Clorox has had an impressive run over the past six months as its shares have beaten the S&P 500 by 15%. The stock now trades at $168.49, marking a 27.9% gain. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Clorox, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why there are better opportunities than CLX and a stock we'd rather own.

Why Is Clorox Not Exciting?

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE: CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

1. Long-Term Revenue Growth Disappoints

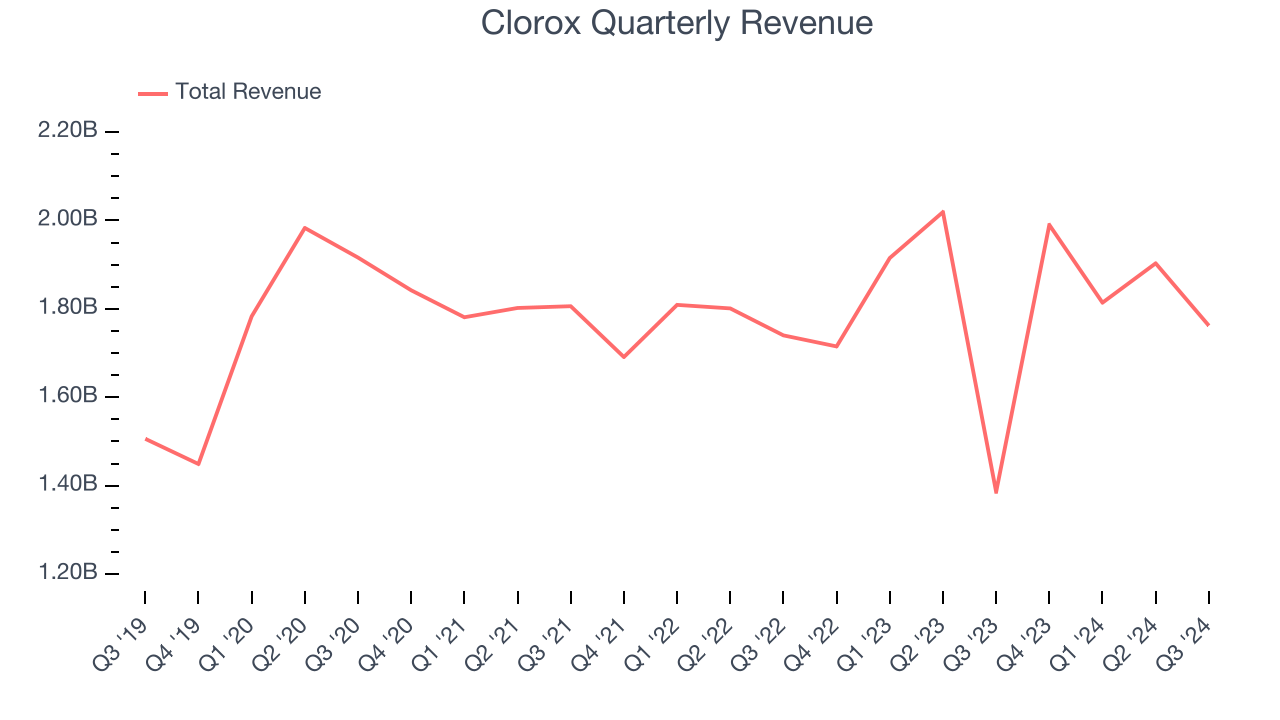

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Clorox grew its sales at a weak 1.1% compounded annual growth rate. This was below our standards.

2. Free Cash Flow Margin Dropping

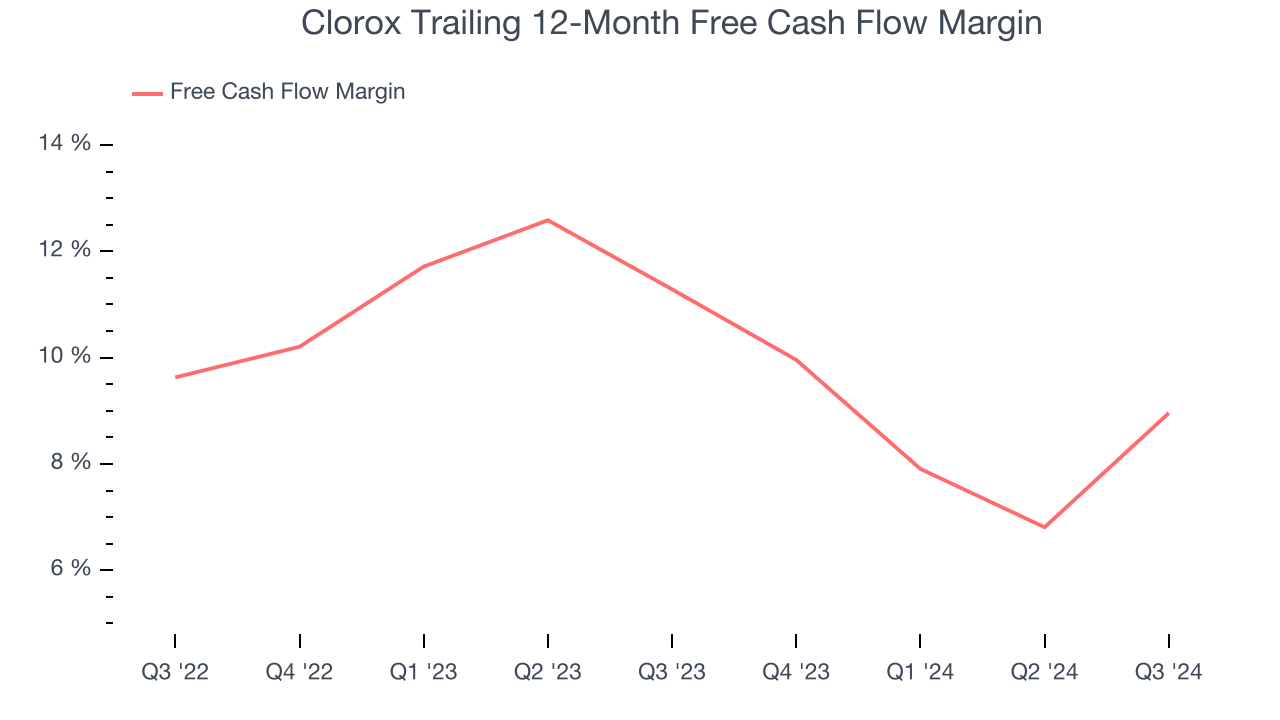

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Clorox’s margin dropped by 2.3 percentage points over the last year. If its declines continue, it could signal higher capital intensity. Clorox’s free cash flow margin for the trailing 12 months was 9%.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Clorox’s revenue to drop by 5.9%, a decrease from its 1.1% annualized growth for the past three years. This projection doesn't excite us and suggests its products will see some demand headwinds.

Final Judgment

Clorox isn’t a terrible business, but it doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 24.8× forward price-to-earnings (or $168.49 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward Wingstop, a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Clorox

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.