The Coca-Cola Company (KO), headquartered in Atlanta, Georgia, is a beverage company that manufactures, markets, and sells various nonalcoholic beverages worldwide. With a market cap of $301. 8 billion, the company also distributes and markets juice and juice-drink products to retailers and wholesalers worldwide.

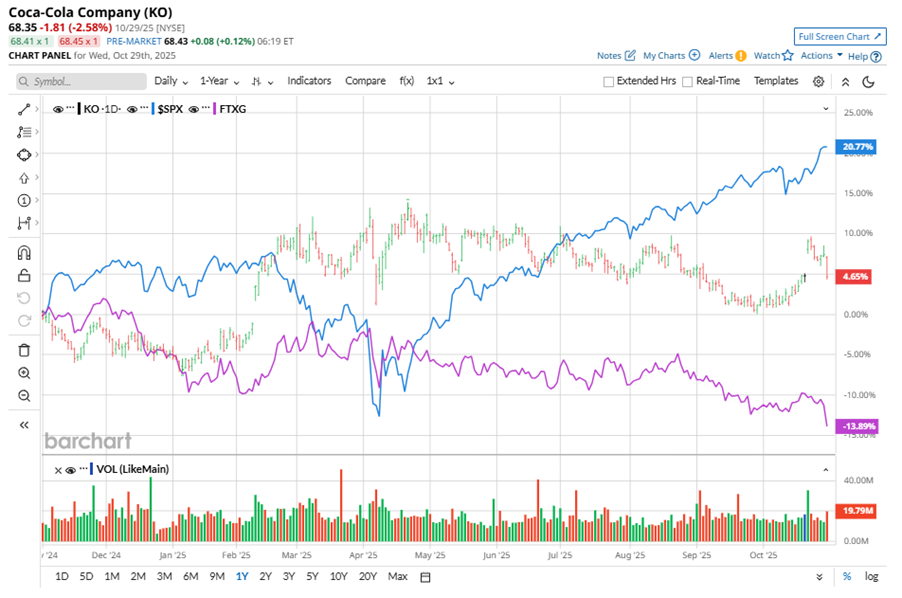

Shares of this beverage giant have underperformed the broader market over the past year. KO has gained 4.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.1%. In 2025, KO stock is up 9.8%, compared to the SPX’s 17.2% gains on a YTD basis.

Narrowing the focus, KO’s outperformance is apparent compared to the First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has declined about 14.9% over the past year. Moreover, KO’s returns on a YTD basis outshine the ETF’s 9.5% loss over the same time frame.

On Oct. 21, KO shares closed up more than 4% after reporting its Q3 results. Its adjusted revenue stood at $12.4 billion, up 3.9% year over year. The company’s adjusted EPS increased 6.5% from the prior-year quarter to $0.82.

For the current fiscal year, ending in December, analysts expect KO’s EPS to grow 3.5% to $2.98 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

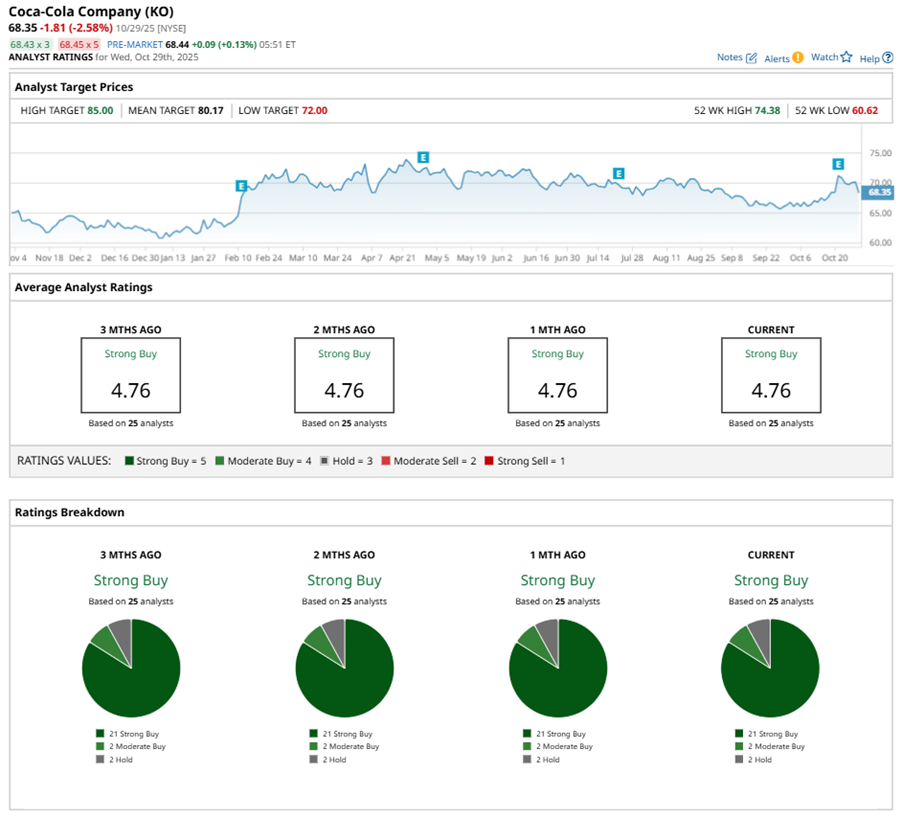

Among the 25 analysts covering KO stock, the consensus is a “Strong Buy.” That’s based on 21 “Strong Buy” ratings, two “Moderate Buys,” and two “Holds.”

The configuration has been consistent over the past three months.

On Oct. 23, Barclays PLC (BCS) analyst Lauren Lieberman kept an “Overweight rating” on KO and raised the price target to $77, implying a potential upside of 12.7% from current levels.

The mean price target of $80.17 represents a 17.3% premium to KO’s current price levels. The Street-high price target of $85 suggests an upside potential of 24.4%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ashes to Alpha: Adobe’s (ADBE) Implosion Offers an Opportunity for a Rebound

- It's 'Going to Be Like a Shockwave' When Tesla's AI Innovations Hit. Should You Buy TSLA Stock First?

- Adobe Systems Bear Put Spread Could Return 233% in this Down Move

- Stocks Fall Before the Open After Mixed Big Tech Earnings, Trump-Xi Summit