Second highest month in OCC’s history; highest June on record

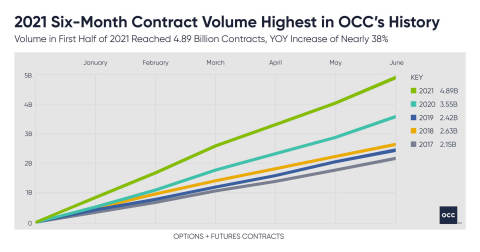

OCC, the world's largest equity derivatives clearing organization, announced today that June 2021 total cleared contract volume was 870,149,871 contracts, the second highest month in OCC’s history and up 32.7 percent compared to June 2020. Year-to-date average daily cleared contract volume through June was 39,400,310 contracts, up 25.6 percent compared to June 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210702005041/en/

OCC Six-Month Historical Volume (Graphic: Business Wire)

Options: Total exchange-listed options cleared contract volume was 866,099,522, up 25.8 percent compared to June 2020. Equity options cleared contract volume was 826,487,445 contracts, up 26.9 percent compared to June 2020. This includes ETF options cleared contract volume of 203,065,100, a 17.3 percent decrease compared to June 2020. Index options volume was 39,612,077, up 5.8 percent compared to June 2020. OCC's year-to-date average daily cleared options volume is 39,163,414 contracts.

Futures: Total futures cleared contract volume was 4,050,349, a 9.9 percent decrease compared to June 2020. OCC's year-to-date average daily cleared futures volume is 236,895 contracts.

Securities Lending: The average daily loan value at OCC in June 2021 was $128,437,950,629, a 68.5 percent increase compared to June 2020. Securities lending CCP activity increased by 38.5 percent in new loans from June 2020 with 171,873 transactions last month.

For 2021 monthly exchange market share information, click here.

|

June 2021

|

June 2020

|

June 2021

|

YTD Avg

|

YTD Avg

|

June 2021

|

Equity Options |

826,487,445 |

651,089,358 |

26.9% |

37,272,281 |

25,992,438 |

43.4% |

Index Options |

39,612,077 |

37,455,152 |

5.8% |

1,891,133 |

2,137,212 |

-11.5% |

Total Options |

866,099,522 |

688,544,510 |

25.8% |

39,163,414 |

28,129,650 |

39.2% |

Futures |

4,050,349 |

4,497,670 |

-9.9% |

236,895 |

279,362 |

-15.2% |

Total Volume |

870,149,871 |

693,042,180 |

25.6% |

39,400,310 |

28,409,012 |

38.7% |

About OCC

The Options Clearing Corporation (OCC) is the world's largest equity derivatives clearing organization. Founded in 1973, OCC is dedicated to promoting stability and market integrity by delivering clearing and settlement services for options, futures and securities lending transactions. As a Systemically Important Financial Market Utility (SIFMU), OCC operates under the jurisdiction of the U.S. Securities and Exchange Commission (SEC), the U.S. Commodity Futures Trading Commission (CFTC), and the Board of Governors of the Federal Reserve System. OCC has more than 100 clearing members and provides central counterparty (CCP) clearing and settlement services to 19 exchanges and trading platforms. More information about OCC is available at www.theocc.com.

Copyright © 2021. The Options Clearing Corporation. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210702005041/en/

Contacts

OCC Public Relations

Michael Shore

PublicRelations@theocc.com