What if you could collect cash upfront — before buying a stock — and still end up owning shares at a discount?

That’s exactly what traders accomplish using the Naked Put Strategy, one of the most practical yet misunderstood tools in the options playbook.

In his latest Barchart webinar, Senior Market Strategist John Rowland, CMT, explains exactly how to use naked puts to generate income, manage risk, and identify the perfect “buy-the-dip” levels for high-quality stocks — all using Barchart’s Naked Puts Screener and Put/Call Ratio tools.

What Is a Naked Put?

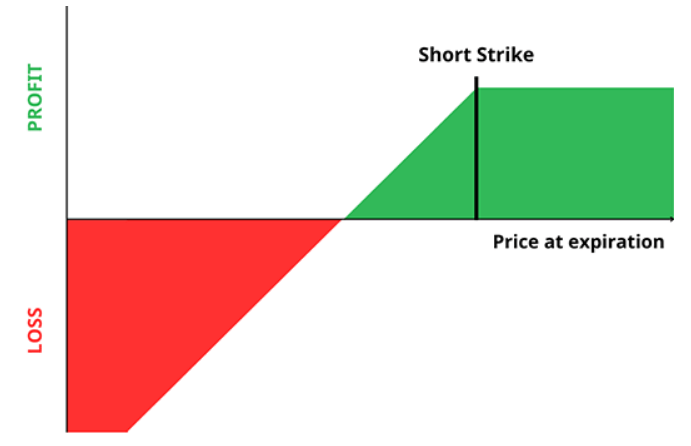

A naked put (also known as a cash-secured put) is a strategy where you sell (to open) a put option on a stock you’d like to own.

If the stock price stays above your strike price through expiration, the option expires worthless, and you keep the initial premium collected as your profit on the trade. If the stock falls below the strike, you’re obligated to buy it at your pre-selected strike price, with the entry price reduced by the initial credit received on the options trade.

“It’s a way to get paid while waiting for the right entry,” John explained. “You’re effectively saying, ‘I’ll buy this stock if it drops to my price — and pay me now for the privilege.’”

Using the Naked Put Screener

During the session, John walked through how to use Barchart’s Naked Puts Screener to find high-probability trades based on your own watchlist — in his case, the Magnificent 7 tech stocks.

Here’s how:

- Go to Options on the menu→ Naked Put Screener.

- Add filter “My Personal Lists,” and select your watchlist (e.g., “Magnificent 7”).

- Filter by expiration date (e.g., 30 days out).

Look for at-the-money or slightly out-of-the-money puts where:

- Your breakeven price sits near key technical support (e.g., 100-day MA or central Bollinger Band moving average).

- You’re comfortable owning the stock if assigned.

A Real Example: Tesla (TSLA)

John used Tesla (TSLA) to illustrate how this works.

He looked at the $420 strike put, which aligns closely with Trend Seeker®’s value and Tesla’s Bollinger Band support.

If Tesla dropped to between $420 and $390, that would represent about a 5.5% discount to current prices. For the 30-day option, that trade would collect about $4.70 in premium per share, or a 1.3% return for the month — equivalent to roughly 16% annualized.

“Where else can you earn 16% annualized while waiting to buy a stock you already want?” John asked.

The Role of the Put/Call Ratio

To increase your odds of success, John suggests also checking the Put/Call Ratio on the options chain for your chosen expiration.

“If the ratio is above 1,” he explained, “that means there are more puts being bought than calls. That’s a good day to sell naked puts — because higher demand can inflate put premiums.”

You can find this data on Barchart by navigating to any stock’s options tab and selecting Put/Call Ratios. This ratio helps confirm when the market is overly bearish, which often means better entry opportunities for disciplined income traders.

Managing Risk and Return

The goal of naked puts isn’t just to collect income. It’s about entering trades strategically and managing risk.

Here are John’s key takeaways for balancing risk and reward:

- Aim for 1–2% return per month on premium collected.

- Look for break-even levels near technical support zones (moving averages or Bollinger Bands).

- Stay within moderate implied volatility (30–70th percentile).

- Focus on liquid, high-quality stocks that you’d be happy to own.

- Be patient: most corrections are 10% or less, so choose strikes around that discount range.

Tools to Use on Barchart

You can put this strategy into action right now using Barchart’s tools:

- Naked Puts Screener → find put selling opportunities filtered by your own watchlists.

- Put/Call Ratios Page → identify favorable days to sell puts based on option market sentiment.

- Bollinger Bands & Trend Seeker on Charts → confirm technical support for your break-even levels.

- 30-Day Free Trial of Barchart Premier → unlock all options screeners and analytics.

Final Takeaway

The naked put strategy flips traditional investing on its head. Instead of waiting for stocks to drop, you’re paid for your idle time, and can collect income while setting up buy targets at bargain levels.

As John put it, “If I’m going to own a stock, I’d rather buy it at a discount — and get paid while I wait.”

Watch the Clip: How to Trade Naked Puts Using Barchart’s Screener

- Stream the Full Webinar: Get Paid to Buy Stocks? Naked Puts Trading Strategy Explained

- Explore Barchart’s Naked Puts Screener

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Get Paid to Buy Stocks With These Pro Tips for Selling Naked Put Options Successfully

- Option Volatility and Earnings Report for November 17 - 21

- Nvidia's Earnings Report Will Be Out on Wednesday, Nov. 19 - How to Play NVDA Stock

- The Saturday Spread: Using Quant Analysis to Uncover the Best Discounts (PINS, XYZ, HPQ)