Over the past six months, Employers Holdings’s stock price fell to $42.85. Shareholders have lost 9.4% of their capital, which is disappointing considering the S&P 500 has climbed by 9.9%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Employers Holdings, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Employers Holdings Will Underperform?

Even though the stock has become cheaper, we're cautious about Employers Holdings. Here are three reasons we avoid EIG and a stock we'd rather own.

1. Net Premiums Earned Point to Soft Demand

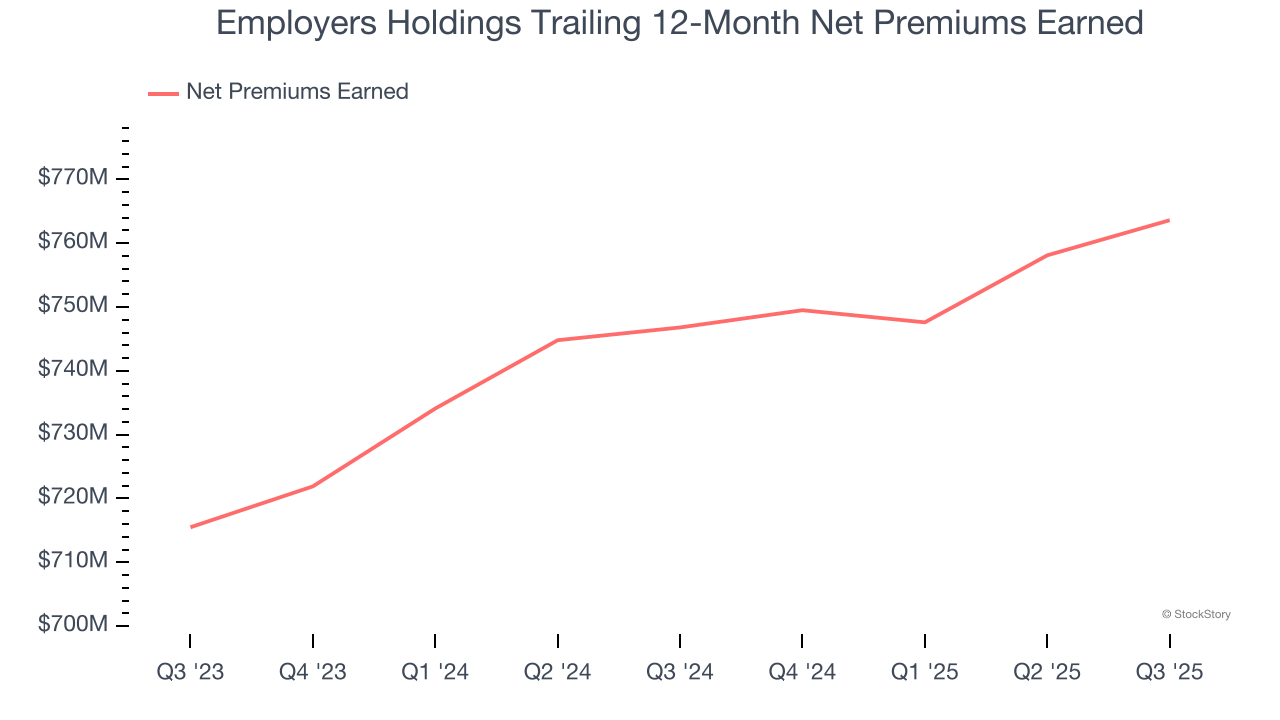

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Employers Holdings’s net premiums earned has grown at a 3.3% annualized rate over the last two years, worse than the broader insurance industry and in line with its total revenue.

3. EPS Trending Down

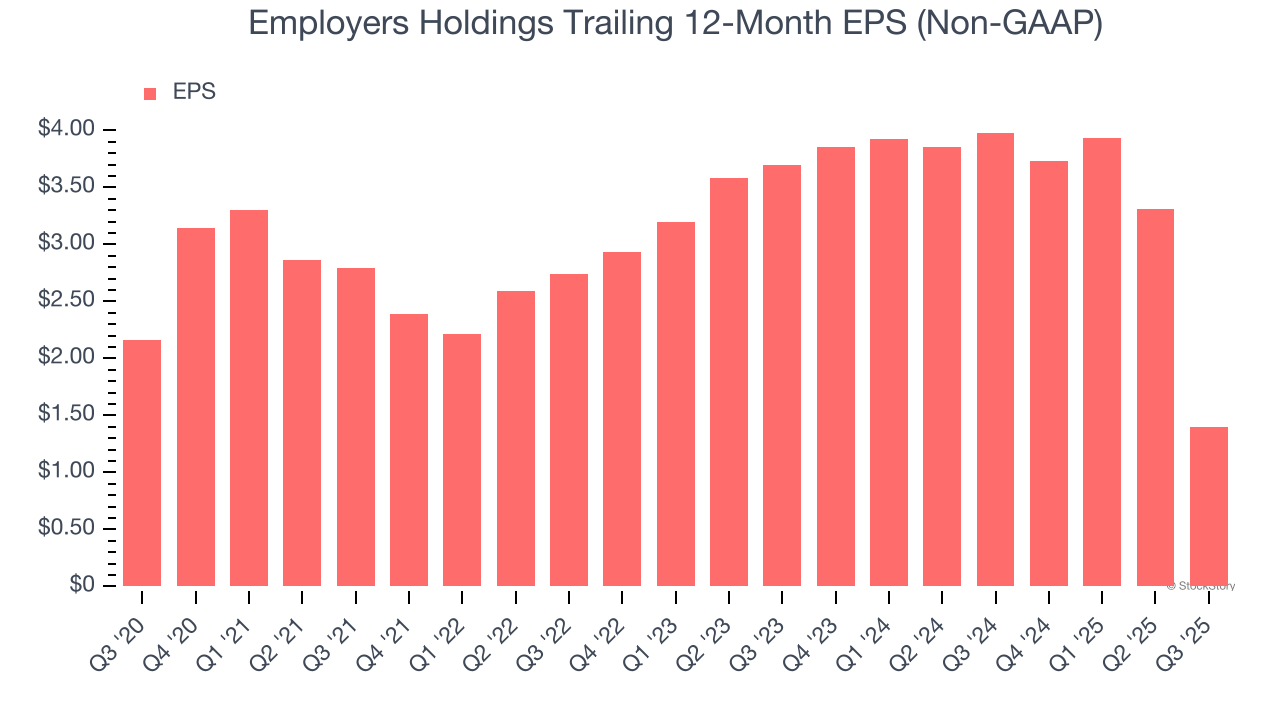

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Employers Holdings, its EPS declined by 8.3% annually over the last five years while its revenue grew by 4.4%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Employers Holdings doesn’t pass our quality test. Following the recent decline, the stock trades at 0.9× forward P/B (or $42.85 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.