Over the past six months, Greenbrier has been a great trade, beating the S&P 500 by 23.4%. Its stock price has climbed to $67.74, representing a healthy 35.3% increase. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Greenbrier, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re happy investors have made money, but we're swiping left on Greenbrier for now. Here are three reasons why there are better opportunities than GBX and a stock we'd rather own.

Why Is Greenbrier Not Exciting?

Having designed the industry’s first double-decker railcar in the 1980s, Greenbrier (NYSE: GBX) supplies the freight rail transportation industry with railcars and related services.

1. Long-Term Revenue Growth Disappoints

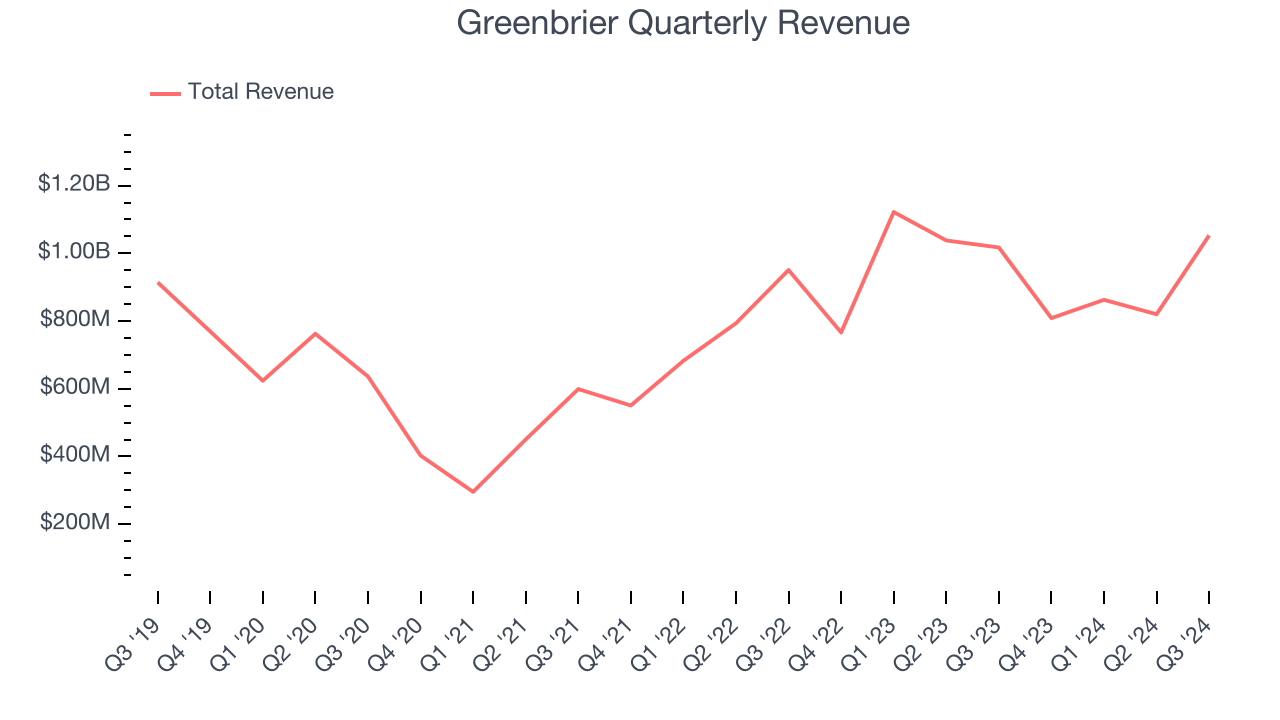

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Greenbrier grew its sales at a sluggish 3.2% compounded annual growth rate. This fell short of our benchmark for the industrials sector.

2. Low Gross Margin Reveals Weak Structural Profitability

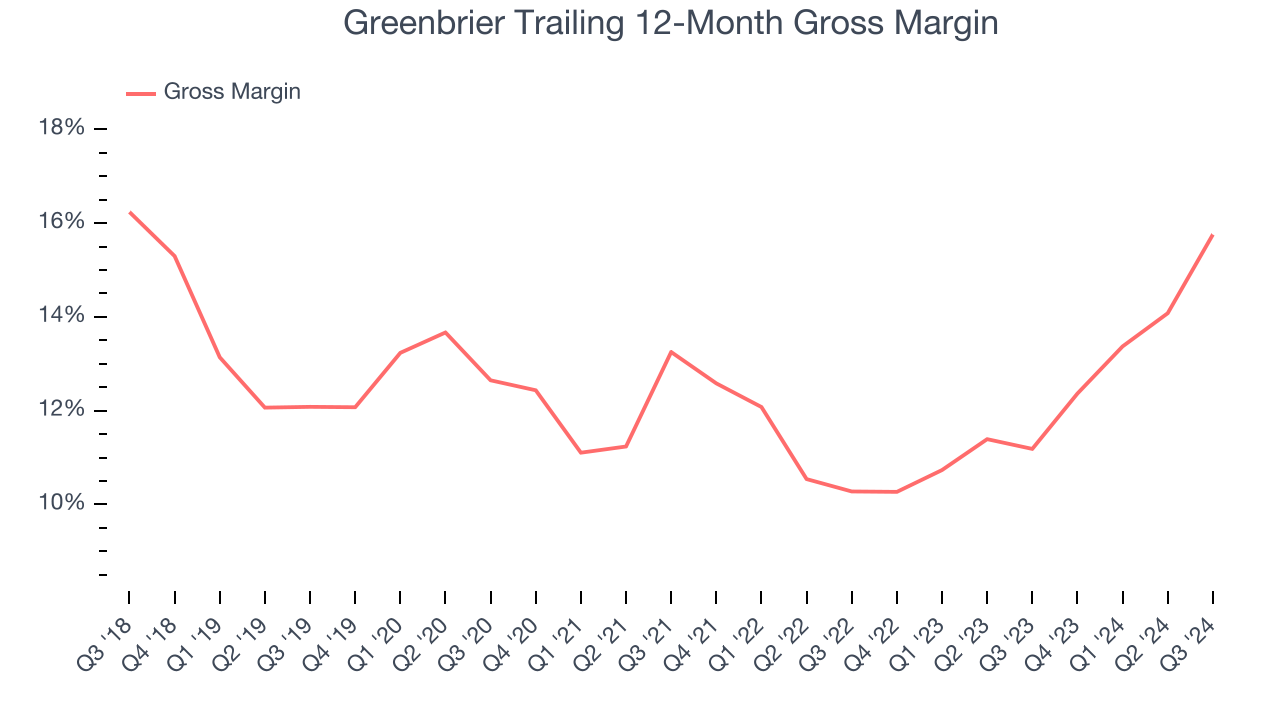

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Greenbrier has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 12.6% gross margin over the last five years. Said differently, Greenbrier had to pay a chunky $87.40 to its suppliers for every $100 in revenue.

3. Free Cash Flow Margin Dropping

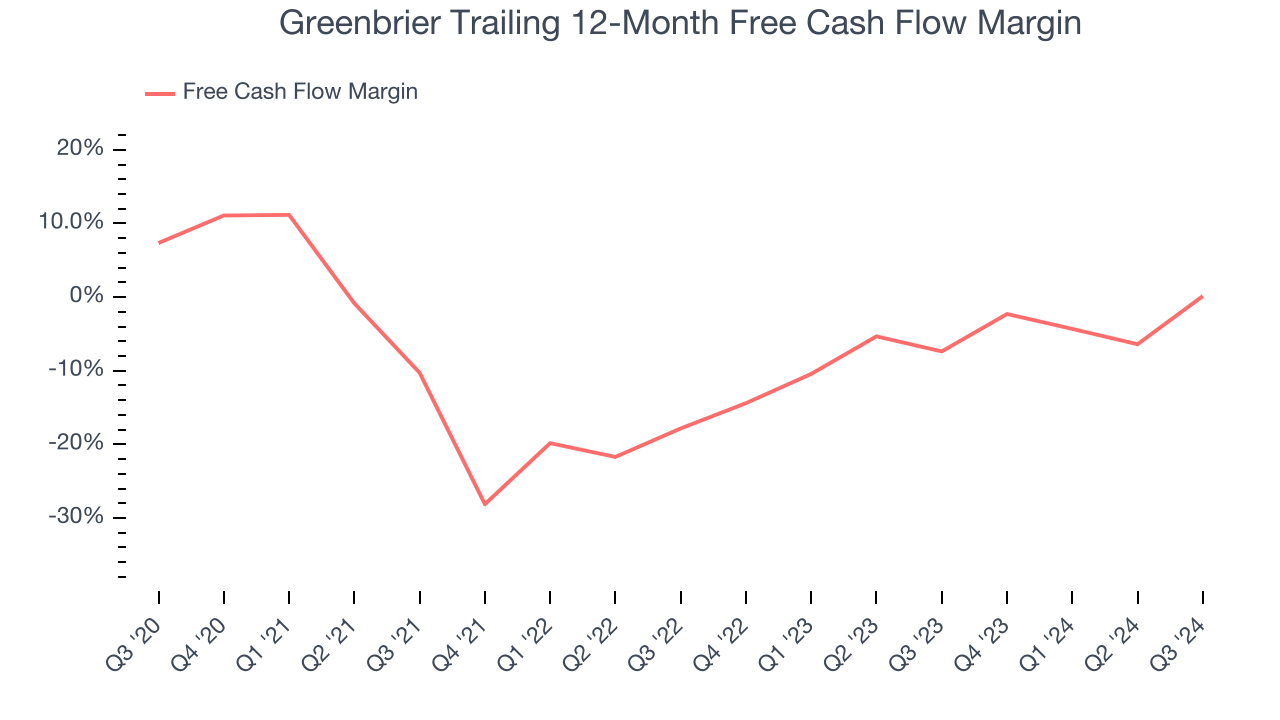

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Greenbrier’s margin dropped by 7.2 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because it’s already burning cash. If the longer-term trend returns, it could signal it’s becoming a more capital-intensive business. Greenbrier’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

Greenbrier isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 16.9× forward EV-to-EBITDA (or $67.74 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. We’d recommend looking at Wingstop, a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Greenbrier

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.