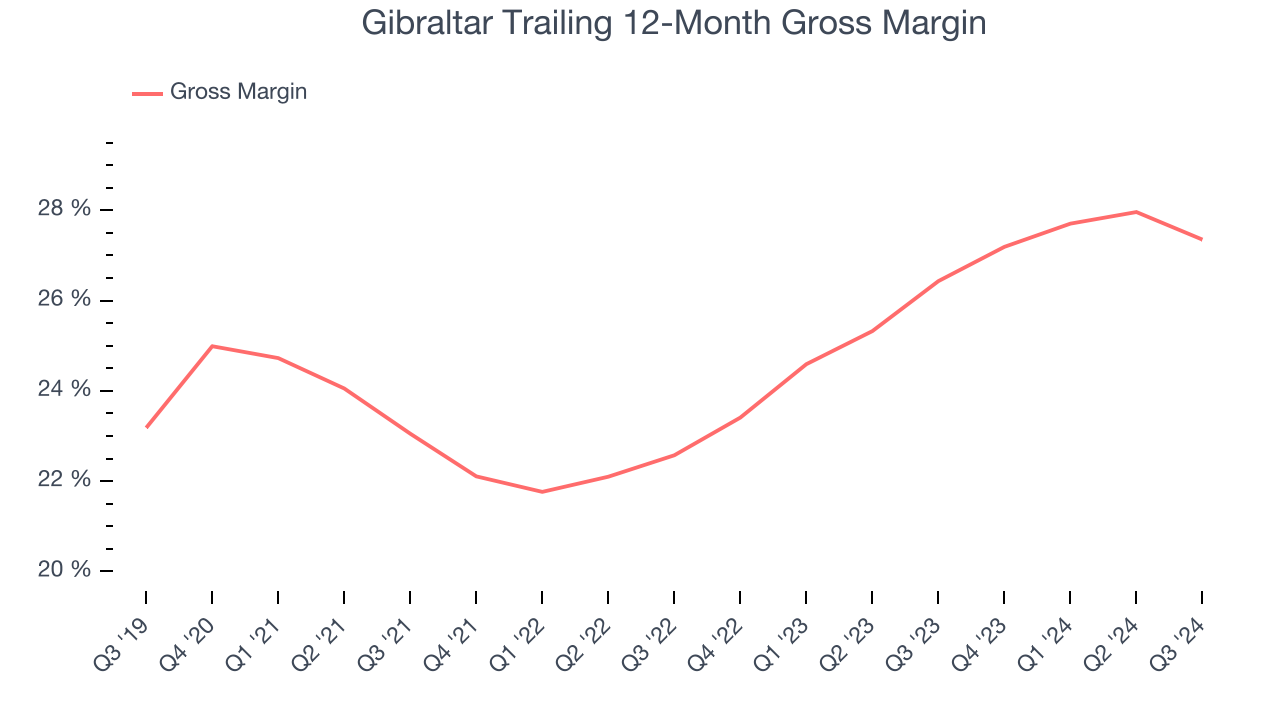

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Gibraltar has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 24.9% gross margin over the last five years. That means Gibraltar paid its suppliers a lot of money ($75.07 for every $100 in revenue) to run its business.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Gibraltar’s revenue to rise by 3.9%. Although this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

Final Judgment

Gibraltar isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 15.2× forward price-to-earnings (or $70.66 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. We’d recommend looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Like More Than Gibraltar

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.