NEW YORK, NY / ACCESSWIRE / December 13, 2021 / You validated the market. You're planning your product launch. Now, you're worried about knowing prospective users well enough to tell the fraudsters apart from genuine customers before onboarding.

Traditionally, negotiating with multiple fraud prevention and identity verification tool vendors would be your first step towards screening customers cost-effectively. Or you could consider pre-built platforms that let you orchestrate customer verification steps through integrated vendors, a la carte. Both systems will effectively reject numerous customers, but there's a problem. While you might think that you're winning against fraud, you're rejecting heaps of 'thin-file' genuine millennial and GenZ customers - and slowing your growth. So, why must businesses play the vendor-roulette game to onboard screened customers?

This is the problem that Sunil Madhu, CEO of Instnt, is addressing with the world's first fully-managed insured customer acceptance platform. Instnt assesses risk innovatively and absorbs fraud loss liability from businesses. This way, businesses gain 95% more genuine customers and lose the liability of up to $100 million of fraud loss annually.

An evolution of decades-long innovation

As a serial entrepreneur with 25 years of business and technical expertise in risk, compliance, and consumer identity, Sunil is best-placed to disrupt the customer verification and onboarding process. Instnt, his 6th startup was born out of the limitations of his 5th startup, Socure - now a multi-billion dollar company.

Sunil built Socure to verify customer identities for fraud prevention and KYC compliance across financial institutions, e-commerce businesses, and more. As CEO of Socure for 7 ½ years, Sunil scaled the company to 8-figure dollar revenue, powering the customer verification processes of 3 out of the top 5 banks in the US, as well as popular credit bureaus, card networks, fintechs, neo banks, etc.

In this time, Sunil noticed a trend in how businesses used its products. Businesses seemed to use Socure as one risk assessment tool out of many, picked for cost-benefit within a complex risk and compliance orchestration waterfall. The other tools seemed to all assess customers' risk and compliance in a similar way - by matching personal information to Credit Bureau and data-broker utility databases.

The repeated data that these tools depended on showed no diversity or accuracy in any single demographic or market. For millennials and GenZ demographics, especially those that favored on-demand, rental services, this was a real problem.

There was a huge flaw in the core risk assessment process that powered hundreds of companies. Human-orchestrated risk identification processes kept fraud rates below 1% at the expense of businesses losing up to 60% of genuine customers to false positives. The rejection of large numbers of good customers left businesses operating at only a fraction of their growth potential.

This was Sunil's lightbulb moment. He wanted to solve this problem but after bringing Socure to a repeatable scale, he realized that the problem could not be solved within the existing system. It needed bold new thinking and more innovation.

"At this point, I told the board that I was going to start a new business, but not before bringing on a trusted colleague who had operated public companies to pass my baton to, to take Socure public", says Sunil.

A better way to accept and onboard customers

With a fully-managed service model, Instnt's approach is revolutionary. Businesses can now shift their fraud loss liability to Instnt, together with the costs and complexity of building and maintaining in-house risk and compliance ‘toolboxes'. Instnt also offers performance guarantees to maximize customer acceptance rates, leaving businesses to focus on growth and better customer experiences. Instnt's performance-based charge model (rather than transaction-based charging regardless of the outcome) is another industry first.

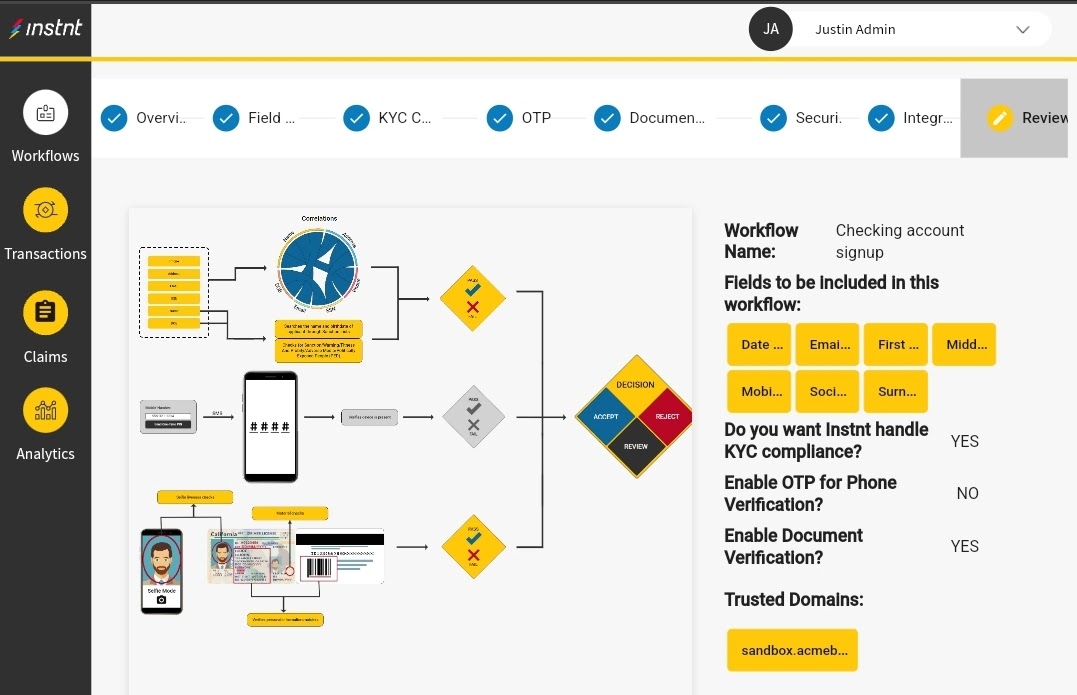

Instnt's patent-pending technology can be deployed code-free in minutes as part of any customer sign-up flow. It then evaluates risk signals covering manual and automated fraud attack mechanisms including bots, botnets, malware, malicious devices, remote access trojans, man-in-the-middle, coached humans, stolen identities, synthetic identity, fake identity documents, chargebacks etc, to reduce the fraud loss risk exposure taken on behalf of its customers. Instnt's managed service also includes AI that dynamically reduces value-at-risk rather than just matching customer personal information against external databases as others do.

By combining a unique risk assessment system with a fraud liability indemnification guarantee, Instnt helps businesses compliantly accept roughly 10x more ‘good' customers than the alternative. For every business signed up to Instnt, a diversified pool of low risk is created and intelligently arbitraged in the insurance risk-transfer marketplace. With this, experts can deal with the pain of managing evolving fraud.

Shaping the future of customer acceptance

With its value-driven model, Instnt is the disruptor that is bridging the gap into the future with a superior risk mitigation technique. Like Analytics technology, Instnt runs in the background, performing risk assessments for all customer sign-ups before approval, so that normal operations continue undisrupted. Customers are intelligently gated based on the projected magnitude of risk they pose to the business, all in approximately under a second. Instnt also prevents future losses from its accepted customers through an ecosystem of partners that offer complementary authentication solutions in the long term.

For businesses that devote a portion of their resources to anticipating or managing customer acceptance and potential fraud, Sunil offers one piece of advice:

"Use your resources wisely to grow your business. Let the experts manage fraud, while you focus on better customer experiences.", he says.

In the future, Sunil wants to see a simplified customer acceptance process that is seamless, yet powerful enough to power a single sign-up and KYC process across institutions. Customers will then forever escape the hassle of replicating information across institutions, while businesses never have to dirty their hands with fraud management again.

Media Contact:

Eliana Daboul

E-mail: eliana@instnt.org

Phone number: +13475742466

SOURCE: Instnt

View source version on accesswire.com:

https://www.accesswire.com/676781/Meet-Instnt-the-Startup-Built-by-a-Serial-Entrepreneur-Thats-Disrupting-How-Millennial-and-GenZ-Customers-Are-Accepted-and-Onboarded-Everywhere