Shares of industrial technology solutions provider Honeywell International (HON) are up this week after reports emerged that the company is looking to go for an initial public offering (IPO) of its quantum computing unit, Quantinuum. Unlike other quantum computing players in the market, which focus primarily on one layer of the quantum stack, Quantinuum builds and integrates both quantum hardware and software to deliver end-to-end quantum solutions.

Although the details of the proposed IPO are yet to come to light, the company was valued at about $10 billion after a recent fundraise of roughly $600 million from marquee investors such as Nvidia's (NVDA) NVentures venture capital arm, Amgen (AMGN), and JPMorgan (JPM).

About Honeywell

Before diving into more about Quantinuum and how an IPO may unlock value (or not) for Honeywell, it would be apt to have a look at the latter firm.

Tracing its roots back to 1906, Honeywell is one of the oldest and most diversified industrial technology companies in the world. It operates as a technology-led industrial manufacturer with a broad portfolio of products, services, and software solutions across several key sectors, such as aerospace technology, building automation, energy and sustainability solutions, and software and digital solutions.

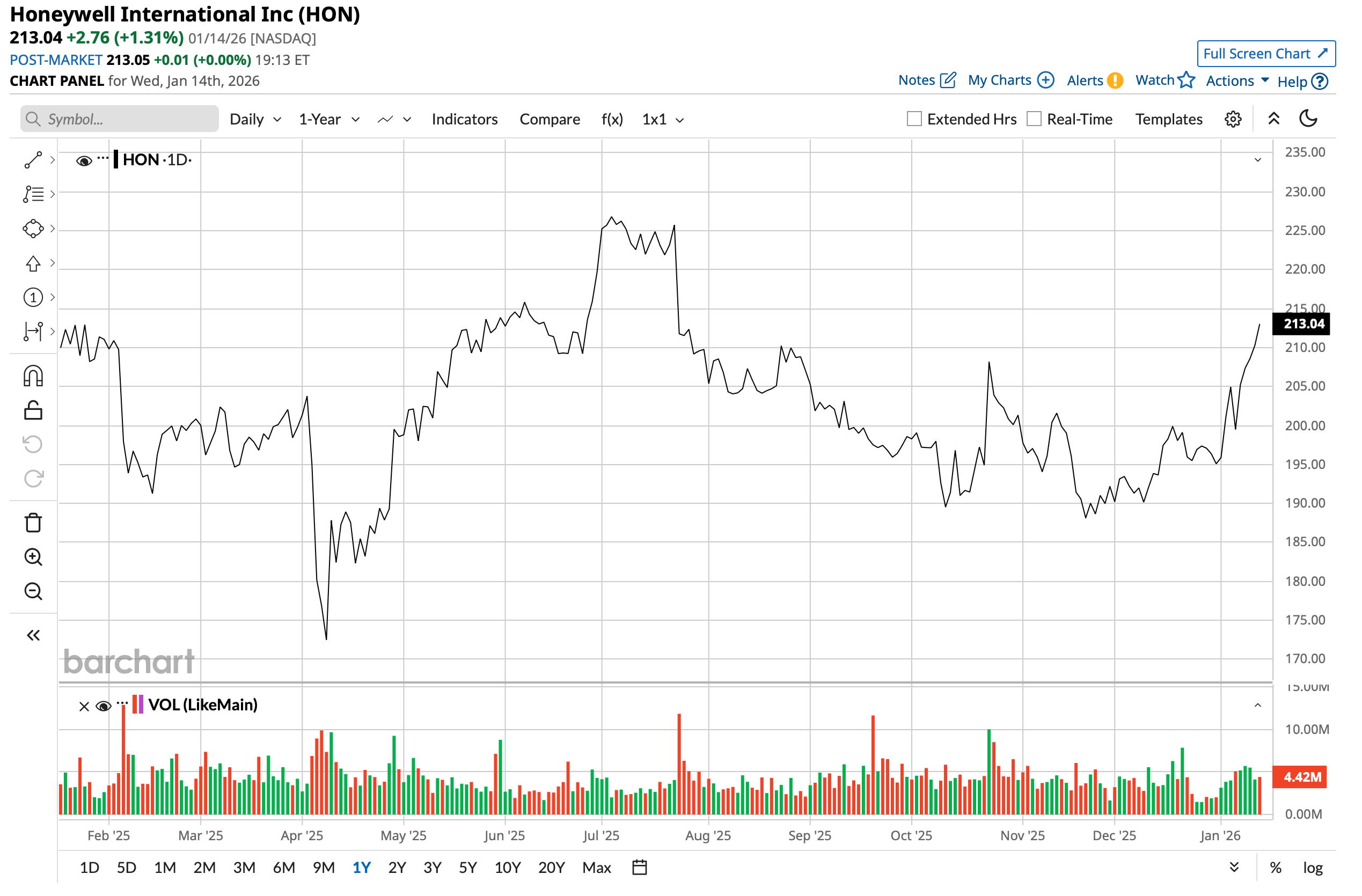

Valued at a market capitalization of $136.5 billion, HON stock is up just 5% over the past year. However, its dividend yield of 2.23% is higher than the sector median, with the company raising dividends consecutively over the past 15 years. With a payout ratio of about 43%, headroom for further growth also remains.

How Valuable Is Quantinuum to Honeywell?

Aside from its pre-money equity valuation of about $10 billion, Quantinuum gives Honeywell the scope to become a key player in an industry that is set to be the next battleground in tech after AI. With an economic potential expected to exceed $1trillion by 2035, quantum computing has use cases in almost every industry today.

However, with established players such as Ionq (IONQ), D-Wave Quantum (QBTS), and Rigetti (RGTI) already making rapid strides, how will Quantinuum make a space for itself? Apart from its full-stack nature of having presence from software to hardware, Quantinuum develops H-Series trapped-ion quantum computers using a quantum charge-coupled device (QCCD) architecture that offers all-to-all qubit connectivity, a structural advantage in building high-fidelity, scalable quantum processors. Its systems have set world records for quantum volume, with the System Model H2 demonstrably reaching quantum volume milestones that put it among the most powerful quantum machines globally.

Meanwhile, expanding on its full-stack advantage, while companies like IonQ and Rigetti are also hardware-focused, Quantinuum couples hardware excellence with advanced software, middleware, and platforms such as TKET (a platform-agnostic compiler/SDK) and InQuanto (a computational chemistry platform). This contrasts with pure hardware vendors that may rely on external software ecosystems or classical integrations.

Lastly, another differentiator is quantum cybersecurity and encryption tools like Quantum Origin, which uses quantum processes to generate enhanced cryptographic keys, an example of near-term quantum applications being commercialized today rather than far-future, uncertain research projects.

A Strong Q3 for Honeywell

Shifting focus towards its latest quarterly results, Honeywell continued on its earnings beat spree in the third quarter of 2025. During Q3, revenues grew by 7% year-over-year (YOY) to $10.41 billion. All segments, except that of industrial automation, witnessed growth when compared to the year-ago period. Building automation and the energy segment increased by 8% and 11% to $1.88 billion and $1.74 billion, respectively. Meanwhile, the company's largest revenue segment rose by the biggest tick, with aerospace technologies seeing yearly growth of 15% to $4.51 billion. Notably, Honeywell plans to complete the spinoff of this segment in the second half of 2026.

Earnings went up by 9% on a YOY basis to $2.82 per share, easily outpacing the consensus estimate of $2.56. Further, the quarter marked another consecutive earnings beat from the company.

Net cash from operating activities jumped to $3.29 billion from about $2 billion in the year-ago period as the company closed the quarter with a cash balance of $12.9 billion, higher than its short-term debt levels of about $7 billion.

Finally, Honeywell also raised its full-year 2025 guidance for revenues and earnings to the ranges of $40.7 billion to $40.9 billion and $10.60 to $10.70, respectively. These were up from previous ranges of $40.1 billion to $40.6 billion and $10.24 to $10.44, respectively.

How Do Analysts View HON Stock?

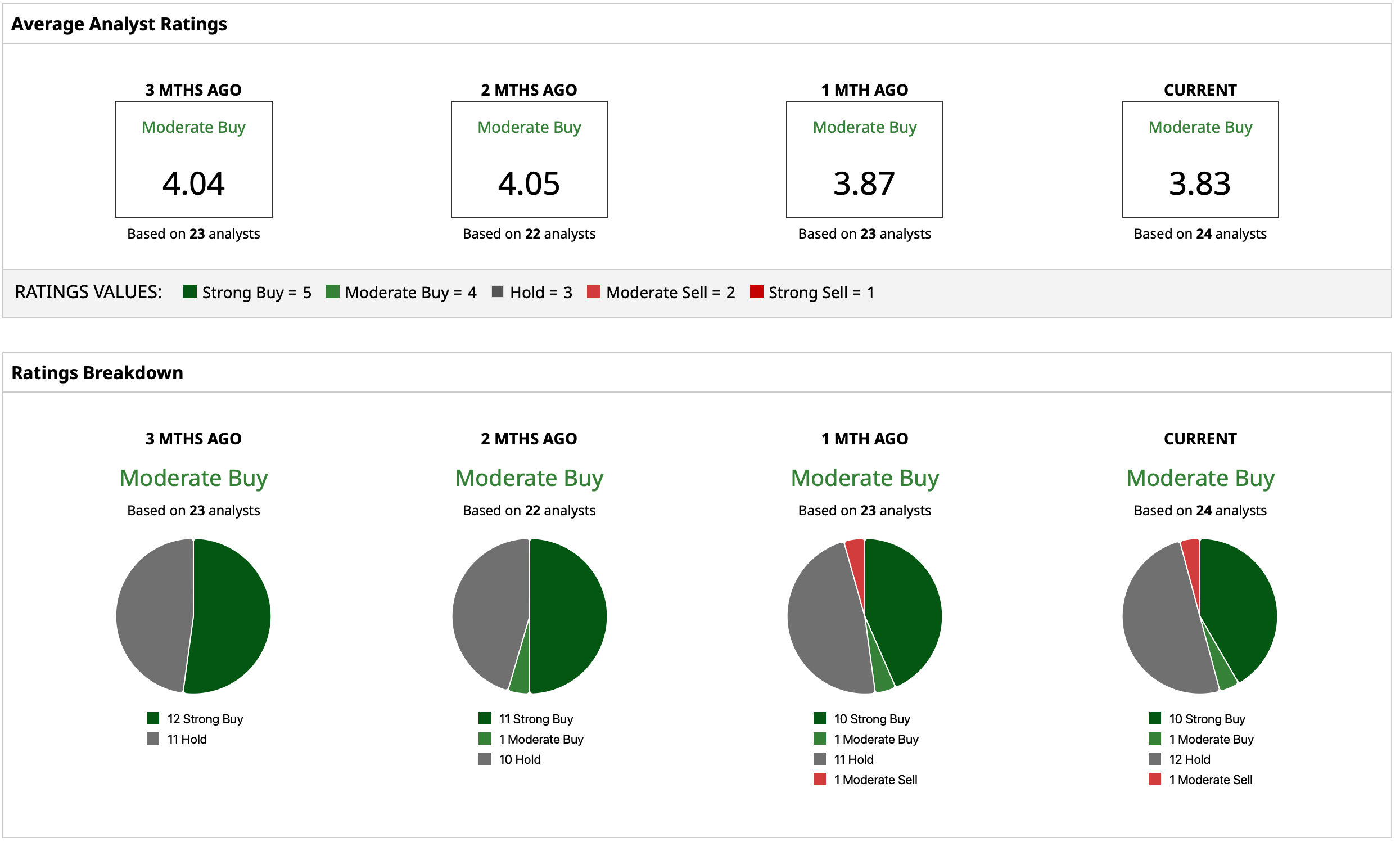

Overall, analysts have earmarked a consensus rating of “Moderate Buy” for HON stock. The mean target price of $234.59 indicates potential upside of about 7% from current levels. Out of 24 analysts covering the stock, 10 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 12 have a “Hold” rating, and one analyst has a “Moderate Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Super Micro Computer Is One of the Most Shorted Stocks. Could a Squeeze Take It Higher in 2026?

- Intel Reports Earnings on January 22. Here Is Where Options Data Says INTC Stock Could Be Trading Next.

- Trump Just Took Aim at Health Insurance ‘Middlemen.’ What Does That Mean for UnitedHealth Stock?

- Dear Netflix Stock Fans, Mark Your Calendars for January 20