Corbin Advisors, a strategic consultancy accelerating value realization globally, today released its quarterly Earnings Primer, which captures trends in institutional investor sentiment. The survey, which marks the 45th issue of Inside The Buy-side®, was conducted from December 3, 2020 to January 6, 2021 and is based on responses from 80 institutional investors and sell side analysts, representing more than $2.6 trillion in equity assets under management.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210114005901/en/

(Graphic: Business Wire)

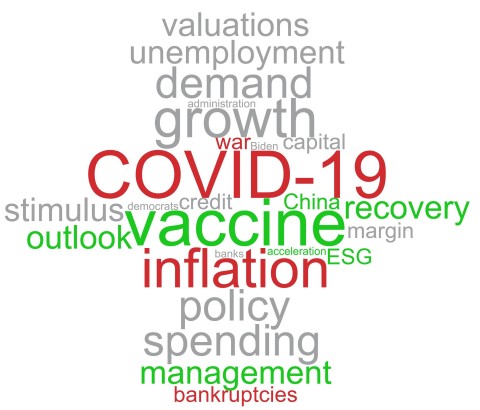

For the third consecutive quarter and accelerated by the hopes of a quick and successful vaccine rollout, our survey finds investor confidence continues to climb and now registers at the most bullish level since June 2018. This aligns with the most upbeat management tone in three years, as those perceiving executives as sanguine nearly doubles QoQ.

Supporting widespread optimism, nearly 60% are forecasting sequential earnings improvement and approximately half expect consensus beats, while FCF is again expected to be strong. Most still expect organic growth and operating margins to have improved this quarter, though positive sentiment has eroded somewhat.

Amid continued stabilization and confident executive tone, nearly 80% of investors report companies should issue guidance and our survey of corporates also sees 75% expecting to provide outlooks, demonstrating increased conviction despite continued economic uncertainty. This quarter, the leading topics for upcoming earnings calls include "return to normalcy" expectations, 2021 outlook and assumptions and growth initiatives and trends.

Steve DeLuca, Partner at Jadwin Partners commented, "For upcoming earnings, I am looking for management to address what specific assumptions guidance is based on, how behavior changes and goes back to normal post-vaccine and real estate footprint needs.”

With the increasing focus on growth initiatives, more than 60% identify reinvestment as the leading preferred use of cash, up from 48% last quarter and surpassing debt paydown for the first time since the onset of COVID-19. Still, debt reduction is the second preferred use, as ideal Net Debt-to-EBITDA levels remain conservative at 2.0x or less.

“We saw a significant increase in optimism across all channel checks this survey, lifted by continued earnings improvement and resilient free cash flow generation,” said Rebecca Corbin, Founder and CEO of Corbin Advisors. “As anticipation builds that companies will issue formal guidance this upcoming quarter, expectations management will play an even more critical role in setting the stage for 2021. We look for companies to remain conservative in their outlooks and provide wider ranges as uncertainty and challenges persist. The buy side eagerly awaits detailed assumptions into guides and will likely be skeptical of those unable to quantify 2021 expectations.”

Despite the S&P 500 and Dow finishing at record levels in 2020 and investors classifying U.S. equities as Overvalued for the 13th consecutive quarter, 89% believe valuations will Expand or Remain Flat for the first half of 2021. As a result, 47% report Net Buying, a high watermark for the second consecutive quarter, while only 10% are in the Net Selling camp.

Not surprisingly given the frothy equity appetite, most sectors are seeing a greater number of supporters than skeptics, with technology, biotech, and healthcare experiencing the most bullish sentiment. Financials and consumer discretionary register the greatest increases in bulls. Notably, while energy remains out of favor, it saw the largest decrease in bearishness across all sectors this quarter.

Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at CorbinAdvisors.com.

About Corbin Advisors

Corbin is a strategic consultancy accelerating value realization globally. We engage deeply with our clients to assess, architect, activate, and accelerate value realization, delivering research-based insights and execution excellence through a cultivated and caring team of experts with deep sector and situational experience, a best practice approach, and an outperformance mindset.

Inside The Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit CorbinAdvisors.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210114005901/en/

Contacts:

Hot Paper Lantern

Gabriella Miranda, (212) 931-6188

gMiranda@hotpaperlantern.com