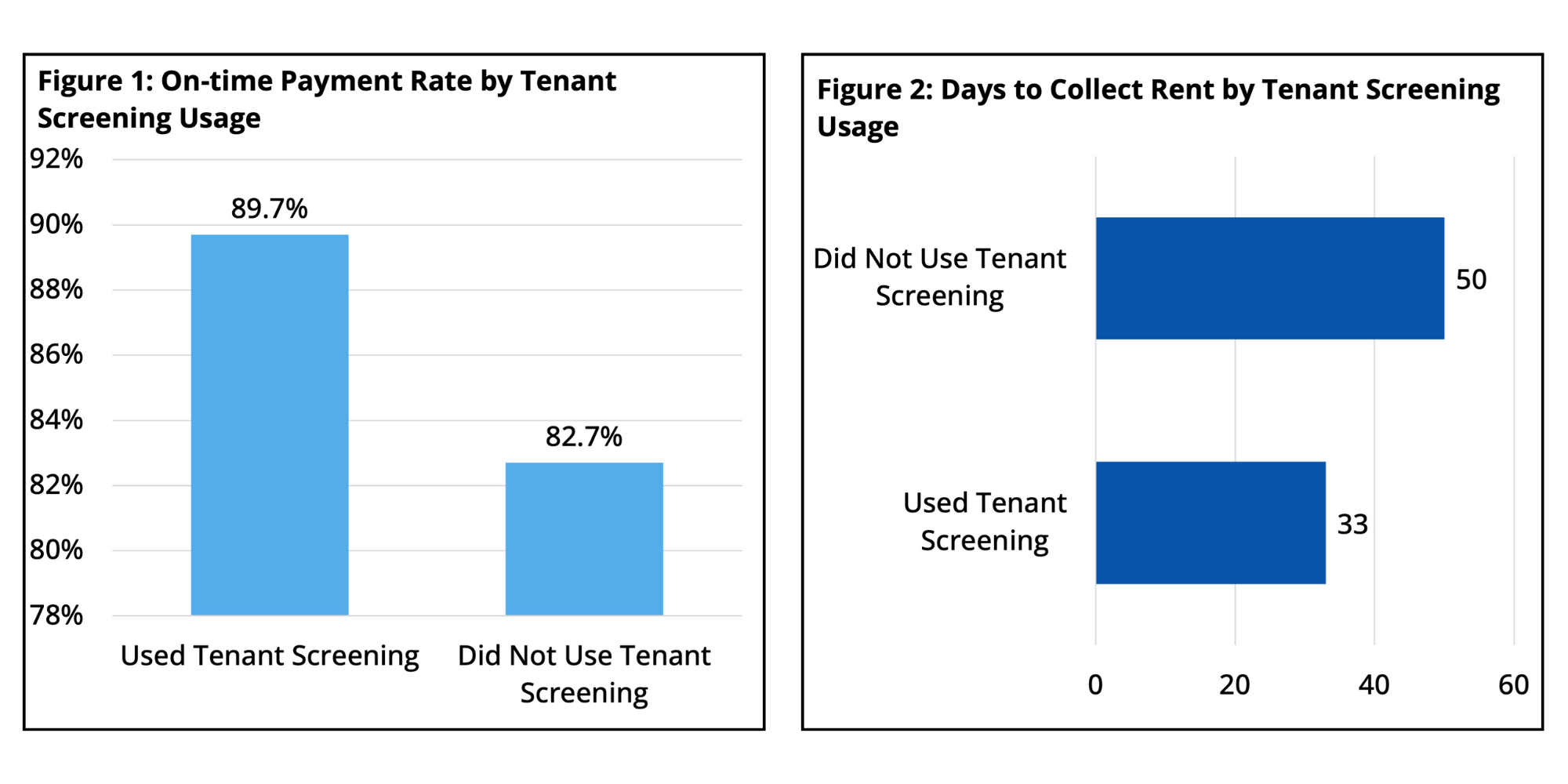

NEW YORK, Nov. 14, 2024 (GLOBE NEWSWIRE) -- RentRedi, the fastest-growing property management software, released new data that demonstrates the effectiveness of its tenant screening feature in helping landlords collect rent early and on time. RentRedi data collected between January 2020 and August 2024 shows tenants submit their rent payments 17 days faster when they were screened by landlords using the RentRedi platform, compared with tenants who did not go through the screening process. Additionally, on-time payment rates for units with a tenant who underwent tenant screening via the RentRedi platform paid their rent on time about 90% of the time—7 percentage points higher than those who did not use tenant screening.

These findings validate the importance of establishing an effective and efficient vetting process that identifies tenants who are more likely to pay rent on-time and less likely to lead to eviction when marketing a rental property. RentRedi offers a better solution to manually screening rental applicants, which is labor intensive and increases the risk of renting to unreliable or problematic tenants. RentRedi’s complete tenant screening feature provides DIY landlords with a comprehensive review of their rental applicant’s financial information and rental history, making it fast and easy to screen tenants.

Using RentRedi’s tenant screening technology, DIY landlords can conduct TransUnion-certified background checks that include credit, criminal, and eviction reports to filter out applicants who may not fit a landlord’s minimum requirements. Additionally, RentRedi’s tenant screening feature boasts advanced capabilities, powered by Plaid, that go beyond verifying proof of income to also provide summaries of earnings by month, assets, and unpaid debts.

“Tenant screening is a popular feature within the RentRedi app because it provides an easy way to help landlords protect their real estate investments,” said RentRedi co-founder and CEO Ryan Barone. “RentRedi’s tenant screening feature reduces the risk of handing the keys to your property over to someone who lacks the proper income and funds to pay rent consistently or who has a history of irresponsible behavior.”

RentRedi’s custom pre-qualification and applications also empowers landlords to incorporate their individual needs and preferences (like screening for smokers or pets) into the tenant pre-screening process, assisting landlords in vetting their applicant pool faster, more thoroughly, and more effectively.

More information about these findings and other related data can be found in the RentRedi white paper: The Secret Success of Self-Managing Your Rentals.

Methodology

For this analysis, as long as one tenant occupying a unit was using autopay at the time of payment, the entire unit is considered to be benefiting from that feature. Payment status categories (on-time, late, and unpaid) are from the same methodology used in the Chandan Economics Independent Landlord Rental Performance Report. Critical features of Chandan Economics’ methodology are:

- It only includes rent income charges.

- It only contains charges between $500 and $10,000.

- It removes units that are inactive for more than two months from the sample.

About RentRedi

RentRedi offers an award-winning, comprehensive property management platform that simplifies the renting process for landlords and renters by automating and streamlining processes. Landlords can quickly grow their rental businesses by using RentRedi's all-in-one web and mobile app to collect rent, list and market vacancies, find and screen tenants, sign leases, and manage maintenance and accounting. Tenants enjoy the convenience and benefits of RentRedi’s easy-to-use mobile app that allows them to pay rent, set up auto-pay, build credit by reporting rent payments to all three major credit bureaus, prequalify and sign leases, and submit 24/7 maintenance requests.

Founded in 2016, RentRedi is VC-backed and a proven leader in the PropTech market. The company ranks No. 180 on the 2024 Inc. 5000 list and No. 12 on the Inc. 5000 Regionals list and was named an Inc. Power Partner in 2023 and 2024, as well as a GetApp Category Leader, a Capterra Established Player, and a G2 High Performer and Momentum Leader based on the software’s user ratings and popularity. To date, RentRedi has more than $28 billion in assets under management with nearly 200,000 landlords and tenants using the platform. The company partners with technology leaders such as Zillow, TransUnion, Experian, Equifax, Realtor.com, Plaid, and Stripe to create the best customer experience possible. For more information visit RentRedi.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/7c607987-8df3-48b9-90a4-e850f54b2763

Media Contact: Jennifer Tolkachev jen@rentredi.com (949) 929-2497