The Hanover Insurance Group has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 11% to $163.30 per share while the index has gained 6.9%.

Is there a buying opportunity in The Hanover Insurance Group, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is The Hanover Insurance Group Not Exciting?

We don't have much confidence in The Hanover Insurance Group. Here are three reasons why you should be careful with THG and a stock we'd rather own.

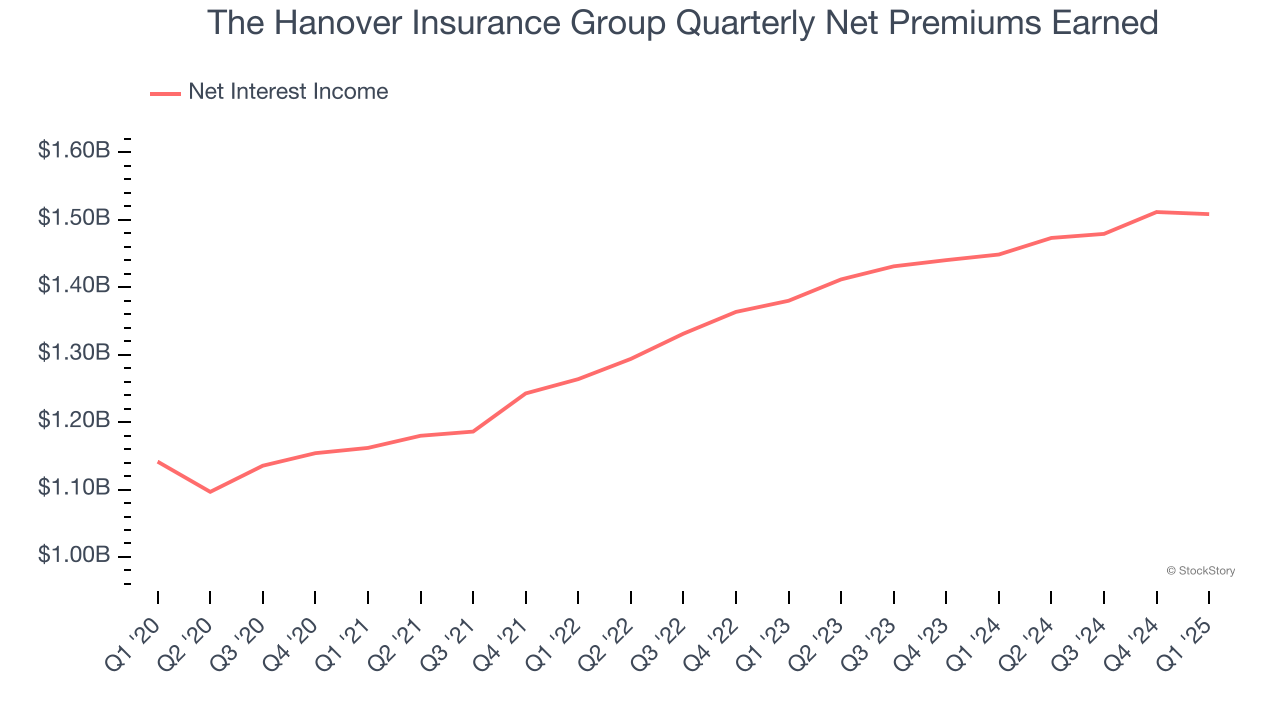

1. Net Premiums Earned Points to Soft Demand

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

The Hanover Insurance Group’s net premiums earned has grown at a 5.5% annualized rate over the last two years, worse than the broader insurance industry and in line with its total revenue.

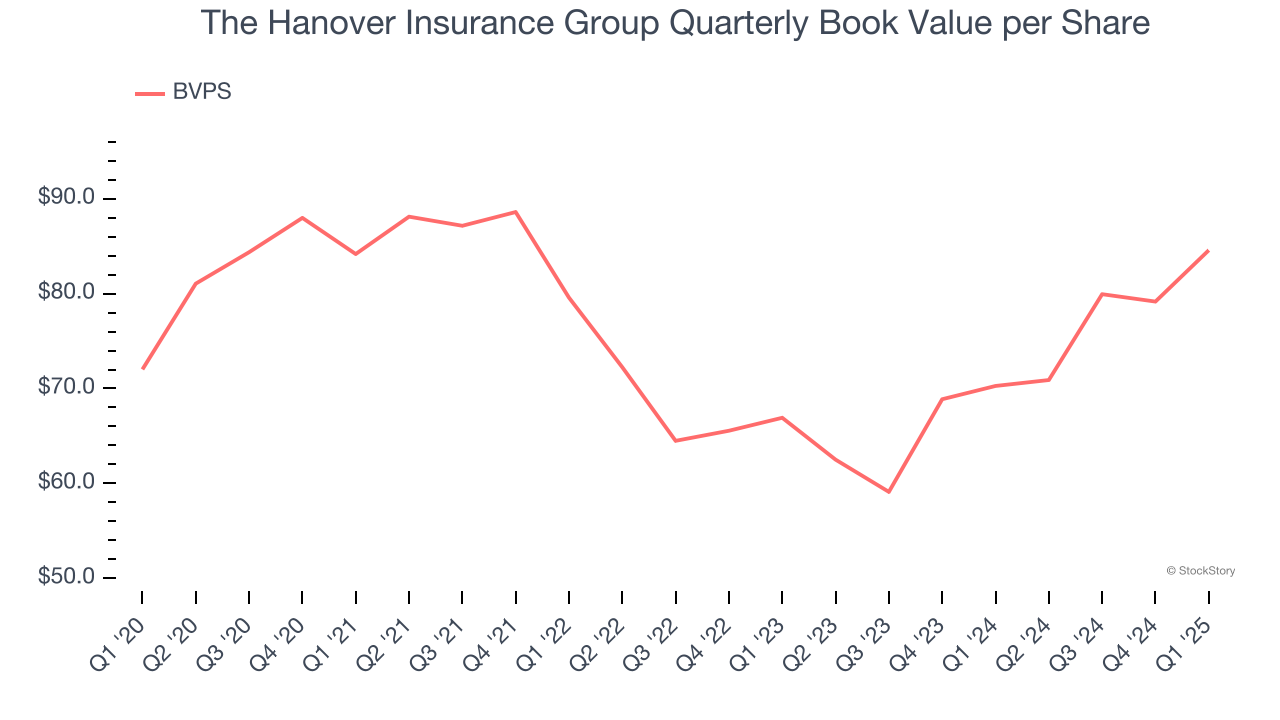

2. Substandard BVPS Growth Indicates Limited Asset Expansion

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

To the detriment of investors, The Hanover Insurance Group’s BVPS grew at a mediocre 12.4% annual clip over the last two years.

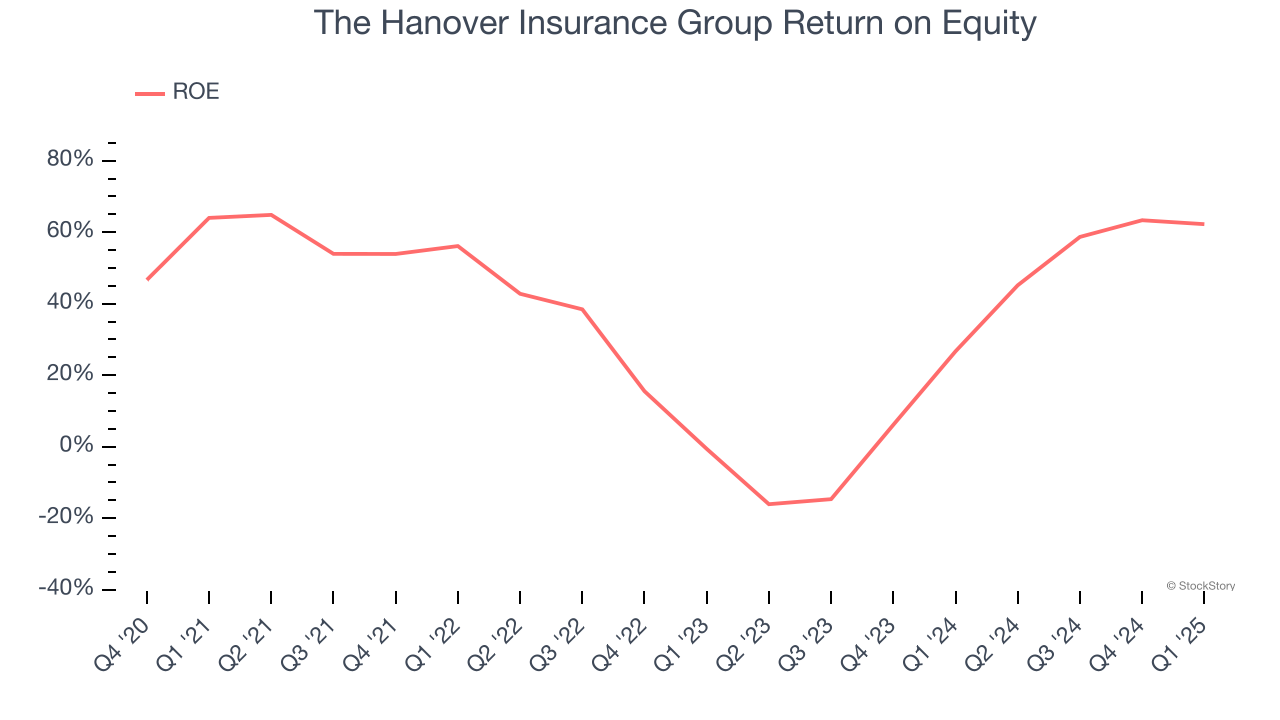

3. Previous Growth Initiatives Haven’t Impressed

Return on equity, or ROE, represents the ultimate measure of an insurer's effectiveness, quantifying how well it transforms shareholder investments into profits. Over the long term, insurance companies with robust ROE metrics typically deliver superior shareholder returns through a balanced approach to capital management.

Over the last five years, The Hanover Insurance Group has averaged an ROE of 10.4%, uninspiring for a company operating in a sector where the average shakes out around 12.5%.

Final Judgment

The Hanover Insurance Group isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 1.8× forward P/B (or $163.30 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than The Hanover Insurance Group

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.