MGM Resorts currently trades at $38.09 per share and has shown little upside over the past six months, posting a small loss of 2.3%. The stock also fell short of the S&P 500’s 13.1% gain during that period.

Is now the time to buy MGM Resorts, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're sitting this one out for now. Here are three reasons why we avoid MGM and a stock we'd rather own.

Why Do We Think MGM Resorts Will Underperform?

Operating several properties on the Las Vegas Strip, MGM Resorts (NYSE: MGM) is a global hospitality and entertainment company known for its resorts and casinos.

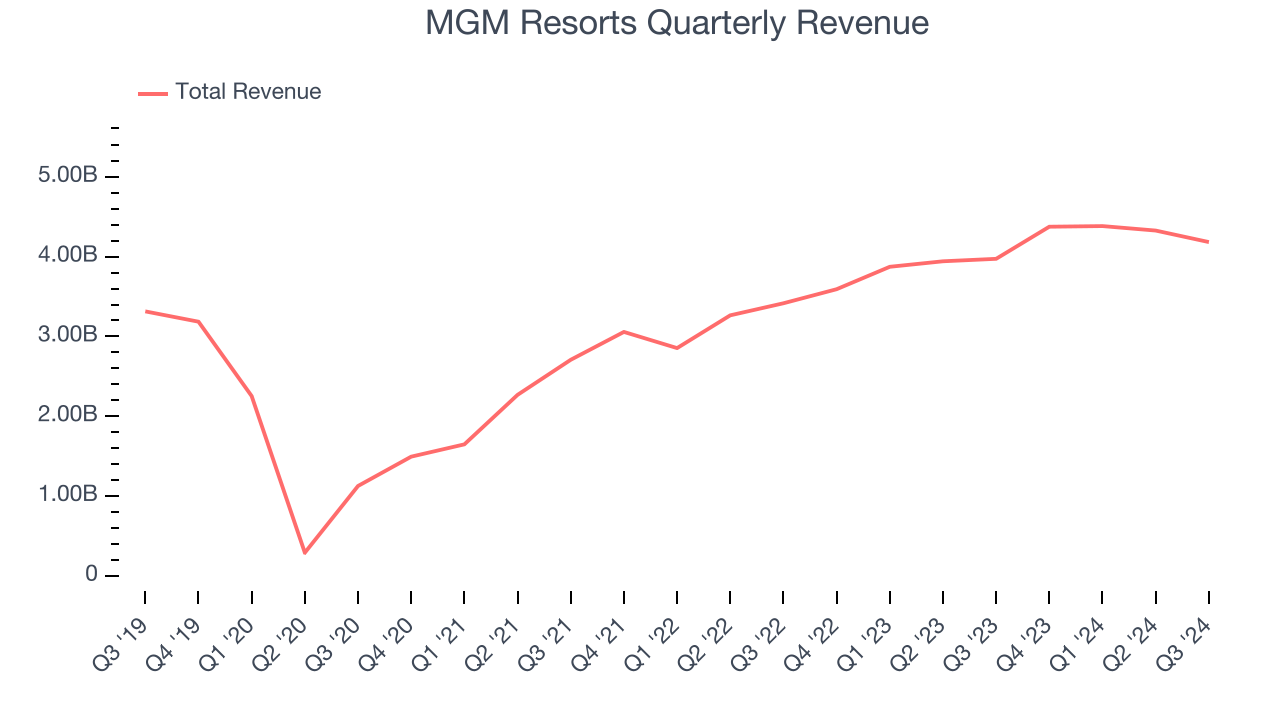

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, MGM Resorts grew its sales at a sluggish 6.2% compounded annual growth rate. This was below our standard for the consumer discretionary sector.

2. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, MGM Resorts’s ROIC has decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

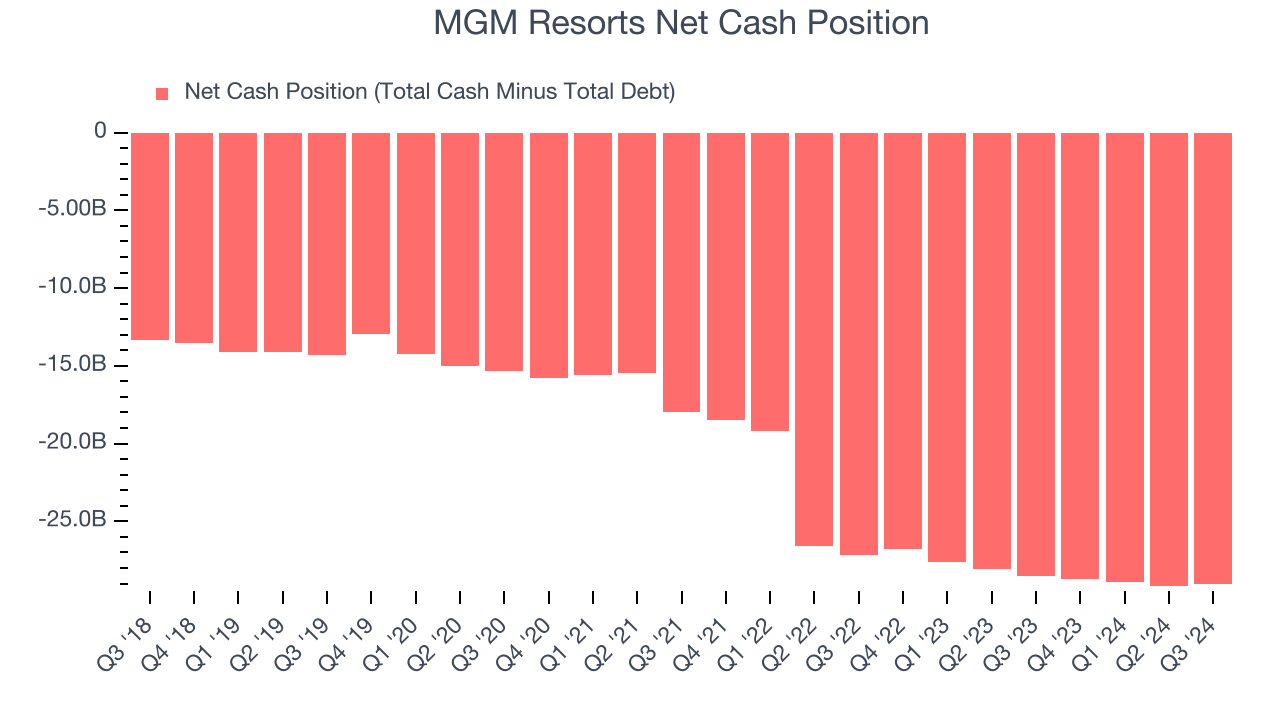

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

MGM Resorts’s $32 billion of debt exceeds the $2.95 billion of cash on its balance sheet. Furthermore, its 12x net-debt-to-EBITDA ratio (based on its EBITDA of $2.50 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. MGM Resorts could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope MGM Resorts can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We see the value of companies helping consumers, but in the case of MGM Resorts, we’re out. With its shares trailing the market in recent months, the stock trades at 13.6x forward price-to-earnings (or $38.09 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better investments elsewhere. Let us point you toward Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of MGM Resorts

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.