WesBanco currently trades at $32.99 per share and has shown little upside over the past six months, posting a middling return of 1.9%. The stock also fell short of the S&P 500’s 11.3% gain during that period.

Is now the time to buy WesBanco, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is WesBanco Not Exciting?

We're cautious about WesBanco. Here are three reasons we avoid WSBC and a stock we'd rather own.

1. Low Net Interest Margin Reveals Weak Loan Book Profitability

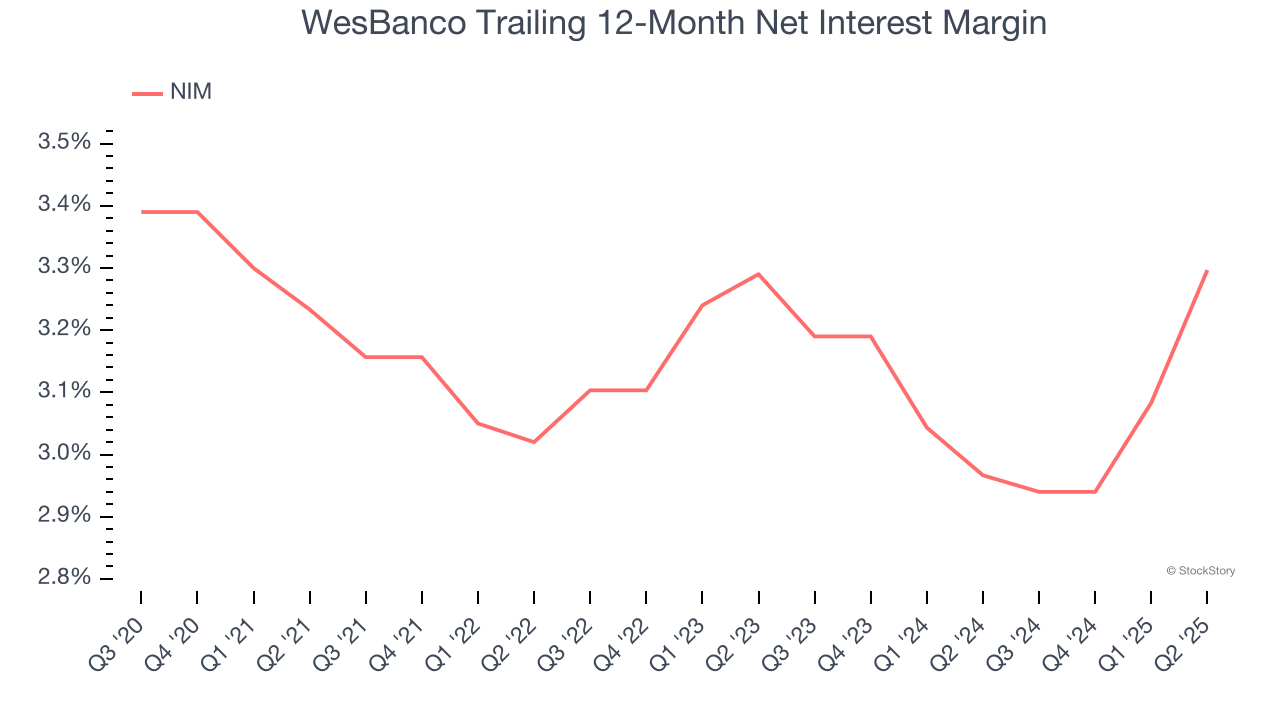

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that WesBanco’s net interest margin averaged a subpar 3.1%, indicating the company has weak loan book economics.

2. TBVPS Has Plateaued, Reflecting Stagnating Assets

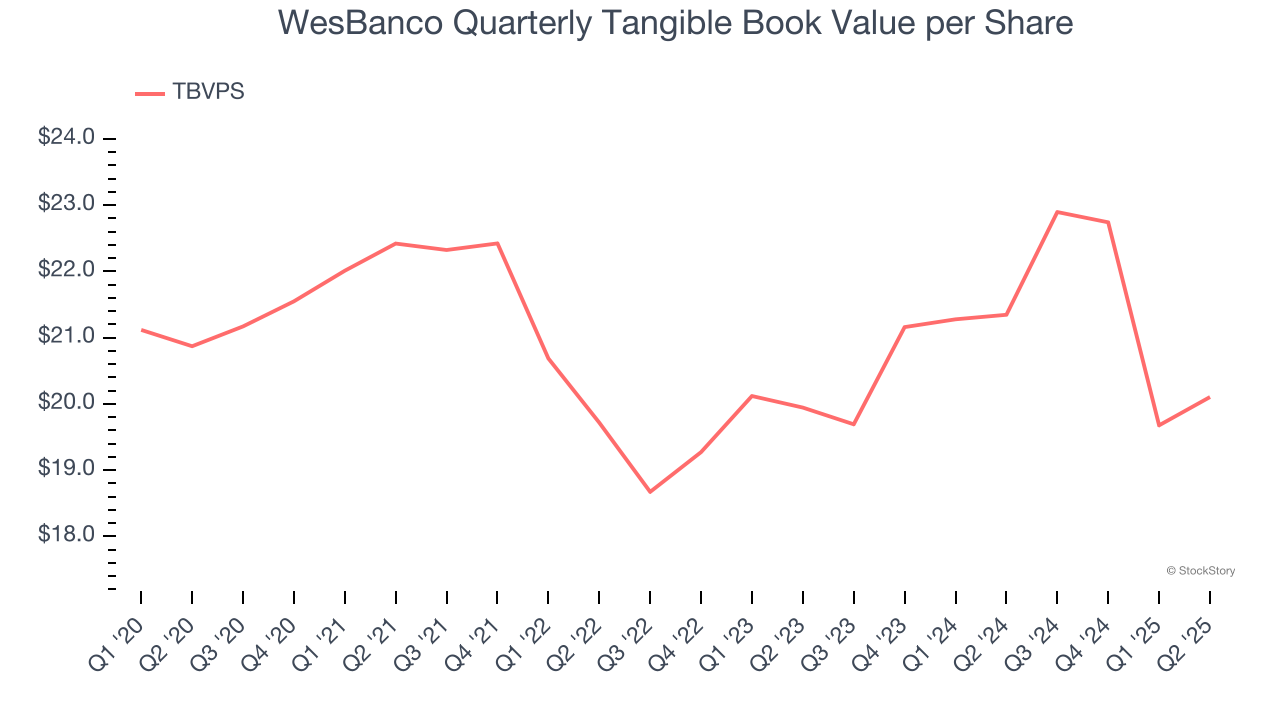

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Disappointingly for investors, WesBanco’s TBVPS was flat over the last two years.

3. Previous Growth Initiatives Haven’t Impressed

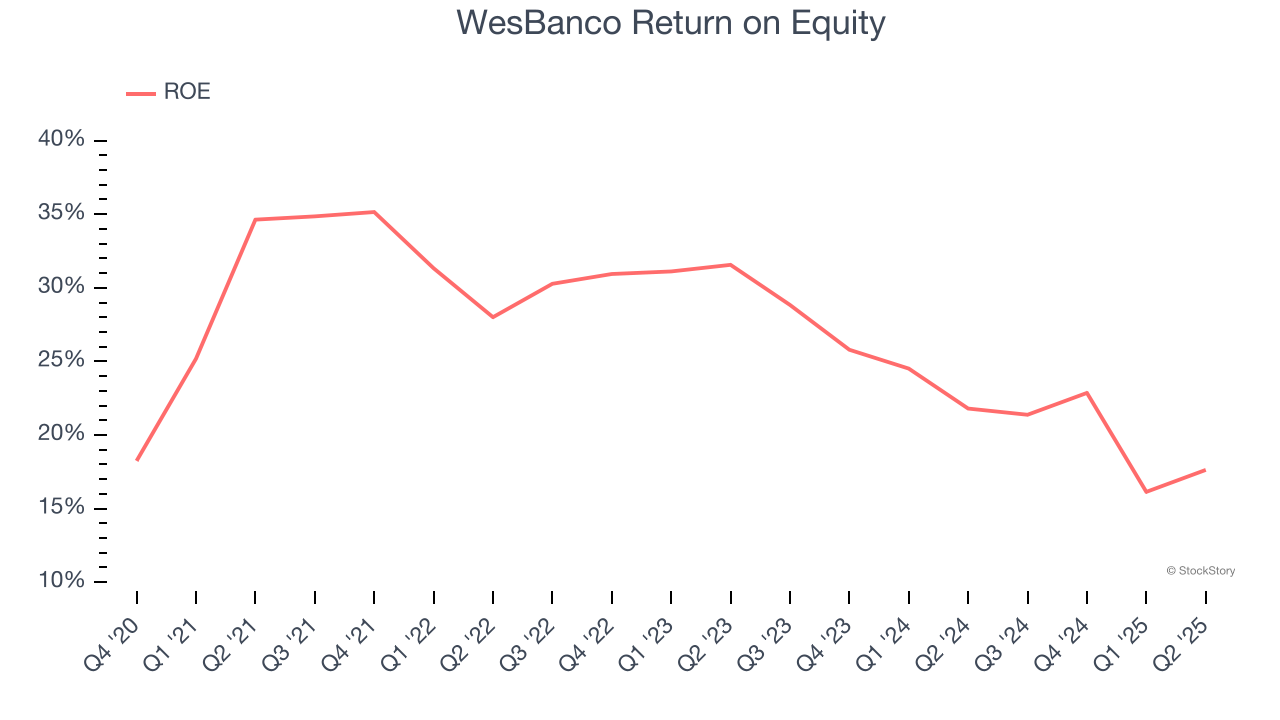

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, WesBanco has averaged an ROE of 6.7%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

Final Judgment

WesBanco isn’t a terrible business, but it doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 0.8× forward P/B (or $32.99 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.