AT&T has had an impressive run over the past six months as its shares have beaten the S&P 500 by 20.2%. The stock now trades at $23.07, marking a 33.6% gain. This performance may have investors wondering how to approach the situation.

Is there a buying opportunity in AT&T, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re happy investors have made money, but we're swiping left on AT&T for now. Here are three reasons why there are better opportunities than T and one stock we like more.

Why Do We Think AT&T Will Underperform?

Founded by Alexander Graham Bell, AT&T (NYSE: T) is a multinational telecomm conglomerate providing a range of communications and internet services.

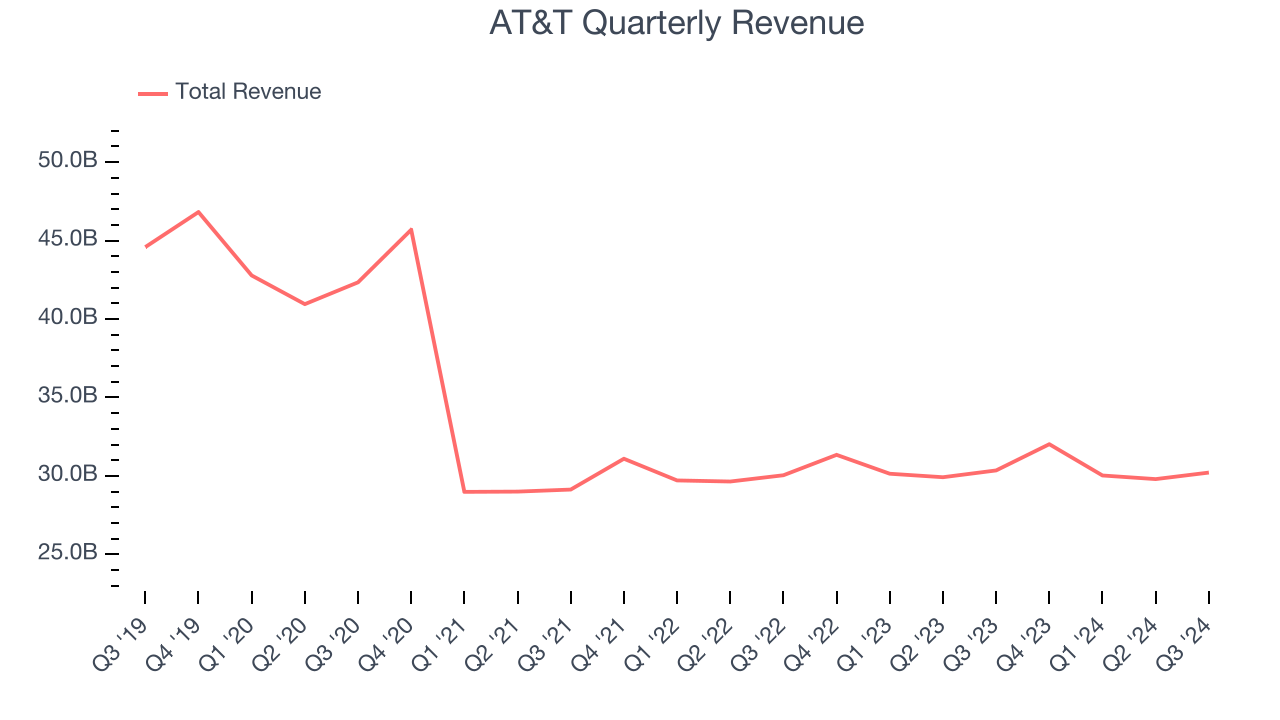

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. AT&T struggled to consistently generate demand over the last five years as its sales dropped by 7.7% annually. This fell short of our benchmarks and is a sign of poor business quality.

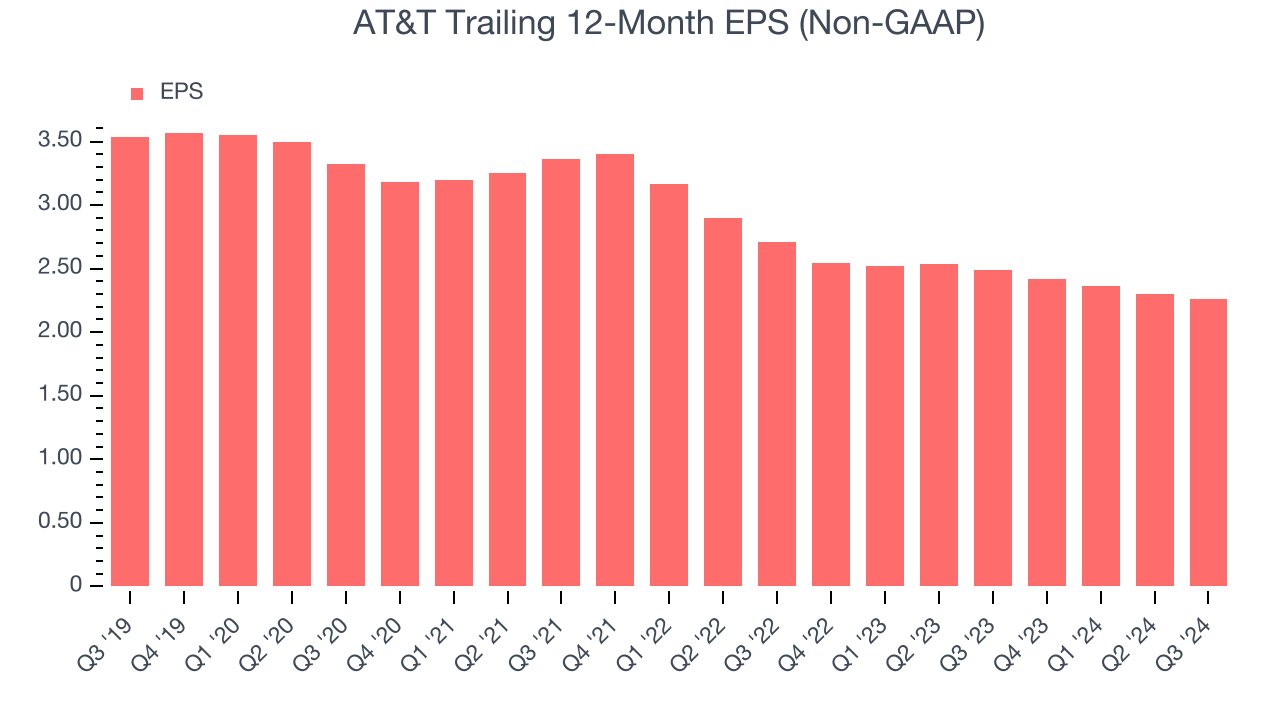

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for AT&T, its EPS and revenue declined by 8.6% and 7.7% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, AT&T’s low margin of safety could leave its stock price susceptible to large downswings.

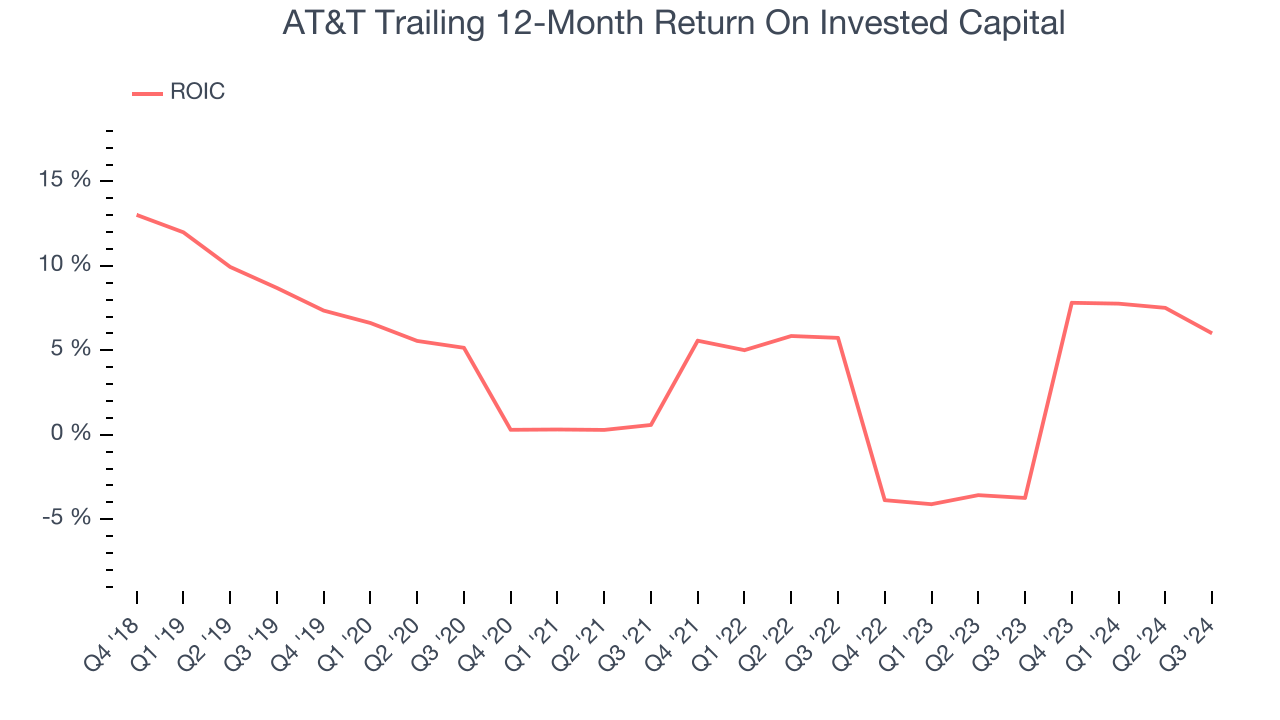

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

AT&T’s five-year average ROIC was 2.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+. Its returns suggest it historically did a mediocre job at investing in profitable growth initiatives.

Final Judgment

AT&T doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 10.1x forward price-to-earnings (or $23.07 per share). While this valuation could be justified, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. We’d suggest taking a look at TransDigm, a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of AT&T

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.