Smith & Nephew plc (SNN), a United Kingdom-based medical devices manufacturer, displayed strong revenue performance in the first quarter of 2023. Following the announcement of a 12-point plan to boost the delivery of its Strategy for Growth and advance into the higher-growth territory, SNN is making good progress. The company is reaffirming its commitment to top-line growth and margin advancement through impressive product launches.

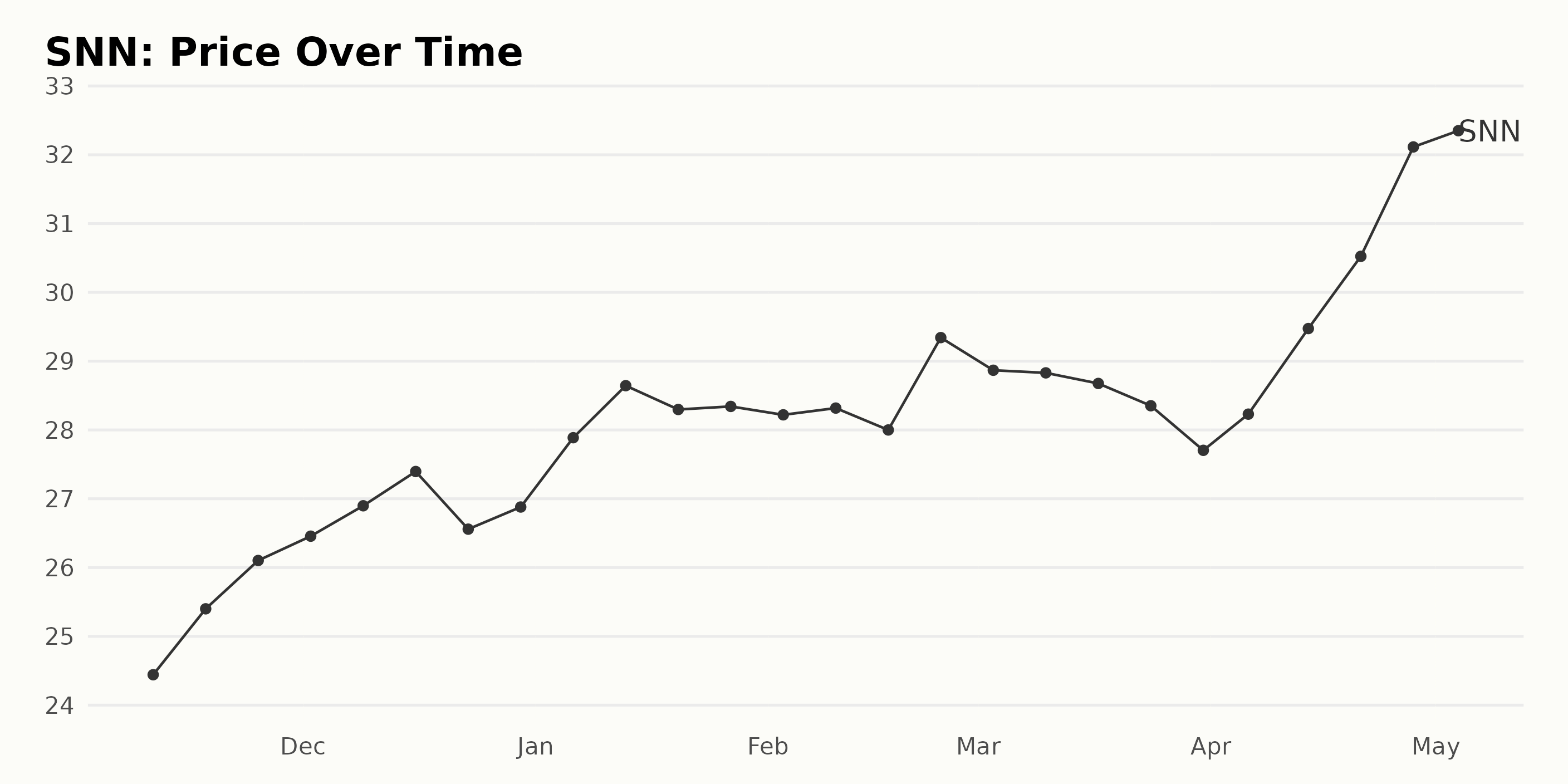

This resulted in a buoyant stock price, which closed the last trading session significantly above its 50-day and 200-day moving averages of $29.42 and $26.77, respectively. To gain further insights into SNN's long-term growth potential, let us take a closer look at some key metrics.

Analyzing SNN’s Financial Performance

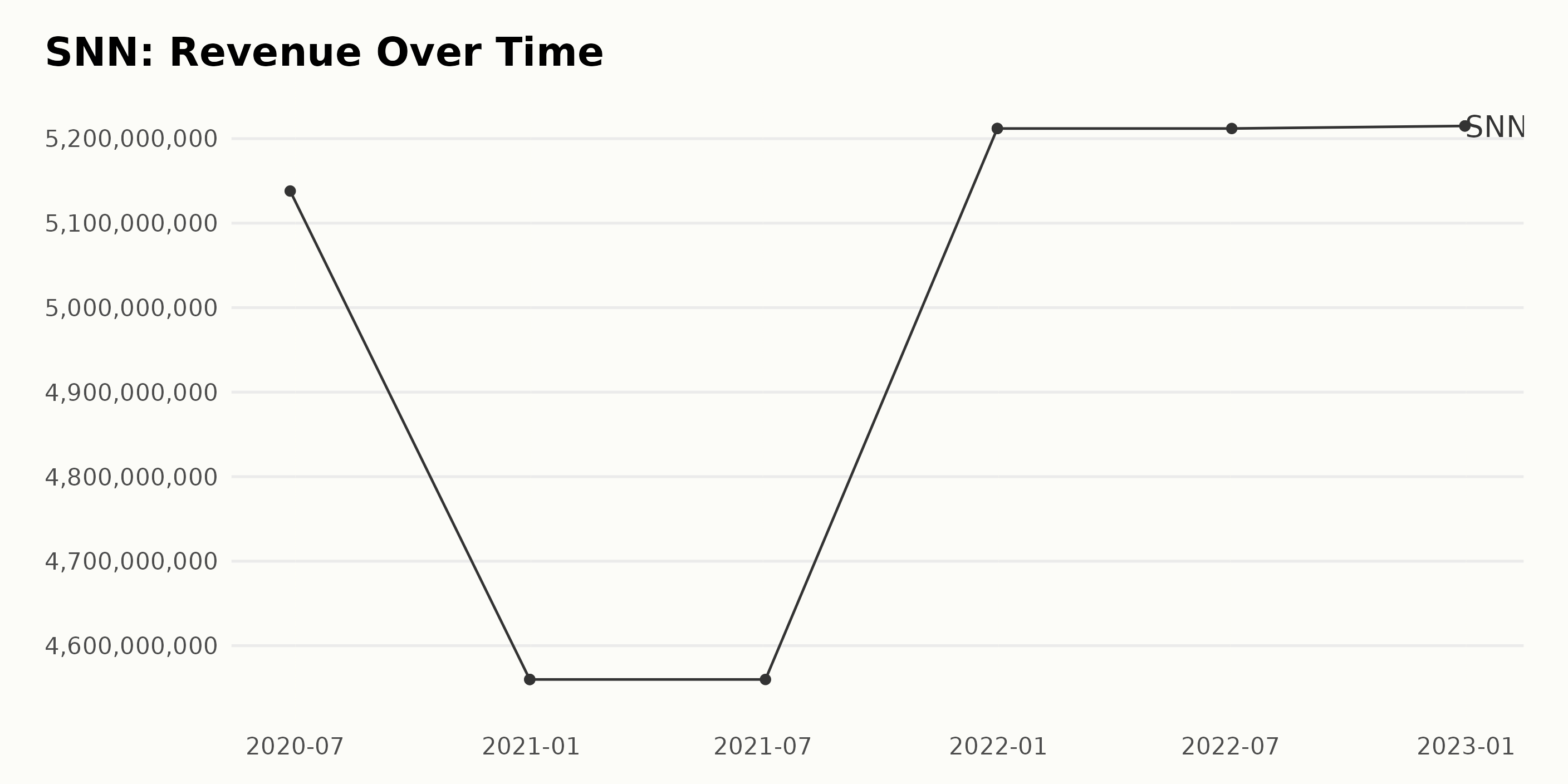

SNN’s revenue has been fluctuating since 2020. The revenue started at $51.38 billion on June 27, 2020, and decreased to $45.60 billion by the end of the year on December 31, 2020. This was followed by growth to $52.12 billion by the end of 2021 on December 31 and subsequently rose to $52.15 billion by July 2, 2022. The overall growth rate of the series is 1.86%.

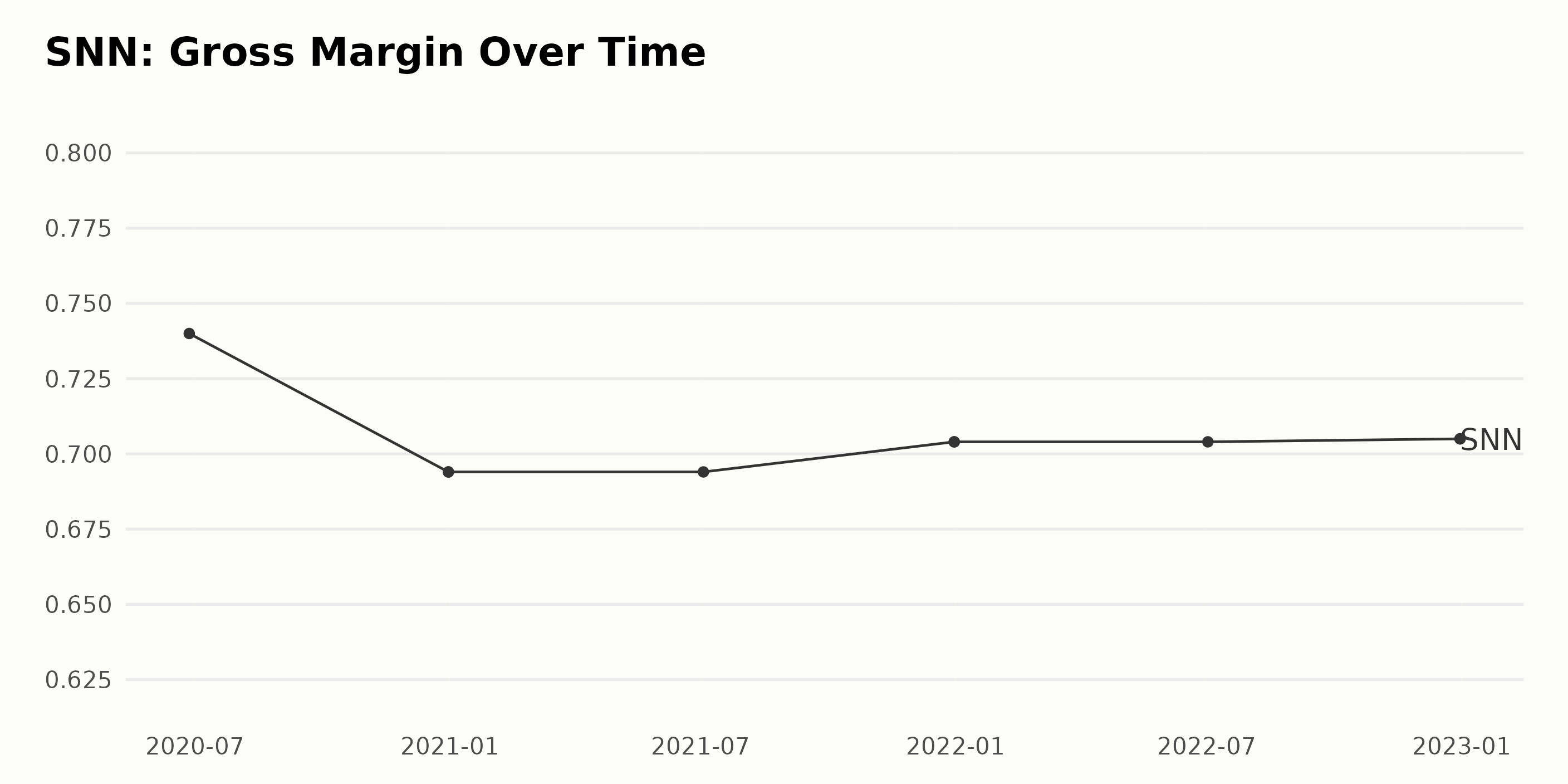

SNN has seen a slight increase in gross margin over the past two years, rising from 74% in June 2020 to 70.5% in December 2022. This indicates a 4.9% growth rate over the course of two years.

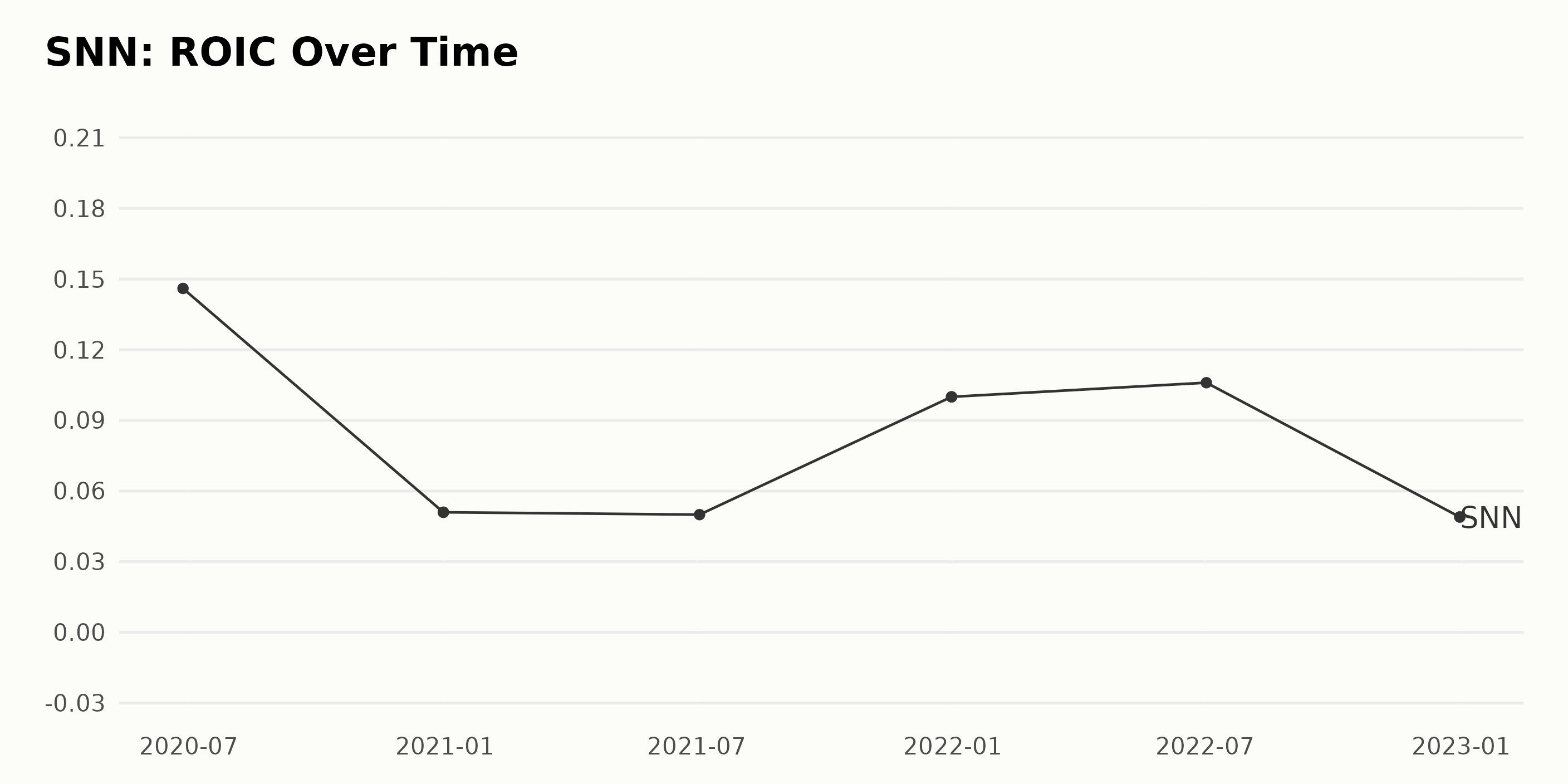

SNN’s ROIC has been fluctuating between 0.051 and 0.146 since 2020. Its most recent value, as reported in July 2022, was 0.106, representing a growth rate of 27.7% compared to the first value in June 2020.

SNN Share Price Experiences Steady Growth

The share price of SNN shows a generally increasing trend from $24.44 at the start of November 2022 to $32.43 at the beginning of May 2023. The growth rate is relatively consistent, with the share price increasing by around $1 every two weeks. Here is a chart of SNN's price over the past 180 days.

SNN’s POWR Ratings Overview

SNN has an overall rating of A, translating to a Strong Buy in our POWR Ratings system. It has held an A rating consistently for the past two months. This puts SNN at the #1 rank out of 141 stocks in the Medical - Devices & Equipment category.

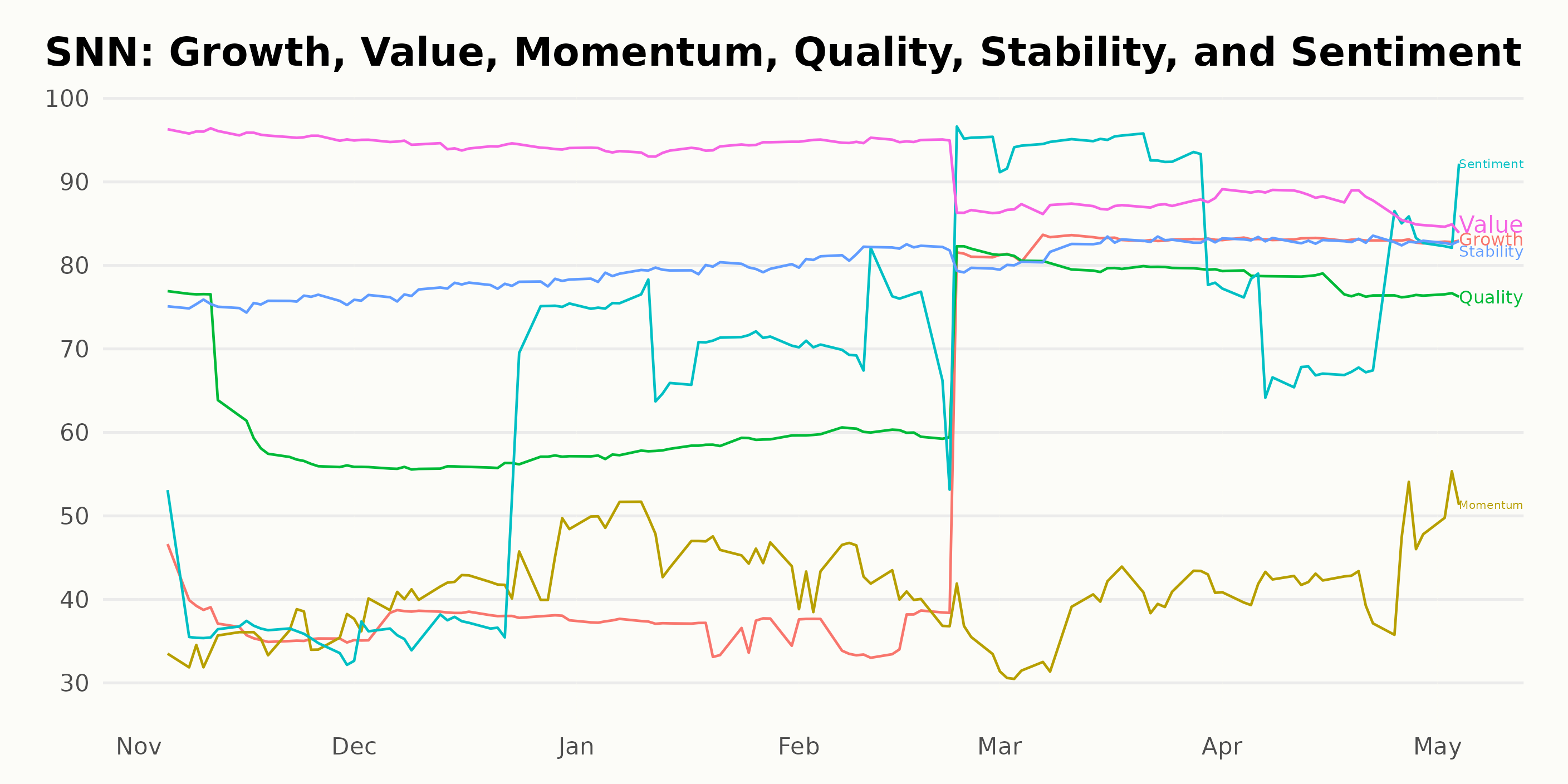

The POWR Ratings of SNN show that Stability is the most noteworthy dimension with consistently high ratings; it scored 76 on November 30, 2022, 77 on December 31, 2022, 79 on January 31, 2023, 81 on February 28, 2023, 82 on March 31, 2023, 83 on April 29, 2023, and 83 on May 3, 2023. Quality and Value also have high ratings: Quality scored 63 on November 30, 2022, and 80 on March 31, 2023, while Value scored 96 on November 30, 2022, and 85 on May 3, 2023.

How does Smith & Nephew plc (SNN) Stack Up Against its Peers?

Other stocks in the Medical - Devices & Equipment sector that may be worth considering are Avanos Medical, Inc. (AVNS), Olympus Corp. (OLYMY), and Utah Medical Products Inc. (UTMD). These stocks are also rated A.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

SNN shares were trading at $32.13 per share on Thursday morning, down $0.00 (0.00%). Year-to-date, SNN has gained 21.47%, versus a 6.47% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Add This Top Equipment Stock to Your Portfolio for a Strong Week Ahead appeared first on StockNews.com