Filtration products manufacturer Atmus Filtration Technologies (NYSE: ATMU) announced better-than-expected revenue in Q3 CY2025, with sales up 10.9% year on year to $447.7 million. Its non-GAAP profit of $0.69 per share was 15.1% above analysts’ consensus estimates.

Is now the time to buy Atmus Filtration Technologies? Find out by accessing our full research report, it’s free.

Atmus Filtration Technologies (ATMU) Q3 CY2025 Highlights:

- Revenue: $447.7 million vs analyst estimates of $416.4 million (10.9% year-on-year growth, 7.5% beat)

- Adjusted EPS: $0.69 vs analyst estimates of $0.60 (15.1% beat)

- Adjusted EBITDA: $91.5 million vs analyst estimates of $80.69 million (20.4% margin, 13.4% beat)

- Operating Margin: 18.3%, up from 15.7% in the same quarter last year

- Free Cash Flow Margin: 15.4%, up from 13.5% in the same quarter last year

- Market Capitalization: $4.53 billion

Company Overview

Spun out of Cummins in 2023 after 65 years as part of the engine maker, Atmus Filtration Technologies (NYSE: ATMU) manufactures filters for trucks, construction equipment, and agriculture machinery to reduce emissions and protect engines.

Revenue Growth

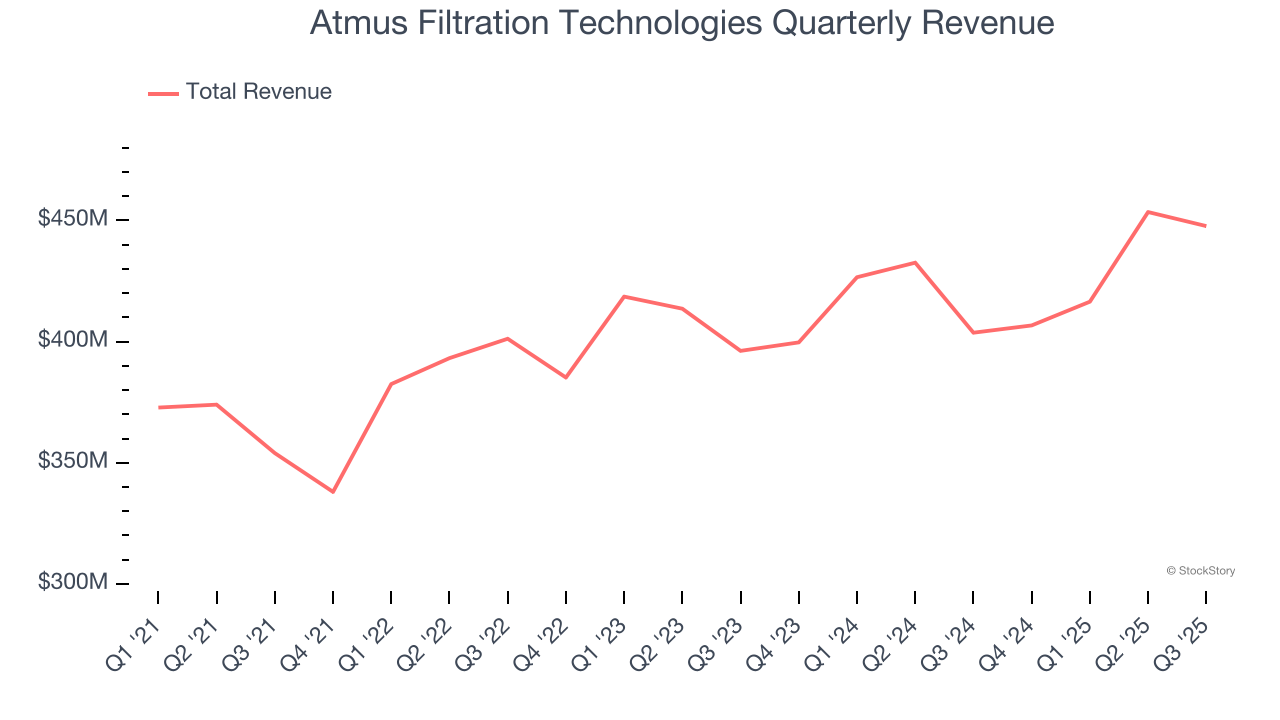

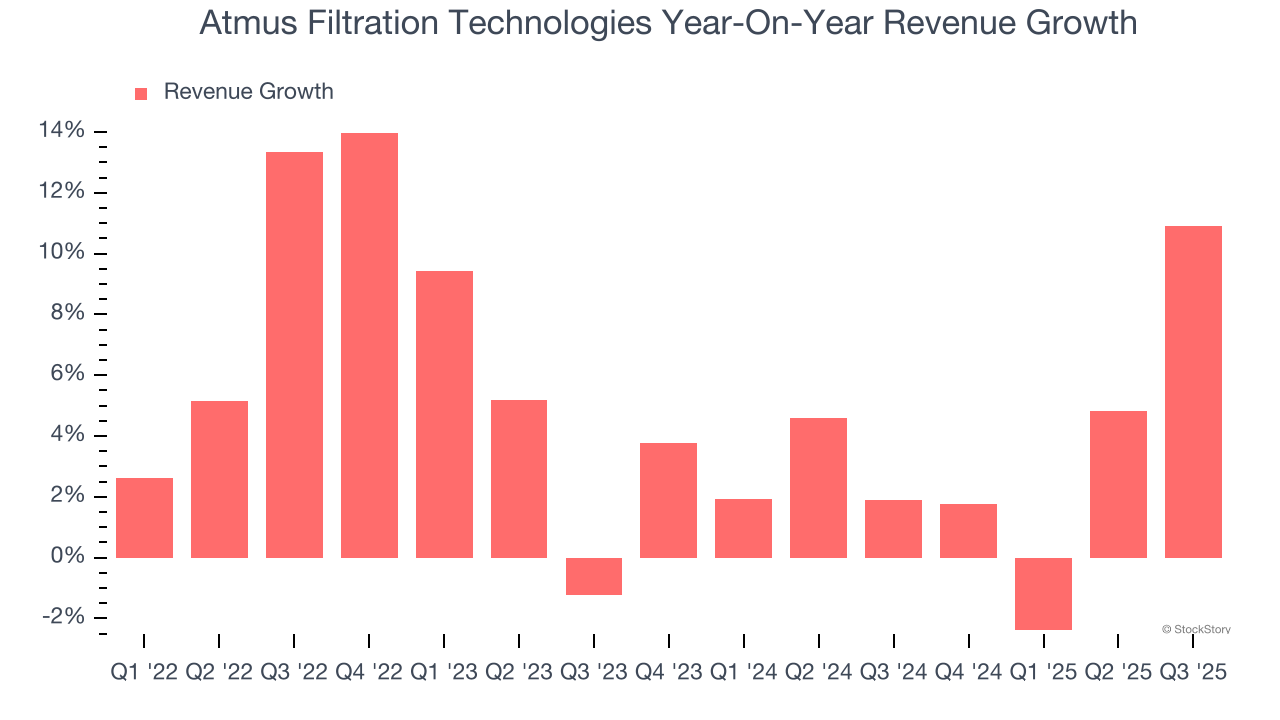

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Atmus Filtration Technologies’s 4.6% annualized revenue growth over the last four years was tepid. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Atmus Filtration Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 3.4% over the last two years was below its four-year trend.

This quarter, Atmus Filtration Technologies reported year-on-year revenue growth of 10.9%, and its $447.7 million of revenue exceeded Wall Street’s estimates by 7.5%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

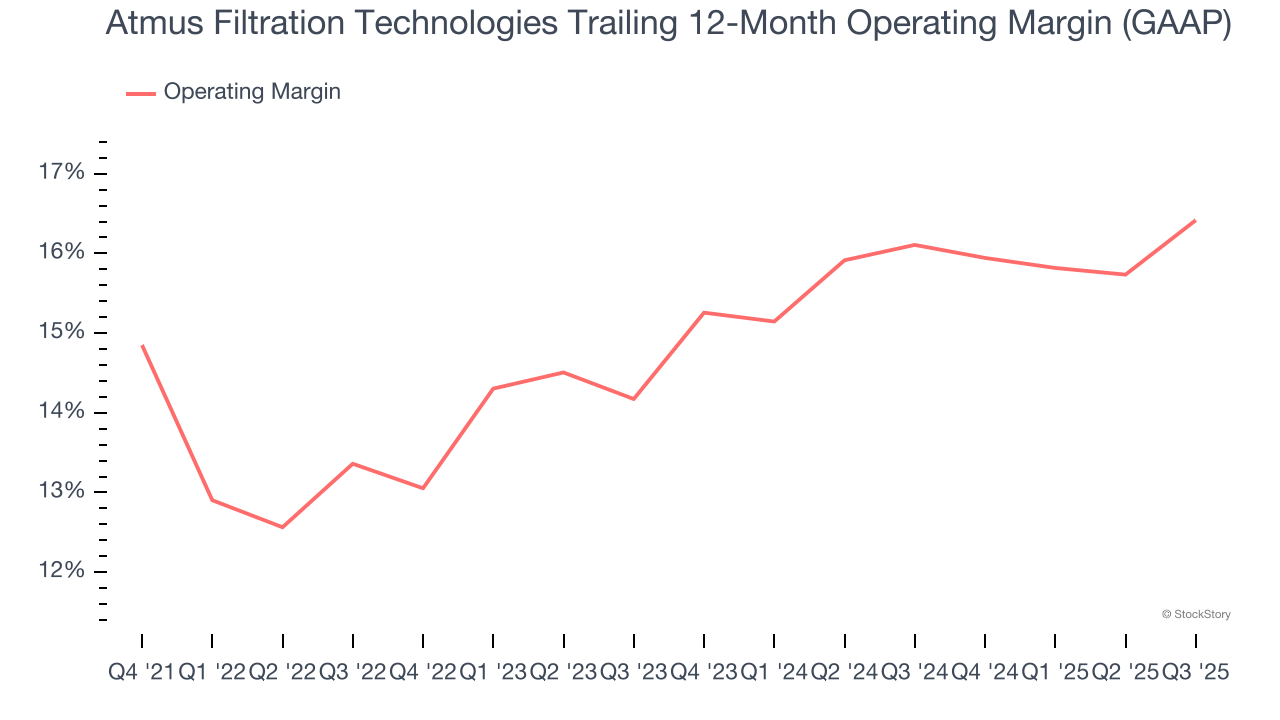

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Atmus Filtration Technologies has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Atmus Filtration Technologies’s operating margin rose by 1.1 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Atmus Filtration Technologies generated an operating margin profit margin of 18.3%, up 2.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Cash Is King

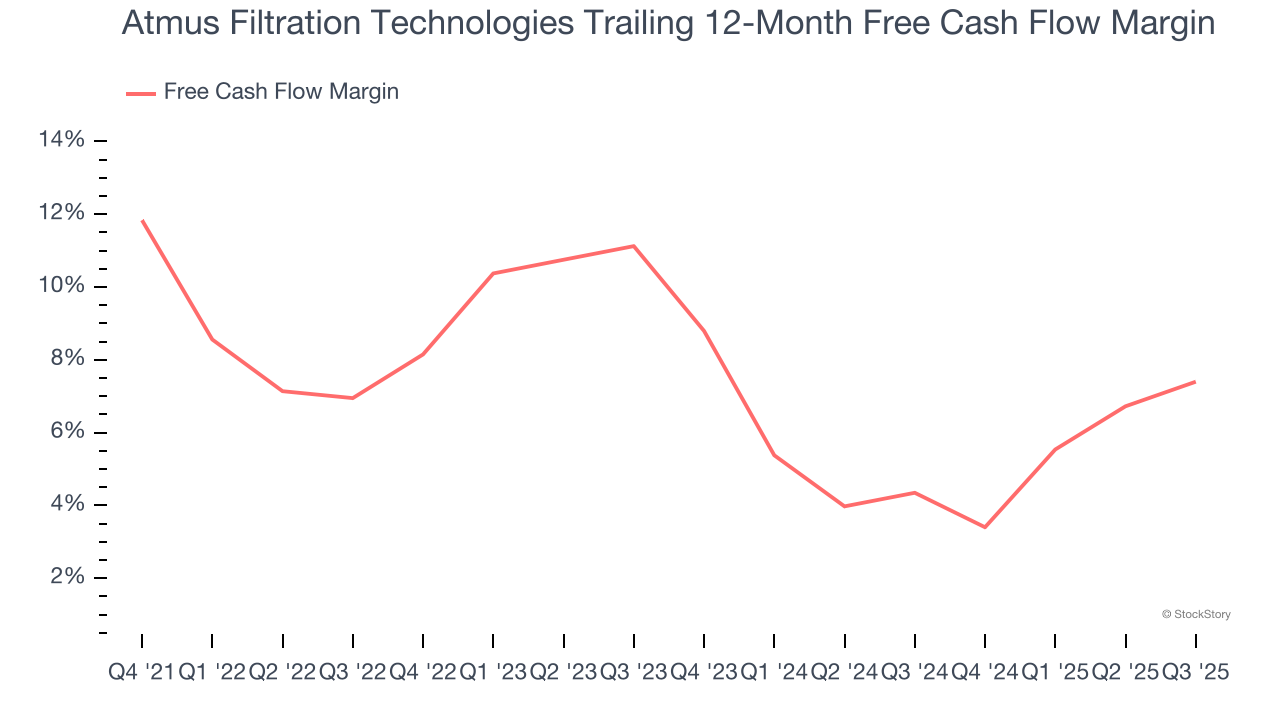

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Atmus Filtration Technologies has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.1% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Atmus Filtration Technologies’s margin dropped by 2.9 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Atmus Filtration Technologies’s free cash flow clocked in at $68.9 million in Q3, equivalent to a 15.4% margin. This result was good as its margin was 1.9 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Key Takeaways from Atmus Filtration Technologies’s Q3 Results

We were impressed by how significantly Atmus Filtration Technologies blew past analysts’ EBITDA expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $57.22 immediately following the results.

Is Atmus Filtration Technologies an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).