Wall Street’s spotlight is turning toward quantum computing, and one name is capturing outsized attention. Most recently, Mizuho Securities just kicked off coverage of IonQ (IONQ) with a Barron's “Outperform” rating and a $90 price target, a projection that implies 95.65% upside from current trading levels.

Quantum computing promises to be the next major leap in high-performance computing, to solve complex problems that are intractable for classical machines. Investors see this as a transformative technology with applications in cryptography, drug discovery, logistics, and beyond.

IonQ stands out in this emerging field by developing trapped-ion quantum computers, systems that many believe offer superior coherence and lower error rates than some rival approaches and engaging in partnerships with major cloud platforms.

But with quantum computing still in its early stages and commercial viability not yet proven, should you buy IonQ stock, or is today’s optimism already priced in?

About IonQ Stock

IonQ is a quantum computing hardware and software company founded in 2015. Headquartered in College Park, Maryland, IonQ specializes in trapped-ion quantum computers, along with cloud software, quantum networking, and quantum cryptography tools. IonQ’s market cap is around $17.3 billion.

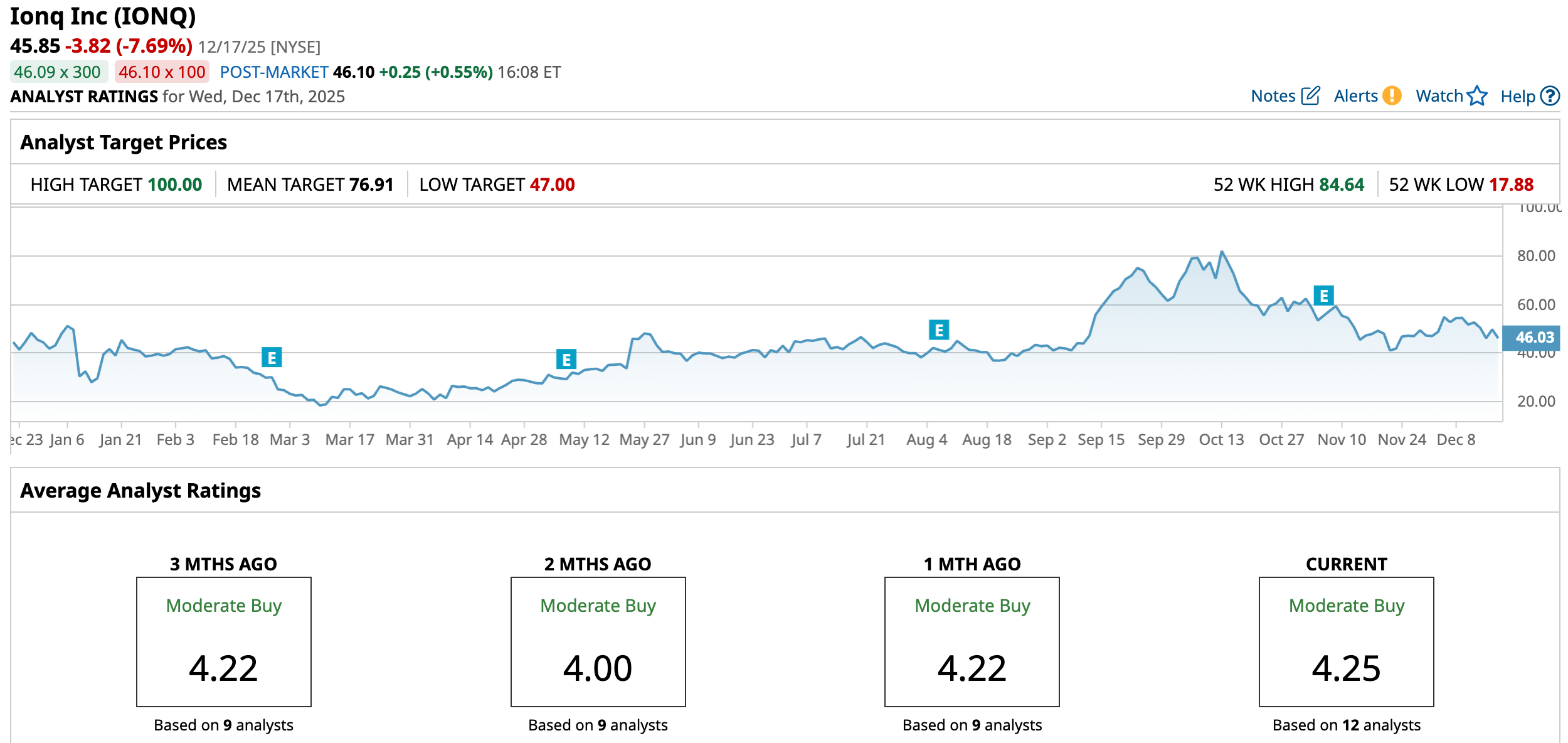

Over the past 52 weeks, IONQ has delivered a nominal run, with its share price increase of 5.13%, while it had hit a 52-week high of $84.64 on Oct. 13. The stock has gained 10.34% year-to-date (YTD).

These gains have been driven by speculative enthusiasm around quantum computing’s long-term potential and company-specific catalysts, including strategic acquisitions and expanded cloud partnerships that reinforce IonQ’s positioning in an emerging industry. Also, Wall Street interest highlighted by recent analyst coverage with bullish price targets has added to upside momentum. However, currently, the stock is down 45% from the peak reached in mid-October.

The stock is currently trading at a lofty valuation compared to the sector median at 416.77 times forward sales.

Top Line Growth Isn’t Translating into Bottom Line Improvements

IonQ’s Q3 2025 results, released on Nov. 5, after markets closed, delivered a strong top line performance that beat expectations and helped to reinforce the company’s growth narrative. For the quarter ended Sept. 30, IonQ reported revenue of $39.9 million, a 222% year-over-year (YOY) increase that came in about 37% above the high end of its prior guidance range, underscoring accelerating demand for its quantum computing solutions.

Despite the impressive revenue growth, IonQ remained unprofitable in Q3, with a net loss of about $1.1 billion, marking a substantial rise from a loss of $52.5 million in the same quarter last year.

Its adjusted EBITDA loss stood at $48.9 million, compared to $23.7 million in the prior-year quarter, reflecting continued heavy investment in technology development and scaling. Its adjusted loss per share came in at $0.17, compared to the year-ago value of $0.11.

The company also delivered a number of technical milestones ahead of schedule, including achieving a world-record 99.99% two-qubit gate performance and reaching its #AQ 64 Tempo milestone three months early, achievements management highlighted as foundational to its long-term competitive position.

Alongside the quarterly results, IonQ raised its full-year 2025 revenue guidance to a range of $106 million to $110 million, up from its prior outlook, while reaffirming expectations for continued operating losses as it scales. The company maintained its adjusted EBITDA loss midpoint guidance between $206 million and $216 million.

Analysts anticipate loss per share to deteriorate 229.5% YOY to $5.14 in fiscal 2025, but improve by 66.2% to reach $1.74 in fiscal 2026.

What Do Analysts Expect for IonQ Stock?

Mizuho has initiated coverage on IonQ with an “Outperform” rating and a $90 price target, implying 95.65% upside from current levels. Mizuho views IonQ as a leading player in quantum computing, emphasizing the advantages of its trapped-ion architecture, including lower error rates and higher coherence times, which could support faster commercial adoption if the company successfully scales its qubit count.

The firm also pointed to IonQ’s full-stack strategy, spanning quantum computing, networking, and sensing as a key competitive strength that positions the company well within the emerging quantum ecosystem.

On the other hand, JPMorgan initiated coverage on IonQ last month with a “Neutral” rating and a $47 price target, noting that the stock’s current valuation already prices in aggressive growth expectations. Nevertheless, the firm views IonQ as well-positioned to lead next-generation quantum computing. JPMorgan highlighted IonQ’s full-stack platform strategy, revenue growth, and partnerships with major companies as key strengths that support its long-term outlook.

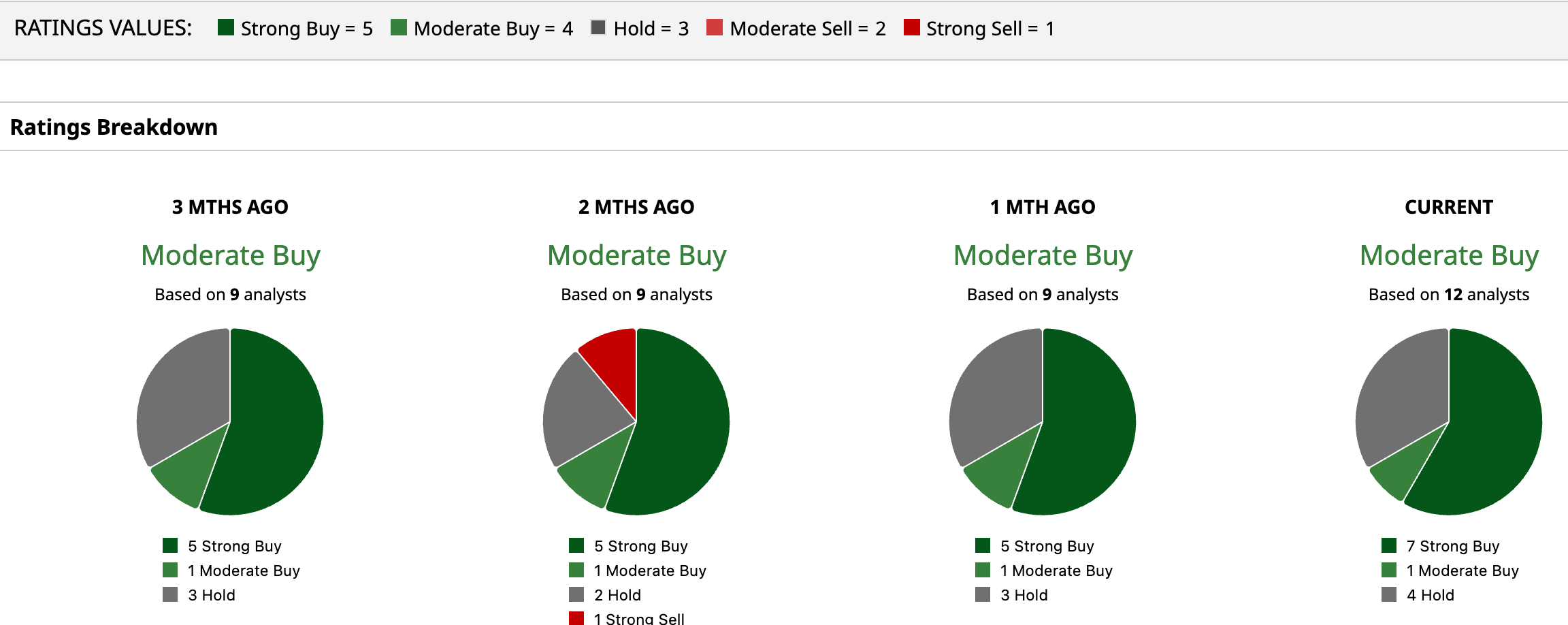

IonQ stock has a consensus “Moderate Buy” rating overall. Out of 12 analysts covering the tech stock, seven recommend a “Strong Buy,” one suggests a “Moderate Buy,” and four analysts stay cautious with a “Hold” rating.

IONQ’s average analyst price target of $76.91 indicates an upside potential of 67.2%. Also, the Street-high target price of $100 suggests 117.4% upside ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $4.8 Million Reason to Buy AeroVironment Stock Today

- This Analyst Says IonQ Stock Can Gain Over 75% from Here. Should You Buy It Now?

- 3 Barchart Stock Screeners to Help You Find Better Call Option Trades

- ‘You Didn’t Want to Be in Jamestown’: Elon Musk Warns Mars Won’t Be A Billionaire Vacation Spot; It Will Be ‘Very Dangerous’ and ‘You Might Die’