Over the past six months, USANA’s shares (currently trading at $37.74) have posted a disappointing 18.2% loss, well below the S&P 500’s 12.1% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy USANA, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Even though the stock has become cheaper, we don't have much confidence in USANA. Here are three reasons why USNA doesn't excite us and a stock we'd rather own.

Why Is USANA Not Exciting?

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE: USNA) manufactures and sells nutritional, personal care, and skincare products.

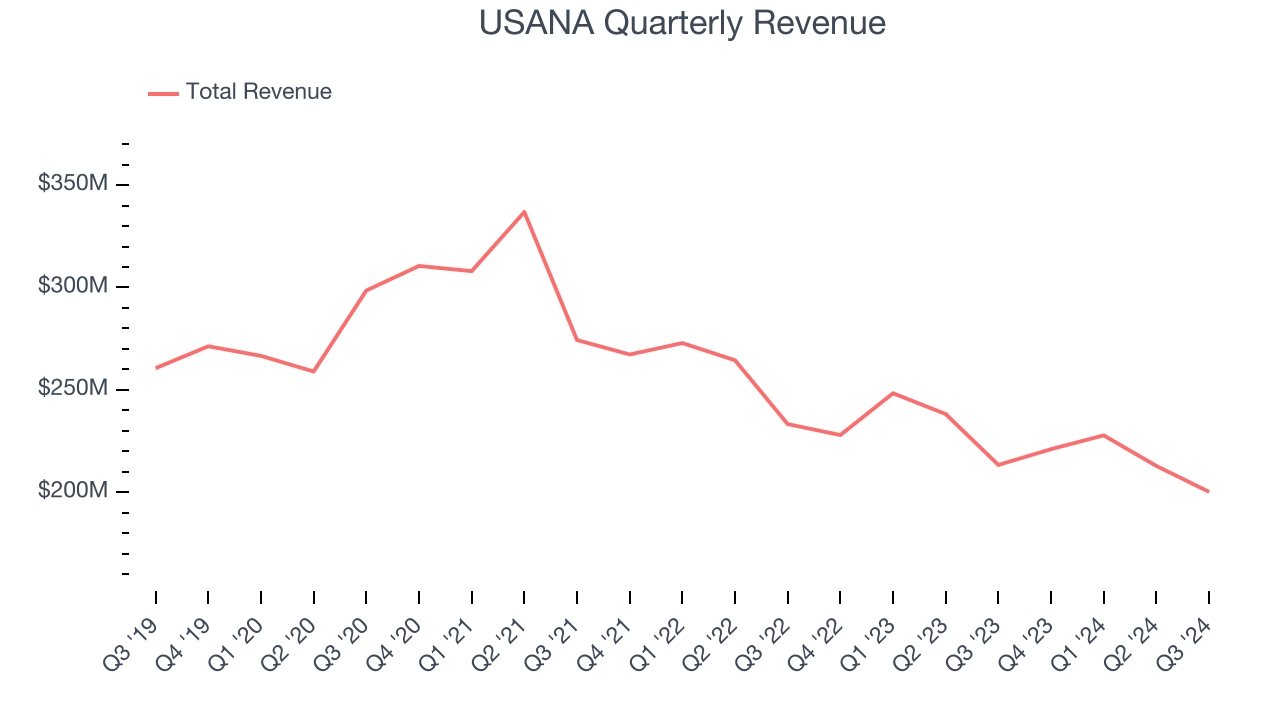

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. USANA’s demand was weak over the last three years as its sales fell at a 11.2% annual rate. This was below our standards and is a sign of lacking business quality.

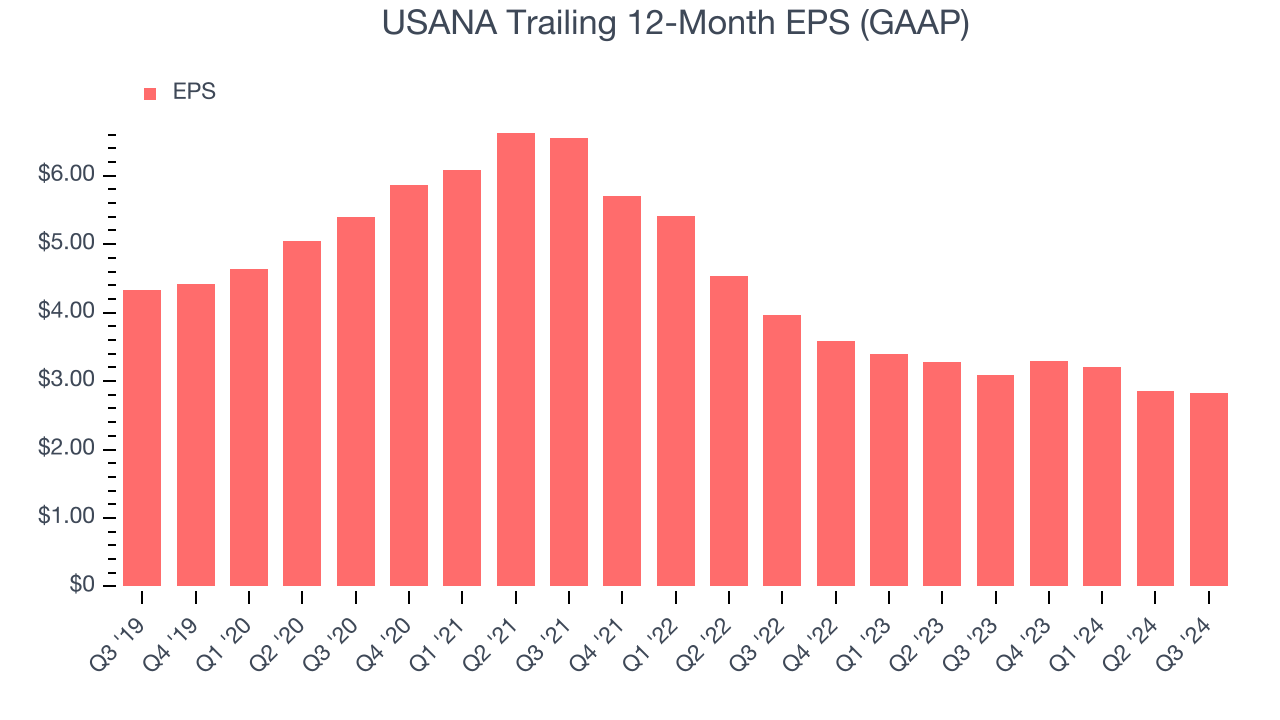

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for USANA, its EPS declined by more than its revenue over the last three years, dropping 24.4% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Final Judgment

USANA isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 14.7× forward price-to-earnings (or $37.74 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than USANA

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.