One side effect of the race to build artificial intelligence platforms and data centers is the staggering cost of AI infrastructure. Data centers use hundreds of bundled graphics processing units, each costing tens of thousands of dollars. That’s why many companies have been raising their capital expenditure budgets—they need the computing power to handle greater AI workloads.

But not every company has the resources to handle the capital outlay. Oracle (ORCL) made news last year when it raised its capital expenditure budget from $15 billion to $50 billion, raising the entire amount through equity and debt.

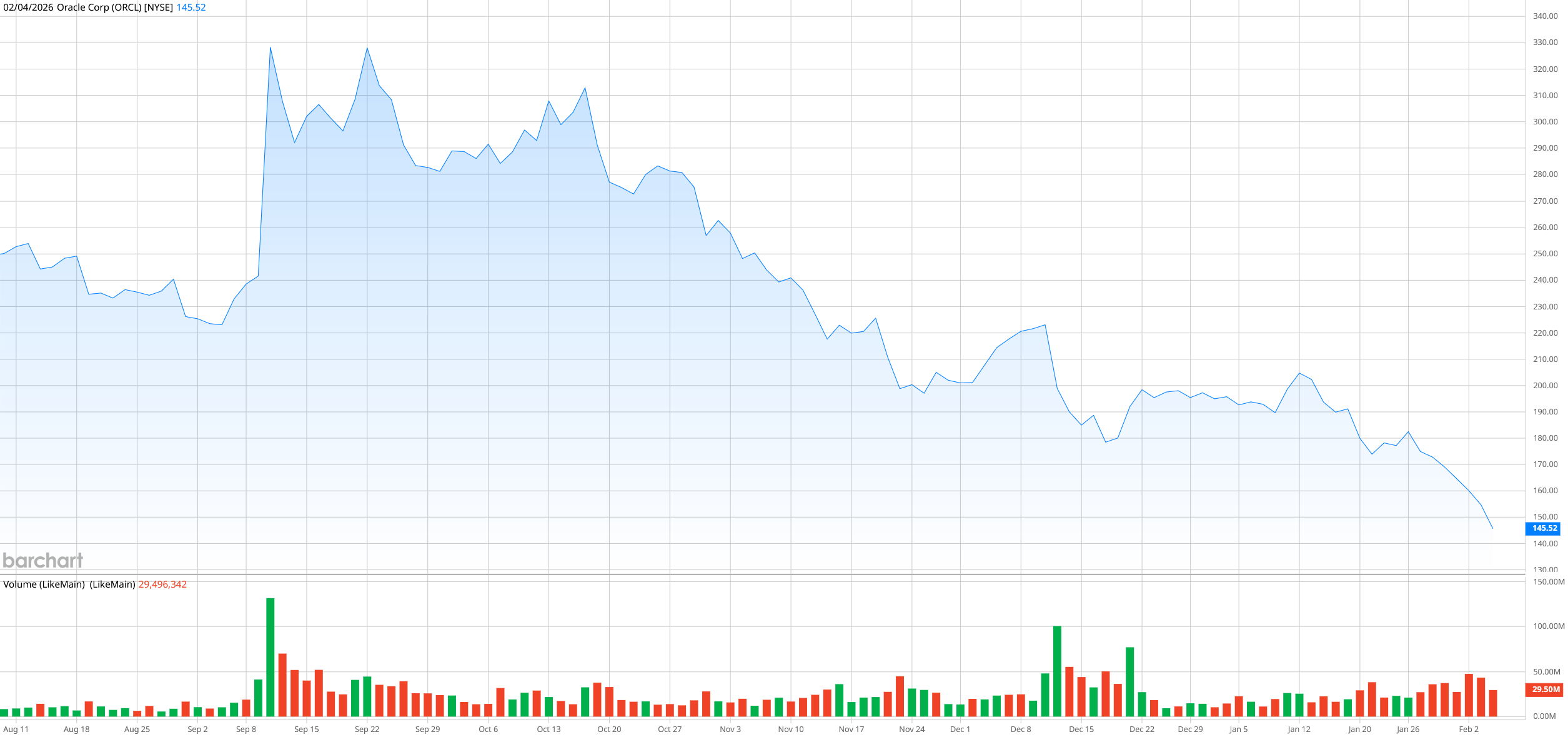

But now analysts are raising concerns about Oracle, whose stock is down nearly 58% from its peak in September. A $300 billion deal to supply cloud infrastructure to OpenAI means that Oracle must spend $156 billion on GPUs and other equipment, according to TD Cowen analysts. The investment bank says Oracle may seek to sell its health tech unit, Cerner, and cut up to 30,000 jobs to help pay for its data center expansion.

Should investors be concerned about Oracle, or is this an opportunity to buy a quality stock at discounted prices?

About Oracle Stock

Oracle, based in Austin, Texas, is a software and cloud computing company. It was founded in 1977 by Larry Ellison, who is one of the richest people in the world and who was CEO of Oracle until 2014. Ellison still serves as executive chairman of the company, as well as chief technology officer of Oracle, which has a market cap of $444 billion.

Despite the steep decline in share price since September, Oracle shares are down 14% in the last year, which is certainly worse than the S&P 500’s ($SPX) gain of 14%. Competitors Amazon (AMZN) and Microsoft (MSFT) have managed to stay flat over the last year, while a third competitor, Alphabet (GOOG) (GOOGL), is up a whopping 61%.

However, the falling stock price means that Oracle shares are relatively cheap. Its forward price-to-earnings ratio of 20.9 is far below the five-year P/E mean of 32.7. So, the stock is attractively priced—if you believe that it's not overextending itself with its AI buildout.

Oracle also pays a dividend of $2 per year, or $0.50 per quarter, for a dividend yield of 1.3%.

Oracle Beats on Earnings

Oracle enjoyed a blowout fiscal 2026 second quarter (ending Nov. 30, 2025). Revenue of $16.05 billion was up 14% from a year ago, with fully 50% of the company’s revenue coming from cloud services.

Net income was $6.13 billion, up 95% from last year, and earnings per share of $2.10 were far better than the $1.29 EPS that analysts expected. Earnings got a big boost from the company’s sale of Ampere Computing to SoftBank Group (SFTBY), giving it a $2.7 billion pre-tax gain.

“Oracle sold Ampere because we no longer think it is strategic for us to continue designing, manufacturing and using our own chips in our cloud datacenters,” Ellison said. “We are now committed to a policy of chip neutrality where we work closely with all our CPU and GPU suppliers. Of course, we will continue to buy the latest GPUs from Nvidia (NVDA), but we need to be prepared and able to deploy whatever chips our customers want to buy. There are going to be a lot of changes in AI technology over the next few years and we must remain agile in response to those changes.”

Management said it continues to see massive opportunity in training and selling AI models, as well as embedding AI in products. The company will seek to embed AI in its Cloud Data Center software, its Autonomous Database and Analytics software, and its Applications software. “All of the top five AI Models are in the Oracle Cloud,” co-CEO Mike Sicila said. “We have huge advantages over our applications competitors.”

The company's third-quarter guidance is for cloud revenue to grow by 40% to 44% and total revenue to grow by 19% to 21% from a year ago.

What Do Analysts Expect for ORCL Stock?

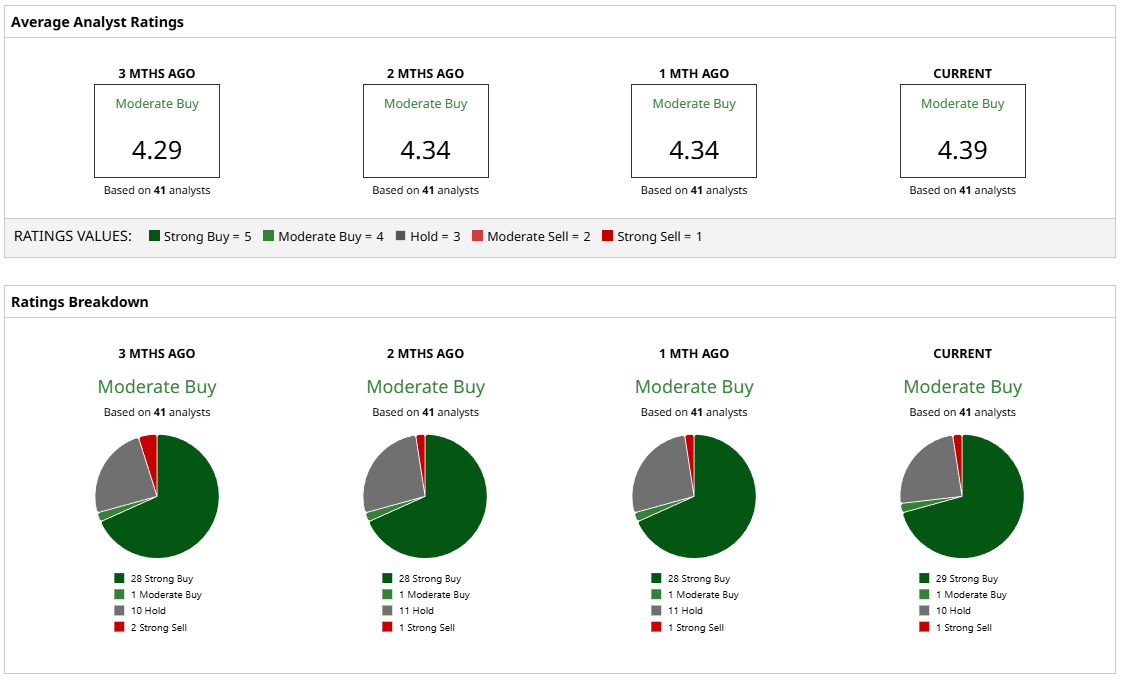

Despite the caution issued by TD Cowen, analysts have an extremely bullish take on ORCL stock, with 30 of 41 analysts who cover the stock giving it “Buy” ratings. Only one has a “Sell” rating, and the rest suggest holding.

Notably, the mean price target of $301 suggests a 107% increase in Oracle stock is possible, with one analyst going even further to a $400 price target. The low price target of $155 suggests a much more modest 7% gain.

The bottom line for Oracle is that this stock is undervalued and has a strong growth window, with its cloud business booming. While the company must invest in GPUs to build out its data centers, the investment appears to be a good one, as deals from companies like OpenAI should more than pay off in the end.

ORCL stock is a buy right now before it takes off again.

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Enphase Energy Stock Just Shot Into Overbought Territory. Is It Too Late to Buy ENPH?

- Amazon Is Widely Launching Alexa+. Can That Move the Needle for AMZN Stock?

- As AMD Stock Breaks Below Key Support on Earnings Selloff, Should You Buy the Dip?

- ‘You Don’t Need to Have a PhD in Computer Science’ to Make a Great Living as AI Disrupts the Economy as We Know It. The Good and Bad of Nvidia CEO Jensen Huang’s Latest Prediction.