With a market cap of $55.7 billion, NXP Semiconductors N.V. (NXPI) is a leading global semiconductor company headquartered in the Netherlands. It specializes in embedded processing, secure connectivity, and analog solutions, securing a strong competitive position in automotive electronics, which is its largest revenue driver, supplying chips for vehicle networking, safety, infotainment, and software-defined vehicle architectures.

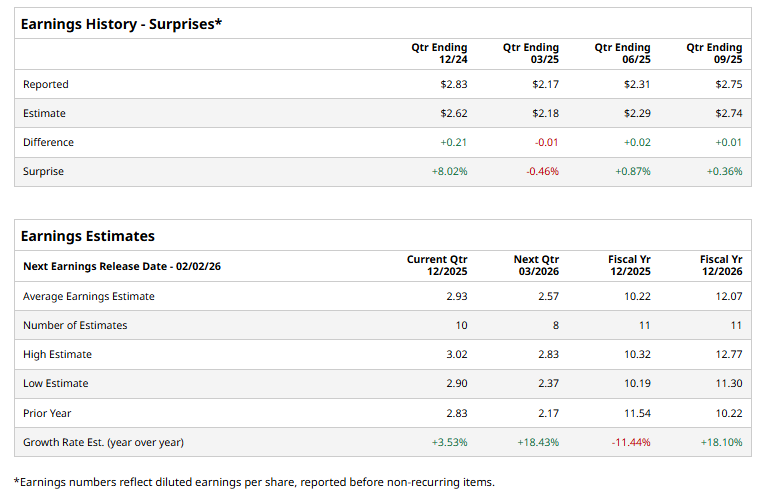

The company is slated to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect NXP Semiconductors to report an EPS of $2.93, a 3.5% increase from $2.83 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the chipmaker to report EPS of $10.22, marking an 11.4% drop from $11.54 in fiscal 2024. However, EPS is anticipated to grow 18.1% year-over-year to $12.07 in fiscal 2026.

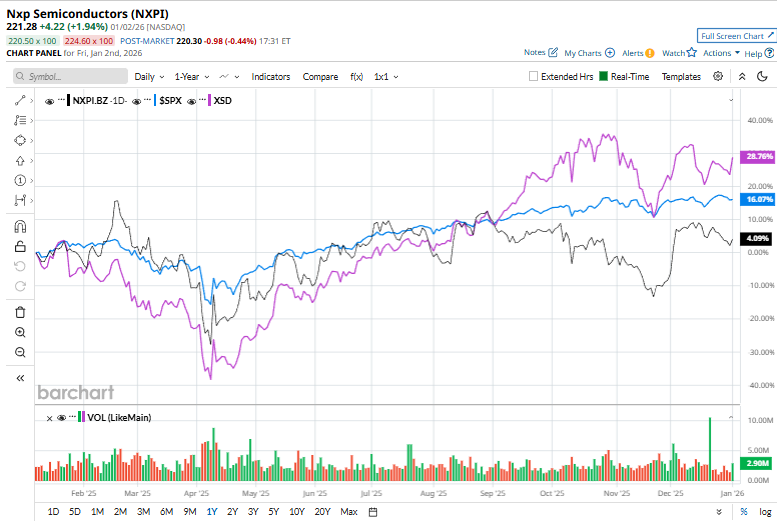

Shares of NXP Semiconductors have surged 7.3% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 16.9% increase and the SPDR S&P Semiconductor ETF's (XSD) 33.1% surge over the same period.

On Dec. 19, Shares of NXP Semiconductors rose 2.6% in afternoon trading after Truist Securities analyst William Stein raised his price target on the stock to $265 from $254 while reaffirming a “Buy” rating, signaling increased confidence in the company’s valuation. The move was also supported by broader optimism across the semiconductor sector, driven by strong demand for artificial intelligence, data centers, and high-performance computing, which continues to underpin expectations of sustained industry growth.

Analysts' consensus view on NXPI stock remains bullish, with an overall "Strong Buy" rating. Out of 30 analysts covering the stock, 22 recommend a "Strong Buy," two "Moderate Buys," and six "Holds." The average analyst price target for NXP Semiconductors is $259.29, indicating a potential upside of 17.2% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- CES 2026, Sector Rotation and Other Key Things to Watch this Week

- Tesla Stock Has Been Flat For 2 Months - How to Make a 3.2% Yield in One-Month Puts

- GOOGL Stock Rocked in 2025, But Is Google’s 2026 Forecast as Bright?

- The Saturday Spread: How Basketball Analytics May Help Extract Alpha (CPNG, DBX, BBY)