Data visualization and business intelligence company Domo (NASDAQ: DOMO) reported Q3 CY2024 results topping the market’s revenue expectations, but sales were flat year on year at $79.76 million. The company expects next quarter’s revenue to be around $78 million, close to analysts’ estimates. Its non-GAAP loss of $0.08 per share was 45.9% above analysts’ consensus estimates.

Is now the time to buy Domo? Find out by accessing our full research report, it’s free.

Domo (DOMO) Q3 CY2024 Highlights:

- Revenue: $79.76 million vs analyst estimates of $77.55 million (flat year on year, 2.9% beat)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.15 ($0.07 beat)

- Adjusted Operating Income: $2.01 million vs analyst estimates of -$1.23 million (2.5% margin, $3.2 million beat)

- Revenue Guidance for Q4 CY2024 is $78 million at the midpoint, roughly in line with what analysts were expecting

- Management lowered its full-year Adjusted EPS guidance to $0.62 at the midpoint, a 15.1% decrease

- Operating Margin: -13.9%, in line with the same quarter last year

- Free Cash Flow was -$13.77 million compared to -$8.38 million in the previous quarter

- Billings: $73.4 million at quarter end, down 1.9% year on year

- Market Capitalization: $385.5 million

“Our focus on ecosystem-led growth, consumption-based contracts and AI innovation is paying off with promising momentum, as we see more demand for Domo as an anchor technology in customers’ data stacks,” said Josh James, founder and CEO, Domo.

Company Overview

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ: DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

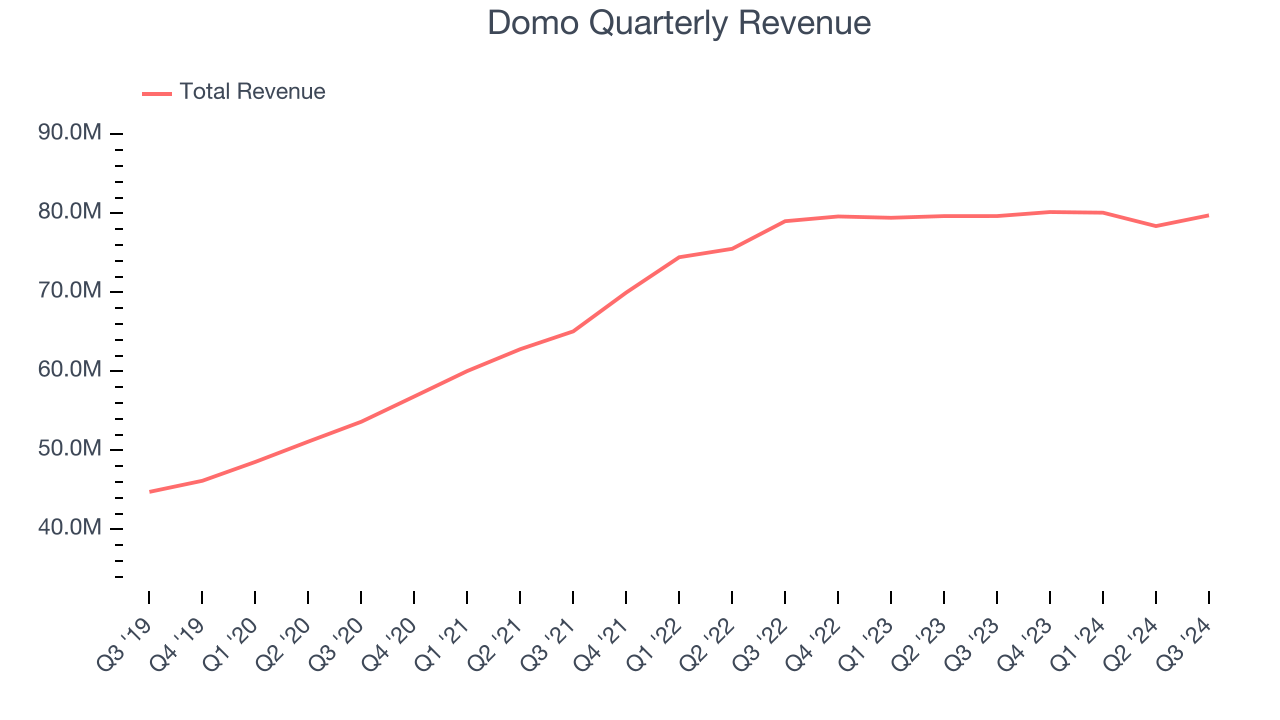

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Domo’s 9.2% annualized revenue growth over the last three years was sluggish. This was below our standard for the software sector and is a rough starting point for our analysis.

This quarter, Domo’s $79.76 million of revenue was flat year on year but beat Wall Street’s estimates by 2.9%. Company management is currently guiding for a 2.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.7% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

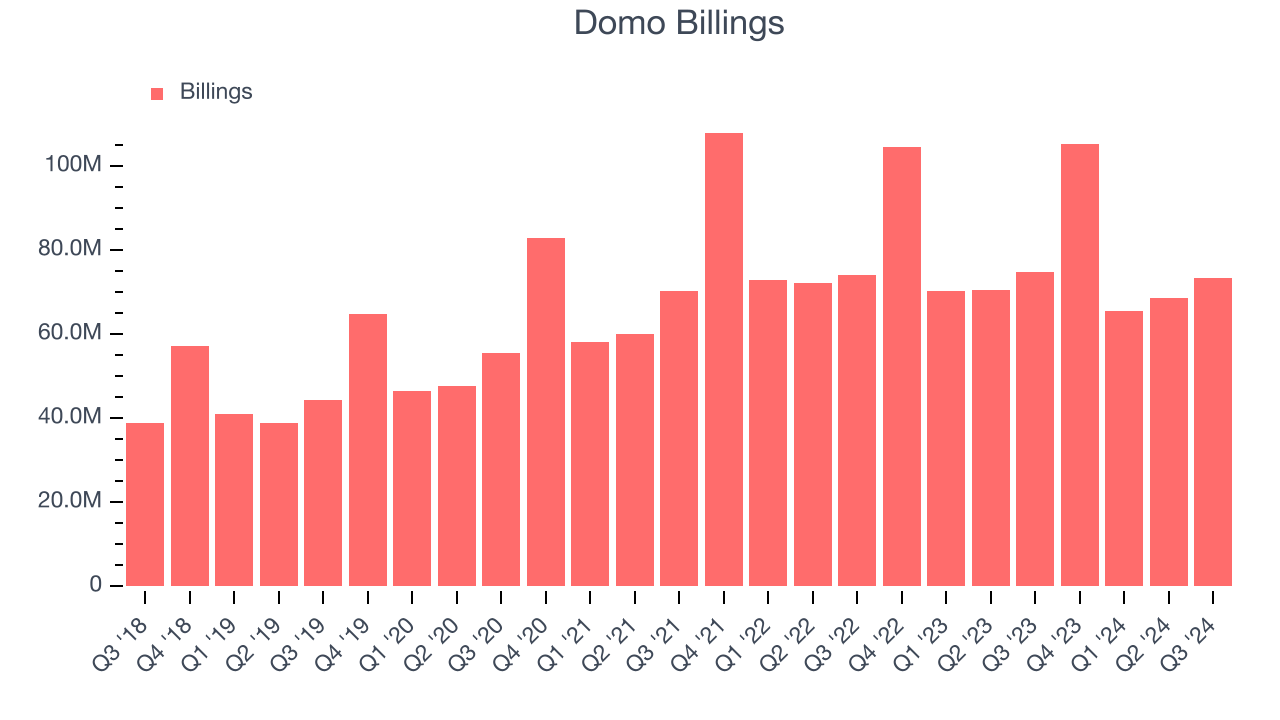

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Domo’s billings came in at $73.4 million in Q3, and it averaged 2.6% year-on-year declines over the last four quarters. This alternate topline metric underperformed its total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Domo’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Domo’s products and its peers.

Key Takeaways from Domo’s Q3 Results

Billings in the quarter missed meaningfully, although revenue beat. Looking ahead, the company lowered full year adjusted EPS guidance despite slightly raising full year revenue guidance. This is a signal of worse future profitability and expense efficiency. Overall, this was a mediocre quarter. Shares traded down 2.7% to $9.50 immediately after reporting.

Is Domo an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.