Papa John's has been treading water for the past six months, recording a small return of 3.6% while holding steady at $49.40. The stock also fell short of the S&P 500’s 14.2% gain during that period.

Is now the time to buy Papa John's, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're cautious about Papa John's. Here are three reasons why we avoid PZZA and a stock we'd rather own.

Why Is Papa John's Not Exciting?

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ: PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

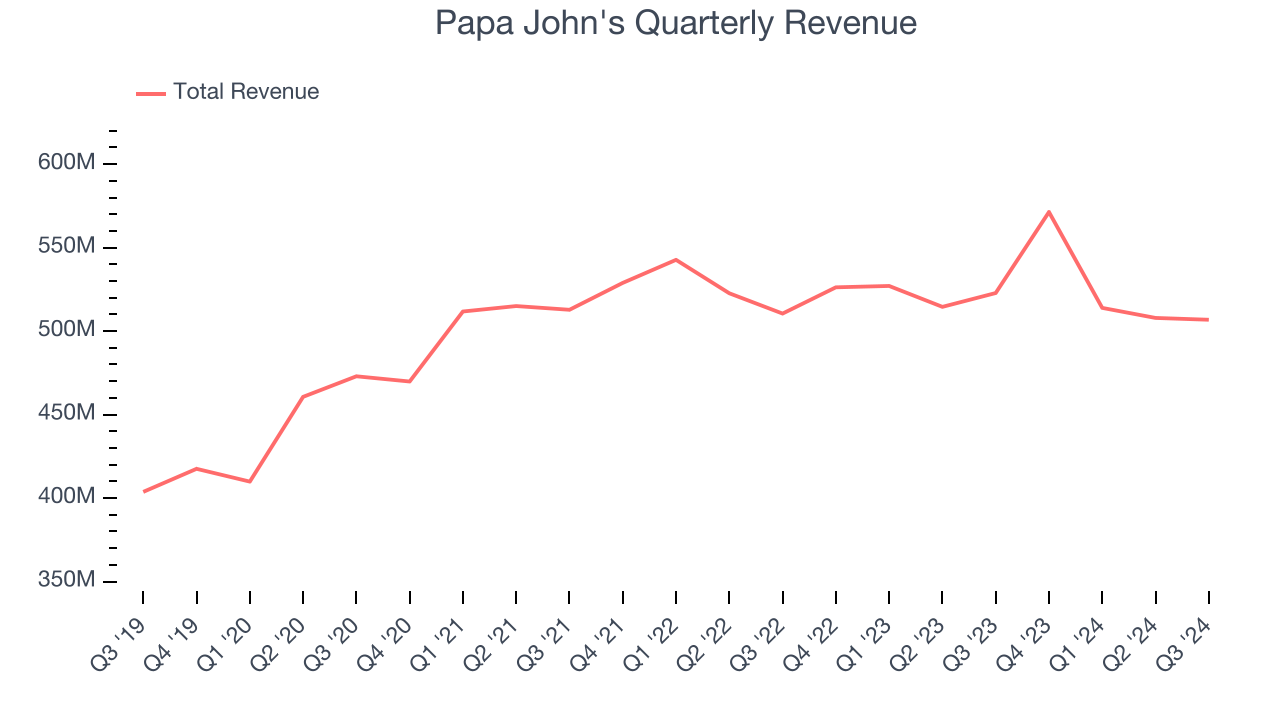

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Papa John’s sales grew at a tepid 5.6% compounded annual growth rate over the last five years. This was below our standard for the restaurant sector.

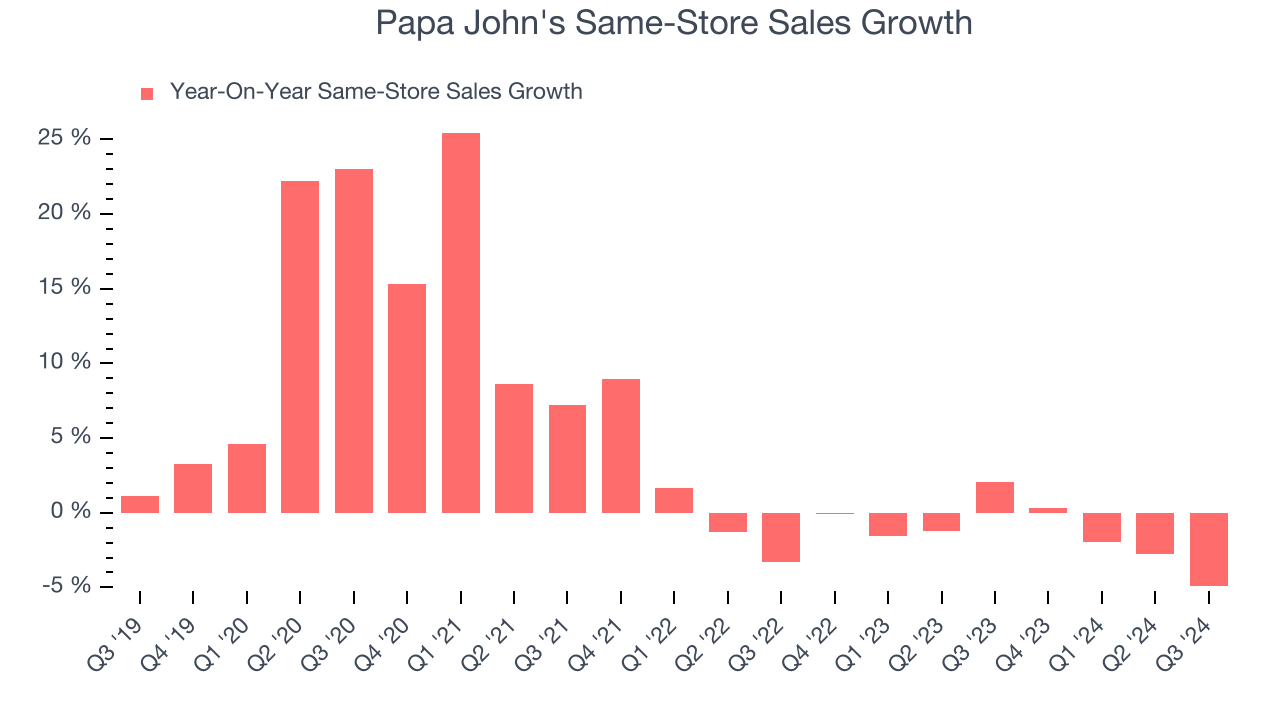

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

Papa John’s demand has been shrinking over the last two years as its same-store sales have averaged 1.3% annual declines.

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Papa John’s revenue to stall, a deceleration versus its 5.6% annualized growth for the past five years. This projection doesn't excite us and suggests its offerings will face some demand challenges.

Final Judgment

Papa John's isn’t a terrible business, but it isn’t one of our picks. With its shares lagging the market recently, the stock trades at 20.2x forward price-to-earnings (or $49.40 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Papa John's

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.