The purpose of this drilling was definition within South Austin to continue building an inventory of high-confidence ounces for eventual restart of the Madsen mill.

—

Global Stocks News – In a press release dated April 18, 2024, West Red Lake Gold Mines (TSXV:WRLG) (OTC:WRLGF) reported drill results from its 100% owned Madsen Mine in Ontario.

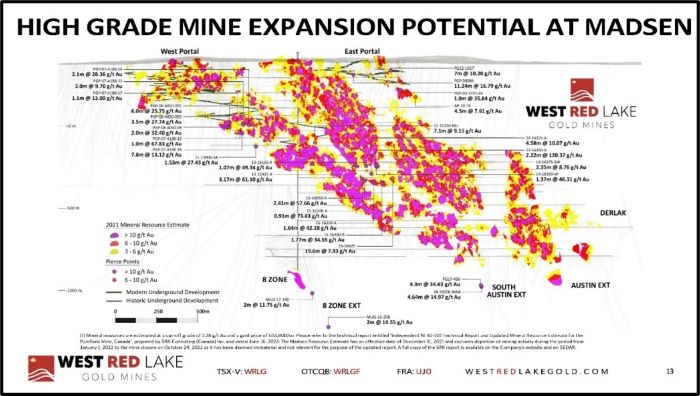

The drill results featured in the April 18 PR were focused on the high-grade South Austin Zone, which currently contains an Indicated mineral resource of 474,600 ounces @ 8.7 grams per tonne gold, with an additional Inferred resource of 31,800 oz @ 8.7 g/t Au.

The purpose of this drilling was definition within South Austin to continue building an inventory of high-confidence ounces for eventual restart of the Madsen mill.

April 18, 2024 DRILL HIGHLIGHTS:

- Hole MM24D-07-4198-001 Intersected 1.1m @ 68.36 g/t Au, from 74.25m to 75.35m, Including 0.5m @ 145.44 g/t Au, from 74.85m to 75.35m

- Hole MM24D-07-4198-002 Intersected 3.95m @ 13.83 g/t Au, from 7.55m to 11.5m, Including 0.5m @ 105.72 g/t Au, from 7.55m to 8.05m.

- The high-grade mineralization encountered near the collar (top of hole) in Holes MM24D-07-4198-002 and MM24D-07-4198-006 is believed to be the down-dip continuation of a mineralized zone defined further up in the system. These intercepts are expected to extend this zone in future model updates.

Previously announced highlights on the North and South Austin drilling can be viewed at the following links:

· West Red Lake Gold Intersects 25.12 g/t Au over 5.5m, 39.46 g/t Au over 2m and 18.60 g/t Au over 4m at South Austin Zone – Madsen Mine (March 4, 2024)

· West Red Lake Gold Intersects 9.15 g/t Au over 3.3m and 10.66 g/t Au over 2.6m at North Austin Zone – Madsen Mine (February 7, 2024)

· West Red Lake Gold Intersects 47.44 g/t Au over 3.2m, 21.64 g/t Au over 7m and 296.83 g/t Au over 1m at South Austin Zone – Madsen Mine (December 5, 2023)

· West Red Lake Gold Intersects 27.15 g/t Au over 10.28m and 22.31g/t Au over 8.5m at North Austin Zone – Madsen Mine (November 21, 2023)

WRLG’s flagship asset - The Madsen Gold Mine in Ontario – was targeted for acquisition by Canadian philanthropist and financier Frank Giustra who formed Wheaton River Minerals which was sold to Newmont for USD $10 billion in 2019.

WRLG’s previous operator was under-capitalised. Debt repayment obligations forced the company into a quick-to-cash-flow mine model that was expensive and inefficient and lead to sub-economic production.

The Madsen Gold Mine – is fully permitted and has a brand-new 800+ tonne per day mill, a tailings and water treatment facility. [1]

The strategy for the Madsen Mine Restart is: 1. De-risk Resources (in-fill and expansion drilling, UG development 2. Restart Planning (engineering, mill expansion assessment, optimisation 3. Restart Execution (assembling team, community relations, focus on operability and profitability).

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [2.] [3.]

WRLG President & CEO Shane Williams recently spoke with the contagiously energetic Thomas George (CFA), President of Grizzle, a media company focused on “the dynamics of the new economic paradigm.”

George was formerly Director of Global Resources at TD Management and lead Portfolio Manager for over $1 billion of global equities (resource and sustainability funds). He has been featured on Fox Business, CNBC, Bloomberg, CTV, CBC and the National Post.

“Mining is the lifeblood of wealth that can transform an entire community,” Williams told George in a wide-ranging conversation. “Young people today are socially conscious. They are concerned about the environment. In Canada, every mining project goes through a rigorous Environmental Assessment Process. It’s one of the best in the world. We should be promoting mining in Canada.”

Williams has designed, built and operated mines (open pit and underground) in Greece, Turkey and Canada - for Skeena Resources, Eldorado Gold and Rio Tinto.

“I'm not an exploration guy,” explained Williams. “I need to be involved in something that's growing and building. That's why I got involved in West Red Lake Gold. It's near-term production. Putting an asset into production is something I’ve done before. Some of the mines are still in operation today. That gives me great satisfaction.”

“We are very pleased with the results that have been coming out from the South Austin definition program,” stated Williams. “The team has been intercepting zones of mineralization where expected, which is helping to increase our confidence in the higher priority areas of the resource model and validates our interpretation of the geology.”

Between October 2, 2023 and April 15, 2024 gold rose USD $570 from $1,830 to $2,400. On April 22, 2024 it pulled back about $70/ounce to $2,344.

“So far, these are just routine downside price corrections in major bull-market runs,” stated Kitco Gold. “There has also been a perceived easing of tensions in the Middle East, which is a negative for the safe-haven metals.”

“Now that we have added a second underground drill at North Austin, we expect to be generating a steady stream of positive news flow from North and South Austin over the coming months,” concluded Williams in the April 18, 2024 PR.

Disclaimer: West Red Lake Gold paid GSN $1,500 CND for the research, writing and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

References:

1. SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

2. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Contact Info:

Name: Guy Bennett

Email: Send Email

Organization: Global Stocks News

Website: http://www.globalstocksnews.com

Release ID: 89127901

In case of encountering any inaccuracies, problems, or queries arising from the content shared in this press release that necessitate action, or if you require assistance with a press release takedown, we urge you to notify us at error@releasecontact.com. Our responsive team will be readily available to promptly address your concerns within 8 hours, resolving any identified issues diligently or guiding you through the necessary steps for removal. The provision of accurate and dependable information is our primary focus.