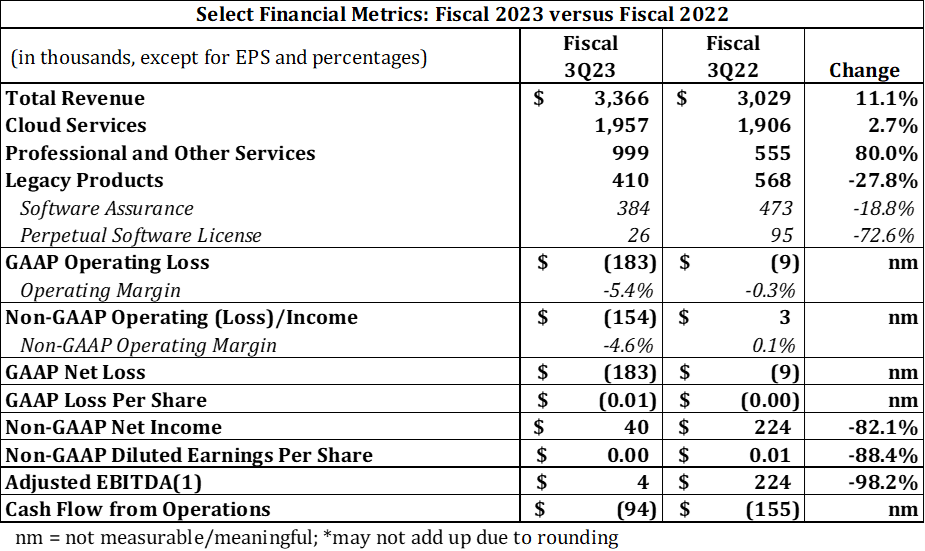

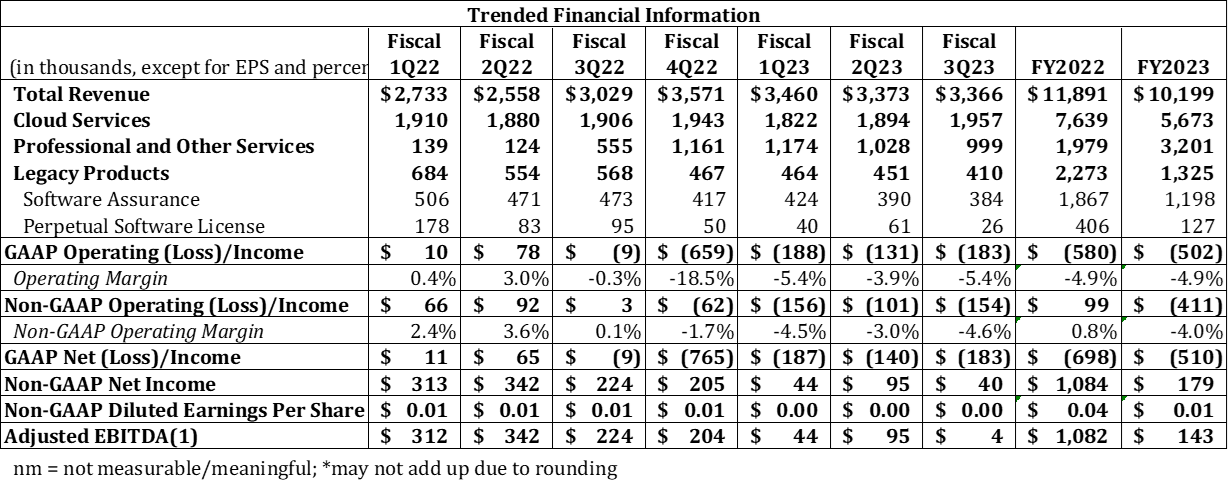

Revenue increased 11%; GAAP Loss Per Share of ($0.01); Non-GAAP diluted EPS of $0.00;

Contract extended with largest services customer

MILPITAS, CA / ACCESSWIRE / August 22, 2023 / Altigen Communications, Inc. (OTCQB:ATGN), a Silicon Valley-based cloud solutions provider for the Unified Communications as a Service (UCaaS), Contact Center as a Service (CCaaS) and our Customer Engagement as a Service (CEaaS) markets, announced today its financial results for the third quarter ended June 30, 2023.

Third Quarter Highlights (Fiscal 2023 versus Fiscal 2022)

- Net Revenue increased 11% to $3.4 million;

- Gross margin decreased to 63.3%, compared with 67.8%;

- GAAP net loss and loss per share of ($0.2) million and ($0.01), respectively, compared to GAAP net loss and loss per share of ($0.01) million and ($0.00), respectively;

- Non-GAAP net income and non-GAAP diluted EPS of $0.1 million and $0.00, respectively, compared to $0.2 million and $0.01, respectively.

"Our cloud services revenues, which are still largely concentrated in our legacy solutions, continued to show an incremental increase quarter over quarter", said Jeremiah Fleming, Altigen President & CEO. "In addition, just after the quarter close, the contract with our largest consulting services customer was extended, which represents a significant increase to the prior contract value. We're pleased to see that our investments are starting to pay off and are looking forward to accelerating our growth as we continue to execute on our business plan."

- Throughout this release, the use of non-GAAP financial measures is intended to provide useful information that supplements Altigen's results in accordance with GAAP. Please refer to the Reconciliation of Non-GAAP Financial Measure at the end of this release.

- Throughout this release, the use of non-GAAP financial measures is intended to provide useful information that supplements Altigen's results in accordance with GAAP. Please refer to the Reconciliation of Non-GAAP Financial Measure at the end of this release.

Conference Call

Altigen will be discussing its financial results and outlook on a conference call today at 2:00 p.m. Pacific Time (5:00 p.m. ET). The conference call can be accessed by dialing (888) 506-0062 (domestic) or (973) 528-0011 (international), conference ID #294551. A live webcast will also be made available at www.altigen.com. To access the replay, dial (877) 481-4010 (domestic) or (919) 882-2331 (international), conference ID #48984. A web archive will be made available at www.altigen.com for 90 days following the call's conclusion.

About Altigen Communications

Altigen Communications Inc. (OTCQB:ATGN), based in Silicon Valley, is a leading Microsoft Cloud Solutions provider, delivering fully managed Cloud-based Unified Communications services based on the Microsoft platform. Our SIP trunk services, enterprise customer engagement and innovative cloud contact center solutions seamlessly integrate with Microsoft Teams to enhance and extend the business communications capabilities for our customers. Altigen's solutions are designed for high reliability, ease of use, seamless integration into Microsoft technologies, all delivered as fully managed cloud services. Our solutions are available through our global network of certified resellers. For more information, call 1-888-ALTIGEN or visit our website at www.altigen.com.

Safe Harbor Statement

This press release contains forward‐looking information. The statements are based on reasonable assumptions, beliefs and expectations of management and the Company provides no assurance that actual events will meet management's expectations. Furthermore, the forward-looking statements contained in this press release are based on the Company's views of future events and financial performances which are subject to known and unknown risks and uncertainties including, but not limited to, statements regarding our ability to successfully integrate acquired businesses and technologies and our ability to accelerate growth and business opportunities. There can be no assurances that the Company will achieve expected results, and actual results may be materially different than expectations and from those stated or implied in forward-looking statements.

Please refer to the Company's most recent Annual Report filed with the OTCQB over-the-counter market for a further discussion of risks and uncertainties. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. The Company does not undertake any obligation to update any forward-looking statements.

Contact:

Carolyn David

Vice President of Finance

Altigen Communications, Inc.

(408) 597-9033

www.altigen.com

ALTIGEN COMMUNICATIONS, INC.

UNAUDITED CONSOLIDATED CONDENSED BALANCE SHEETS

(In thousands)

|

June 30,

2023

|

September 30, 2022 |

||||||

ASSETS |

|||||||

Current assets: |

|||||||

Cash and cash equivalents |

$ | 2,961 | $ | 3,232 | |||

Accounts receivable, net |

1,184 | 1,220 | |||||

Other current assets |

289 | 206 | |||||

Total current assets |

4,434 | 4,658 | |||||

Property and equipment, net |

4 | 7 | |||||

Operating lease right-of-use assets |

302 | 572 | |||||

Goodwill |

2,725 | 2,725 | |||||

Intangible assets, net |

1,745 | 1,882 | |||||

Capitalized software development cost, net |

1,261 | 1,331 | |||||

Deferred tax asset |

6,493 | 6,493 | |||||

Other long-term assets |

25 | 37 | |||||

Total assets |

$ | 16,989 | $ | 17,705 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY |

|||||||

Current liabilities: |

|||||||

Accounts payable |

$ | 33 | $ | 53 | |||

Accrued compensation and benefits |

678 | 364 | |||||

Accrued expenses |

519 | 530 | |||||

Deferred consideration - current |

12 | 500 | |||||

Operating lease liabilities, current |

309 | 383 | |||||

Deferred revenue - current |

473 | 566 | |||||

Total current liabilities |

2,024 | 2,396 | |||||

Deferred consideration - long-term |

670 | 670 | |||||

Operating lease liabilities - long-term |

23 | 233 | |||||

Deferred revenue - long-term |

156 | 206 | |||||

Total liabilities |

2,873 | 3,505 | |||||

Stockholders' equity: |

|||||||

Common stock |

24 | 24 | |||||

Treasury stock |

(1,565) | (1,565) | |||||

Additional paid-in capital |

73,097 | 72,671 | |||||

Accumulated deficit |

(57,440) | (56,930) | |||||

Total stockholders' equity |

14,116 | 14,200 | |||||

Total liabilities and stockholders' equity |

$ | 16,989 | $ | 17,705 | |||

ALTIGEN COMMUNICATIONS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| Three Months Ended | Nine Months Ended | ||||||||||||||

| June 30, | June 30, | ||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||

Net revenue |

$ | 3,366 | $ | 3,029 | $ | 10,199 | $ | 8,320 | |||||||

Gross profit |

2,129 | 2,054 | 6,477 | 5,816 | |||||||||||

Operating expenses: |

|||||||||||||||

Research and development |

1,330 | 1,252 | 3,879 | 3,153 | |||||||||||

Selling, general & administrative |

946 | 811 | 3,063 | 2,583 | |||||||||||

Operating (loss) income |

(147) | (9) | (465) | 80 | |||||||||||

Interest expense |

(36) | - | (36) | - | |||||||||||

Interest and other income/ (expense), net |

- | - | - | 1 | |||||||||||

Net (loss) income before provision for income taxes |

(183) | (9) | (501) | 81 | |||||||||||

Income tax benefit (expense) |

- | - | (9) | (14) | |||||||||||

Net (loss) income |

$ | (183) | $ | (9) | $ | (510) | $ | 67 | |||||||

Per share data: |

|||||||||||||||

Basic |

$ | (0.01) | $ | (0.00) | $ | (0.02) | $ | 0.00 | |||||||

Diluted |

$ | (0.01) | $ | (0.00) | $ | (0.02) | $ | 0.00 | |||||||

Weighted average shares outstanding: |

|||||||||||||||

Basic |

24,690 | 24124 | 24,426 | 23,946 | |||||||||||

Diluted |

24,690 | 24,124 | 24,426 | 25,509 | |||||||||||

ALTIGEN COMMUNICATIONS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

|

Nine Months Ended

June 30,

|

||||||||

| 2023 | 2022 | |||||||

Cash flows from operating activities: |

||||||||

Net (loss) income |

$ | (510 | ) | $ | 67 | |||

Adjustments to reconcile net income to net cash from operating activities: |

||||||||

Depreciation and amortization |

3 | 12 | ||||||

Amortization of intangible assets |

137 | 131 | ||||||

Amortization of capitalized software |

450 | 573 | ||||||

Stock-based compensation |

90 | 82 | ||||||

Changes in operating assets and liabilities: |

||||||||

Accounts receivable and unbilled accounts receivable |

36 | (205 | ) | |||||

Prepaid expenses and other current assets |

(83 | ) | (158 | ) | ||||

Other long-term assets |

12 | 8 | ||||||

Accounts payable |

(20 | ) | (12 | ) | ||||

Accrued expenses |

325 | 1,154 | ||||||

Deferred revenue |

(142 | ) | 3 | |||||

Net cash provided by operating activities |

298 | 1,655 | ||||||

Cash flows from investing activities: |

||||||||

Acquisition of business |

(225 | ) | (4,655 | ) | ||||

Capitalized software development costs |

(380 | ) | (386 | ) | ||||

Net cash used in investing activities |

(605 | ) | (5,041 | ) | ||||

Cash flows from financing activities: |

||||||||

Proceeds from issuances of common stock |

36 | 35 | ||||||

Net cash provided by financing activities |

36 | 35 | ||||||

Net increase in cash and cash equivalents |

(271 | ) | (3,351 | ) | ||||

Cash and cash equivalents, beginning of period |

3,232 | 6,799 | ||||||

Cash and cash equivalents, end of period |

$ | 2,961 | $ | 3,448 | ||||

ALTIGEN COMMUNICATIONS, INC.

UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data)

| Three Months Ended | Nine Months Ended | ||||||||||||||

| June 30, | June 30, | ||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||

Reconciliation of GAAP to Non-GAAP Gross Profit: |

|||||||||||||||

GAAP gross profit |

$ | 2,129 | $ | 2,054 | $ | 6,477 | $ | 5,816 | |||||||

Amortization of capitalized software |

134 | 153 | 407 | 482 | |||||||||||

Acquisition related expenses |

40 | 43 | 120 | 131 | |||||||||||

Non-GAAP gross profit |

$ | 2,303 | $ | 2,250 | $ | 7,004 | $ | 6,429 | |||||||

Reconciliation of GAAP to Non-GAAP Expenses: |

|||||||||||||||

GAAP operating expenses |

$ | 2,276 | $ | 2,063 | $ | 6,942 | $ | 5,736 | |||||||

Depreciation and amortization |

1 | 3 | 3 | 12 | |||||||||||

Amortization of capitalized software |

13 | 20 | 43 | 91 | |||||||||||

Amortization of intangible assets |

6 | - | 18 | - | |||||||||||

Stock-based compensation |

29 | 13 | 90 | 82 | |||||||||||

Non-GAAP operating expenses |

$ | 2,227 | $ | 2,027 | $ | 6,788 | $ | 5,551 | |||||||

Reconciliation of GAAP to Non-GAAP Net Income: |

|||||||||||||||

GAAP net (loss) income |

$ | (183) | $ | (9) | $ | (510) | $ | 67 | |||||||

Depreciation and amortization |

1 | 3 | 3 | 12 | |||||||||||

Amortization of capitalized software |

147 | 173 | 450 | 573 | |||||||||||

Amortization of intangible assets |

46 | 43 | 138 | 131 | |||||||||||

Stock-based compensation |

29 | 13 | 90 | 82 | |||||||||||

Deferred tax asset valuation allowance |

- | - | 9 | 14 | |||||||||||

Non-GAAP net income |

$ | 40 | $ | 223 | $ | 180 | $ | 879 | |||||||

Per share data: |

|||||||||||||||

Basic |

$ | 0.00 | $ | 0.01 | $ | 0.01 | $ | 0.04 | |||||||

Diluted |

$ | 0.00 | $ | 0.01 | $ | 0.01 | $ | 0.03 | |||||||

Weighted average shares outstanding: |

|||||||||||||||

Basic |

24,690 | 24,124 | 24,426 | 23,946 | |||||||||||

Diluted |

25,691 | 25,599 | 25,514 | 25,509 | |||||||||||

Non-GAAP Financial Measures

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of our core operating performance on a period-to-period basis. These non-GAAP financial measures exclude stock-based compensation expense, amortization of acquired intangible assets, depreciation and amortization expenses, acquisition-related costs, change in deferred tax asset valuation allowance, litigation costs and other non-recurring or unusual charges or benefits that may arise from time to time that we do not consider to be directly related to core operating performance. We use non-GAAP measures to evaluate the core operating performance of our business and to perform financial planning. Since we find these measures to be useful, we believe that investors benefit from seeing results reviewed by management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with our GAAP financials, provide useful information to investors by facilitating: (i) the comparability of our on-going operating results over the periods presented and (ii) the ability to identify trends in our underlying business.

SOURCE: Altigen Communications, Inc.

View source version on accesswire.com:

https://www.accesswire.com/775993/Altigen-Communications-Inc-Reports-Third-Quarter-Results-for-Fiscal-Year-2023