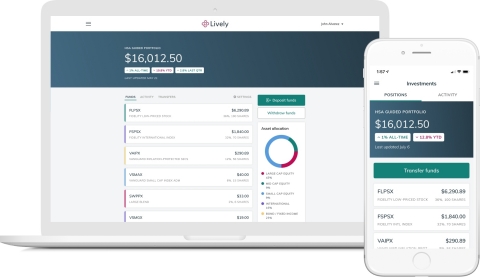

Lively, Inc., creators of the modern Health Savings Account (HSA), today announced the launch of its HSA Guided Portfolio investment feature, by Devenir. HSA Guided Portfolio provides account holders access to personalized investment guidance that helps them capitalize on the HSA’s unique tax advantages, with no investment threshold. With this feature, Lively is expanding its HSA investment options, and removing barriers for consumers to optimize the functions of their HSAs and work toward their retirement goals.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200805005147/en/

(Graphic: Business Wire)

“Investing should be accessible to all HSA account holders, so we’re thrilled to add HSA Guided Portfolio to our already robust investing offering. This new feature adds more flexibility to our investment suite and provides a more hands-off option,” said Alex Cyriac, CEO and Co-Founder of Lively. “By offering industry-leading investment solutions, we help each account holder make their money go further by investing in the way that is right for them. This is just another way Lively is working to offer the most personalized HSA experience for our account holders.”

This strategic partnership with Devenir, a national leader in investment solutions for health-based accounts, complements Lively’s existing investment feature. As a leading investing solution, HSA Guided Portfolio provides a suggested portfolio mix based on each account holder’s profile, risk preferences, and time horizon. The account holder then allocates funds from a curated menu of highly-rated, low cost funds across diverse asset classes. And automated features, such as rebalancing and transfers, can be easily enabled to keep their portfolio on track with their financial goals with minimal effort.

Lively’s user-friendly HSA, backed by accessible customer support and dynamic education, already has significant HSA investment adoption; more than one-fifth of Lively account holders currently invest their HSA funds, compared to the industry average of 4%*. Lively has increased investment access for the average HSA account holder by eliminating opportunity cost due to cash minimums. The launch of HSA Guided Portfolio further empowers that segment while extending the invitation to the currently uninvested account holders to incorporate this critical feature into their long-term savings and retirement strategies. With no investment thresholds, account holders can get started from their first dollar.

Approximately 1.2 million Americans are investing a portion of HSA dollars. This number is only expected to grow in the coming years and exceed $20 billion in investments by 2021*. The increasing consumerization and popularity of investing through HSAs highlight the need for these accounts to meet consumers where they are at. With the addition of HSA Guided Portfolio, Lively is doing just that.

*Source: Devenir. “2019 Year-End Devenir HSA Research Report.” March 2020.

About Lively

Lively is the modern healthcare spending experience built for—and by—those seeking stability in the ever-shifting landscape. By harnessing modern innovation and deep industry expertise, Lively is committed to bridging today’s savings with tomorrow’s unknowns. Unlike traditional institutions hindered by bureaucracy, Lively’s commitment extends beyond initial set up. It provides dedicated, ongoing support and education during every step, so that each account can reach its maximum potential with minimal headache. Lively is headquartered in San Francisco, CA. For more information please visit Livelyme.com or follow us on Twitter (@LivelyHSA).

View source version on businesswire.com: https://www.businesswire.com/news/home/20200805005147/en/

Contacts:

lively@thekeypr.com