Darden’s 21.2% return over the past six months has outpaced the S&P 500 by 7%, and its stock price has climbed to $176.99 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Darden, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why you should be careful with DRI and a stock we'd rather own.

Why Is Darden Not Exciting?

Started in 1968 as the famous seafood joint, Red Lobster, Darden (NYSE: DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

1. Long-Term Revenue Growth Disappoints

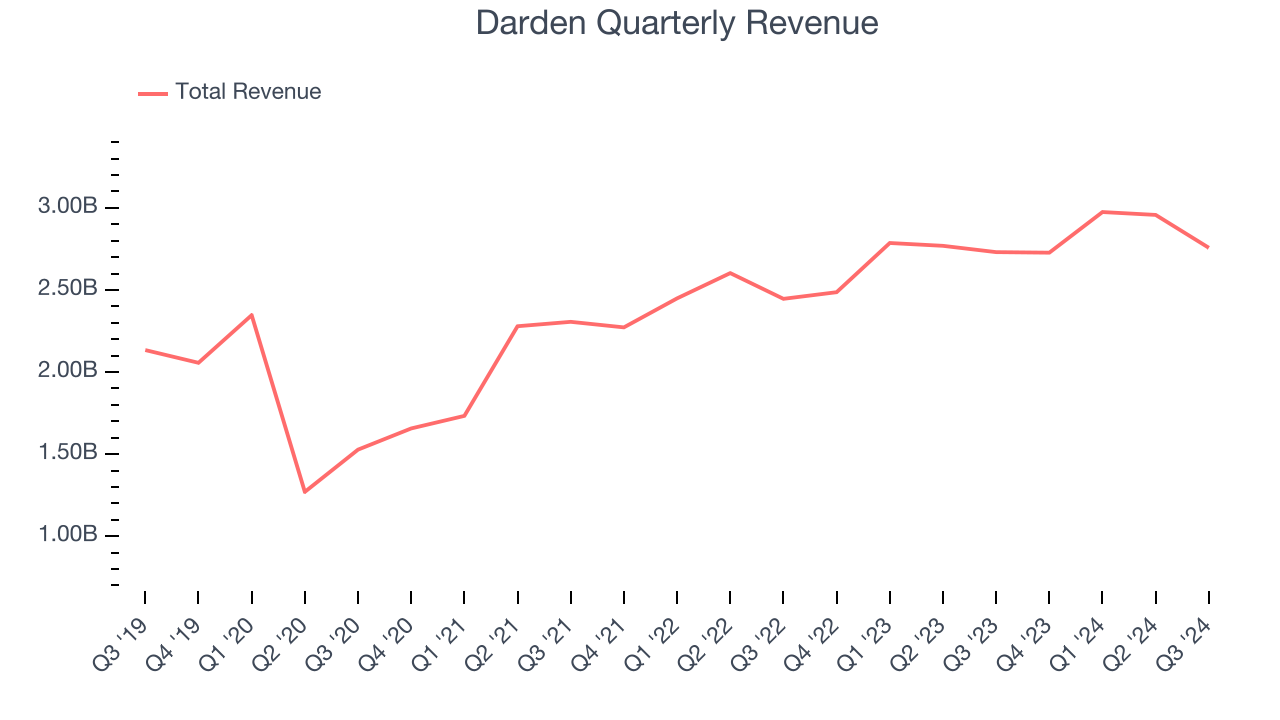

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Darden grew its sales at a tepid 5.9% compounded annual growth rate. This was below our standard for the restaurant sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Darden’s revenue to rise by 5%, close to its 5.9% annualized growth for the past five years. This projection doesn't excite us and implies its newer offerings will not accelerate its top-line performance yet.

3. Low Gross Margin Reveals Weak Structural Profitability

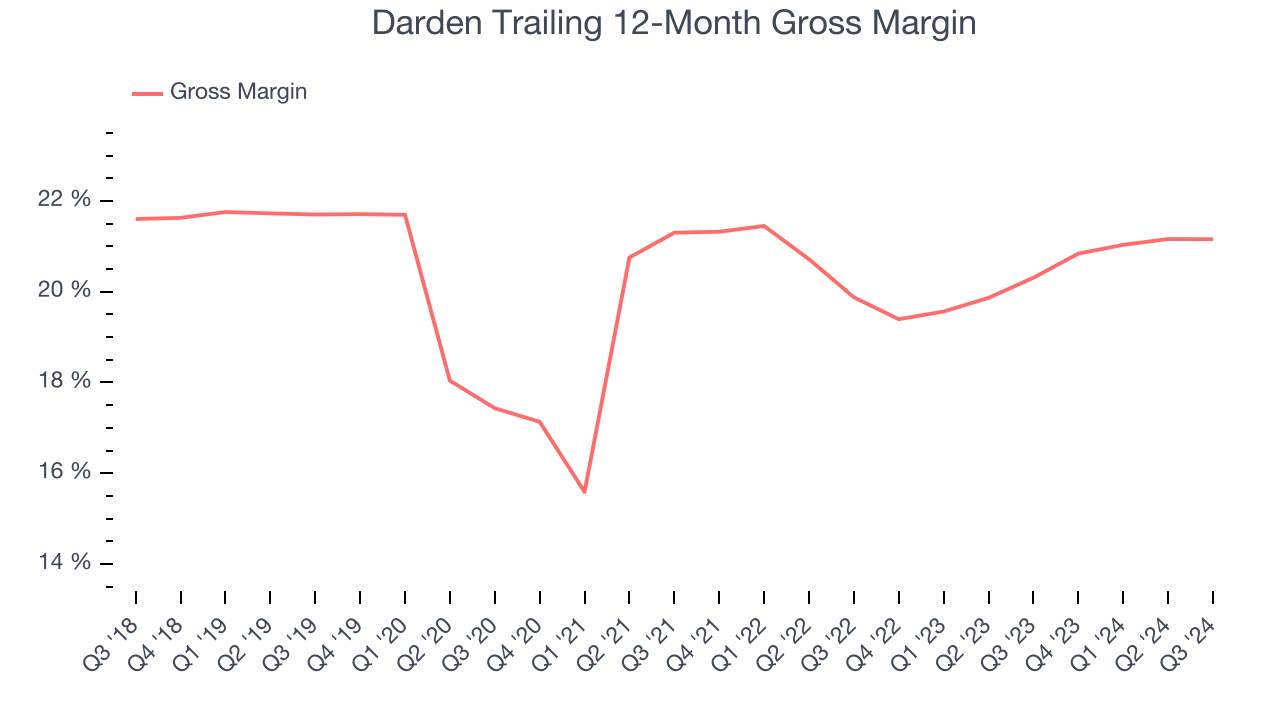

Gross profit margins tell us how much money a restaurant gets to keep after paying for the direct costs of the meals it sells, like ingredients, and indicate its level of pricing power.

Darden has weak unit economics for a restaurant company, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 20.7% gross margin over the last two years. That means Darden paid its suppliers a lot of money ($79.26 for every $100 in revenue) to run its business.

Final Judgment

Darden isn’t a terrible business, but it doesn’t pass our bar. With its shares beating the market recently, the stock trades at 18.1x forward price-to-earnings (or $176.99 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than Darden

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.