With a market cap of $8.6 billion, LKQ Corporation (LKQ) is a global distributor of replacement parts, components, and systems for vehicle repair and maintenance, serving collision and mechanical repair shops, dealerships, and retail customers. It operates across North America and Europe through four segments: Wholesale–North America, Europe, Specialty, and Self Service.

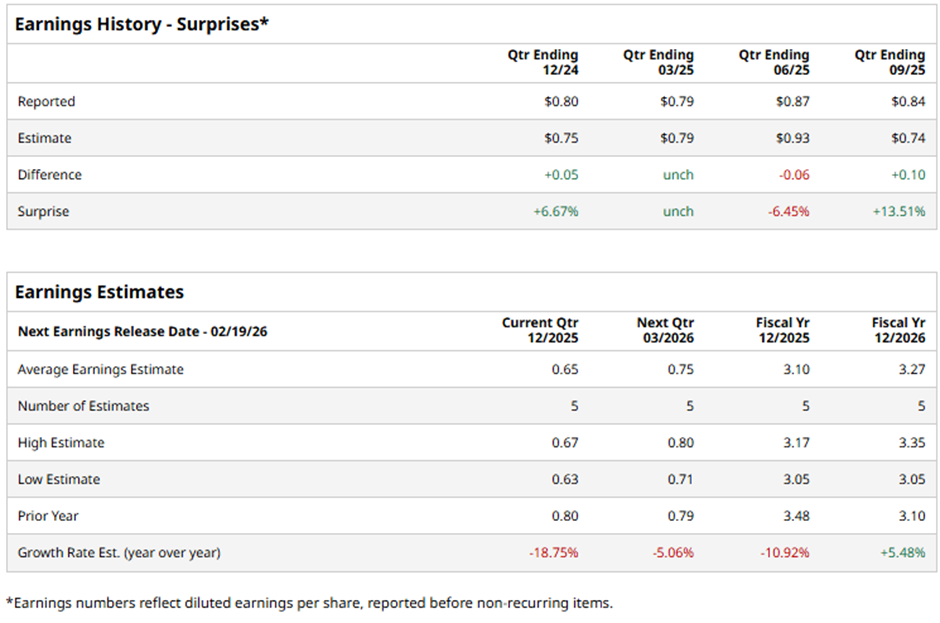

The Antioch, Tennessee-based is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast LKQ to report an adjusted EPS of $0.65, down 18.8% from $0.80 in the year-ago quarter. It has surpassed or met Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect the vehicle components company to report an adjusted EPS of $3.10, a drop of 10.9% from $3.48 in fiscal 2024. However, adjusted EPS is anticipated to grow 5.5% year-over-year to $3.27 in fiscal 2026.

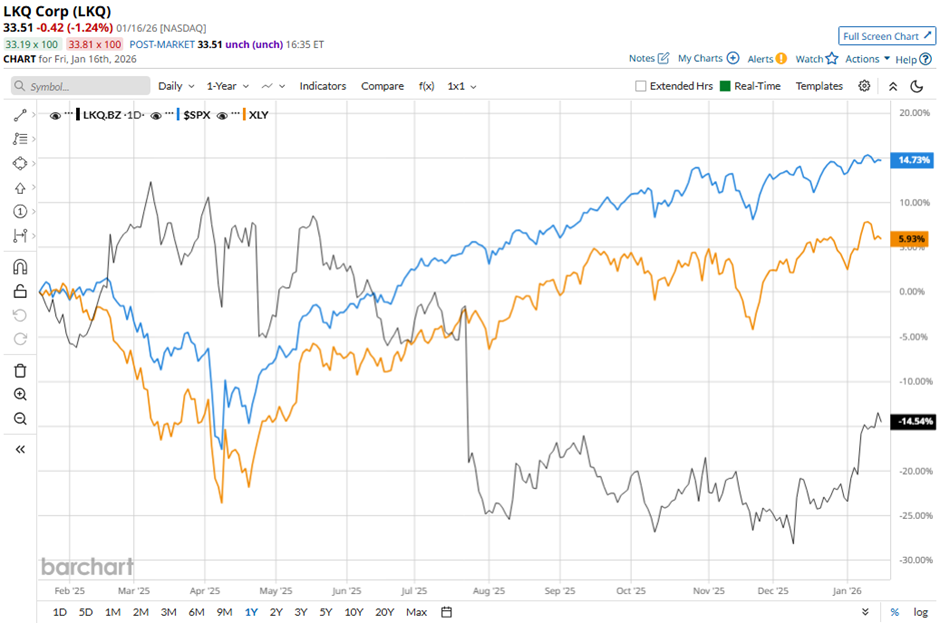

Shares of LKQ have declined 12.7% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 16.9% gain and the State Street Consumer Discretionary Select Sector SPDR ETF's (XLY) 8.2% rise over the period.

Shares of LKQ rose 3.7% on Oct. 30 after the company reported Q3 2025 adjusted EPS of $0.84, beating the consensus estimate, and delivered strong segment performances, particularly in Europe and Specialty. The stock also gained on improved 2025 guidance, with adjusted EPS projected in the range of $3 - $3.15.

Analysts' consensus view on LKQ stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 10 analysts covering the stock, six recommend "Strong Buy," one suggests "Moderate Buy," and three indicate “Hold.” The average analyst price target for LKQ Corporation is $41.19, suggesting a modest potential upside of 22.9% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart