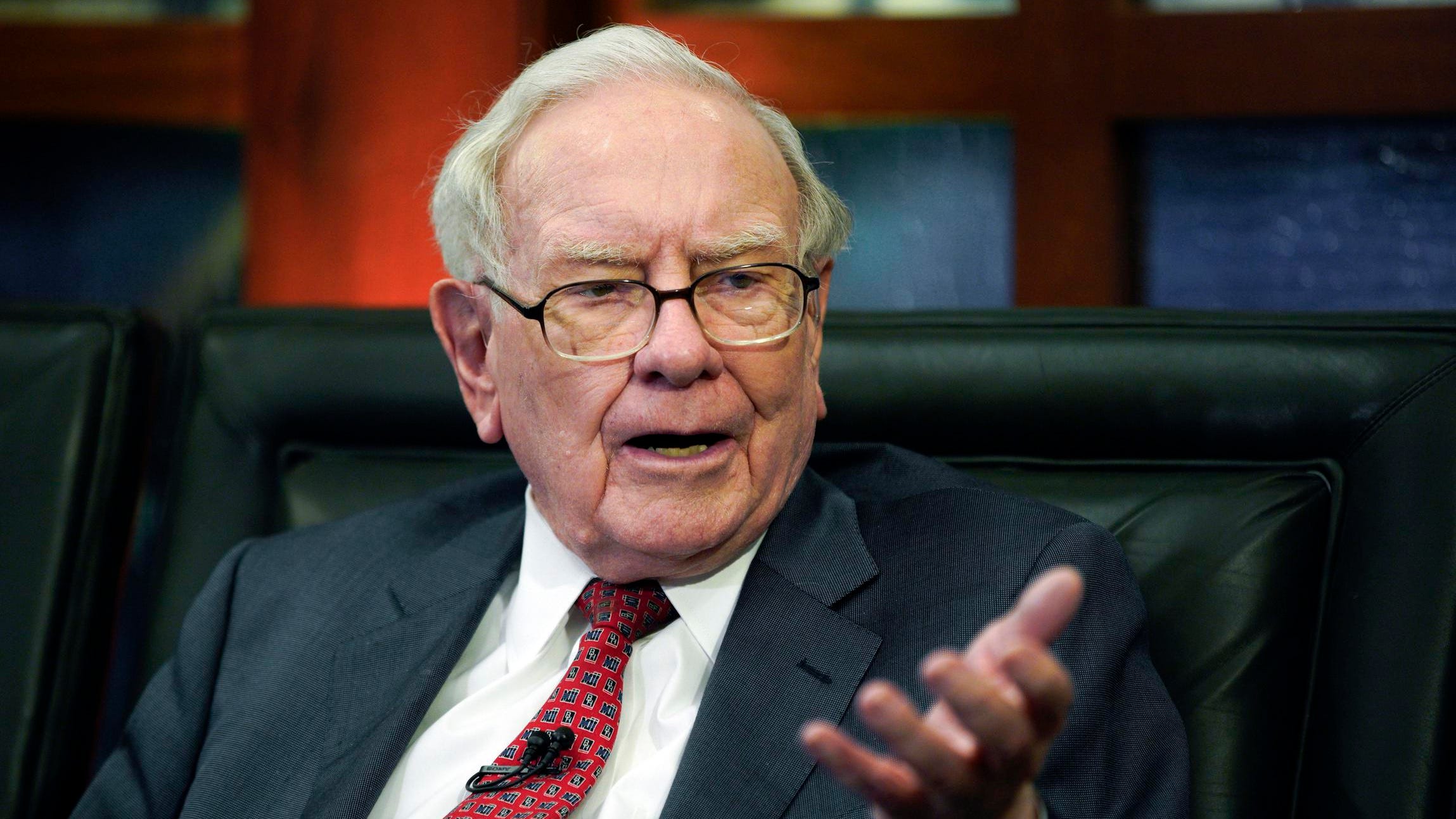

Warren Buffett, through his holding company Berkshire Hathaway (NYSE: BRK.B) is pivoting to investments in the energy sector. Buffett is divesting from American banks, in favor of oil & gas stocks despite many of them being at multi-year highs.

WHY IS BUFFET BETTING BIG ON BOOMING OIL?

Buffett has added shares in top energy companies Occidental Petroleum Corp. (NYSE: OXY) and Chevron Inc. (NYSE: CVX), because he like many other investment gurus see the S&P energy sector still lagging far behind its 2014 levels from the last time oil crossed $100 per barrel.

Increased optimism in the sector makes several stocks intriguing in the current climate.

There are several blue chips with the potential for solid returns and dividends of the next several quarters like the aforementioned OXY and CVX.

SPECULATIVE STOCKS ADD EXPONENTIAL UPSIDE POTENTIAL

Investors with more risk tolerance shooting for larger short-term gains may want to look at diversifying their oil & gas holdings with small-micro cap energy equities that add even more upside to their portfolio.

Allied Energy Corporation (OTCMKTS: AGYP), is a very intriguing microcap that has put itself in a position for a promising 2022.

–The company reworks and re-completes existing oil wells once thought to be exhausted of their oil.

–It currently has 6 producing wells.

–AGYP stock has been extremely volatile over the past 18 months; with bullish moves from $0.03 cents to $0.70, and then $0.20 to $0.83.

AGYP stock currently sits at its 12-month low, meaning it could be an ideal entry point for speculative investors.

But why?

AGYP has been relatively quiet over the past few months. In one of its last press releases company CEO George Monolith said, “2021 was a foundational year. Our initial production numbers have barely scratched the surface of the real potential of Allied's six existing well projects. Now that we have this foundation of six active wells, I intend to build upon that throughout 2022 by maximizing production at each well, adding new wells and leases along with other strategic ventures to benefit the company and its shareholders.” The company is also planning to uplist, which would open up its potential pool of investors and access to capital.

News updating this progress could be a potential catalyst for the stock in the near term.

Zion Oil & Gas, Inc. (OTCMKTS: ZNOG) is another energy penny trading around 20 cents that has been quiet over the past few months. The company is not as far along in its drilling phases as AGYP, however, is worth a look for speculative oil & gas investors.

88 Energy Limited (OTCMKTS: EEENF) has been one of the most active oil & gas penny stocks over the past 12 months. It is also sitting at a 12-month low and if any updates come in the next few weeks, could be another breakout candidate.

KEY TAKEAWAY

Anytime you can place bets on the same side as Buffett, it's usually a good choice. Blue-chip energy stocks should provide consistent returns in the coming months, and diversifying with higher risk options in the space such as AGYP could bring investors major windfalls in the near term.

Disclaimers: The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled. Capital Gains Report ‘CGR’ is responsible for the production and distribution of this content. CGR is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. CGR authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. CGR has been compensated three thousand dollars via wire transfer by Crossroads Inc. to produce and syndicate content related to AGYP. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website.

Media Contact

Company Name: Capital Gains Report

Contact Person: Mark McKelvie

Email: Send Email

City: NAPLES

State: FLORIDA

Country: United States

Website: https://capitalgainsreport.com/