Over the past six months, Braze’s stock price fell to $38.26. Shareholders have lost 7.6% of their capital, which is disappointing considering the S&P 500 has climbed by 13%. This may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy BRZE? Find out in our full research report, it’s free.

Why Does BRZE Stock Spark Debate?

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ: BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

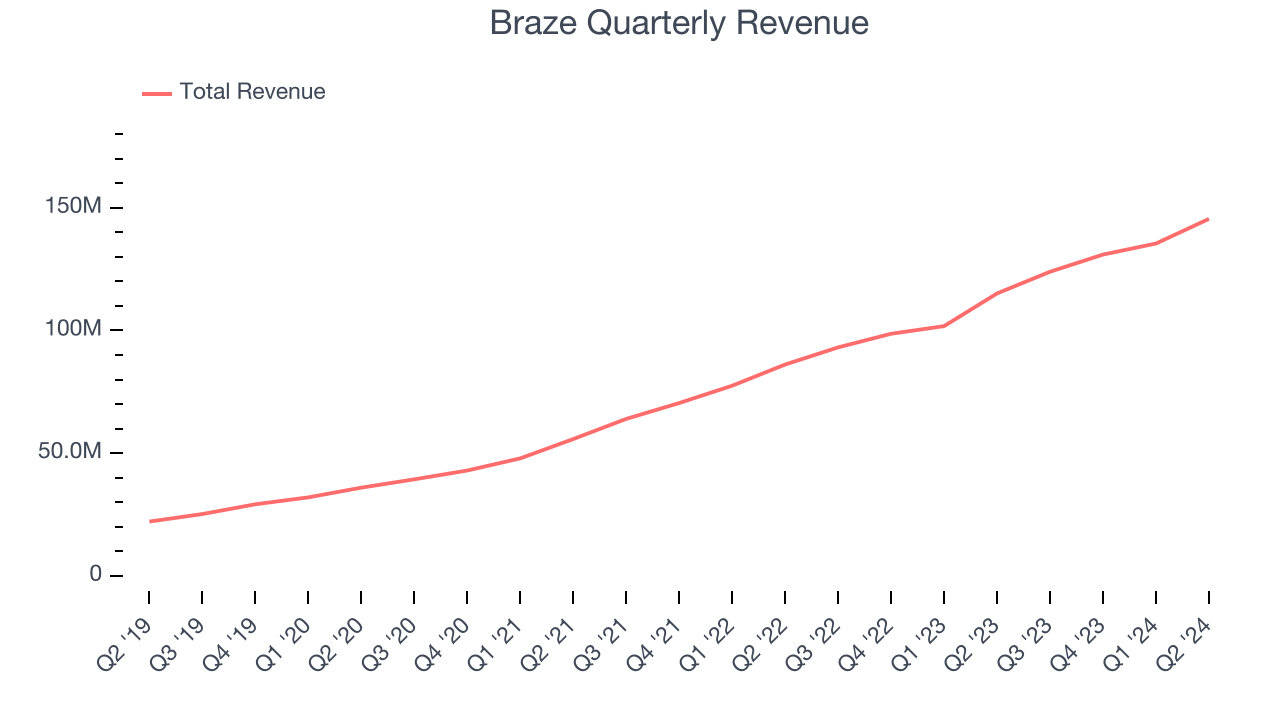

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Braze’s 42.3% annualized revenue growth over the last three years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers.

2. ARR Surges as Recurring Revenue Flows In

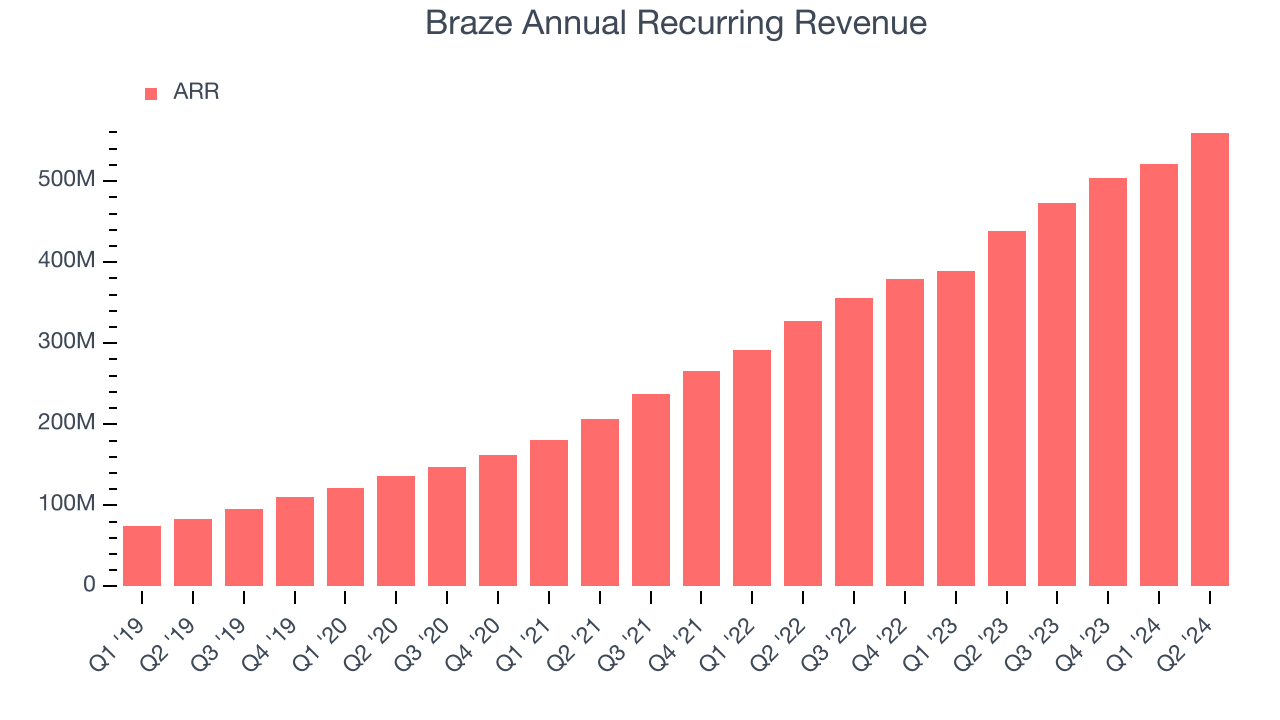

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Braze’s ARR punched in at $559.8 million in Q2, and over the last four quarters, its growth averaged 31.8% year-on-year increases. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Braze a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

One Reason to be Careful:

Mediocre Free Cash Flow Limits Reinvestment Potential

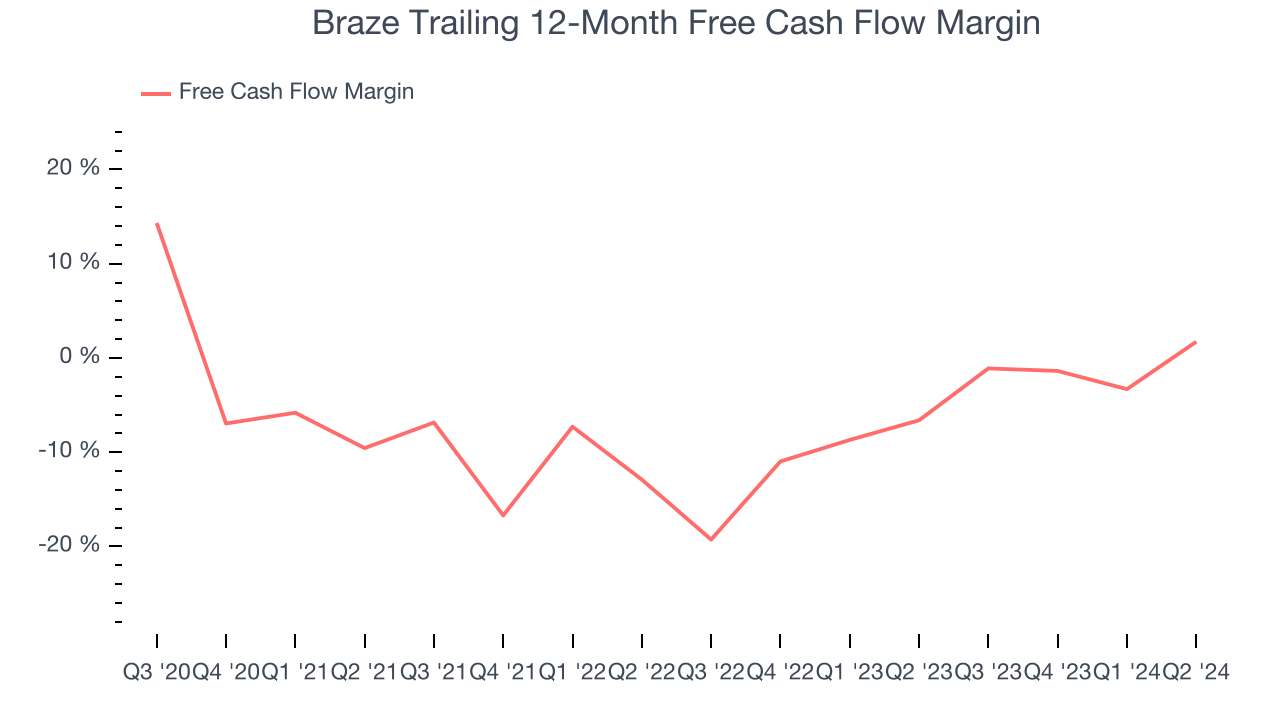

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Braze has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.7%, subpar for a software business.

Final Judgment

Braze has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 6.2x forward price-to-sales (or $38.26 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Braze

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.