LAKEWOOD, CO / ACCESSWIRE / November 8, 2018 / General Moly, Inc. (the "Company" or "General Moly") (NYSE AMERICAN and TSX: GMO), the only western-exchange listed, pure-play molybdenum ("moly") development company, announced its financial results for the third quarter ended September 30, 2018.

Third quarter and year-to-date highlights:

- The Company reported positive initial drill assay results confirming near-surface, high-grade zinc and at-depth, noteworthy copper-silver mineralization at the Mt. Hope Project site in central Nevada, with remaining drilling and assay results expected by the end of 2018;

- All protest issues raised by Eureka County and the Diamond Natural Resources Protection & Conservation Association ("DNR") related to the Mt. Hope water permit applications were resolved in an agreement reached with Eureka County and DNR in September 2018, through which the Company is making a positive impact on the local agricultural community (see October 15, 2018 news release for further details);

- An eight-day public hearing before the Nevada State Engineer in regard to the remaining protests by a Kobeh Valley rancher to the water permit applications was completed in September 2018 and the Company anticipates that the water permits for the Mt. Hope moly project will be granted by mid-2019.

- The Company raised $1.9 million in net proceeds after commissions and expenses from an underwritten public offering of units, consisting of one common share and one share-purchase warrant, as described in the Company's news releases on October 17, 2018;

- The Company's 80%-owned joint venture company, which operates the Mt. Hope Project, Eureka Moly, LLC ("EMLLC"); ended the quarter with a restricted cash balance of $8.2 million (100% basis) in a reserve account, and remains self-funded into 2021, based on estimated care and maintenance expenses; and

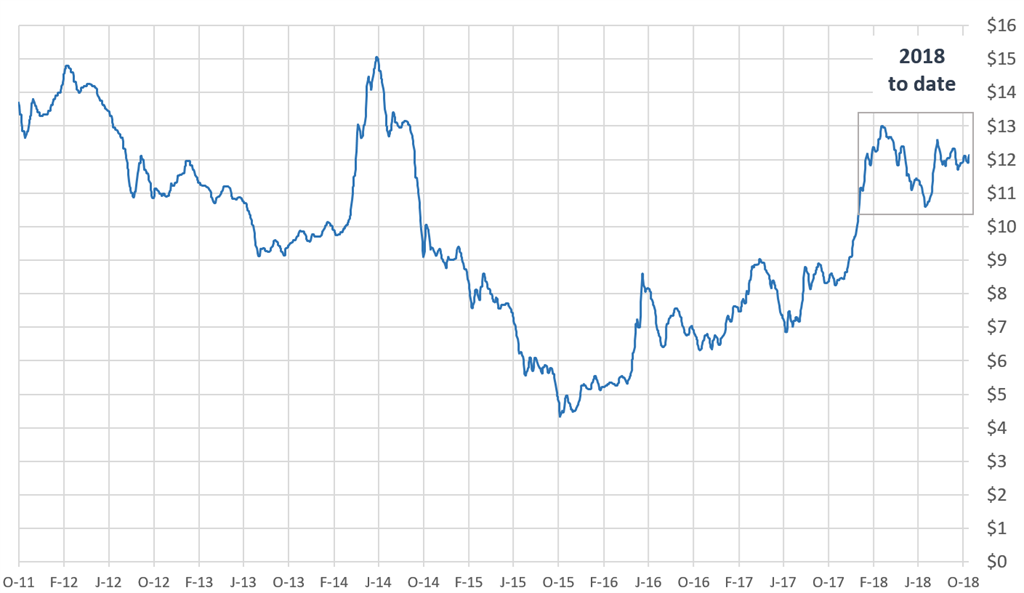

- The moly oxide daily global spot price averaged $11.81/lb during the quarter, up 45 percent over the average of $8.13/lb in 3Q 2017, according to Platts.

The Company reported a consolidated net loss for the three months ending September 30, 2018 of $3.0 million ($0.02 per share), compared to a consolidated net loss of $1.8 million ($0.02 per share) for the 3Q 2017.

Over the near term, the Company expects, per its agreement with its largest shareholder AMER International Group ("AMER"), additional funding from the Tranche 3 $10.0 million private placement, which is priced at $0.50 per share, and its closure is contingent upon the earlier of receipt of water permits for the Mt. Hope Project, the completion of a joint business opportunity involving 10 million shares, or a negotiated acceleration of Tranche 3. At the end of the third quarter, the Company had $1.7 million in unrestricted cash and equivalents before the Company's October public offering raising $1.9 million in net proceeds as described above.

During the third quarter, total cash use of $3.0 million was primarily the result of $0.3 million spent in the exploration drilling program and $2.5 million spent in general and administrative ("G&A") expenses, including approximately $1.0 million associated with confidential negotiations with a potential acquisition target that were not completed, and other due diligence efforts assessing value-accretive acquisition opportunities with the Company's long-term strategic partner AMER. The G&A expenses were funded by $2.0 million in unrestricted cash and $0.5 million drawn from a joint restricted cash account for business development activities with AMER.

Bruce D. Hansen, Chief Executive Officer, said, "Together with our 80%-owned EMLLC joint venture at the Mt. Hope Project, we are excited to have reached a milestone settlement with Eureka County and DNR to build a long-term positive partnership for the benefit of the Mt. Hope Project and the local communities. With the re-granting of water permits, and the completion of the Supplemental Environmental Impact Statement and Record of Decision anticipated by mid-2019, and ongoing improvement in the moly market, we continue to move closer to the eventual project financing, development and operation of the Mt. Hope moly mine.

"The moly price per pound continues to stay strong in a range of high $11s to low $12s. Moly is up 45% from a year ago and has been one of the best performing commodities this year."

Table 1: Financial Summary

| (Shares in 000) | 3Q 2018 | 3Q2017 | 3Q YOY Variance | |||||||||

| Exploration & evaluation expenses | $ | 379 | $ | 302 | 25 | % | ||||||

| General and administrative expenses, including non-cash stock compensation | 2,473 | 1,660 | 49 | % | ||||||||

| Total Operating Expenses | 2,852 | 1,962 | 45 | % | ||||||||

| Interest expense | ( 186 | ) | (205 | ) | n.a. | |||||||

| Consolidated Net Loss | $ | (3,038 | ) | $ | (2,167 | ) | 40 | % | ||||

| Less: Net loss attributable to Contingently Redeemable Non-controlling Interest | $ | 5 | $ | 6 | n.a. | |||||||

| Net Loss attributable to General Moly | $ | (3,033 | ) | $ | (2,161 | ) | 40 | % | ||||

| Net Loss Per Share | $ | (0.02 | ) | $ | (0.02 | ) | 0 | % | ||||

| Avg. Weighted Shares Outstanding | 127,964 | 111,168 | 15 | % | ||||||||

Table 2: Balance Sheet Summary

| Balance Sheet Summary | ||||||||

| ($ in 000) | June 30, 2018 | Dec. 31, 2017 | ||||||

| Cash and Cash Equivalents | $ | 1,660 | $ | 6,676 | ||||

| Current Assets | 1,685 | 6,790 | ||||||

| Current Liabilities | 1,740 | 1,102 | ||||||

| Working Capital | (55 | ) | 5,688 | |||||

| Restricted cash held at EMLLC | 8,175 | 9,911 | ||||||

| Other restricted cash | 819 | 1,787 | ||||||

| Total Assets | 330,896 | 335,775 | ||||||

| Long term debt | 1,340 | 1,340 | ||||||

| Senior convertible notes | 5,791 | 5,745 | ||||||

| Return of contributions payable to POS-Minerals | 33,641 | 33,641 | ||||||

| Other liabilities | 16,808 | 13,529 | ||||||

| Long term liabilities | 57,580 | 54,255 | ||||||

| Contingently Redeemable Non-controlling Interest | 172,266 | 172,633 | ||||||

| Total Shareholders' Equity | $ | 100,210 | $ | 107,785 | ||||

Water Permit & Supplemental EIS Update

At the water rights hearing that concluded September 21, 2018, the Company addressed concerns raised by the remaining sole protestant in the Kobeh Valley through presentation of expert testimony in support of the Company's augmentation and monitoring plan, which will protect senior water rights in the Kobeh Valley basin, near the town of Eureka, Nevada.

In addition, the Company and the Bureau of Land Management ("BLM") continue to progress the Draft Supplemental Environmental Impact Statement ("DSEIS") for the Mt. Hope Project towards publication of its Notice of Availability ("NOA") in the Federal Register. The U.S. Department of Interior is expected to publish the NOA for the DSEIS in the Federal Register this month, opening the public review and comment period. Following completion of public review and comment, the BLM will prepare the Final Supplemental Environmental Impact Statement (FSEIS), which will also be published in the Federal Register for public review and comment. Thereafter, the BLM is anticipated to issue its Record of Decision ("ROD") approving the FSEIS and authorizing the construction and development of the Mt. Hope Project.

Mt. Hope Project Status

Engineering remains approximately 65% complete at the Mt. Hope moly project. Currently, there is no ongoing engineering and procurement effort. The Company anticipates EMLLC will re-initiate its engineering and procurement programs once permitting is complete and market conditions allow for full Mt. Hope Project financing.

Drilling at Cu-Ag Target at Mt. Hope Project Site

The exploration drilling program underway on the patented claims at the Mt. Hope Project focuses on copper-silver-zinc mineralized skarns immediately adjacent to the Mt. Hope moly deposit. Results from the first five assayed holes intersected significant intervals of high-grade, sulfide zinc mineralization close to the surface, suggesting the potential for open pit recovery. Hole MH-251 intersected 50 feet of 8.72% zinc, including 20 feet of 13% zinc, and hole MH-253 intersected 45 feet of 4.6% zinc, as reported in the Company's October 16, 2018 news release.

In addition, the assay results confirmed high-grade copper and silver mineralization at depth including 10 feet of 4.54% copper and 10.37 ounce per ton ("opt") silver within an interval of 20 feet of 2.9% copper and 6.57 opt silver in hole MH 251. The Company also reported drill results in its September 4, 2018 news release.

The $0.8 million, over 9,000-foot drilling program, described in the Company's June 21, 2018 news release, is designed to confirm and extend the high-grade Cu-Ag Target defined by historical drilling and to test for extensions of horizons of zinc mineralization, which were historically mined. Refer to the prior exploration news releases for further information and disclosure, including the review of technical information by a Qualified Person, as defined in Canadian National Instrument 43-101.

Resilient Moly Prices

The recent moly price was approximately $12.03/lb, which is up from $10.25/lb at yearend 2017 and $6.70/lb at yearend 2016, according to Platts. The moly price reached a high of $13/lb in early March 2018, which was a level last seen in 2014. 2018 is poised to be the strongest year in moly prices in four years.

As noted in the Company's October 11, 2018 news release about moly price resilience and demand drivers, moly has been a consistent standout among metals during 2018 as the moly price rose 11% during 3Q 2018. Further moly market commentary is also available in the CEO's October 10, 2018 Moly Bits issue.

World stainless steel production, which uses more moly than other forms of steel, increased 13% in the first half 2018 over the first half 2017, according to the International Stainless-Steel Forum ("ISSF"). China, the world's largest stainless steel producer, saw a 13% jump in its production.

The global liquid natural gas demand is growing at 2% annually between 2018 and 2035 as projected by Shell, with associated increase in global trade requiring more moly-alloyed steel infrastructure. There has been a 15% increase in North American petroleum exploration and production capital budgets and an 8% increase for the rest of the world in 2018 over 2017, according to Barclay Research global spending survey of the industry as reported by Oil & Gas Journal.

During the first nine months of 2018, the moly price has been volatile, trading in a range from a high of $13/lb on March 2, 2018 to a low of $10.60 on June 28, 2018. (See the moly price chart in the Appendix.)

2018 Priorities

General Moly's ongoing priorities for 2018 are to:

- Continue to reduce overhead costs and enhance financial liquidity to resourcefully provide additional longer-term sustainability of operations.

- Proceed with geologic assessment and further exploration of the potential copper-silver target and zinc mineralization at the Mt. Hope Project;

- Continue to progress towards obtaining a ROD approving the FSEIS and the issuance of water permits for the Mt. Hope Project.

About General Moly

General Moly is a U.S.-based, molybdenum mineral exploration and development company listed on the NYSE American, recently known as the NYSE MKT and former American Stock Exchange, and the Toronto Stock Exchange under the symbol GMO. The Company's primary asset, an 80% interest in the Mt. Hope Project located in central Nevada, is considered one of the world's largest and highest grade molybdenum deposits. Combined with the Company's wholly-owned Liberty Project, a molybdenum and copper property also located in central Nevada, General Moly's goal is to become the largest primary molybdenum producer in the world.

Molybdenum is a metallic element used primarily as an alloy agent in steel manufacturing. When added to steel, molybdenum enhances steel strength, resistance to corrosion and extreme temperature performance.In the chemical and petrochemical industries, molybdenum is used in catalysts, especially for cleaner burning fuels by removing sulfur from liquid fuels, and in corrosion inhibitors, high performance lubricants and polymers.

Contact:

Scott Roswell

(303) 928-8591

info@generalmoly.com

Website: www.generalmoly.com

Forward-Looking Statements

Statements herein that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act, as amended and Section 21E of the Securities Exchange Act of 1934, as amended and are intended to be covered by the safe harbor created by such sections. Such forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, expected, or implied by the Company. These risks and uncertainties include, but are not limited to metals price and production volatility, global economic conditions, currency fluctuations, increased production costs and variances in ore grade or recovery rates from those assumed in mining plans, exploration risks and results, political, operational and project development risks, including the Company's ability to obtain a re-grant of its water permits and Record of Decision, ability to maintain required federal and state permits to continue construction, and commence production of molybdenum, copper, silver, lead or zinc, ability to identify any economic mineral reserves of copper, silver, lead or zinc; ability of the Company to obtain approval of its joint venture partner at the Mt. Hope Project in order to mine for copper, silver, lead or zinc, ability to raise required project financing or funding to pursue an exploration program related to potential copper, silver, lead or zinc deposits at Mt. Hope, ability to respond to adverse governmental regulation and judicial outcomes, and ability to maintain and /or adjust estimates related to cost of production, capital, operating and exploration expenditures. For a detailed discussion of risks and other factors that may impact these forward-looking statements, please refer to the Risk Factors and other discussion contained in the Company's quarterly and annual periodic reports on Forms 10-Q and 10-K, on file with the SEC. The Company undertakes no obligation to update forward-looking statements.

Source: Platts

SOURCE: General Moly, Inc.

View source version on accesswire.com:

https://www.accesswire.com/527426/General-Moly-Reports-Third-Quarter-Results