Invesco Ltd. (IVZ), valued at a market cap of $12.1 billion, is a global investment management company that provides a wide range of financial products and services to individuals, institutions, and governments. The Atlanta, Georgia-based company manages assets across equities, fixed income, multi-asset strategies, real estate, and alternatives, with a strong presence in exchange-traded funds (ETFs).

Invesco’s shares have outperformed the broader market over the past 52 weeks. IVZ has gained 42% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. Also, the stock is up 3.9% on a YTD basis, compared to SPX’s 1.4% rise.

Zooming in further, Invesco has outpaced the State Street Financial Select Sector SPDR Fund’s (XLF) 3.2% return over the past 52 weeks and an 2.4% decline on a YTD basis.

After releasing its fiscal 2025 fourth-quarter results on Jan. 27, Invesco’s shares whipsawed, dropping 5.1% initially before rebounding 1.5% in the following session, as investors digested the mixed reaction. Adjusted diluted earnings per share were $0.62, surpassing the consensus estimate. Net revenue for the quarter increased 6.1% year over year to $1.26 billion, driven by higher average assets under management (AUM) and revenue from the Invesco QQQ Trust conversion to an open-end ETF. The firm also recorded strong net long-term inflows, reflecting ongoing client demand, and AUM reached approximately $2.2 trillion, highlighting growth in its investment base.

For the current fiscal year, ending in December 2026, analysts expect Invesco’s EPS to grow 31% YoY to $2.66. The company’s earnings surprise history is mixed. It surpassed the Wall Street estimates in three of the last four quarters while missing on one other occasion.

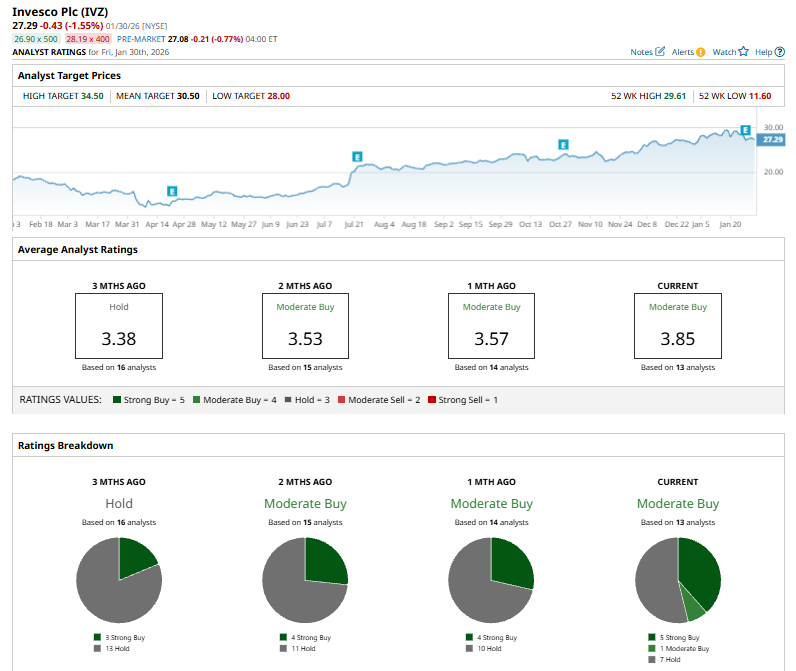

Among the 13 analysts covering the stock, the consensus rating is a “Moderate Buy,” which is based on five “Strong Buy” one “Moderate Buy,” and seven “Hold” ratings.

The overall consensus rating is bullish than three months ago, when it had a “Hold” rating

On January 21, RBC Capital Markets upgraded Invesco from “Sector-Perform” to “Outperform” and raised its price target to $35 from $25.

IVZ’s mean price target of $30.50 represents 11.8% premium to current price levels, while the Street-high target of $34.50 suggests 26.4% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart