Apple (AAPL) will release its first-quarter fiscal 2026 financial results on Thursday, Jan. 29. Shares of the iPhone maker have retreated from recent highs heading into the earnings report, largely reflecting investor unease about profitability.

Apple’s underlying business momentum appears strong. Management has guided for a record quarter, supported by robust performance across both hardware and services. iPhone sales are expected to be a key driver, with revenue projected to remain solid. The primary overhang has been margins, as rising memory costs due to supply constraints have raised questions about near-term cost pressures. This has been enough to temper enthusiasm, even as top-line prospects remain compelling.

From a technical perspective, that pullback has reduced some of the downside risk. Apple’s 14-day Relative Strength Index is hovering around 40, well below the 70 threshold typically associated with overbought conditions. This suggests AAPL stock is no longer extended and could be positioned for a rebound if earnings results or forward guidance exceed expectations.

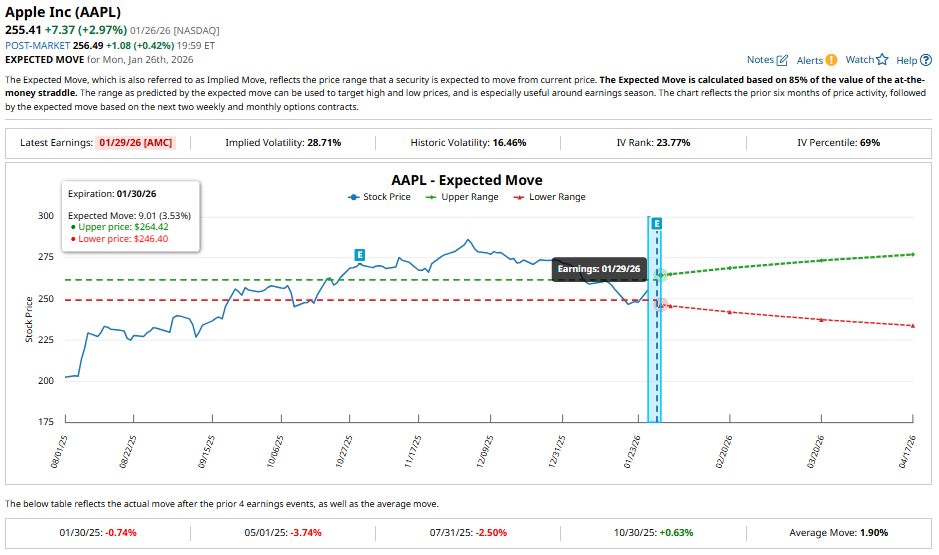

Derivatives markets are also signaling that investors are bracing for a more meaningful reaction than usual. Traders are pricing in a post-earnings move of roughly 3.5% in either direction for options expiring Jan. 30. That is greater than Apple’s average post-earnings move of about 1.9% over the past year, especially given that the stock barely moved after its Q4 earnings report.

Apple Q1: Top Line to Register Double-Digit Growth

Apple’s Q1 is likely to mark strong revenue growth led by momentum across both hardware and services. After delivering $102.5 billion in Q4 revenue, up 8% year-over-year (YOY), the company has guided for Q1 sales growth of roughly 10% to 12%, signaling acceleration from the prior quarter.

Apple’s hardware sales are likely to be driven by its refreshed product lineup, including the latest iPhone 17 family, the AirPods Pro 3, and a new generation of Apple Watch models. The iPhone remains Apple’s significant growth catalyst. In the September quarter, iPhone revenue reached a record $49 billion, up 6% YOY. Strong uptake of the iPhone 16 and 17 models pushed Apple’s active installed base to an all-time high, and management expects iPhone revenue to grow at a double-digit pace in Q1.

Apple’s Mac business also showed strength, with revenue climbing 13% to $8.7 billion, largely due to strong MacBook Air sales. That said, growth in this segment is likely to cool in the near term as comparisons become tougher following last year’s major launches.

Meanwhile, Apple’s services business could sustain its momentum. It reported revenue of $28.8 billion in Q4, up 15% YOY, with broad-based growth across advertising, cloud services, the App Store, and other areas. Apple expects this segment to continue growing at a mid-teens rate, providing stability and margin support.

Thanks to the momentum in its product and services business, Apple will likely report double-digit top-line growth in Q1. While higher memory costs may pressure margins, analysts are forecasting EPS of $2.65 in Q1, up 10.4% YOY.

Notably, Apple has outperformed analysts’ EPS expectations in each of the past four quarters, including a 6.9% beat in Q4.

Is Apple Stock a Buy Ahead of Jan. 29?

Apple is heading into the Q1 earnings report with solid momentum across hardware and services. Demand for its latest product lineup remains healthy, and the company continues to benefit from a steadily expanding base of active devices. Moreover, the seasonal lift from the holiday shopping period will likely push its top-line growth rate higher.

While margin pressures remain a concern, higher overall sales volumes and the continued strength of Apple’s services segment, which carries higher margins, should help offset some of these headwinds. Apple's solid revenue mix gives its earnings resilience even in a challenging cost environment.

That said, much of this optimism is already reflected in the AAPL stock price. Apple currently trades at about 31 times forward earnings, a relatively high valuation given its earnings growth potential over the next couple of years. Wall Street forecasts Apple’s EPS to increase by 10% in fiscal 2026 and 12% in 2027.

Ahead of the earnings release, analysts maintain a “Moderate Buy” consensus rating on AAPL stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is This Little-Known Defense Stock the Next Palantir?

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?

- ‘If You Suffer, We Will Suffer’: The Open Secret Behind Warren Buffett’s 62-Year, 6,088,800% Berkshire Hathaway Success Story

- This Chip Giant Is Set Up for a Strong 2026. Should You Buy the Dip Now?