Over the last six months, nLIGHT’s shares have sunk to $11.47, producing a disappointing 7.9% loss - a stark contrast to the S&P 500’s 13.7% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in nLIGHT, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why there are better opportunities than LASR and a stock we'd rather own.

Why Do We Think nLIGHT Will Underperform?

Founded by a former CEO and Harvard-educated entrepreneur Scott Keeneyn, nLIGHT (NASDAQ: LASR) offers semiconductor and fiber lasers to the industrial, aerospace & defense, and medical sectors.

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, nLIGHT grew its sales at a sluggish 2.5% compounded annual growth rate. This fell short of our benchmarks.

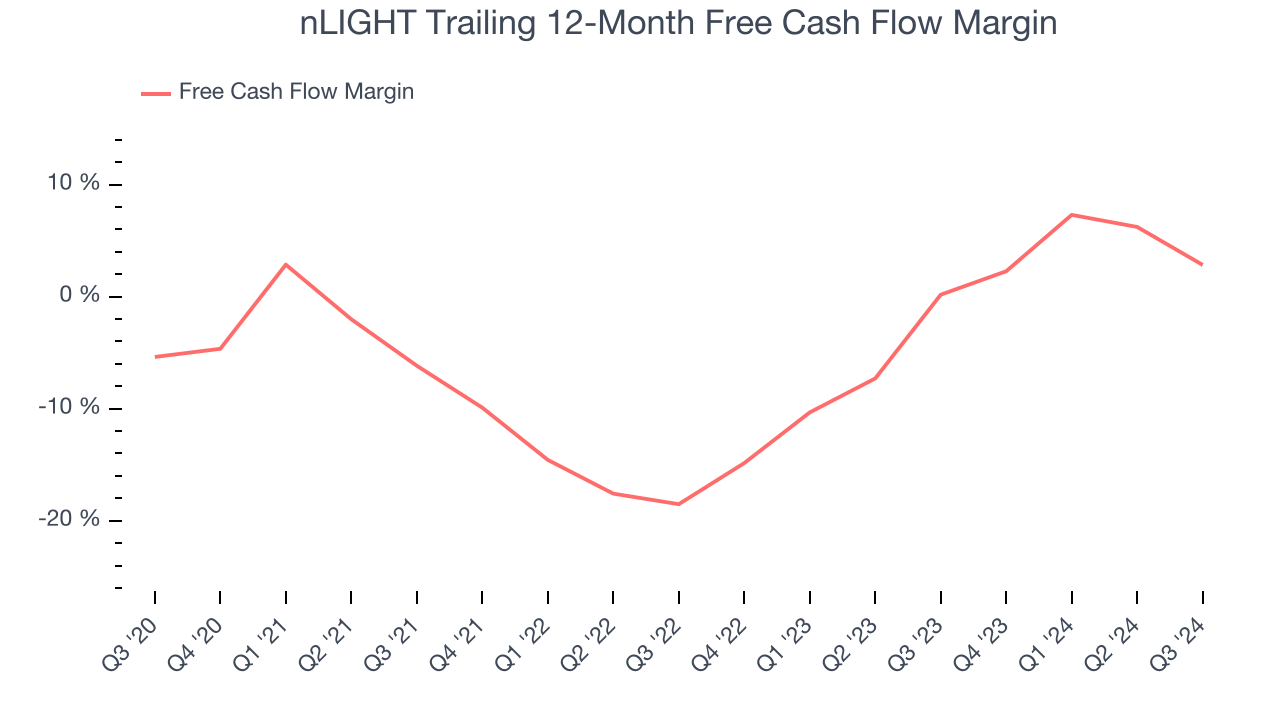

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While nLIGHT posted positive free cash flow this quarter, the broader story hasn’t been so clean. nLIGHT’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 6%, meaning it lit $5.97 of cash on fire for every $100 in revenue.

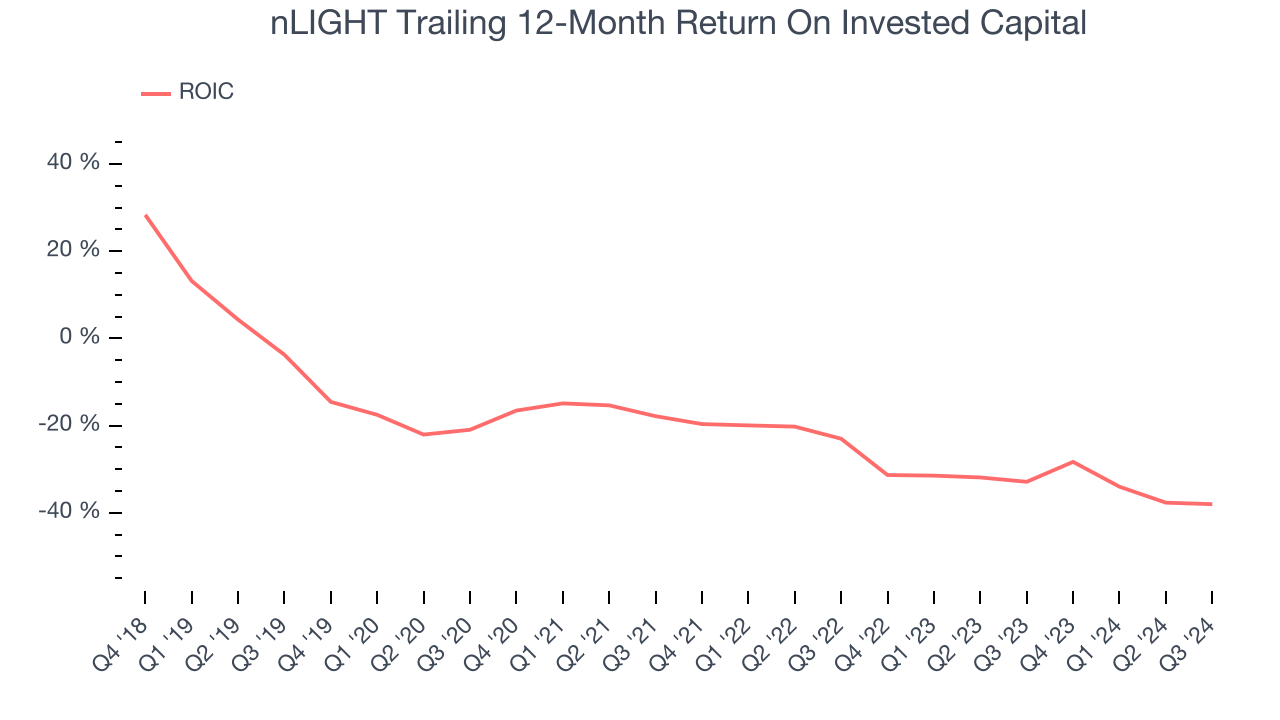

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. nLIGHT’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

nLIGHT falls short of our quality standards. After the recent drawdown, the stock trades at 822.8× forward EV-to-EBITDA (or $11.47 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than nLIGHT

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.