Over the past six months, ESCO has been a great trade, beating the S&P 500 by 21.8%. Its stock price has climbed to $131.79, representing a healthy 27.8% increase. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy ESE? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does ESE Stock Spark Debate?

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE: ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

Two Things to Like:

1. Encouraging Short-Term Revenue Growth

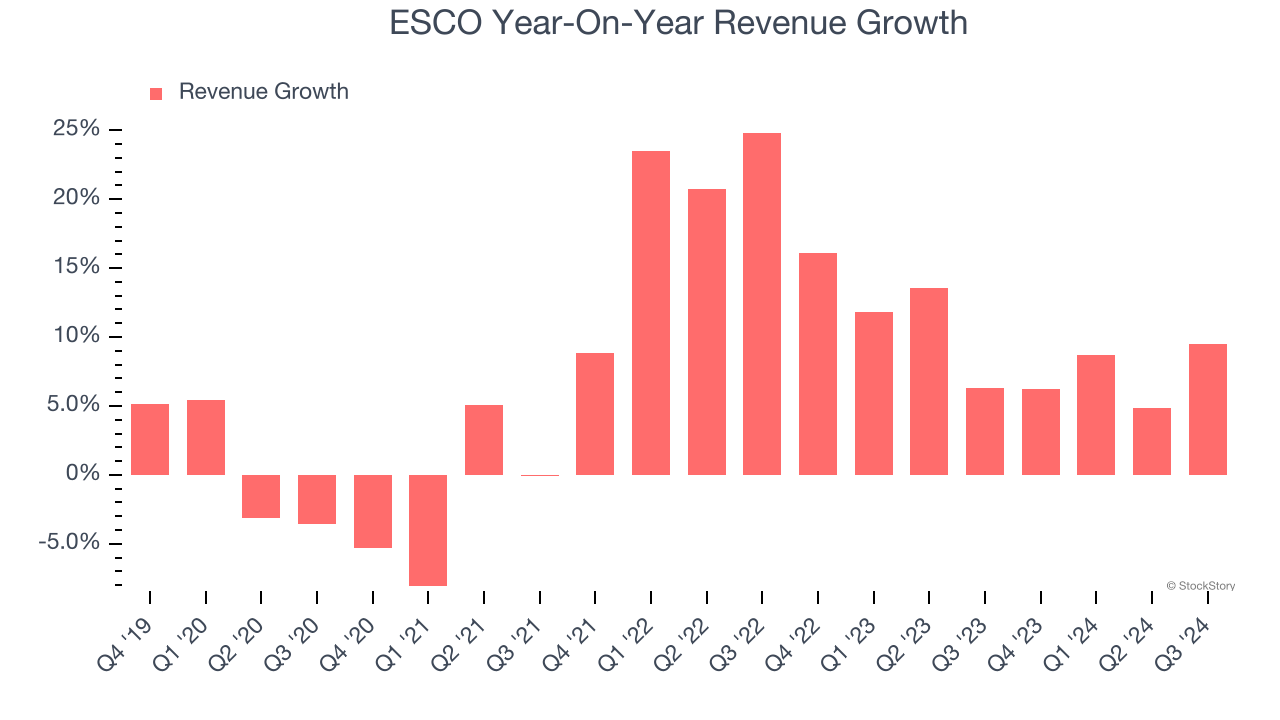

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. ESCO’s annualized revenue growth of 9.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect ESCO’s revenue to rise by 14.4%, an improvement versus its 9.4% annualized growth for the past two years. This projection is admirable and indicates its newer products and services will fuel better top-line performance.

One Reason to be Careful:

Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although ESCO has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

ESCO’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 27.8× forward price-to-earnings (or $131.79 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than ESCO

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.