Arthur Cohen discusses the importance of policy review in insurance planning.

Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-arthur-cohen-founder-of-arthur-cohen-insurance-discussing-policy-review/

Regular policy reviews are essential to ensure that insurance policies are in line with current life circumstances and needs. Arthur Cohen, founder of Arthur Cohen Insurance, discussed that policies such as life insurance, long-term care insurance, and retirement planning should be reviewed every three to five years.

Arthur stressed the importance of reviewing policies to ensure they match the individual’s stage in life. Life circumstances evolve, including events like births, deaths, marriages, divorces, and special needs for loved ones. For instance, outdated beneficiary designations on a life insurance policy can conflict with the intended purpose of the coverage.

Arthur shared stories that underscored the importance of regular policy reviews. One story involved a friend who passed away unexpectedly without any life insurance coverage, because he didn’t “plan on dying anytime soon”, highlighting the need to plan for unforeseen events. Another story showcased the positive impact of having the appropriate long-term care insurance policy, preventing financial ruin for a family facing unexpected health challenges.

By conducting regular policy reviews, individuals can ensure that their insurance coverage meets their current needs and circumstances. Arthur’s experience with clients emphasizes the value of staying proactive and making necessary adjustments in order to provide adequate protection and peace of mind. Regular reviews can help avoid potential pitfalls. At the same time, it’s an opportunity to brainstorm and make informed decisions to safeguard one’s financial future.

An important takeaway from the podcast episode is the significance of regularly reviewing and updating policies so they are commensurate with today’s life. He highlights that circumstances change, and we need to make sure that our policies continue to fulfill our needs and goals.

Arthur shares examples where outdated beneficiary designations led to potential conflicts and unintended consequences. For instance, he mentions cases where ex-spouses or underage children were listed as beneficiaries, which could contradict the original intent of the insurance policy and create tremendous problems. In some instances, policyholders may no longer need life insurance due to circumstances, making it essential to update or adjust their portfolio.

Arthur said: “We protect people against dying too soon, and the very real likelihood of living too long. Longevity planning is essential. Of course, protecting your family is very important, but there’s nothing worse than living a long life and running out of money.”

Video Link: https://www.youtube.com/embed/TPDzl82vcR4

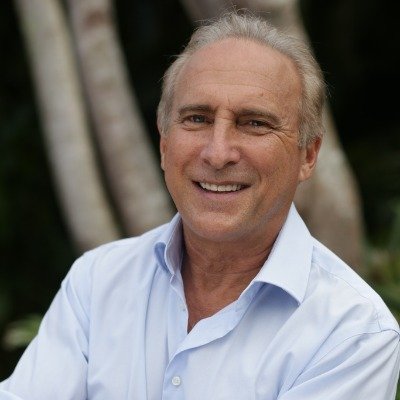

About Arthur Cohen

Old-school sensibility and service combined with up-to-date expertise.

Over 40 years in the insurance planning business. Creative and strategic ways of using his expertise as a valuable tool to protect families and businesses. Expertise in Long Term Care insurance, having brought it to the attention of the public almost since its inception. Longevity planning using the most appropriate annuity products for “safe money.” Board member of a nationally recognized neurocognitive research and care facility. Great reputation among his clients and peers for his dedication and devotion to his clients and the community.

Learn More: https://arthurcoheninsurance.com/

Media Contact

Company Name: Marketing Huddle, LLC

Contact Person: Mike Saunders, MBA

Email: Send Email

Phone: 7202323112

Country: United States

Website: https://www.AuthorityPositioningCoach.com