KELLOGG, Idaho and VANCOUVER, British Columbia , Dec. 13, 2024 (GLOBE NEWSWIRE) -- Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSXV:BNKR |OTCQX:BHLL) announces that the Bunker Hill Mine restart project, which is approximately 64% complete with 98% of procurement completed, has undergone a strategic review resulting in an updated timeline and capital requirements.

Pursuant to this review, the Company now forecasts a total restart expenditure (excluding working capital) of $103 million, up from the previously forecasted $67 million and the $56 million in the 2022 Pre-Feasibility Study (the “PFS”), with the restart project anticipated to be delayed by up to four months. To provide sufficient project finance for the ongoing development of the Bunker Hill Mine, the Company intends to draw down on the $21 million standby facility (the “Standby Facility”) provided by Sprott Private Resource Streaming and Royalty Corp. and finalize the ongoing discussions with its strategic partners for potential offtake or similar financing for an additional $30 million.

Sam Ash, President and CEO, commented: “This revised plan takes full account of the many challenges facing the project and the rest of the US mining industry. Work onsite continues round the clock at the highest intensity possible to complete mechanical installation and commissioning and deliver the demanding restart plan. The adjustment we’re announcing reflects the outcome of weeks of intense work by the small Bunker team, Gypsy LLC, our procurement, construction, and management contractor and their many supporters to counter the worst effects of inflation, scope changes since the PFS, and an unplanned contractor change. We are pleased to be able to draw upon the Standby Facility and conclude offtake and associated financing discussions to ensure that profitable and sustainable operations may commence by the revised start date of Q2 2025. We wish to thank our partners at Sprott Private Resource Streaming and Royalty Corp. and our many skilled contractors working on this critical US project for their steadfast and enduring support.”

STRATEGIC REVIEW – ACTIVITY AND CONCLUSIONS

Over the past eight weeks, the Company has reviewed the impact of the following key factors on the restart plan, seeking ways to mitigate them and incorporate them within the revised forecast:

- Input Cost Inflation—As widely reported across the US Mining Industry, the cost of skilled construction labor (specifically electricians) has increased by 53% over the last 12 months, from an average of $75/hour to $114/hour. The cost of structural steel has also increased by 40%, copper (a proxy for electrical fittings) by 40%, and concrete by 20%. These are extraordinary numbers that deeply impact every aspect of the project.

With labor being the primary input cost in the project's mechanical installation and commissioning phases, this has been the most challenging to mitigate. Efforts have been made to bring some of this work in-house, but these have not significantly impacted total cost projections, particularly given the impact of steel, concrete, electrical and other inflation (as crystallized in the recent and final procurement orders).

- Filter Press Scope Change - As reported in the news release dated May 21, 2024 the Company chose to change the Tailings Management System envisaged in the 2022 PFS and starting budget, in order to improve long-term efficiency and sustainability, following tailings filtration testing. The more effective and expensive filter press (as compared to the $5 million disk filter system described in the 2022 PFS) passed the 90% engineering milestone in October 2024. This final design and associated inflation-effected procurement through November resulted in the final cost forecast increase from $10 million to $18 million.

- Specialist Contractor Walk-Out - In August 2024, the specialist contractor conducting the auger-cast deep piers for the tailings filter press demobilized unexpectedly to pursue other work in North America. Given the tight market for this specialty construction work, securing and mobilizing a replacement contractor for this deep pier construction onto the mine site was challenging passing on delays to the construction timeline.

To mitigate this unexpected schedule delay, the Company conducted an engineering study to consider the deferral of the construction of the Tailings Filter Press into 2026, with tailings instead being pumped directly from the Kellogg Yard to the paste plant in the Wardner operating base and into voids underground at start-up. After conducting trade-off analysis, it was determined that this phased solution was not workable and that it would be more prudent to continue the complete construction as planned, albeit on a delayed timeline. It was judged to be far better to have the optimal system at restart geared to serving the 1,800 tons per day plan, than a potentially risky work-around that would put initial cash flow at risk.

Taking account of these key factors and any mitigating actions, the review determined that the project restart would be delayed until at least Q2 2025 and that the total project expenditure (including working capital) is expected to increase by approximately $50 million.

RESTART PLAN UPDATE

Processing Plant - 66% complete. The mechanical installation of the final elements of the processing plant is continuing, with the phased commissioning of the circuit starting by the end of December 2024 following the plant's connection to the grid power via the Bunker Hill transformer. The external conveyor network is being installed connecting the crusher, ore silo, plant and concentrate load-out facility. Inside the main building piping, pumps, electrical infrastructure and working mezzanine platforms are installed in stages.

Figure 1: Conveyor installation

Figure 2: Mezzanine floor and equipment installation

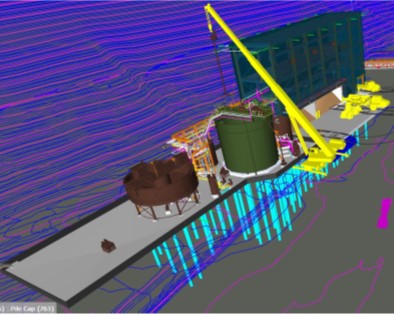

Tailings Filter Press - 38% Complete. The concrete foundations for the tailings filter press are laid in stages upon the deep piers. This is concurrent with the construction of the tailings storage tank and associated infrastructure and off-site, the final construction of the various components of the facility.

Figure 3: Rendering of the final tailings filter press design

Figure 4: Tailings storage tank construction (December 2024)

Underground - 80% Complete. Conducted from the Wardner Operating Facility, the underground development continues to be on track and budget. Access to five mining stopes has already been prepared in the underground area of the mine. These are ready to be mined now. Refurbishment of the access ramp to level 8 mining areas is 75% complete. Work is currently focused on improving the ramp’s geotechnical strength as it cuts through the Cate Fault; and thereby enable longer life mining than that envisaged in the 2022 PFS. Stockpiling of ore underground during the ramp refurbishment will commence by the end of 2024.

Figure 5: Steel Sets supporting ramp through Cate Fault

Mine Planning - This revised forecast incorporates the Company’s optimization efforts conducted over the prior months to ensure the most sustainable and profitable restart operation possible while mitigating the impact of cost increases. The plan update includes an adjusted mine plan to maximize cash flows from year one.

Resource and Reserve Expansion - This revised forecast incorporates more drilling and technical work into the plan. Specifically, it incorporates the identified silver targets in the upper part of the mine into the early mine plan and technical studies for Bunker 2.0: the move to 2,500 tons per day. The Company is processing the data gathered from the 2024 drilling campaign and intends to issue a Resource and Reserve update as planned in Q1 2025, as well as provide periodic updates on these results over the next few weeks.

FINANCING PLAN

The Company intends to commence drawing in tranches upon the Standby Facility provided from December 12, 2024. The first tranche will provide $5 million in working capital. The ongoing negotiations with various financing partners to secure a $30 million financing package are expected to be concluded by the end of January 2025.

Concurrent with this, the Company will continue to advance the process required to unlock the $150 million facility from US EXIM by the end of 2025 which the Company would utilize to refinance the existing debt and increase the mine’s expected production capacity to 2,500 tons per day.

Even with the Company’s plans to secure the necessary financing for the project restart pursuant to the updated forecast, there is no certainty that the Company will be able to raise the funds required to complete the necessary development work needed to restart operations and advance the ongoing mine plan adjustments. While the Company anticipates operations to commence in the second quarter of 2025, there is no certainty that this will be the case.

CORPORATE UPDATE WEBINAR

The Company will host a webinar on Friday, December 13, 2024 at 9:00am PST/12:00pm EST featuring a presentation from Bunker Hill’s President and CEO Sam Ash, Executive Chairman Richard Williams and CFO Gerbrand Van Heerden. A recording of the webinar will be available on the Company’s website.

Attendees can register for the webinar using the following link: https://6ix.com/event/bunker-hill-announces-updated-forecast-for-mine-restart-and-revised-financing

ABOUT BUNKER HILL MINING CORP.

Under Idaho-based leadership, Bunker Hill intends to sustainably restart and develop the Bunker Hill Mine as the first step in consolidating and then optimizing a number of mining assets into a high-value portfolio of operations, centered initially in North America. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

On behalf of the Board of Directors of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: brenda.dayton@bunkerhillmining.com

Cautionary Statements

Neither the TSX Venture Exchange (the “TSX-V”) nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding: the Company’s objectives, goals or future plans, including the restart and development of the Bunker Hill Mine and the updated timeline and forecast and anticipated capital requirements in connection therewith; the achievement of future short-term, medium-term and long-term operational strategies and objectives and the expected timing thereof, including with respect to planned production; the Company raising the required funds for the planned project restart through its project finance initiatives, including by way of debt, equity, offtake or similar financings; and the expected budget and estimated completion time for the underground development of the Bunker Hill Mine. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions relating to: Bunker Hill’s ability to receive sufficient project financing for the restart and development of the Bunker Hill Mine on acceptable terms or at all; the revised forecast, capital requirements and updated timeline for the project restart resulting in planned production by Q2 2025; the future price of metals; and the stability of the financial and capital markets. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the “SEC”) and with applicable Canadian securities regulatory authorities, and the following: the Company’s ability to operate as a going concern and its history of losses; the Company’s ability to raise sufficient project financing for the restart and development of the Bunker Hill Mine on acceptable terms or at all, including through equity or debt financings, concentrate offtake financings or otherwise; the Company requiring more capital expenditures than anticipated in the updated forecast, resulting in delays in the updated timeline; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company’s ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company’s cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; changes in labor costs and availability of skilled labor and specialists; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives or as to whether and when the Company will achieve its operational and construction targets. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov).

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/7cf78a59-dcd6-473e-9eca-0e3d3e2cf415

https://www.globenewswire.com/NewsRoom/AttachmentNg/e4917b71-939b-4ee3-bdff-93b2f4c7e7ab

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d897893-9f21-4e64-abdc-f3f00bdd6452

https://www.globenewswire.com/NewsRoom/AttachmentNg/7c786dc5-e95e-4f33-af66-bce2b86595ee

https://www.globenewswire.com/NewsRoom/AttachmentNg/10e15f9b-5df0-48f2-832f-e9fac73d8118