McDonald's trades at $296.15 and has moved in lockstep with the market. Its shares have returned 16.7% over the last six months while the S&P 500 has gained 13.1%.

Is MCD a buy right now? Find out in our full research report, it’s free.

Why Does McDonald's Spark Debate?

Known by many names including Mickey D's, McDanks, or our personal favorite, Mackers, McDonald’s (NYSE: MCD) is a fast-food behemoth known for its convenience and broken ice cream machines.

Two Things to Like:

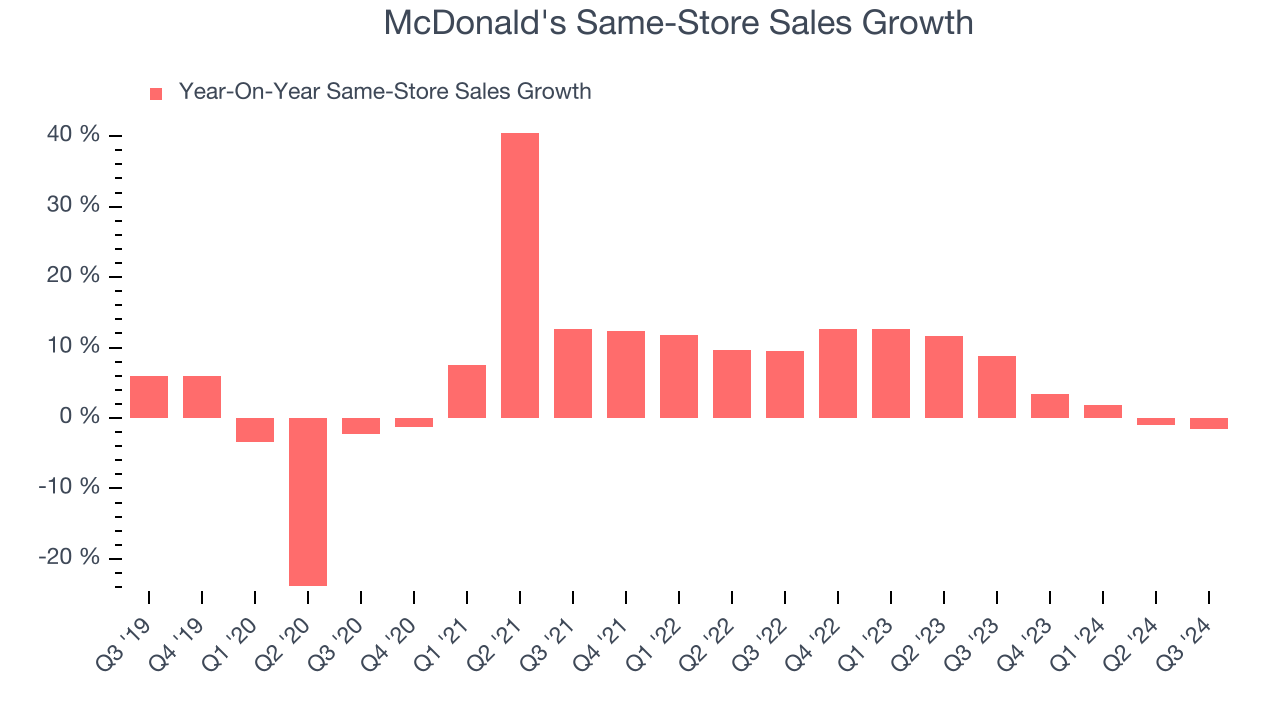

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

McDonald's has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6.1%.

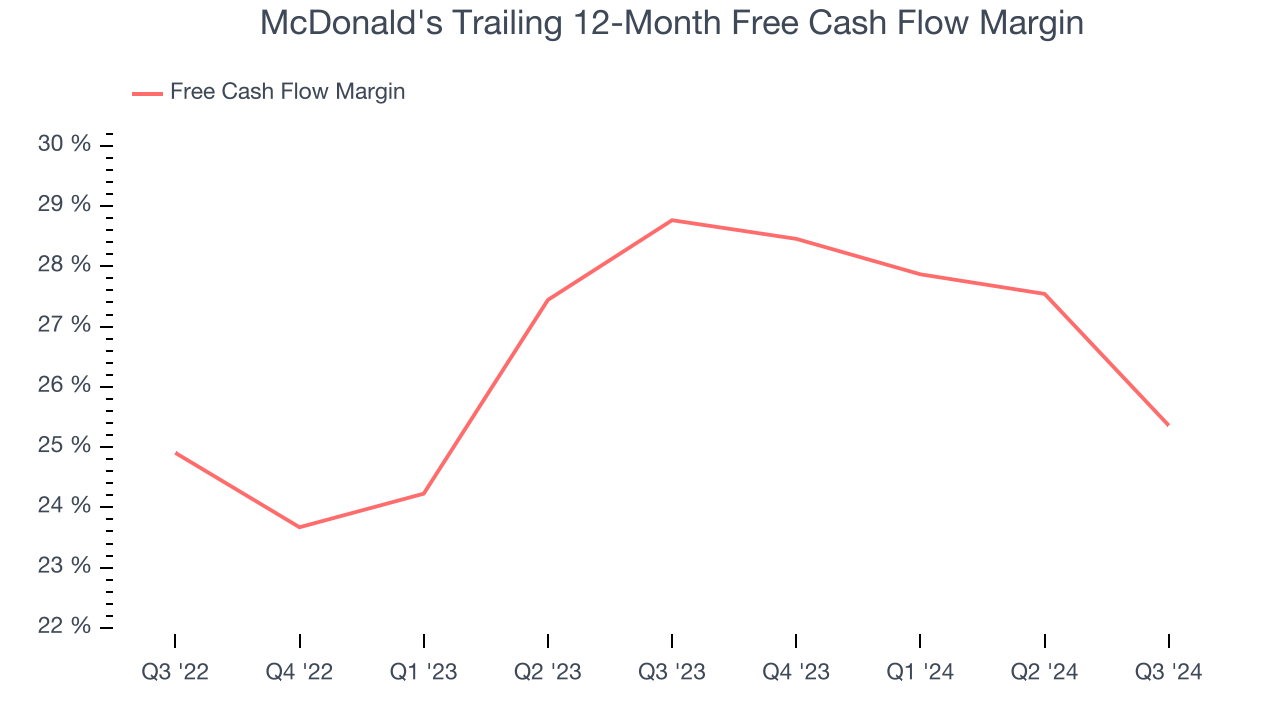

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

McDonald's has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the restaurant sector, averaging 27% over the last two years.

One Reason to be Careful:

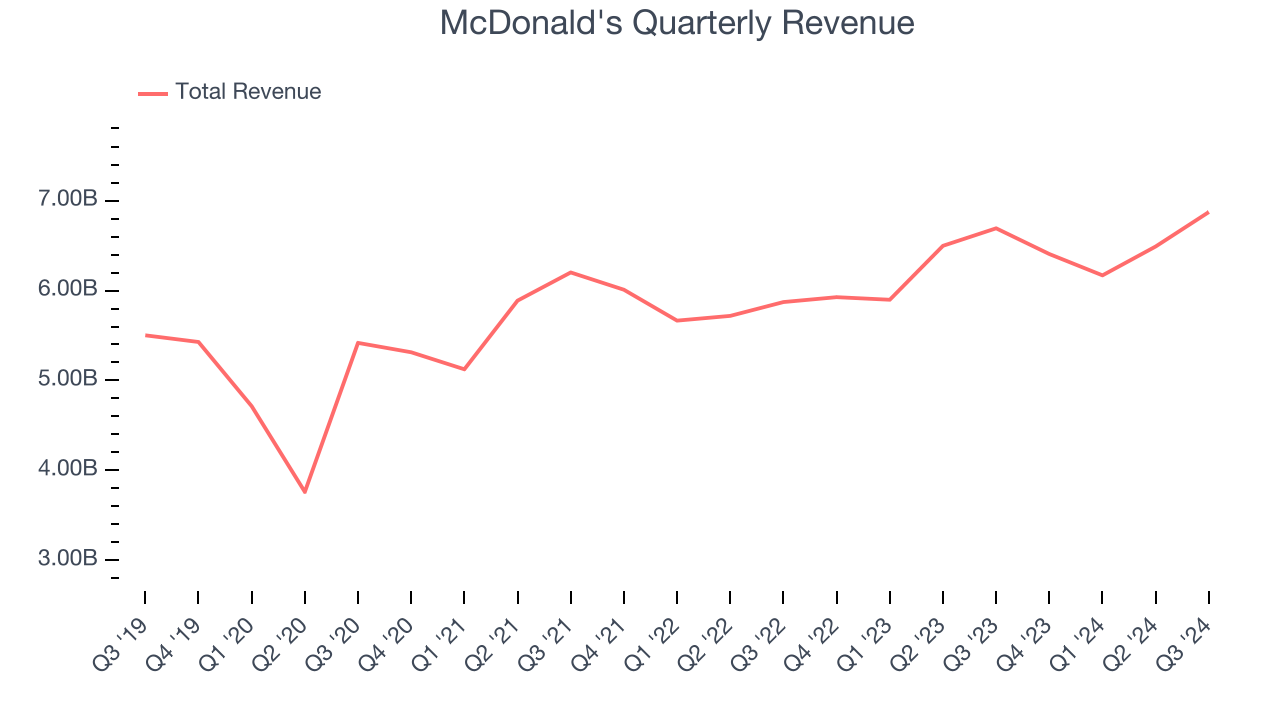

Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, McDonald’s sales grew at a sluggish 4.2% compounded annual growth rate over the last five years. This was below our standard for the restaurant sector.

Final Judgment

McDonald’s merits more than compensate for its flaws, but at $296.15 per share (or 23.8x forward price-to-earnings), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than McDonald's

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.