Houston, Texas-based NRG Energy, Inc. (NRG) operates as an energy and home services company. Valued at $29.1 billion by market cap, the company owns and operates a diverse portfolio of power-generating facilities. It offers energy production and cogeneration facilities, thermal energy production, and energy resource recovery facilities. The leading essential home services platform is expected to announce its fiscal fourth-quarter earnings for 2025 in the near future.

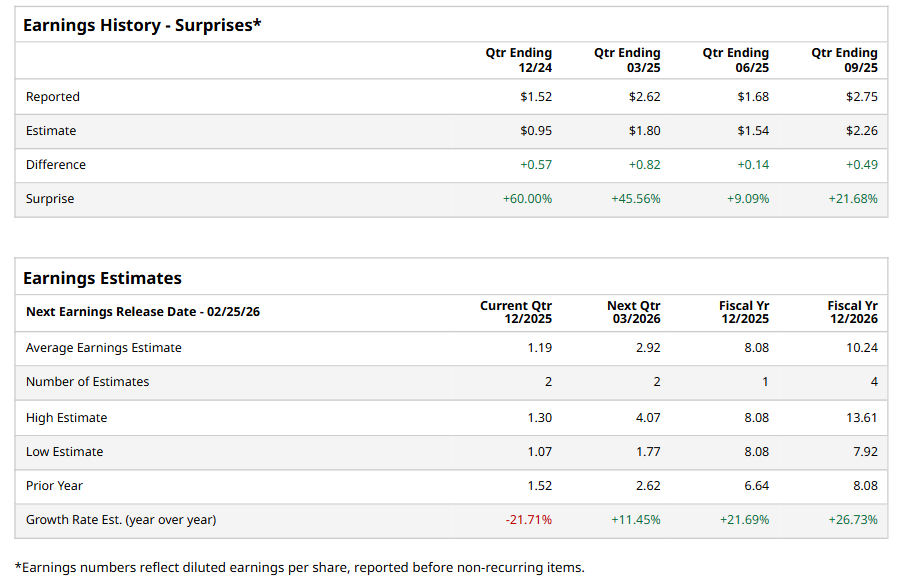

Ahead of the event, analysts expect NRG to report a profit of $1.19 per share on a diluted basis, down 21.7% from $1.52 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect NRG to report EPS of $8.08, up 21.7% from $6.64 in fiscal 2024. Its EPS is expected to rise 26.7% year over year to $10.24 in fiscal 2026.

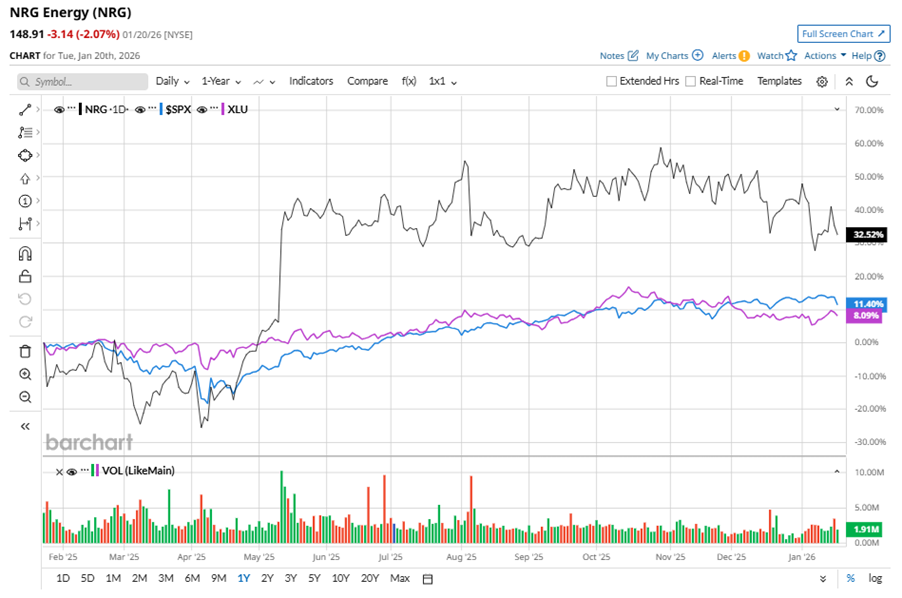

NRG stock has outperformed the S&P 500 Index’s ($SPX) 13.3% gains over the past 52 weeks, with shares up 42.5% during this period. Similarly, it outperformed the Utilities Select Sector SPDR Fund’s (XLU) 9% gains over the same time frame.

NRG’s acquisition of assets from LS Power will double its natural gas generation capacity, driving its performance.

On Nov. 6, 2025, NRG shares closed down by 1.8% after reporting its Q3 results. Its revenue stood at $7.6 billion, up 5.7% year over year. The company’s adjusted EPS came in at $2.78, up 32.4% year over year.

Analysts’ consensus opinion on NRG stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 13 analysts covering the stock, nine advise a “Strong Buy” rating, and four give a “Hold.” NRG’s average analyst price target is $211.64, indicating an ambitious potential upside of 42.1% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is it Time to "Sell America"?

- What Drove Gold and Silver to Record Highs This Weekend?

- The AI Pick-and-Shovel Trade Hiding in Plain Sight: Stocks & ETFs to Invest in Water

- ‘It Makes No Sense To Me’: Nvidia’s Jensen Huang Slams Americans Who ‘Vilified Energy,’ Praises Trump for ‘Sticking His Neck Out’